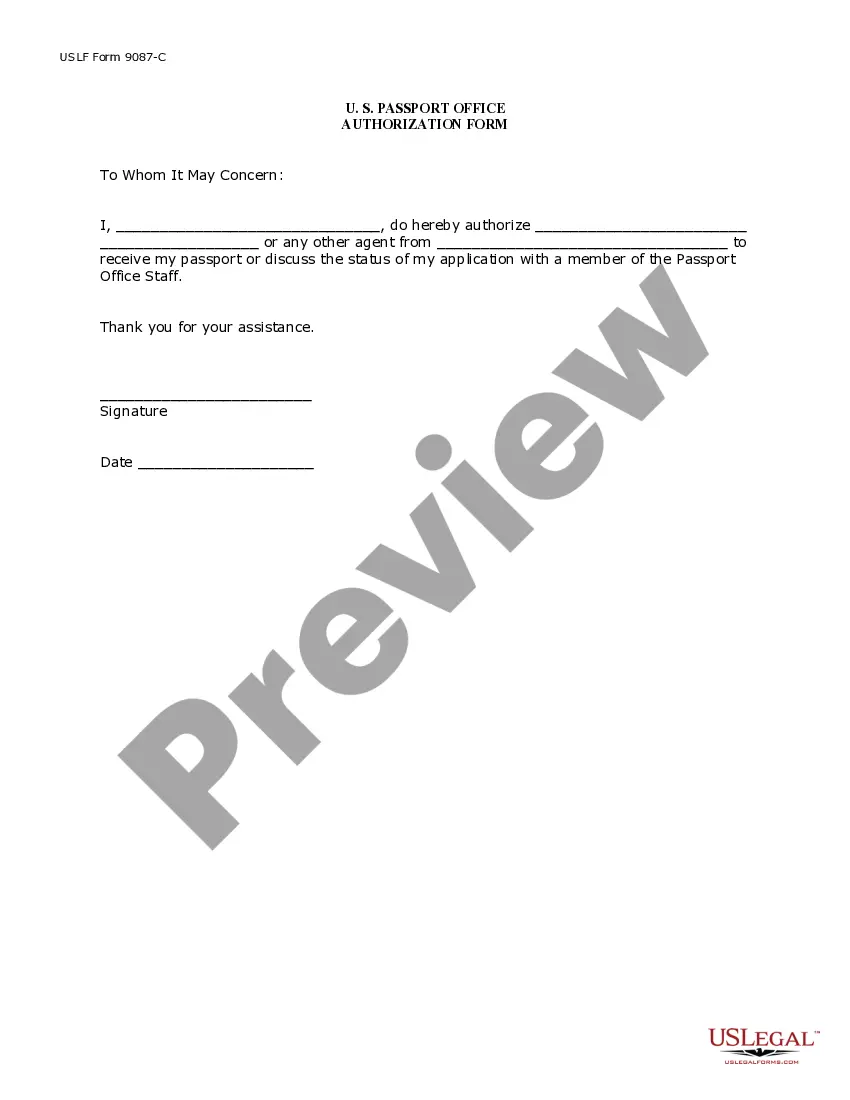

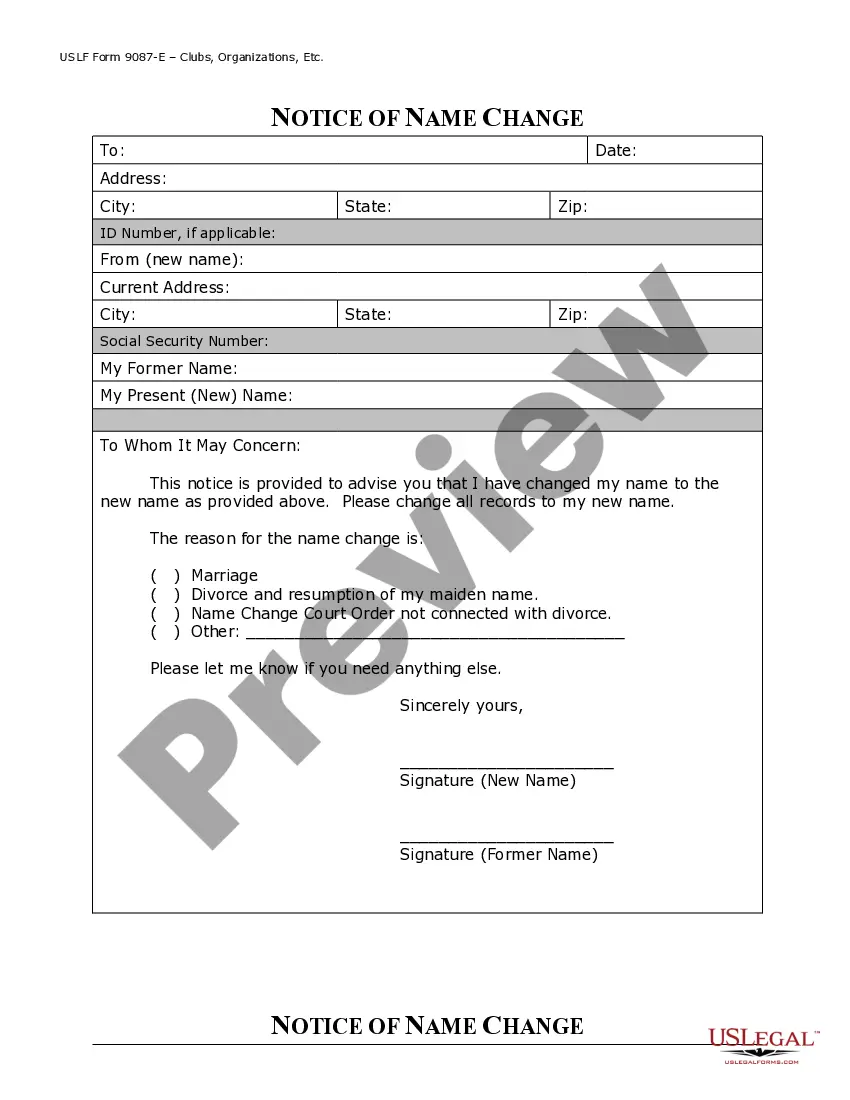

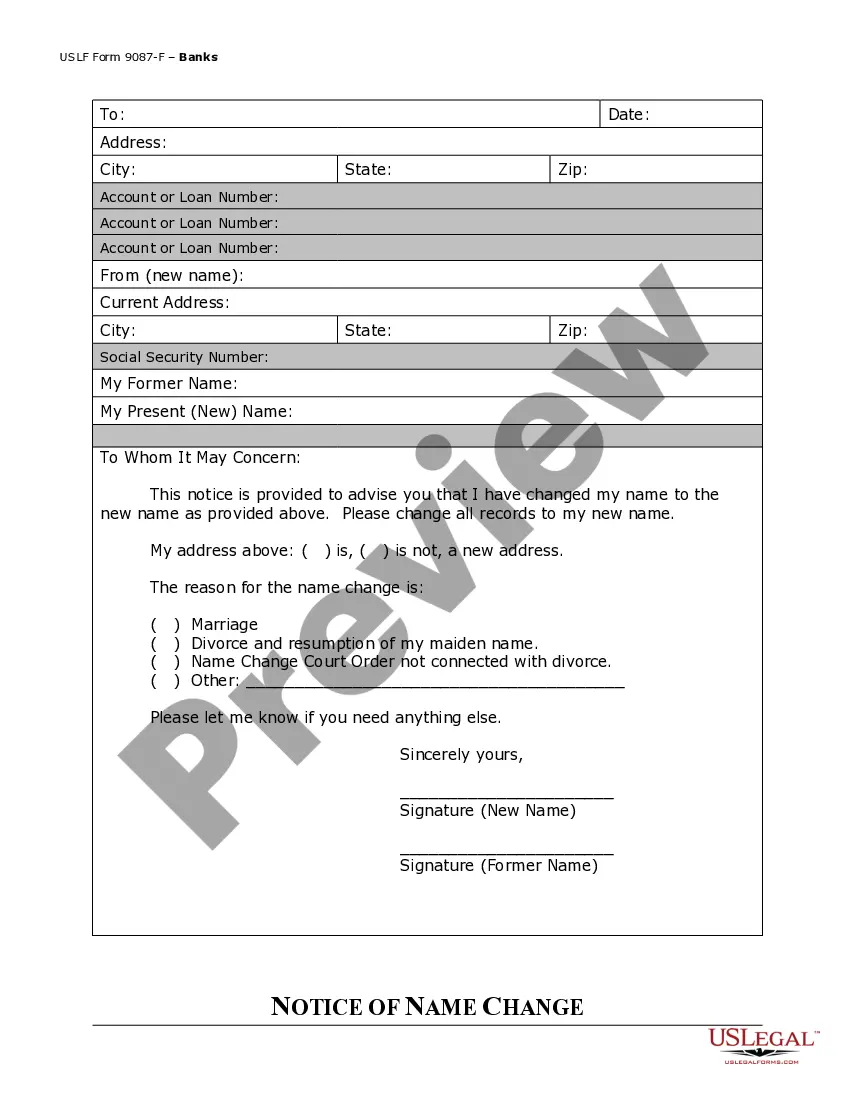

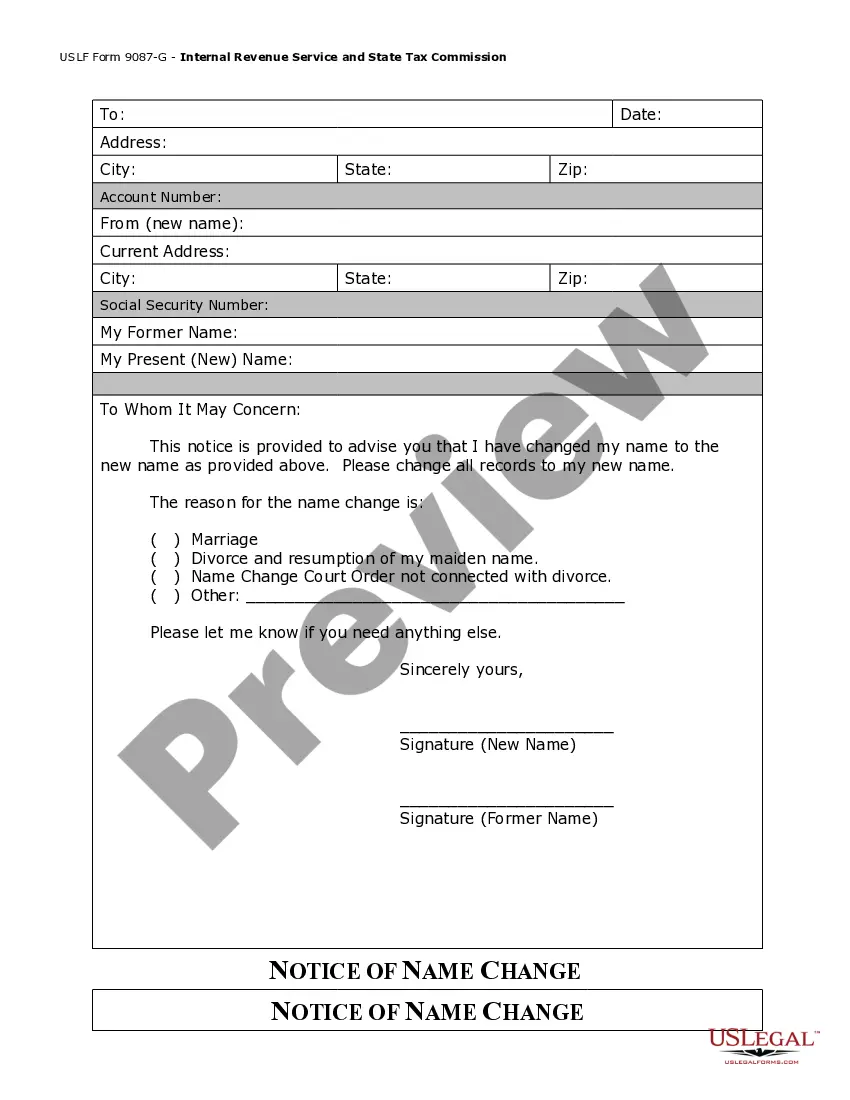

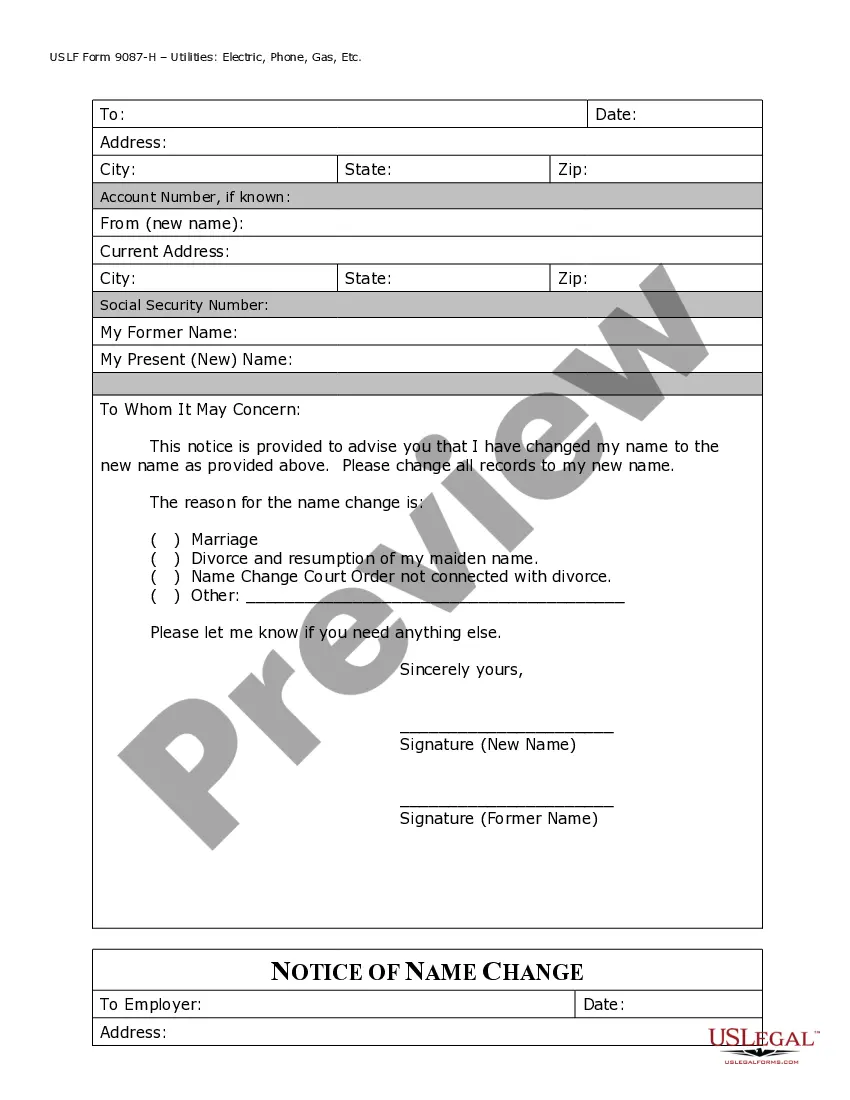

This Name Change Notification Package - Brides, Court Order Name Change, Divorced, Marriage form is an extensive package containing forms and instructions for notifying government agencies and others of a name change. Forms and instructions included for Passport, Social Security Card, Voter Registration, Employer, Banks and other Financial Institutions, Clubs and Organizations, Drivers License, Post Office, Insurance Companies, IRS, State Tax Commission, etc. It also contains forms for changing contracts, wills and other legal documents

Maine Name Change With Irs

Description

Form popularity

FAQ

Yes, you need to include a copy of your federal return with your Maine state return if you are filing a paper return. This ensures that the state tax office has all the necessary information to process your state tax accurately. If you have recently experienced a Maine name change with the IRS, double-check that all names match to keep everything streamlined.

For residents of Maine, tax returns must be sent to the Maine Revenue Services. Typically, you should mail your state tax return to Maine Revenue Services, PO Box 1060, Augusta, ME 04332-1060. If you have undergone a Maine name change with the IRS, make sure to update your state returns accordingly, as this ensures that all records are consistent and accurate.

If you live in Maine and need to send your federal tax return, you should mail it to the address listed for your specific form in the IRS instructions. Generally, Maine residents send their returns to the Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999. If you recently completed a Maine name change with the IRS, ensure that your documents reflect your updated name to avoid potential delays.

The best way to legally change your name involves starting with a court petition, clearly stating your reasons for the change. You should gather and submit all required documents, including identification and any legal paperwork from prior name uses. After you receive approval, be proactive in updating your name with the IRS and other relevant agencies. Using USLegalForms can streamline this journey by providing templates and steps to follow, ensuring you don’t miss critical details.

Many find Maine to be one of the easier states for a legal name change due to its straightforward court process. The requirements are usually minimal, and you can complete your name change efficiently. However, it is essential to follow all steps to ensure proper recognition of your new name, including notifying the IRS. For guidance, platforms like USLegalForms can offer resources tailored to your specific state.

To change your name in Maine, you must first file a request in court. This process includes submitting a petition for a name change and completing the necessary forms. The court will then review your request, and if approved, you can finalize your name change with the IRS along with other agencies. Utilizing a reliable platform like USLegalForms can simplify this process and guide you through each step.

To form an LLC in Maine, start by selecting a unique name that complies with state regulations. Then, file the Articles of Organization with the Maine Secretary of State, either online or by mail. Once established, when you change your business name, notify the IRS to maintain accuracy in your business records. USLegalForms provides easy-to-follow information and forms that can facilitate the LLC formation process.

To change your name in Maine, you must file a petition with the District Court in the county where you reside. The process usually involves filling out forms and possibly attending a hearing. If your name change involves your business, notifying the IRS and ensuring all records reflect your new name is crucial for tax compliance. You can find helpful templates and guidance at USLegalForms to assist you.

To obtain an EIN in Maine, start by visiting the IRS website for the online application or download Form SS-4 to mail in your application. Make sure to provide your business information accurately, including making note of any name changes that impact your EIN. This formality ensures you comply with federal tax regulations. Consider exploring USLegalForms for tailored assistance with your application.

To get an EIN number in Maine, you can apply online through the IRS website, or you may choose to submit a paper Form SS-4. Be sure to clearly indicate your business name as it is important to convey any Maine name change with the IRS if applicable. Correct and timely filings are essential for maintaining compliance and ensuring your business operates smoothly. USLegalForms can help guide you through any necessary filings.