Power Of Attorney For Bank Account Form

Description

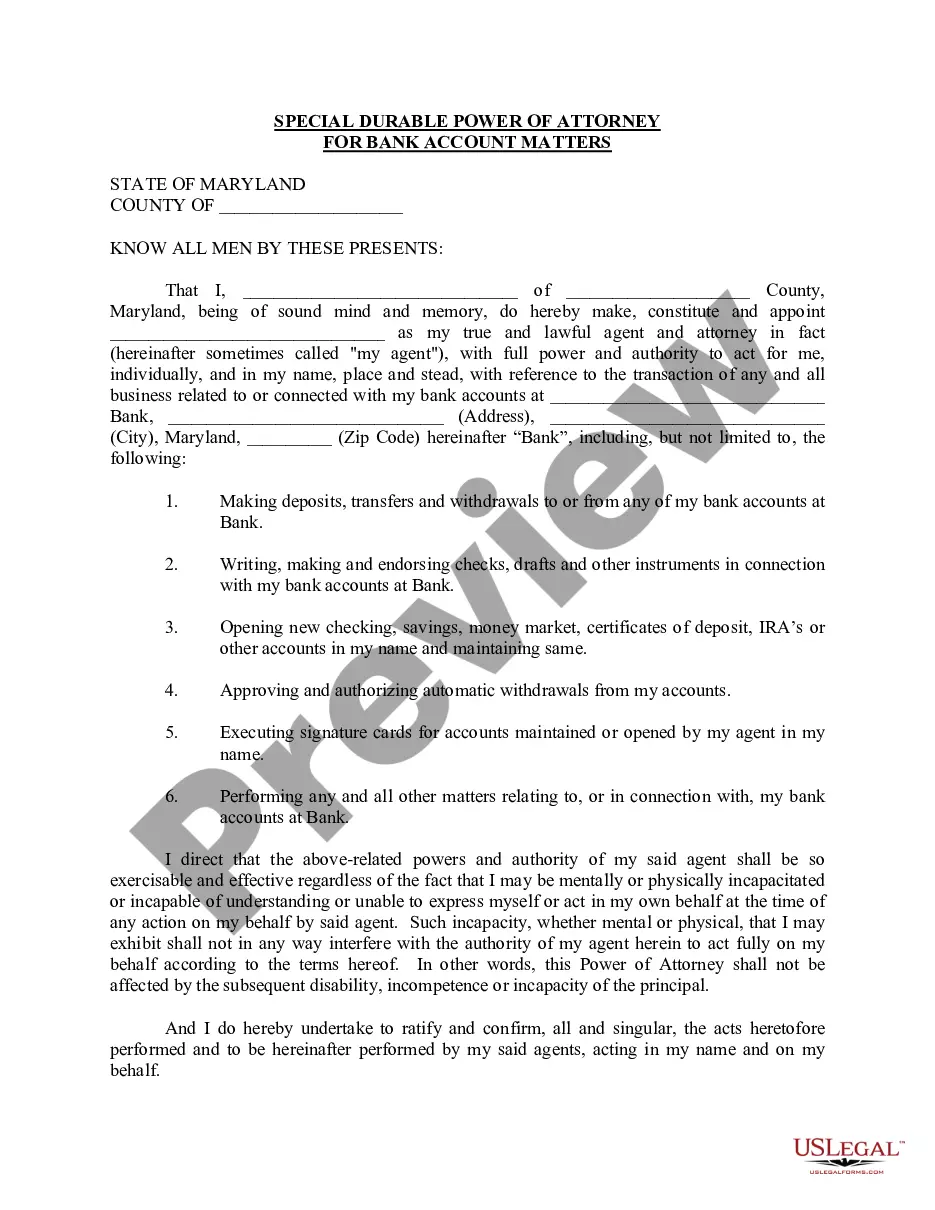

How to fill out Maryland Special Durable Power Of Attorney For Bank Account Matters?

When you must complete the Power Of Attorney For Bank Account Document following your local state's statutes and rules, there may be several choices to select from.

There's no requirement to verify each document to ensure it meets all the legal standards if you are a subscriber of US Legal Forms.

It is a trustworthy source that can assist you in obtaining a reusable and current template on any topic.

Obtaining professionally prepared formal documents becomes easy with US Legal Forms. Additionally, Premium users can also take advantage of the robust integrated solutions for online PDF editing and signing. Give it a try today!

- US Legal Forms is the most extensive online catalog with a repository of over 85k ready-to-use papers for business and personal legal situations.

- All templates are verified to align with each state's statutes and guidelines.

- Thus, when downloading the Power Of Attorney For Bank Account Document from our site, you can be confident that you possess a legitimate and current document.

- Acquiring the needed example from our platform is quite simple.

- If you already have an account, just Log In to the platform, ensure your subscription is active, and save the selected file.

- In the future, you can access the My documents section in your profile and maintain access to the Power Of Attorney For Bank Account Document anytime.

- If this is your initial experience with our library, kindly follow the instructions below.

- Browse through the suggested page and verify it for alignment with your standards.

Form popularity

FAQ

A power of attorney for banking transactions is a POA that allows a trusted agent to deal with your bank account(s) on your behalf. If you want to set up a power of attorney in a way that allows someone to make bank transactions in your stead, your POA has to specifically state that.

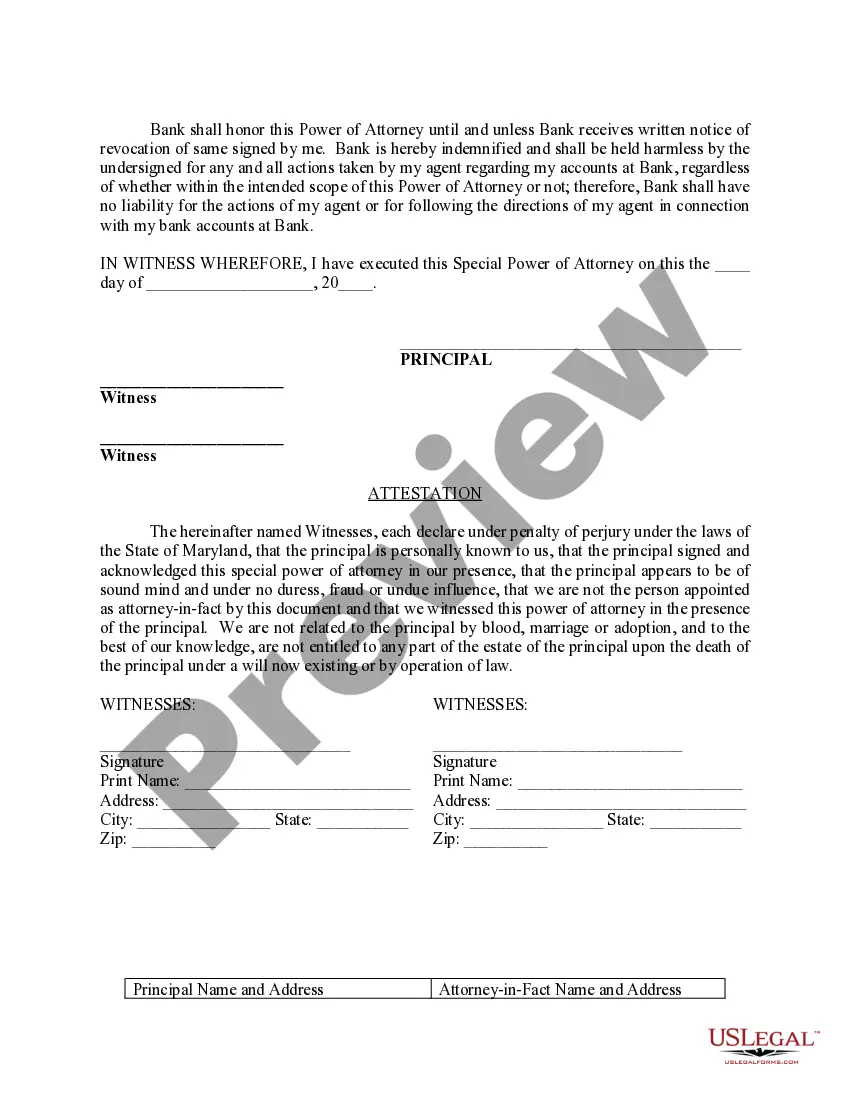

Usually the account owner chooses a spouse, relative, business partner, or close friend as an authorized signer. To add an authorized signer to an account, both you and the individual will usually need to go the bank to fill out an application and provide proper identification.

You can give someone power of attorney to deal with all your property and financial affairs or only certain things, for example, to operate a bank account, to buy and sell property or change investments.

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.

Contact the bank before having a financial power of attorney drafted by a lawyer.Send or deliver your previously drafted financial power of attorney document to the bank.Provide identification and a copy of the financial power of attorney to the bank teller when you ready to complete a transaction.