Life Estate Deed Form Maryland Format

Description

How to fill out Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate?

Securing a reliable source to obtain the most up-to-date and suitable legal templates is half the challenge of managing bureaucracy. Selecting the appropriate legal documents requires accuracy and careful attention, which is why it is vital to acquire Life Estate Deed Form Maryland Format samples solely from trusted providers, such as US Legal Forms. An incorrect template will squander your time and delay the situation you are facing. With US Legal Forms, you have minimal concerns. You can access and review all the information regarding the document’s application and significance for your circumstances and in your state or region.

Follow these outlined steps to complete your Life Estate Deed Form Maryland Format.

Eliminate the stress associated with your legal paperwork. Explore the extensive US Legal Forms collection to locate legal templates, evaluate their relevance to your situation, and download them right away.

- Utilize the catalog navigation or search feature to find your template.

- Examine the form’s details to determine if it meets the requirements of your state and county.

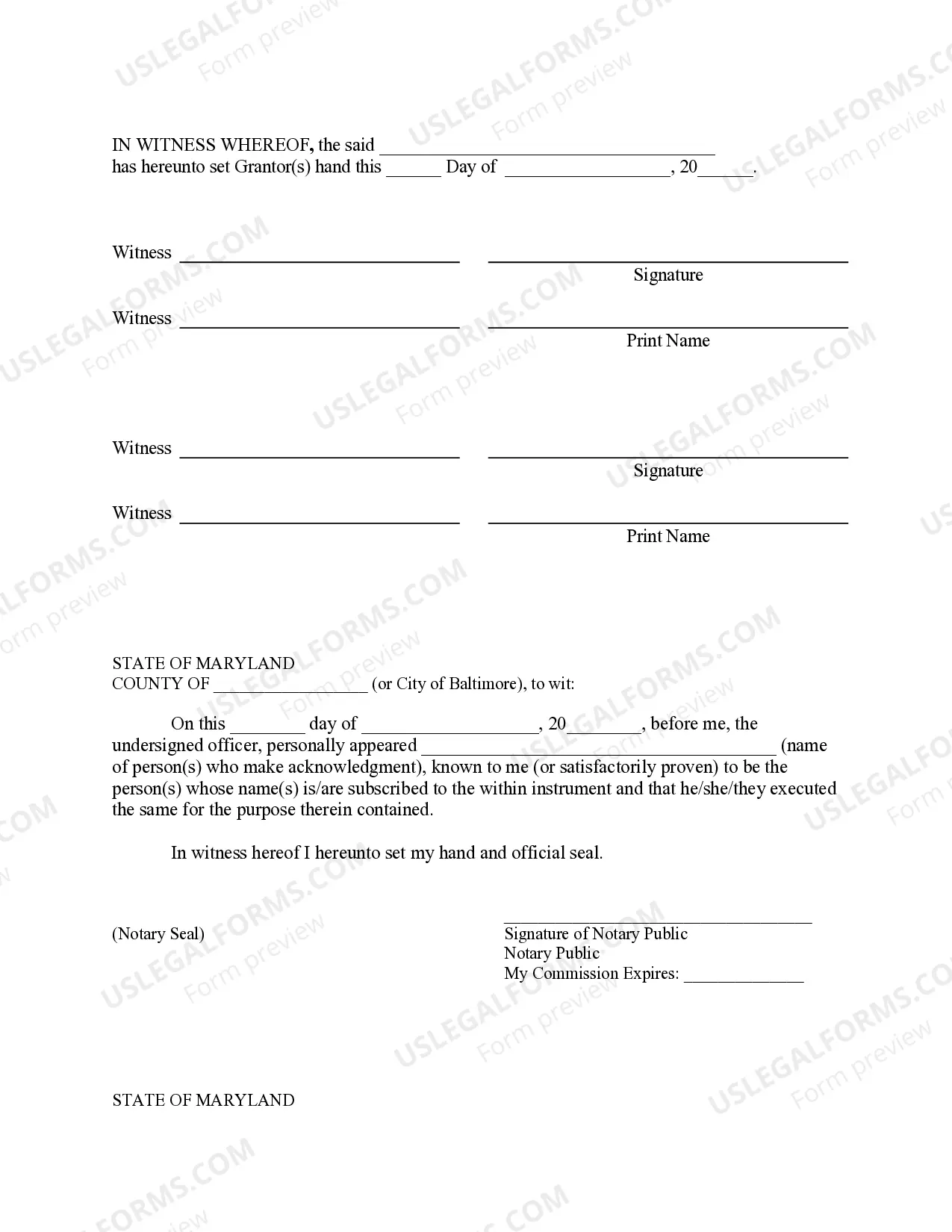

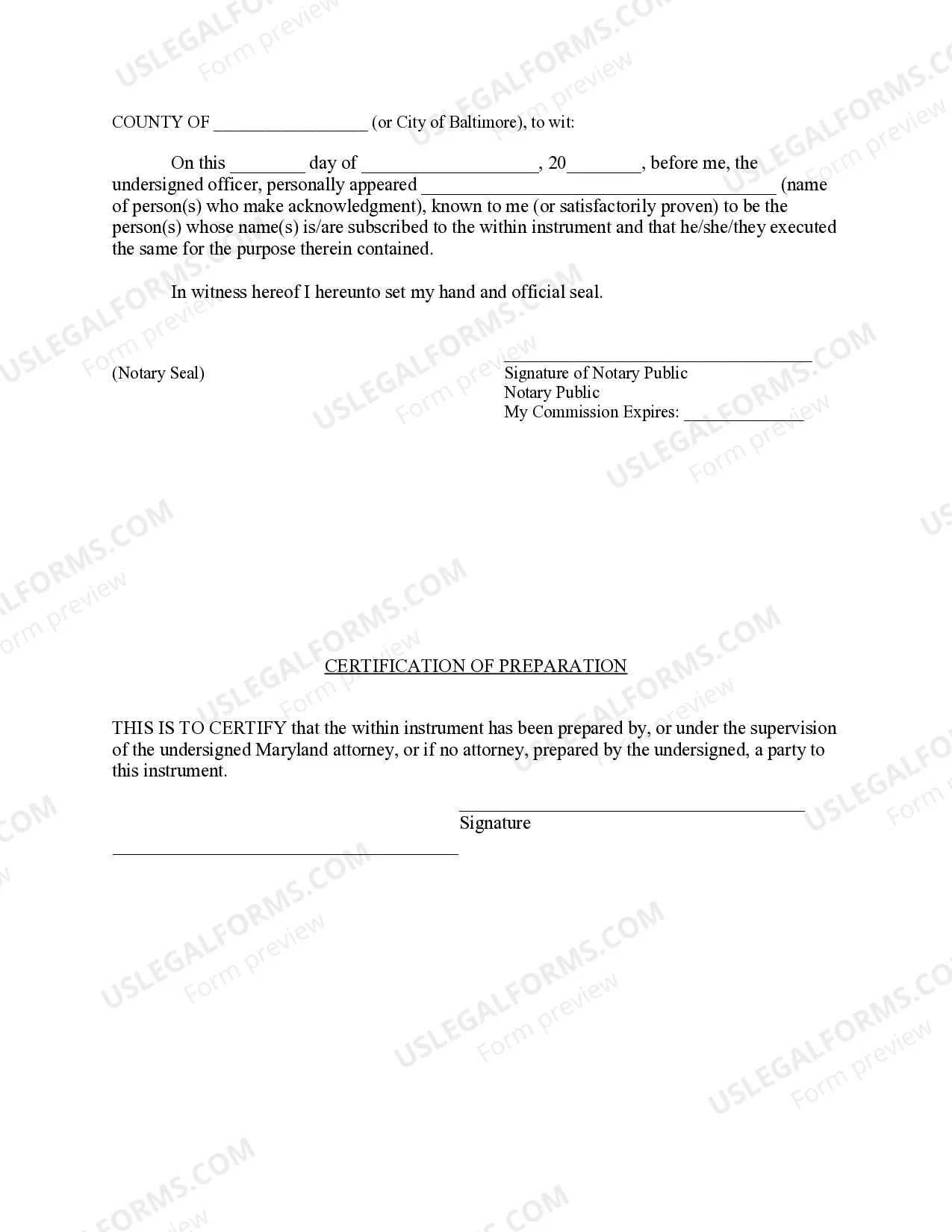

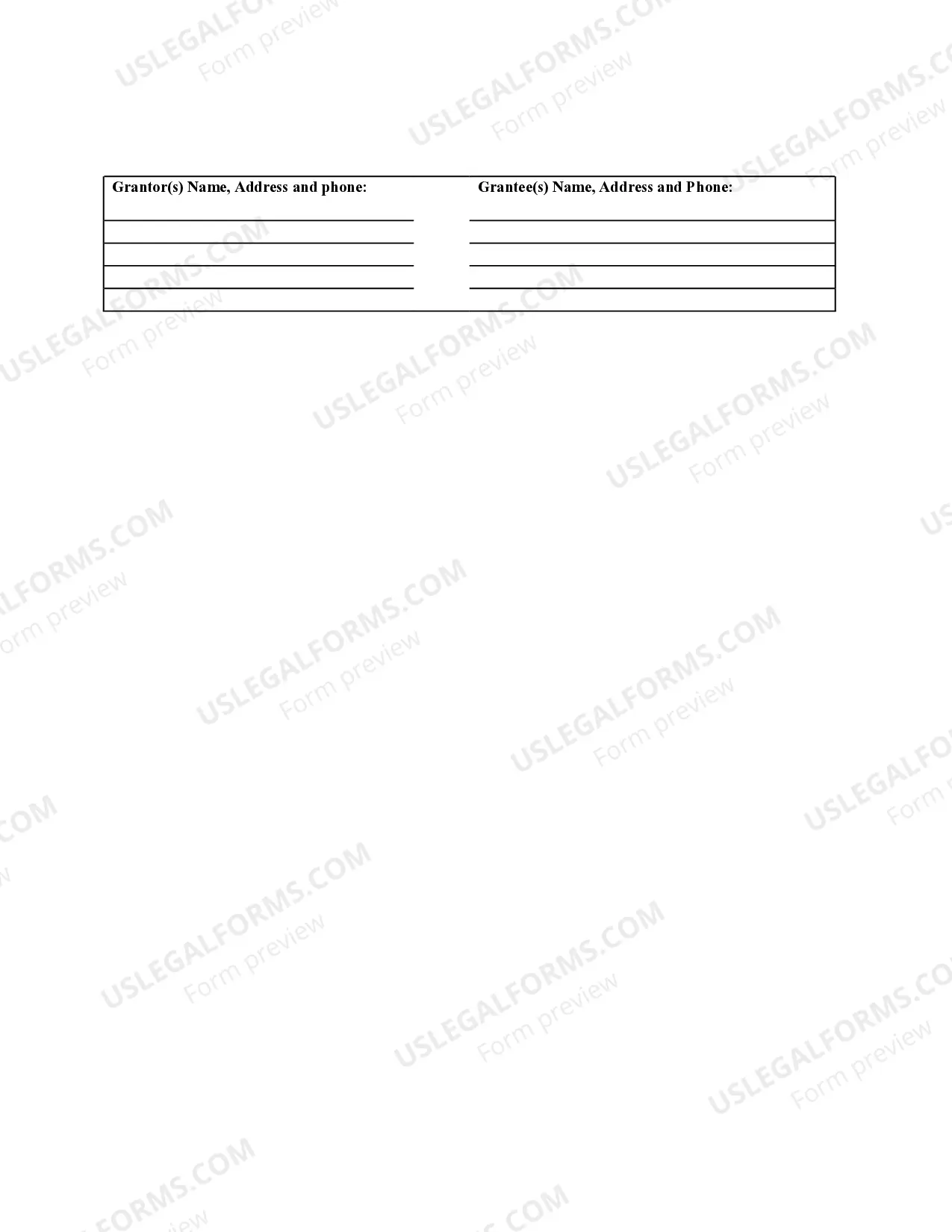

- Inspect the form preview, if available, to confirm the template is the one you need.

- Return to the search to seek the correct document if the Life Estate Deed Form Maryland Format does not fit your requirements.

- Once you are certain about the form’s applicability, download it.

- If you are a registered customer, click Log in to verify and access your selected forms in My documents.

- If you do not have an account yet, click Buy now to purchase the template.

- Choose the pricing option that aligns with your needs.

- Proceed to the registration to complete your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Select the document format for downloading Life Estate Deed Form Maryland Format.

- Once you have the form on your device, you can edit it with the editor or print it and complete it manually.

Form popularity

FAQ

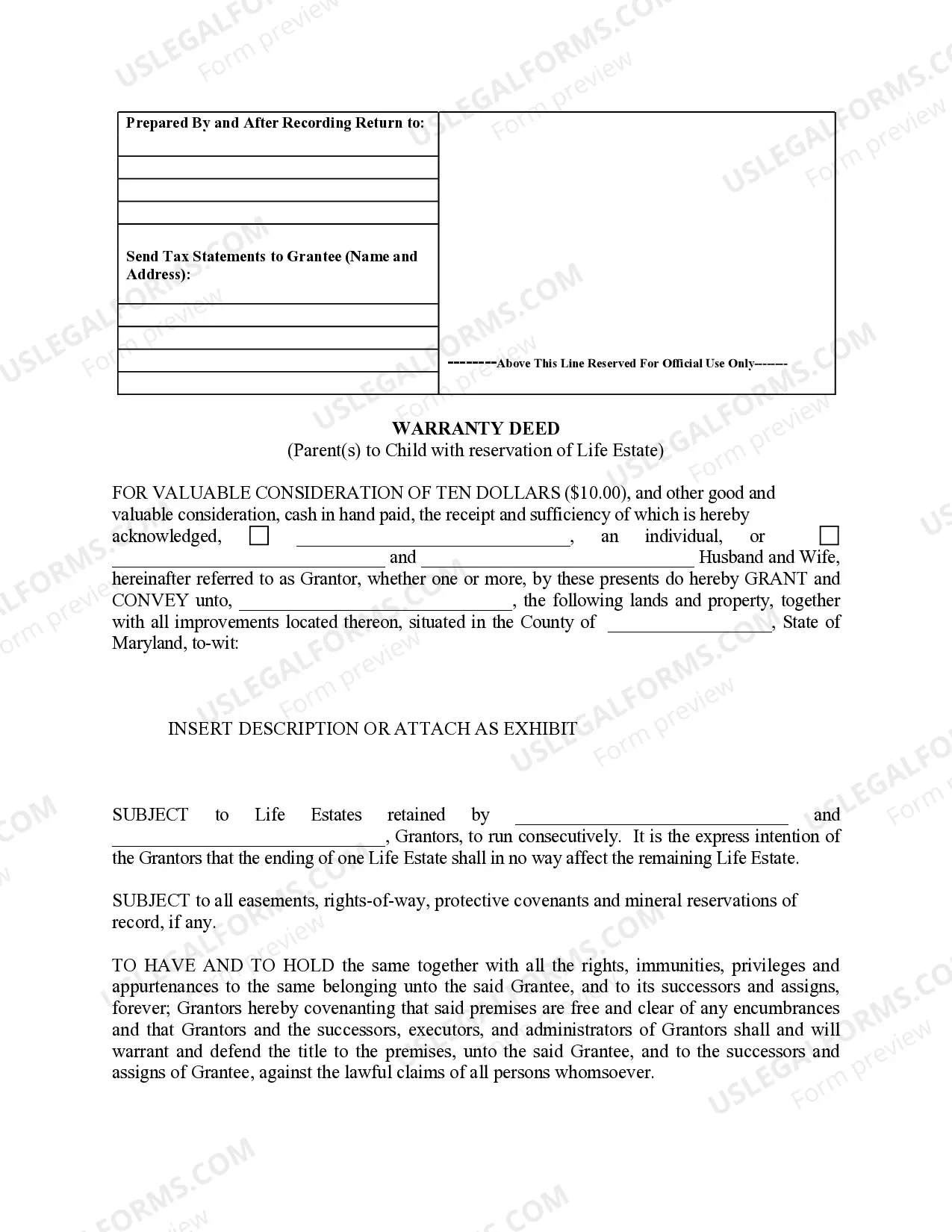

Life estate deeds with full power allow the grantor of the life estate the choice to change the deed, reclaim all rights to their home, or sell or mortgage the property. They do not need the consent of the remaining beneficiaries to do so. They can revoke the life estate for any reason they choose.

To add a name to a deed in Maryland, you must prepare a new deed that includes both the current owner's name and the new owner's name. The current owner is the grantor, and the new owner is the grantee. The new deed should include a legal description of the property.

Life Estate Deed Without Powers With this type of Deed, you are listing the remainderman as a beneficiary of the real property and you are not retaining the right to sell, mortgage, or reconvey the property.

In Maryland, real estate can be transferred via a TOD deed, also known as a beneficiary deed. This deed allows a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.