Maryland Inheritance Tax Waiver Form For New Jersey

Description

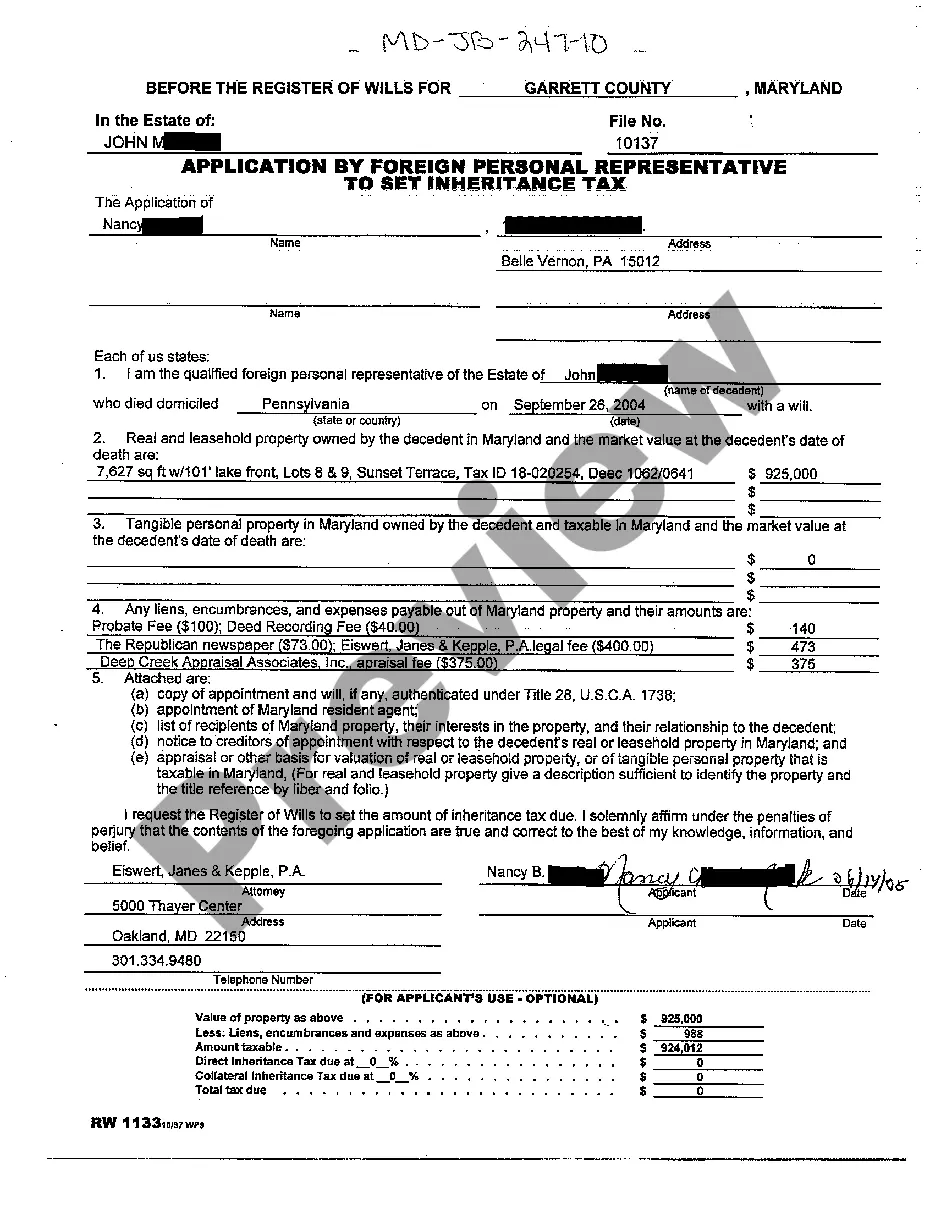

How to fill out Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

Managing legal documents can be exasperating, even for experienced professionals.

If you are searching for a Maryland Inheritance Tax Waiver Form For New Jersey and lack the time to invest in finding the correct and current version, the process can be taxing.

Tap into a valuable resource library of articles, guides, manuals, and materials pertinent to your case and needs.

Save time and energy searching for the documents you require, and use US Legal Forms’ sophisticated search and Preview feature to locate the Maryland Inheritance Tax Waiver Form For New Jersey and obtain it.

Ensure that the template is valid in your state or county. Click Buy Now when you are ready. Select a monthly subscription plan. Choose the required format, and Download, fill out, sign, print, and submit your documents. Leverage the US Legal Forms online library, supported by 25 years of expertise and reliability. Streamline your daily document management into a simple and user-friendly process today.

- If you hold a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to see the documents you have previously downloaded and manage your folders as needed.

- If it's your first experience with US Legal Forms, create an account and gain unlimited access to all the benefits of the platform.

- Follow these steps after accessing the required form.

- Confirm this is the accurate form by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms meets any requirements you may have, from personal to business paperwork, all consolidated in one location.

- Utilize advanced tools to complete and manage your Maryland Inheritance Tax Waiver Form For New Jersey.

Form popularity

FAQ

Yes, Maryland does have procedures that act as an inheritance tax waiver. This waiver can reduce the tax burden on specific assets or beneficiaries under certain conditions. Utilizing the Maryland inheritance tax waiver form for New Jersey can help you navigate this process effectively and ensure you receive all available benefits.

Certain individuals are exempt from the Maryland inheritance tax, including immediate family members like spouses, parents, children, and siblings. Charitable organizations often receive exemptions as well. Understanding these exemptions can be crucial, and the Maryland inheritance tax waiver form for New Jersey may provide additional clarity.

Inheritance tax rates in Maryland vary depending on the relationship to the deceased. Close relatives, such as children and spouses, often face lower rates or exemptions compared to distant relatives or unrelated individuals. It’s advisable to review the specific rates and consider the Maryland inheritance tax waiver form for New Jersey to determine potential tax obligations.

To obtain a New Jersey inheritance tax waiver, you need to file the appropriate paperwork for your estate. This usually includes providing necessary financial disclosures to the state. Using the Maryland inheritance tax waiver form for New Jersey can simplify this process, ensuring you meet all requirements efficiently.

Keeping your inheritance from being taxed requires strategic financial planning. Consider using trusts or making gifts to reduce your taxable estate effectively. Furthermore, utilizing the Maryland inheritance tax waiver form for New Jersey can offer specific solutions to lessen tax burdens.

To avoid NJ inheritance tax, look into the possibility of gifting assets before they are inherited, as this might lower the taxable estate. Trusts can also be beneficial, ensuring a smoother transition of your assets with fewer tax liabilities. Completing the Maryland inheritance tax waiver form for New Jersey could help streamline your efforts to minimize taxes.

The best way to avoid inheritance tax involves careful estate planning, including utilizing tax exemptions and allowances. You should consult financial professionals to develop strategies tailored to your situation. The Maryland inheritance tax waiver form for New Jersey can also play a crucial role in this process, ensuring compliance while reducing taxable amounts.

To avoid Maryland inheritance tax, you may consider gifting assets before death, which reduces the taxable estate. Establishing a living trust can also help to keep assets out of probate, streamlining the process and minimizing tax liabilities. Additionally, using the Maryland inheritance tax waiver form for New Jersey residents can assist in managing taxes effectively.

New Jersey does impose inheritance taxes on out-of-state inheritances, dependent on the relationship to the deceased and the amount received. It is important to understand these regulations to avoid unexpected taxes. Utilizing the Maryland inheritance tax waiver form for New Jersey can help navigate these requirements effectively, ensuring compliance and peace of mind.

If the inheritance exceeds a certain threshold, you must file an inheritance tax return in New Jersey. This return assists in determining the overall tax due on the estate. If you find yourself dealing with interstate issues, use the Maryland inheritance tax waiver form for New Jersey to clarify your responsibilities and facilitate smoother transactions.