Promissory Note For Real Estate Investors

Description

How to fill out Maryland Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Properly composed formal documents are one of the essential assurances for preventing problems and disputes, yet obtaining them without a lawyer's assistance may require time.

Whether you need to swiftly locate a current Promissory Note For Real Estate Investors or additional templates for employment, family, or business situations, US Legal Forms is consistently available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen document. Furthermore, you can access the Promissory Note For Real Estate Investors at any time later, as all documents previously acquired on the platform remain accessible within the My documents section of your profile. Save time and resources on preparing formal documents. Try US Legal Forms immediately!

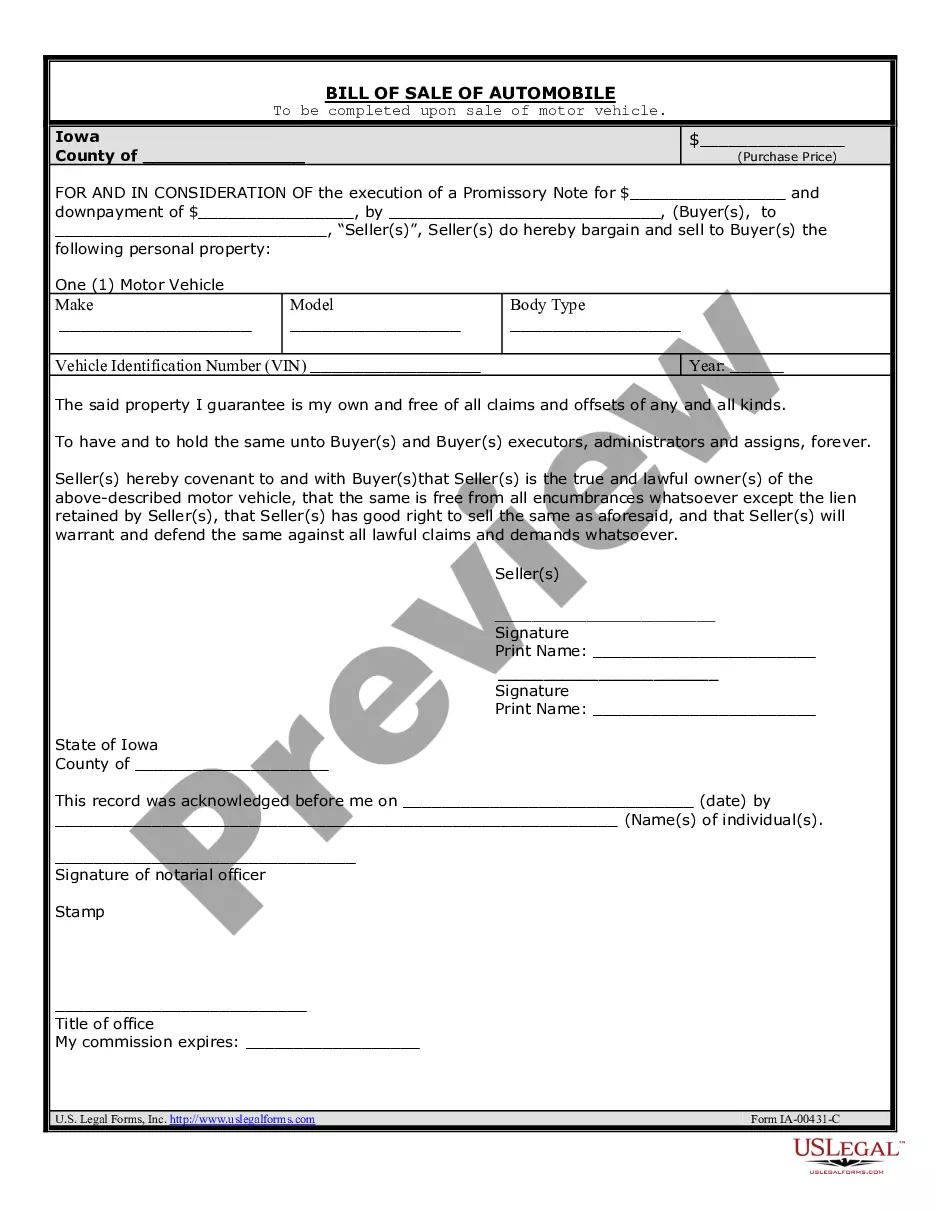

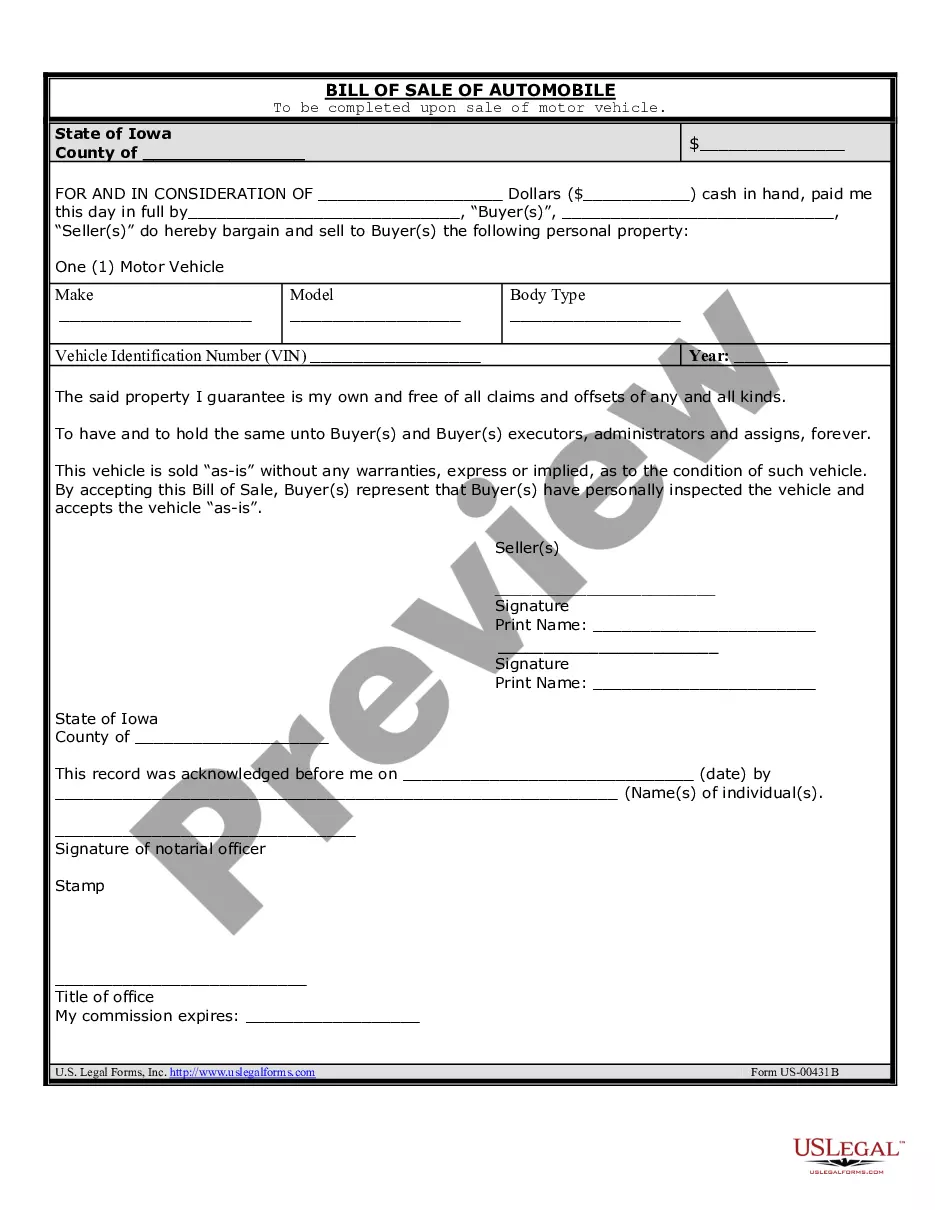

- Ensure that the document is appropriate for your circumstances and location by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the page header.

- Click Buy Now after identifying the suitable template.

- Select the pricing option, sign in to your account or create a new one.

- Choose your preferred payment method to acquire the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Promissory Note For Real Estate Investors.

- Click Download, then print the template to complete it or add it to an online editor.

Form popularity

FAQ

As when applying for a traditional mortgage, a promissory note is signed which obligates the buyer to make principal and interest payments according to a preset schedule. Should the buyer default on payments, the seller can foreclose on the property and sell the home.

The buyer gives a down payment to the seller that acts as a gesture of good faith as well as security for the repayment of the note. The home's deed also acts as collateral on the note and should the buyer default, the deed and the down payment are kept by the seller.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.