Trust Termination Sample Case For Support

Description

Form popularity

FAQ

When writing a case statement, start by clearly defining the purpose and scope of your trust termination sample case for support. Include background information, describe the current situation, and articulate the desired outcome. By providing detailed evidence and support for your claims, you can present a compelling case that influences decision-makers effectively.

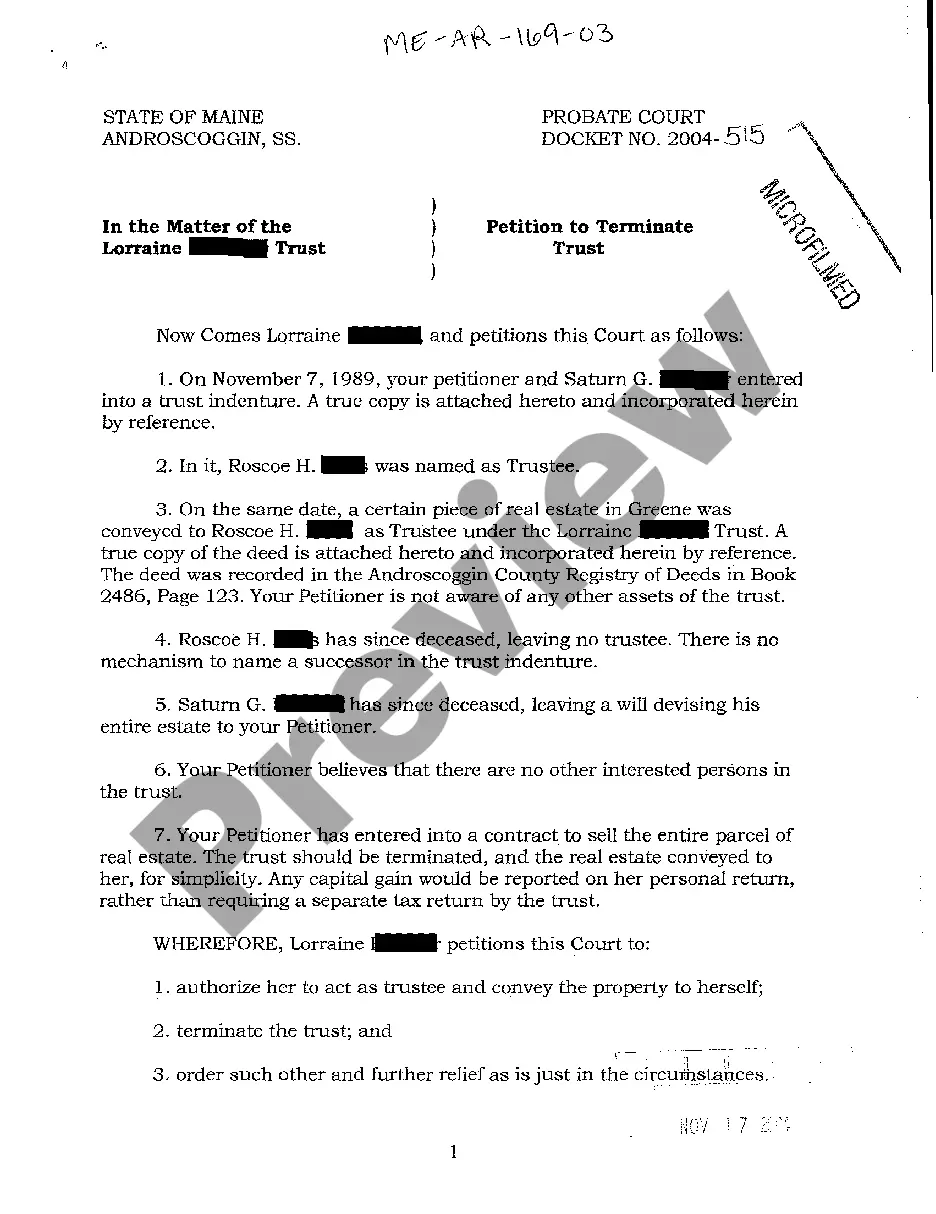

To write a good problem statement for a case study related to trust termination, pinpoint the key issue that needs resolution. Be specific about the implications of the trust termination sample case for support and the impact on beneficiaries. Use concise language to communicate the urgency and significance of addressing the problem. This clarity will guide your research and analysis as you proceed.

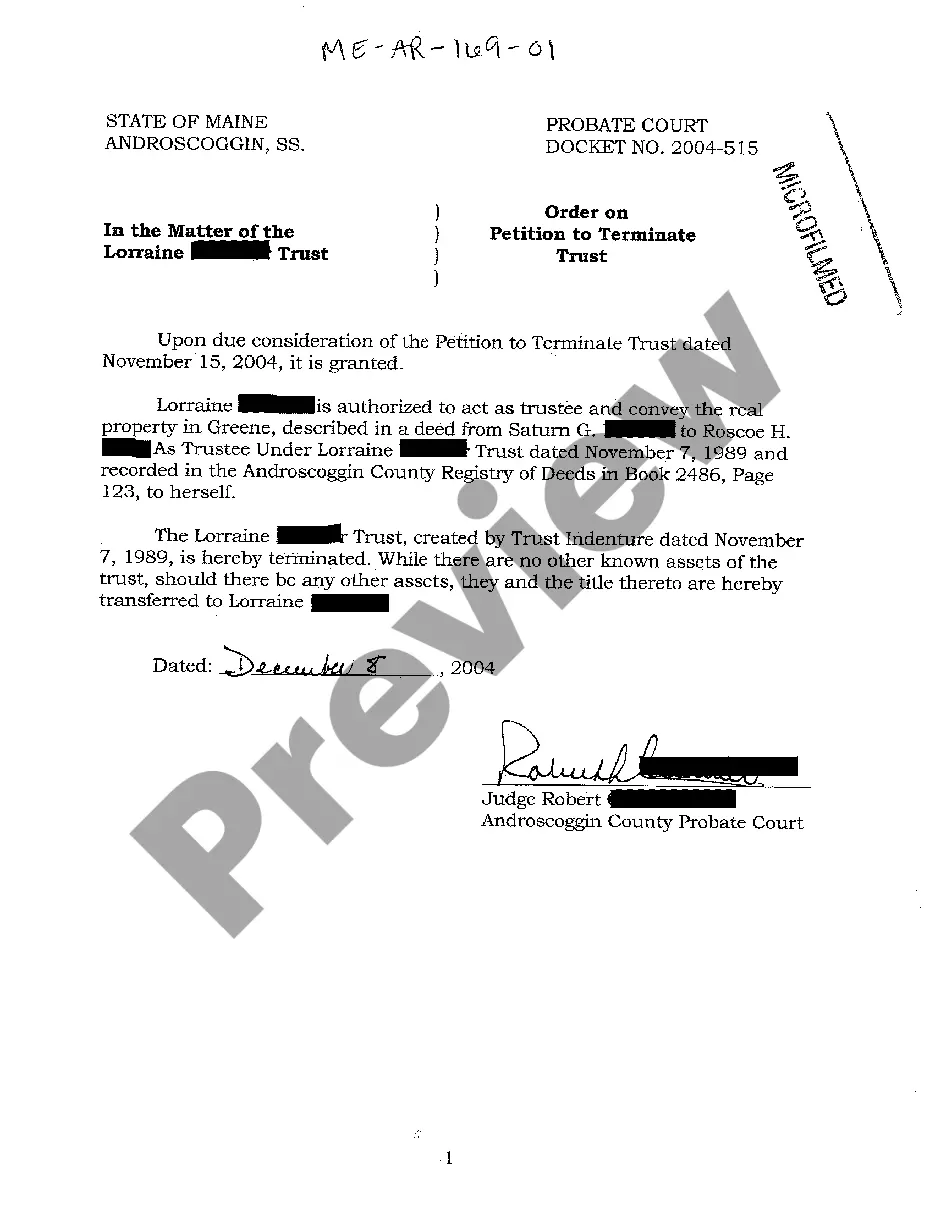

The process of terminating a trust typically begins with reviewing the trust document for any provisions regarding termination. After confirming eligibility, you must inform all beneficiaries and possibly seek consent. Next, settle any outstanding debts or obligations of the trust. Finally, ensure you properly distribute the remaining assets according to the instructions outlined in the trust, making this an effective trust termination sample case for support.

Writing a use case statement involves defining the goal of the trust termination sample case for support and identifying the actors involved. Start by detailing the primary tasks or interactions that will occur, followed by outlining the expected outcomes. This format will help you convey the logical flow and objectives, making it easier for others to understand the process involved in the trust termination.

To prepare a statement of case for a trust termination sample case for support, begin by clearly outlining the main issues involved. Focus on stating your facts, including the trust's background and the specific reasons for termination. Then, ensure you include any relevant documents, such as the trust deed and correspondence with beneficiaries. This structured approach enhances clarity and strengthens your submission.

The 5 percent rule in trust terms generally refers to the provision where beneficiaries can withdraw up to 5% of the trust's value yearly. This allows for financial flexibility without entirely depleting the trust's assets. As you navigate through a trust termination sample case for support, understanding this rule can guide decisions regarding fund withdrawals while keeping the trust's longevity in mind.

The 5 by 5 rule relates to trusts and allows beneficiaries to withdraw a specific amount annually without affecting their overall interest in the trust. It provides a structured way to access funds while still supporting the trust’s integrity. When considering a trust termination sample case for support, knowing the nuances of this rule can help in shaping appropriate withdrawal scenarios for beneficiaries.

One of the biggest mistakes parents make when setting up a trust fund is failing to properly communicate their intentions to their beneficiaries. This lack of clarity can lead to misunderstandings and disputes down the line. In a trust termination sample case for support, clear documentation and communication can significantly reduce confusion and ensure that the trust operates smoothly for all parties involved.

Maintenance and support for a trust refer to the ongoing management and distribution of trust assets for beneficiaries' needs. This includes regular financial reporting, property management, and ensuring that distributions follow the terms of the trust. When handling trust termination sample cases for support, identifying these expenses can help streamline the process and maintain compliance with legal requirements.

The 5 by 5 rule in trust management allows beneficiaries to withdraw up to 5% of the trust's principal each year. This regulation ensures that beneficiaries can access funds while also preserving the trust's value over time. Understanding this rule is crucial when navigating a trust termination sample case for support. By knowing these limits, you can better plan distributions and ensure compliance.