Maine Increase Rental Formula

Description

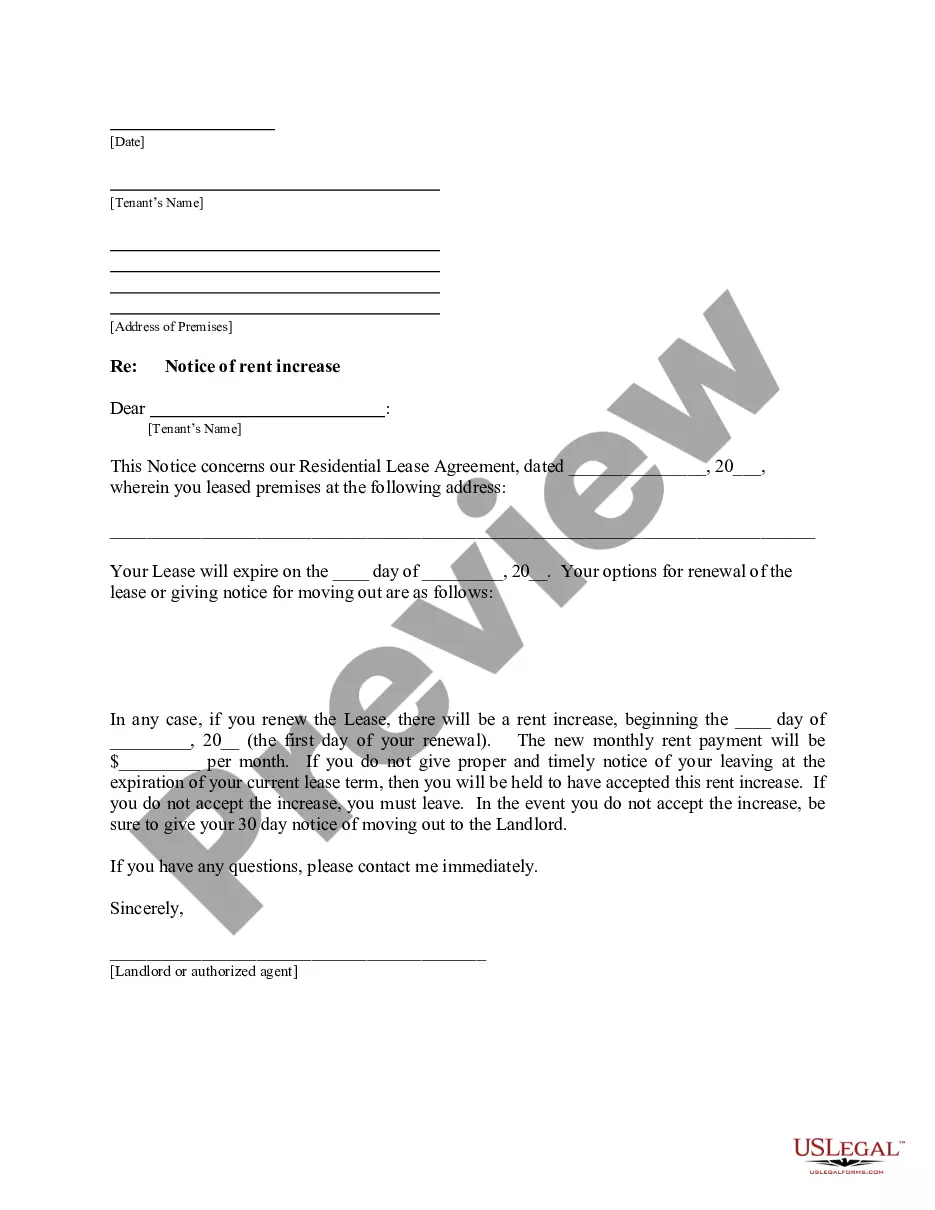

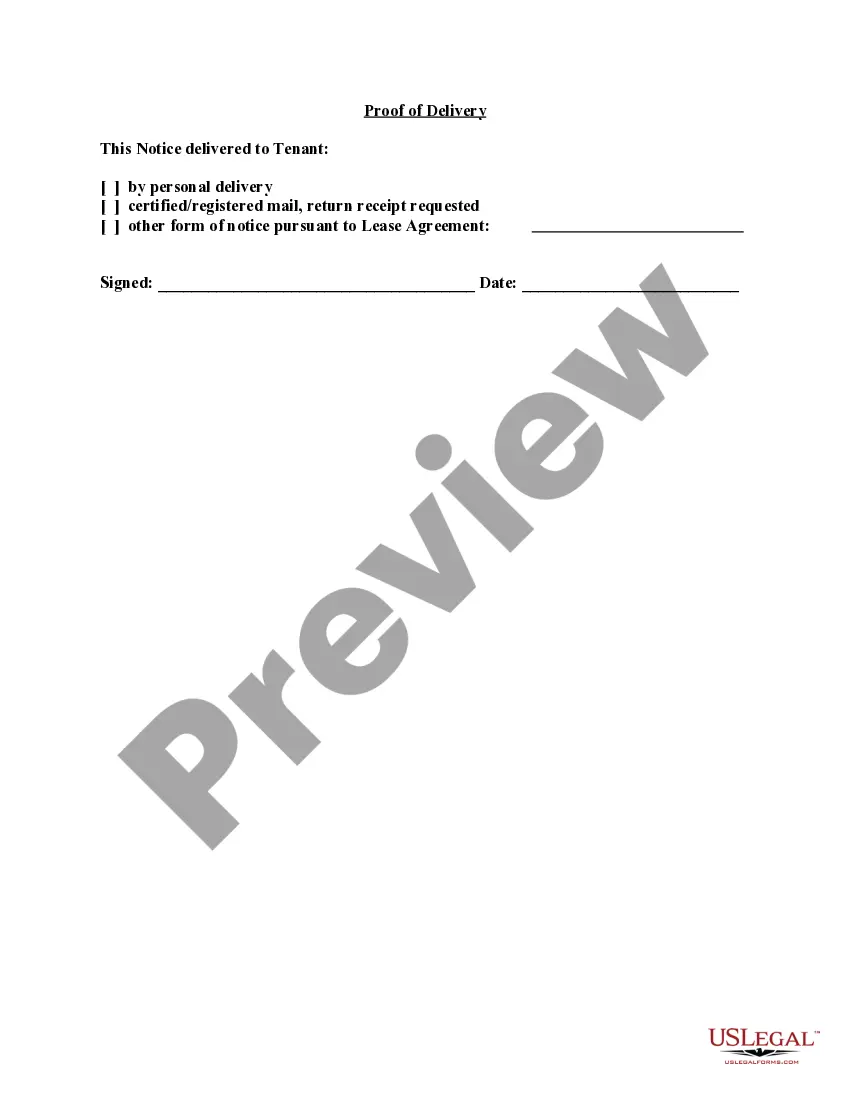

How to fill out Maine Letter From Landlord To Tenant About Intent To Increase Rent And Effective Date Of Rental Increase?

Regardless of whether it’s for corporate reasons or personal issues, everyone must confront legal matters at some point in their lifetime.

Filling out legal documents requires meticulous care, beginning with selecting the correct template.

With a vast US Legal Forms library available, you will never have to waste time searching for the correct template online. Utilize the library’s user-friendly navigation to find the suitable form for any situation.

- For instance, if you select an incorrect version of a Maine Increase Rental Formula, it will be rejected upon submission.

- Thus, it is vital to have a reliable source of legal documents such as US Legal Forms.

- If you wish to obtain a Maine Increase Rental Formula template, adhere to these straightforward steps.

- Acquire the template you require by using the search box or browsing the catalog.

- Review the description of the form to verify it suits your circumstances, state, and locality.

- Click on the form’s preview to inspect it.

- If it is not the correct form, return to the search tool to find the Maine Increase Rental Formula template you need.

- Download the document if it aligns with your specifications.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the profile registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the file format you prefer and download the Maine Increase Rental Formula.

- After saving it, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

The benefit is a refund based on either property tax owed or rent paid. The refund is calculated on the first $3,650 (single) or $4,750 (with spouse or dependent) of property taxes. For renters the base is considered 20% of annual rent.

How does someone apply for the refundable credit? To claim the credit, file Form 1040ME and Schedule PTFC/STFC for the tax year during which the property tax or rent was paid.

All income derived from or connected with the carrying on of a trade or business within Maine is Maine-source income.

Extended Deadline with Maine Tax Extension: Maine offers a 6-month extension, which moves the filing deadline from April 15 to October 15 (for calendar year filers). Maine Tax Extension Form: Maine's tax extension is automatic, so there's no official application or written request to submit.