Minnesota Order Requiring Financial Disclosure

What is this form?

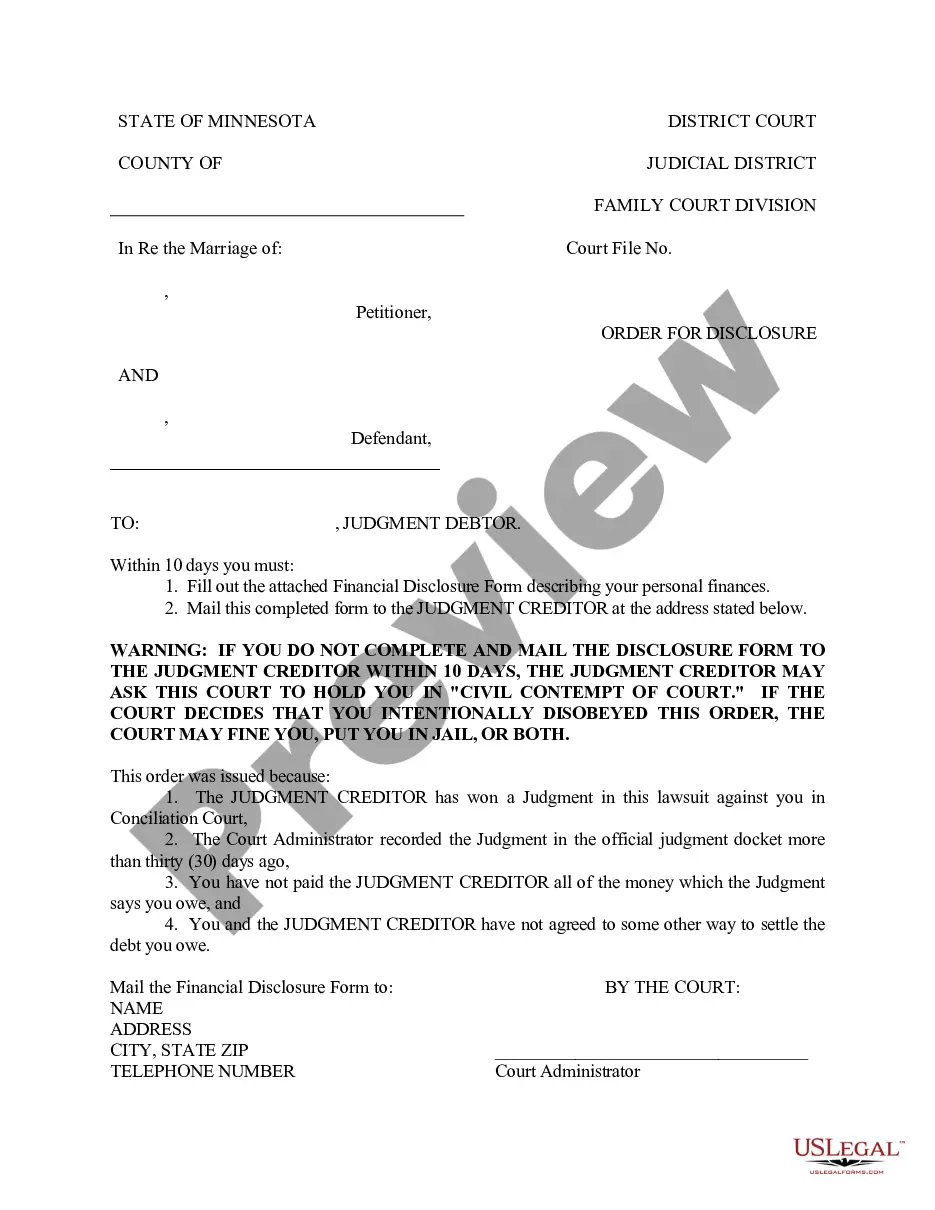

The Order Requiring Financial Disclosure is a legal document that mandates a judgment debtor to provide a detailed account of their financial status. This form is crucial for creditors seeking to enforce a judgment and ensure the debtor's compliance. Unlike other financial forms, this order comes with legal consequences if not adhered to, such as potential civil contempt charges, which can lead to fines or incarceration.

What’s included in this form

- Order for Disclosure: Initiates the requirement for the debtor to disclose financial information.

- Judgment details: States the judgment creditorâs name and the court ruling which necessitated this form.

- Deadline: Specifies the 10-day period for the debtor to complete and return the financial disclosure form.

- Consequences of non-compliance: Outlines the legal repercussions if the debtor fails to meet the requirements.

Common use cases

This form is used after a judgment has been entered in favor of a creditor. It is necessary when the debtor has not fulfilled their financial obligations as outlined in a court decision. Creditors can use this order to obtain essential financial information needed to enforce the judgment effectively.

Who this form is for

- Judgment creditors seeking compliance from debtors.

- Debtors who have been ordered to disclose their financial status following a court judgment.

- Legal professionals assisting clients in enforcement of court judgments.

Instructions for completing this form

- Identify the judgment debtor and creditor details as specified in the form.

- Complete the attached financial disclosure form, providing accurate financial information.

- Mail the completed form to the judgment creditor's address indicated in the order.

- Ensure that the form is sent within the specified ten days to avoid penalties.

- Keep a copy of the mailed form for your records.

Notarization guidance

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to complete the financial disclosure form accurately.

- Missing the ten-day deadline for submission.

- Not mailing the form to the correct address provided in the order.

- Ignoring the potential legal consequences of non-compliance.

Advantages of online completion

- Quick access to the form without the need for a meeting with a lawyer.

- Editable templates allow users to customize information easily.

- Reliable legal documents drafted by licensed attorneys, ensuring valid compliance.

- Instant download options save time and improve efficiency.

Looking for another form?

Form popularity

FAQ

Minnesota statute 550.011 addresses the requirement for financial disclosure in certain legal proceedings. It mandates that individuals involved in divorce, custody, or support cases submit a Minnesota Order Requiring Financial Disclosure. This statute ensures transparency and fairness in financial matters, enabling the court to make informed decisions. By understanding this statute, you can better navigate the financial aspects of your case and ensure compliance with Minnesota law.

The financial disclosure process involves several steps to ensure that all relevant financial information is shared among parties involved in a legal matter. Typically, this begins with a Minnesota Order Requiring Financial Disclosure, which outlines the specific documents and data that must be provided. Utilizing platforms like uslegalforms can simplify this process, ensuring you meet all legal requirements efficiently.

The purpose of disclosure is to promote transparency and honesty in legal proceedings. By requiring parties to share financial information through a Minnesota Order Requiring Financial Disclosure, the legal system aims to ensure fair outcomes. This process helps prevent deceit and allows all parties to make informed decisions based on the available data.

The disclosure laws in Minnesota encompass various regulations that mandate the sharing of financial information during legal proceedings. These laws include the Minnesota Order Requiring Financial Disclosure and other statutes that ensure transparency among parties. Adhering to these laws is essential for a fair resolution of disputes and can significantly impact the outcome of your case.

Rule of Practice 521 in Minnesota addresses the disclosure of financial information in family law cases. This rule complements the Minnesota Order Requiring Financial Disclosure by establishing clear guidelines for the information that must be shared. Familiarizing yourself with this rule can help you understand your obligations and rights during legal proceedings.

Rule 69 in Minnesota governs the procedures for enforcement of judgments, particularly regarding the disclosure of assets. This rule plays a significant role when a Minnesota Order Requiring Financial Disclosure is issued, as it outlines how parties must disclose financial information. Understanding Rule 69 helps individuals navigate the enforcement of court orders effectively.

The order for disclosure in Minnesota refers to a legal directive that requires parties to provide financial documents and information. This is often initiated through a Minnesota Order Requiring Financial Disclosure, which ensures that all relevant financial facts are made available during court proceedings. This process helps maintain fairness and integrity in legal disputes.

The 181.79 law in Minnesota relates to the Minnesota Order Requiring Financial Disclosure. This statute mandates that parties involved in certain legal proceedings must exchange financial information to promote transparency. Understanding this law is crucial for individuals seeking to comply with legal requirements and ensure fair proceedings.

Yes, in Minnesota, you can be served by mail under certain conditions. Typically, you need to send the documents via certified mail, ensuring the recipient signs for them. However, if you have a Minnesota Order Requiring Financial Disclosure, proper service is crucial to enforce compliance. USLegalForms can assist you in understanding the requirements and ensuring that you follow the correct procedures.

Collecting on a judgment in Minnesota involves several steps, including obtaining a Minnesota Order Requiring Financial Disclosure. This order can compel the debtor to reveal their financial status. Once you have this information, you can use various collection methods, such as garnishing wages or seizing assets. For guidance and forms that streamline this process, consider USLegalForms as a valuable resource.