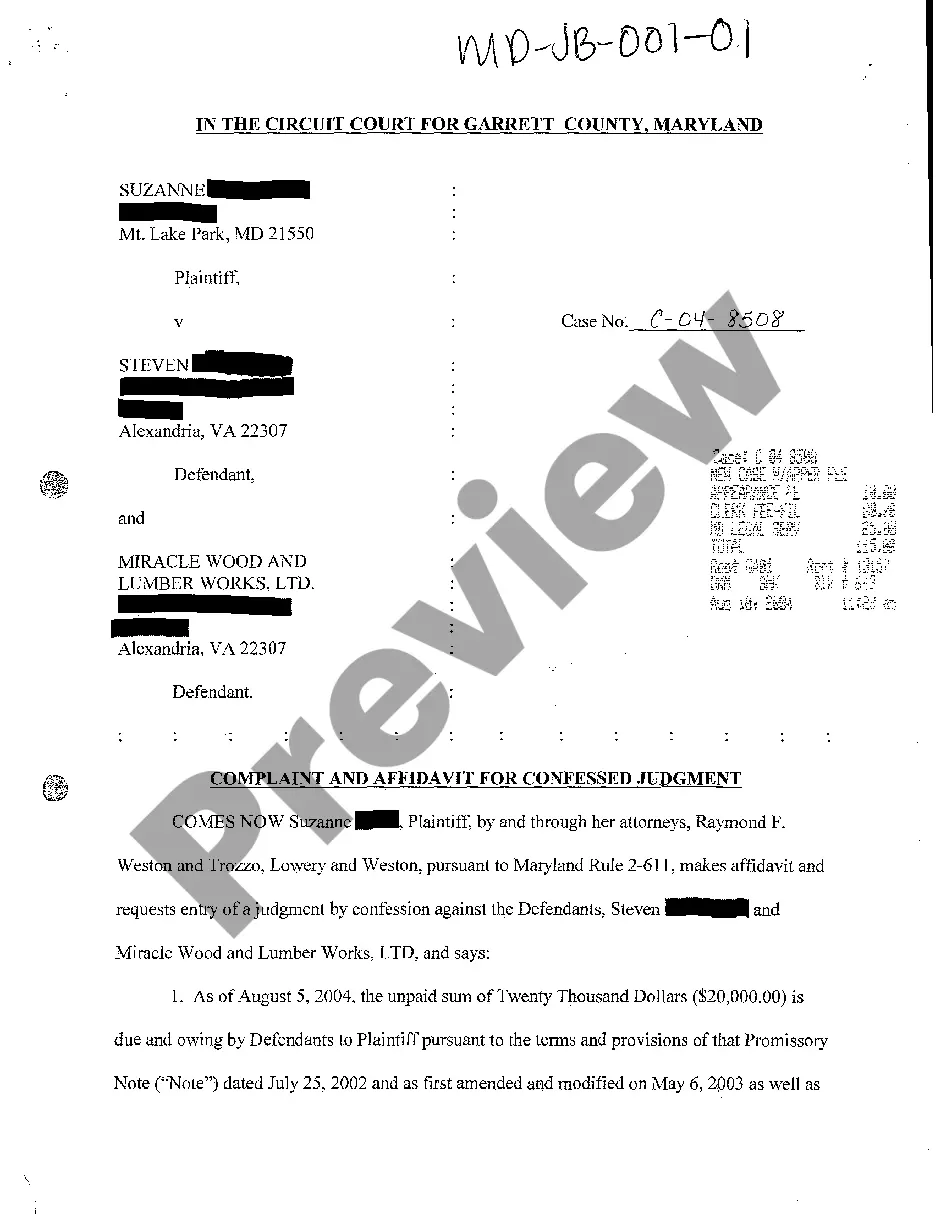

Confessed Judgment Promissory Note Maryland Foreclosure

Description

How to fill out Maryland Complaint And Affidavit For Confessed Judgment?

Dealing with legal documentation and processes can be a lengthy addition to your day.

Confessed Judgment Promissory Note Maryland Foreclosure and similar forms usually require you to look for them and navigate the process to complete them efficiently.

Thus, if you are managing financial, legal, or personal issues, possessing a comprehensive and functional online database of forms readily available will be highly beneficial.

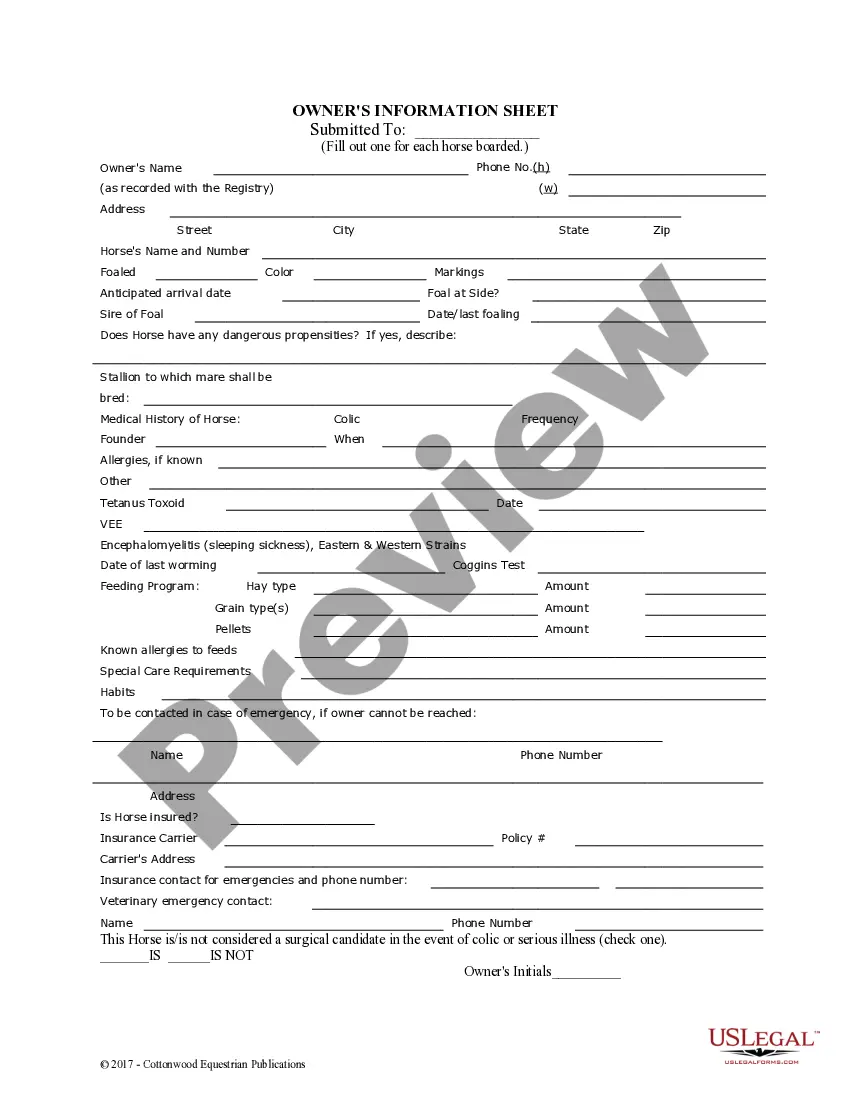

US Legal Forms is the premier online platform for legal templates, providing over 85,000 state-specific documents and a range of tools that will assist you in promptly completing your paperwork.

Is this your initial experience with US Legal Forms? Register and create an account in a few minutes and you'll gain entry to the form catalog and Confessed Judgment Promissory Note Maryland Foreclosure. Then, follow the steps below to finalize your form: Make sure you have located the correct form by utilizing the Review option and examining the form details. Select Buy Now once prepared, and pick the subscription plan that suits your requirements. Select Download then fill, sign, and print the form. US Legal Forms boasts twenty-five years of experience aiding users in managing their legal documents. Discover the form you need today and simplify any process effortlessly.

- Browse the selection of relevant documents accessible to you with a single click.

- US Legal Forms presents you with state- and county-specific forms available for immediate download.

- Protect your document management processes with a top-notch service that enables you to prepare any form within minutes without extra or concealed charges.

- Just Log In to your account, search for Confessed Judgment Promissory Note Maryland Foreclosure and retrieve it directly from the My documents section.

- You can also access previously stored forms.

Form popularity

FAQ

Wages can be garnished immediately after a default judgment is entered, provided proper legal procedures are followed. In Maryland, creditors must file a request with the court and notify the debtor before garnishment begins. Familiarizing yourself with these steps can help manage the impact of a confessed judgment promissory note in Maryland and mitigate foreclosure risks.

Once a judge signs a judgment, it becomes legally binding, and the creditor can begin enforcement actions. This may include garnishing wages, placing liens on property, or other methods of collecting the debt. Being aware of these processes is crucial to address any concerns regarding a confessed judgment promissory note in Maryland and to take proactive measures.

Yes, in Maryland, judgments do expire but can be renewed if necessary. Generally, a judgment remains enforceable for 12 years, starting from the date of the court's decision. Knowing about the expiration period can help you address potential foreclosure risks arising from a confessed judgment promissory note in Maryland.

Confession of judgment laws vary by state, and not all states permit this legal approach. States such as Maryland allow confession of judgment clauses in certain promissory notes, facilitating faster foreclosure processes for creditors. Before proceeding, it's essential to understand the regulations in your state, especially if you are considering a confessed judgment promissory note in Maryland.

A consent judgment is a legally binding agreement between parties where they agree to settle a dispute without going to trial. Unlike a confession of judgment, which does not require the debtor's consent, a consent judgment may involve negotiations and mutual terms. This option can provide a more collaborative way to resolve issues related to a debt, including those connected to a confessed judgment promissory note in Maryland.

A confession of judgment clause is a provision in a promissory note that allows a creditor to obtain a judgment against a debtor without a trial, if the debtor defaults. For instance, if you have a confessed judgment promissory note in Maryland, it means the lender can file for foreclosure directly after default without going through the entire legal process. This clause provides a quick and efficient means for creditors to recover debts.

In person (at a clinic or help desk). Apply Online through Illinois Legal Aid Online or call 312-341-1070 to get help now.

ILAO is the only legal aid service in Illinois where people can get free legal aid 24/7/365. A game changer.

Illinois Legal Aid Online Web Address: .Illinoislegalaid.org. IllinoisLawyerFinder. 800-922-8757. 217-525-5297. .illinoislawyerfinder.com. 20 South Clark Street. Suite 900. Chicago, IL 60603-1802. 312-726-8775. 800-678-4009. 312-738-9200. EMAIL: Info@carpls.org. Web Address: .carpls.org.

If you have a legal issue, please call our hotline at 312.738. 9200 or use this tool to find the right assistance. Please use the contact form below for GENERAL inquiries only.