Tenant Subordination Agreement For Ucc

Description

How to fill out Maryland Lease Subordination Agreement?

Individuals frequently link legal documentation with complexity that only an expert can handle.

In certain respects, this holds true, as composing a Tenant Subordination Agreement For Ucc requires a comprehensive knowledge of subject parameters, encompassing both state and local laws.

However, with US Legal Forms, the process has become easier: pre-prepared legal templates for any personal and business event tailored to state regulations are compiled in a single digital directory and are now accessible to everyone.

All templates in our collection are reusable: once acquired, they remain stored in your account. You can access them anytime via the My documents section. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe now!

- Evaluate the page details carefully to ensure it meets your requirements.

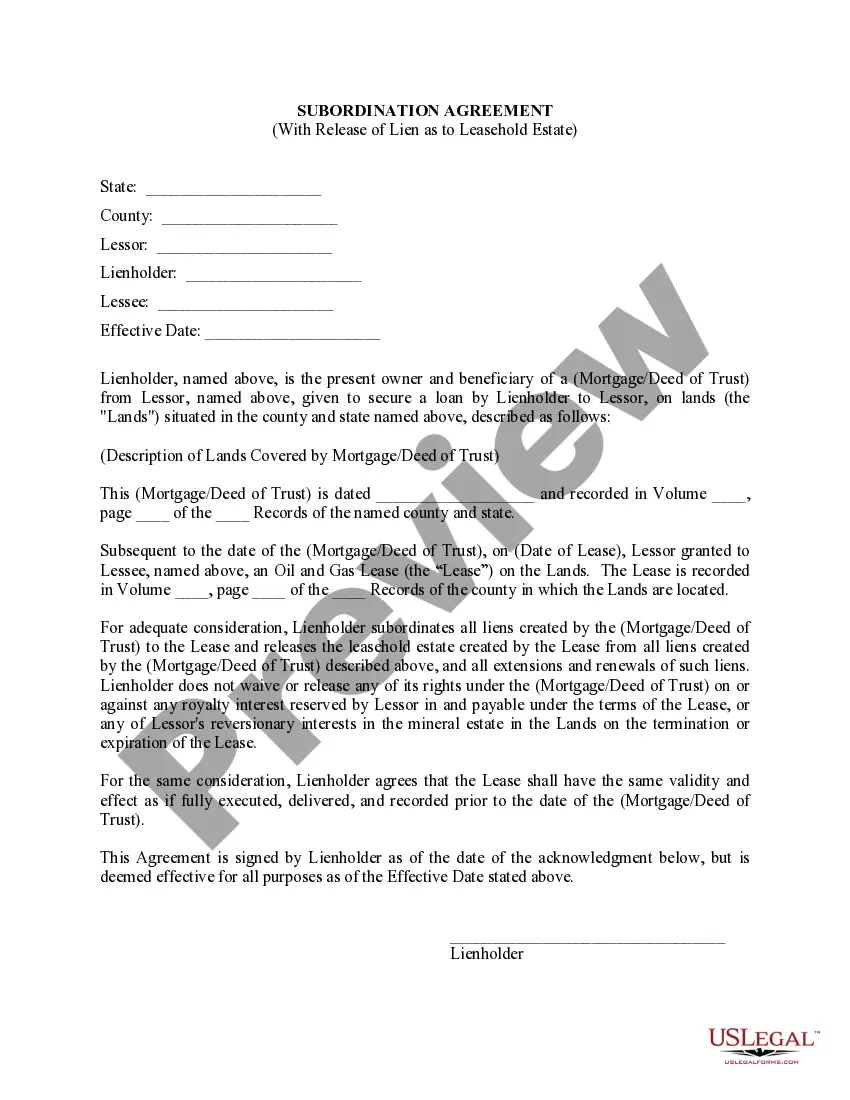

- Review the form overview or examine it using the Preview feature.

- Search for an alternative example through the Search field above if the previous one doesn't fit your needs.

- Press Buy Now when you identify the appropriate Tenant Subordination Agreement For Ucc.

- Select the subscription plan that aligns with your needs and financial situation.

- Create an account or Log In to move to the payment screen.

- Complete the payment for your subscription using PayPal or your credit card.

- Choose the format for your document and click Download.

- Print your file or upload it to an online editor for faster completion.

Form popularity

FAQ

Example of a Subordination AgreementThe business files for bankruptcy and its assets are liquidated at market value$900,000. The senior debtholders will be paid in full, and the remaining $230,000 will be distributed among the subordinated debtholders, typically for 50 cents on the dollar.

How to complete a UCC1 (Step by Step)Filer Information. Name and phone number of contact at filer. Email contact at filer.Debtor Information. Organization or individual's name. Mailing address.Secured Party Information. Organization or individual's name. Mailing address.Collateral Information. Description of collateral.

A UCC 3 sub-ordination is a form used when more than one lender is interested in the same collateral. In this situation, a subordination agreement should be signed to determine the order in which lenders will be repaid. As a rule, the second lender`s interest in collateral is subordinated to the first lender.

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.

It has a shot at the collateral only after the first lender gets what it's owed. The first lender could, however, agree to subordinate its security interest in favor of the second lender. I.e., switch positions. The first lender would file a UCC3 Subordination form to record the switch.