Minnesota Nonearning Disclosure

About this form

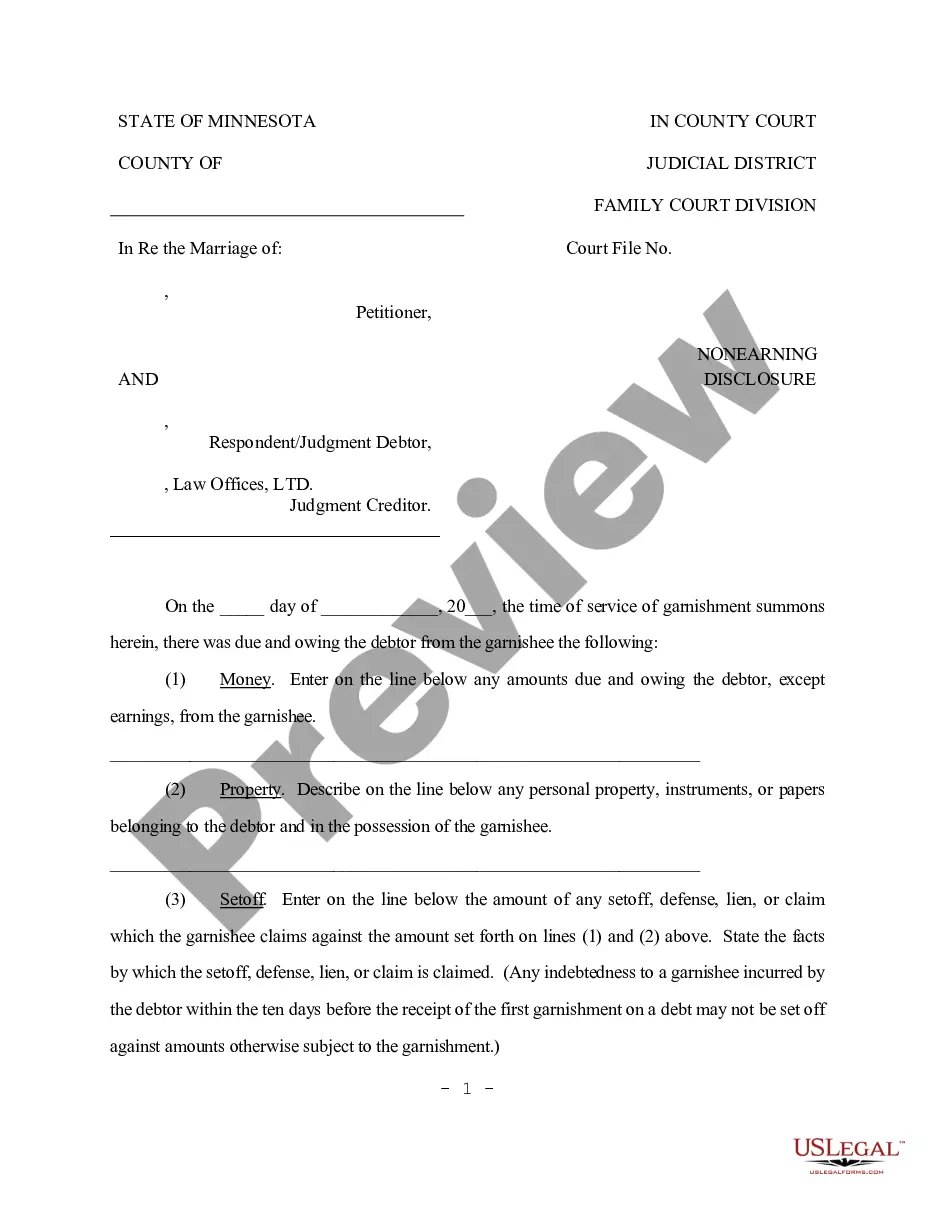

The Nonearning Disclosure is a specialized form designed to disclose information relevant to garnishment cases, specifically regarding setoffs and exemptions. Unlike other types of financial disclosure forms, the Nonearning Disclosure focuses on non-earning assets and claims against the debtorâs property, providing a clear framework for garnishees to report financial liabilities.

What’s included in this form

- Identification of amounts owed to the debtor, excluding earnings.

- Detailed description of personal property and assets belonging to the debtor.

- Disclosure of any setoffs or claims the garnishee asserts against the amounts owed.

- Claims of exemptions and interests by other parties regarding the debtor's property.

- Affirmation statement signed by the garnishee, attesting to the accuracy of the disclosed information.

When to use this form

This form should be used when a garnishee receives a garnishment order but has no earnings of the debtor to report. It is crucial for providing transparency about any non-earning assets or other financial claims. Scenarios may include situations where the debtor has personal property that is subject to garnishment or where setoffs may exist against the amounts owed.

Who should use this form

This form is intended for:

- Garnishees required to report to a court regarding the financial standing of a debtor.

- Entities holding property or assets belonging to a debtor, such as banks or leasing companies.

- Legal representatives managing garnishment proceedings.

Instructions for completing this form

- Gather information on any amounts due and owing to the debtor, excluding earnings.

- Detail any personal property or assets of the debtor in your possession.

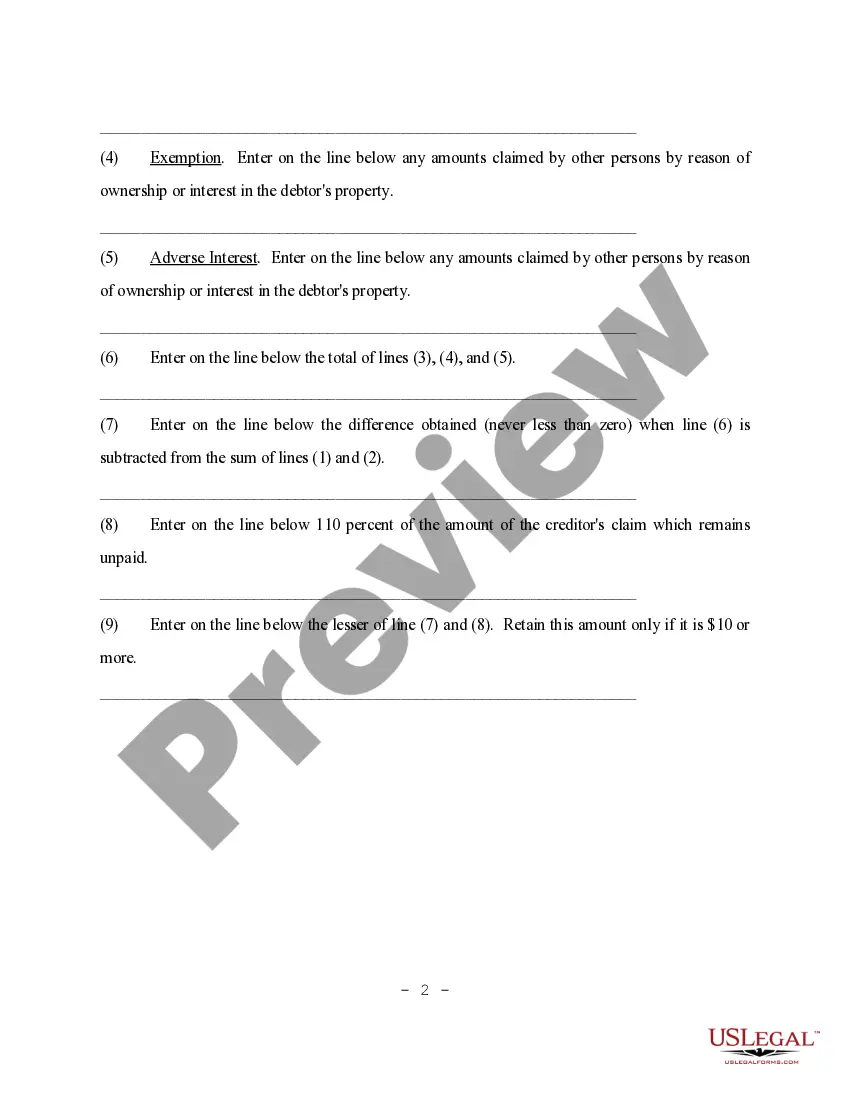

- Calculate and enter any setoffs, defenses, or claims against the amounts owed.

- Indicate any claims of exemption or adverse interests related to the debtorâs property.

- Sign and date the affirmation section, verifying the information provided is accurate and truthful.

Notarization requirements for this form

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to report all amounts due and coming from the debtor.

- Omitting necessary details about personal property or assets.

- Not completing the affirmation section correctly, resulting in an invalid disclosure.

- Neglecting to consider applicable setoffs or claims that could affect the amounts reported.

Why use this form online

- Convenient access to the form from anywhere, allowing for easy completion and submission.

- Editability to ensure all information is accurate and up to date before finalizing.

- Reliable templates prepared by licensed attorneys, ensuring compliance with legal standards.

Looking for another form?

Form popularity

FAQ

When selling property, you need to disclose all known defects and any relevant history that could affect the buyer's interest. This includes issues with the land, such as zoning problems or environmental concerns. Utilizing the Minnesota Nonearning Disclosure ensures you fulfill your legal obligations and maintain a trustworthy relationship with potential buyers.

In Minnesota, sellers must disclose any known issues that could influence a buyer's decision, such as water damage or previous repairs. Additionally, sellers should provide information about the home's history and any relevant inspections. The Minnesota Nonearning Disclosure emphasizes the importance of transparency in the selling process.

In Minnesota, expert disclosure requires sellers to provide detailed information about the property’s condition if they have conducted any professional inspections. This may include reports from home inspectors or contractors. Adhering to the Minnesota Nonearning Disclosure helps ensure that buyers are fully informed about the property's status.

When selling your house, you need to declare any known issues that may affect the property’s value or safety. This includes disclosing any repairs that have been made, along with their history. Following the Minnesota Nonearning Disclosure guidelines ensures you provide potential buyers with a comprehensive view of the home.

A seller must disclose any known defects or issues that could impact the property value or safety. This can include problems with the roof, plumbing, or electrical systems. According to the Minnesota Nonearning Disclosure, being transparent about these concerns helps protect both the seller and the buyer in the transaction.

When selling a house in Minnesota, sellers must disclose material facts that could affect the buyer's decision. This includes information about the property's condition, such as past flooding, structural issues, or pest infestations. The Minnesota Nonearning Disclosure requires that sellers provide this information clearly and honestly to potential buyers.

The disclosure requirements for real estate in Minnesota include providing information about any material defects and the property's overall condition. Sellers must complete the Minnesota Nonearning Disclosure form, which outlines these requirements. Understanding and fulfilling these obligations is crucial for a successful sale and helps avoid potential legal issues.

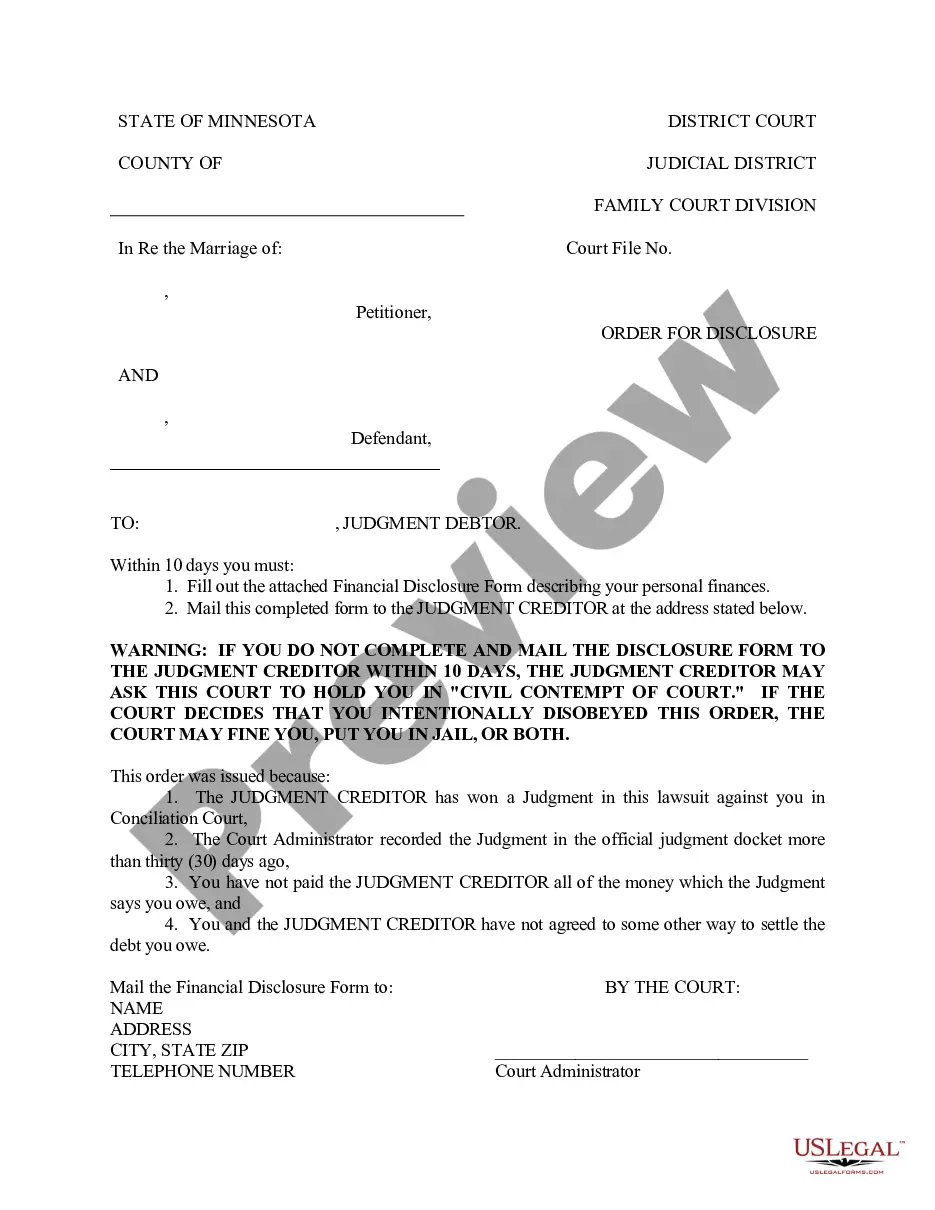

The order for disclosure in Minnesota typically involves sellers providing the Minnesota Nonearning Disclosure early in the transaction process. This allows buyers to review the property's condition before making an offer. Proper timing in disclosure can lead to smoother negotiations and a more transparent transaction.

To enforce a judgment in Minnesota, you generally need to follow specific legal procedures, including filing for garnishment or levying property. It’s essential to understand your rights and the process involved. The Minnesota Nonearning Disclosure can be a valuable resource in ensuring all disclosures are met, potentially affecting your case.

Real estate agents are obligated to disclose material facts that may influence a buyer's decision. This includes information about the property's history, any legal issues, and other significant factors. Utilizing the Minnesota Nonearning Disclosure ensures agents meet their legal responsibilities and maintain professional integrity.