Maryland Inheritance Tax Waiver Form For Deceased Person

Description

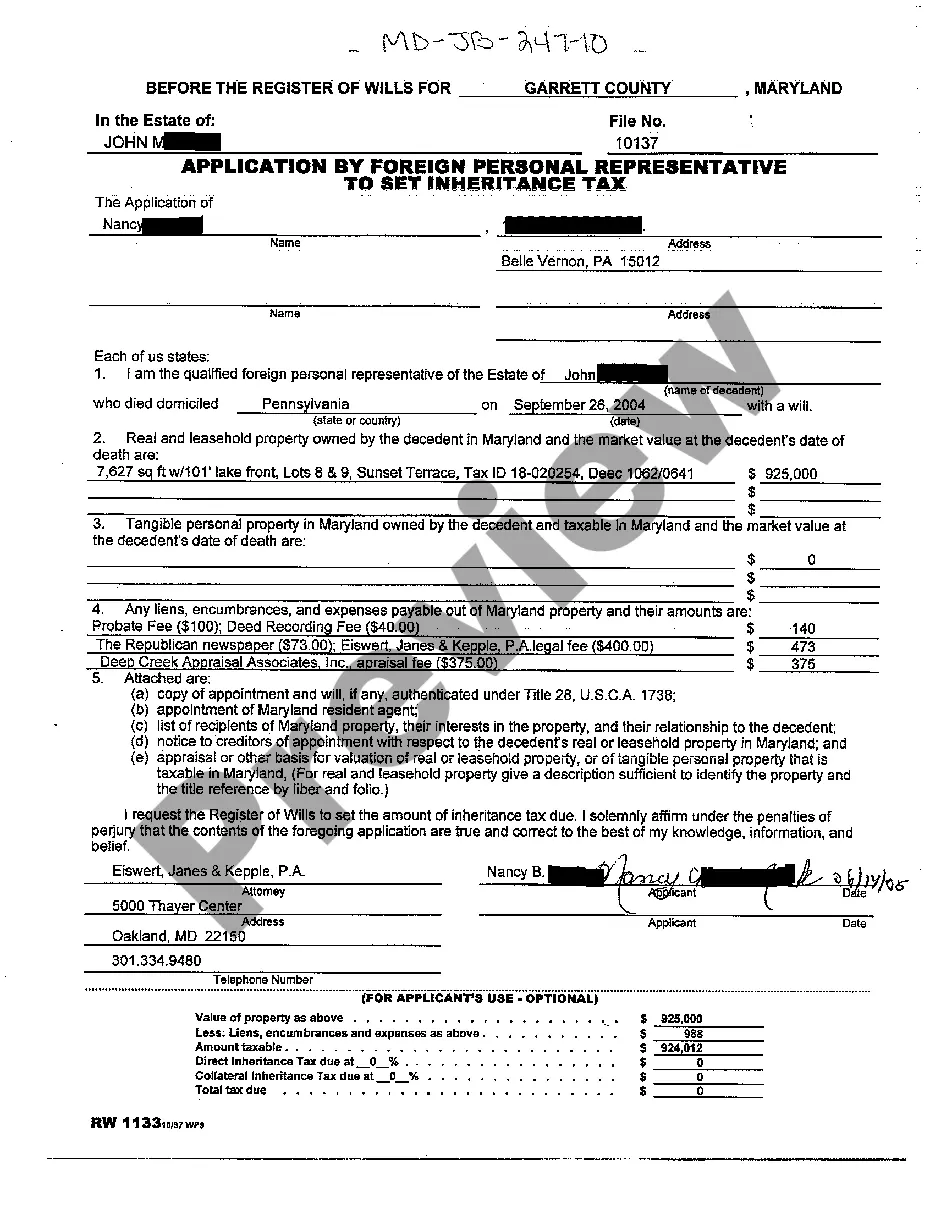

How to fill out Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

Managing legal paperwork and processes might be a lengthy addition to your entire schedule.

Maryland Inheritance Tax Waiver Form for a Deceased Individual and similar documents often necessitate you to look for them and comprehend how to fill them out correctly.

Therefore, if you are handling financial, legal, or personal affairs, utilizing a comprehensive and practical online repository of forms at your disposal will significantly help.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific documents and numerous resources to assist you in completing your paperwork with ease.

Simply Log In to your account, look for Maryland Inheritance Tax Waiver Form for a Deceased Individual, and obtain it immediately within the My documents section. You can also retrieve previously saved forms.

- Explore the repository of relevant documents available to you with just one click.

- US Legal Forms provides you with state- and county-specific forms accessible for download at any time.

- Safeguard your document management processes with a reputable service that enables you to prepare any form in minutes without any additional or concealed fees.

Form popularity

FAQ

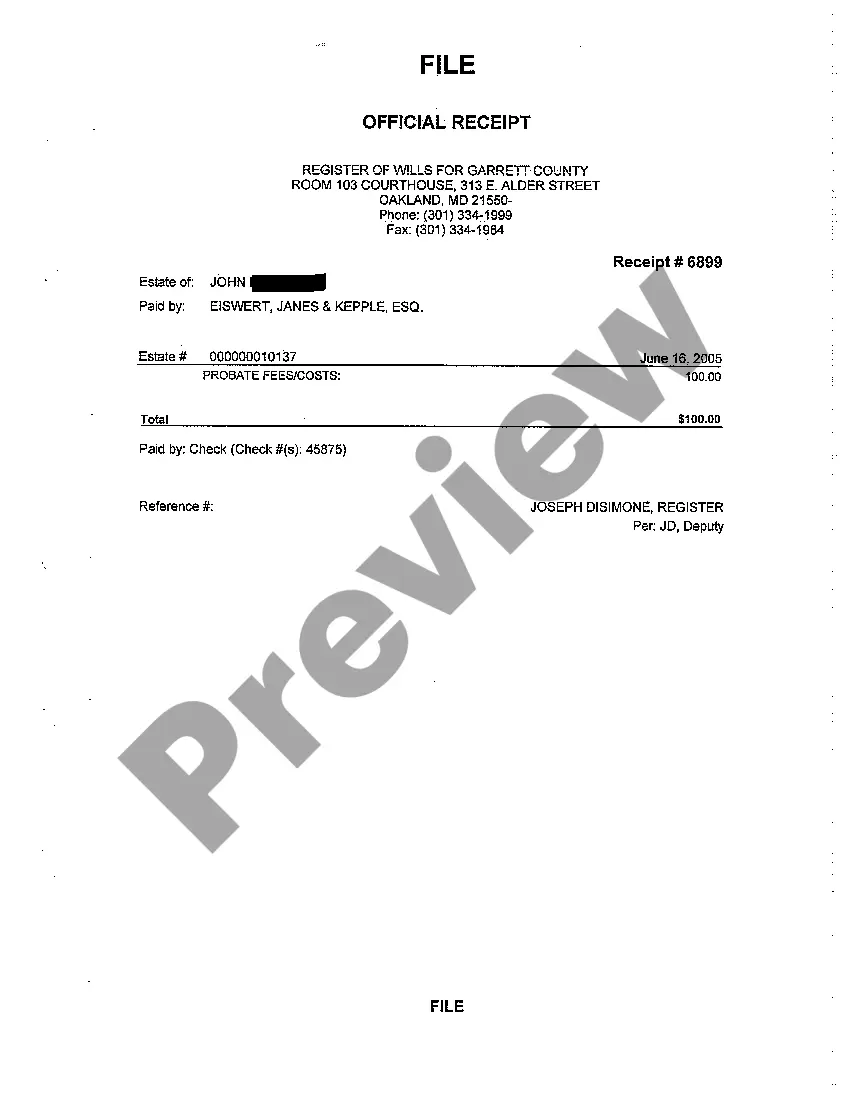

To file a deceased person's tax return in Maryland, you first need to gather all relevant financial documents, including W-2s, 1099s, and any other income records. Once you've compiled the necessary information, you should complete the Maryland inheritance tax waiver form for deceased person, which may also be needed if the estate has any tax obligations. Ensure you understand the specific filing deadlines, as these can affect the overall process. If you need assistance, platforms like USLegalForms can provide guidance and templates to help streamline the filing process.

In Maryland, certain individuals are exempt from inheritance tax, including spouses and charitable organizations. Additionally, parents and children also benefit from tax exemptions within specified limits. Understanding these exemptions is crucial, particularly when filling out the Maryland inheritance tax waiver form for deceased person, as it can significantly impact tax liabilities. Always consider consulting with a legal professional to ensure you understand your exemptions fully.

To waive inheritance, beneficiaries must formally renounce their rights to inherit, which often involves drafting a legal document. It’s important to understand the implications of renouncing an inheritance, as it may determine future estate distribution. Utilizing the Maryland inheritance tax waiver form for deceased person can clarify the tax responsibilities tied to any waivers. This process should ideally be discussed with a legal expert to ensure all aspects are covered.

Reducing inheritance tax in Maryland can be achieved through careful planning and strategic gifting. By distributing assets before death, you might lessen the taxable estate. Using the Maryland inheritance tax waiver form for deceased person allows for easy identification of exemptions and possible reductions. Consulting with a tax advisor can provide tailored strategies to minimize your tax burden effectively.

To avoid Maryland inheritance tax on property, planning ahead is essential. One effective strategy is to transfer assets through living trusts or joint ownership. Additionally, using a Maryland inheritance tax waiver form for deceased person can help clarify exemptions and streamline tax processes. Seeking guidance from a legal professional can further assist in implementing these strategies.

In Maryland, inheritance laws dictate how assets are distributed after a person's death. Generally, inheritance taxes apply to estates worth over a certain value, and a Maryland inheritance tax waiver form for deceased person is necessary for settling these taxes. It's crucial to understand that spouses are typically exempt from this tax, while other heirs might face varying rates based on their relationship to the deceased. Familiarizing yourself with these laws can help you navigate the process with ease.

Avoiding Maryland inheritance tax can involve careful planning and timely legal actions. A well-prepared estate plan, including gifting assets and charitable donations, plays a significant role. Additionally, completing the Maryland inheritance tax waiver form for deceased person can help clarify tax duties and guide you through the necessary processes, ensuring compliance while minimizing taxes.

Yes, Maryland provides an inheritance tax waiver that allows the executor to manage the estate without the burden of immediate tax payments. This waiver is critical when dealing with certain beneficiaries or property transfers. To initiate this process, you will need to obtain the Maryland inheritance tax waiver form for deceased person, which helps streamline the tax responsibilities.

To avoid inheritance taxes in Maryland, you may need to utilize certain exemptions provided by the state. For example, spousal transfers and certain charitable contributions can be exempt. Additionally, you should consider filing a Maryland inheritance tax waiver form for deceased person to ensure you meet all legal requirements and potentially reduce tax liability.

Filling out a tax form for a deceased person can be straightforward when you follow the right steps. First, gather all necessary information such as the deceased's financial records, Social Security number, and date of death. Then, use a reliable resource like the uslegalforms platform to access the Maryland inheritance tax waiver form for deceased persons, ensuring you submit a complete and accurate document. Finally, review your form thoroughly to avoid errors and be prepared for any additional requirements from the state.