Maryland Tax Lien Foreclosure Process

Description

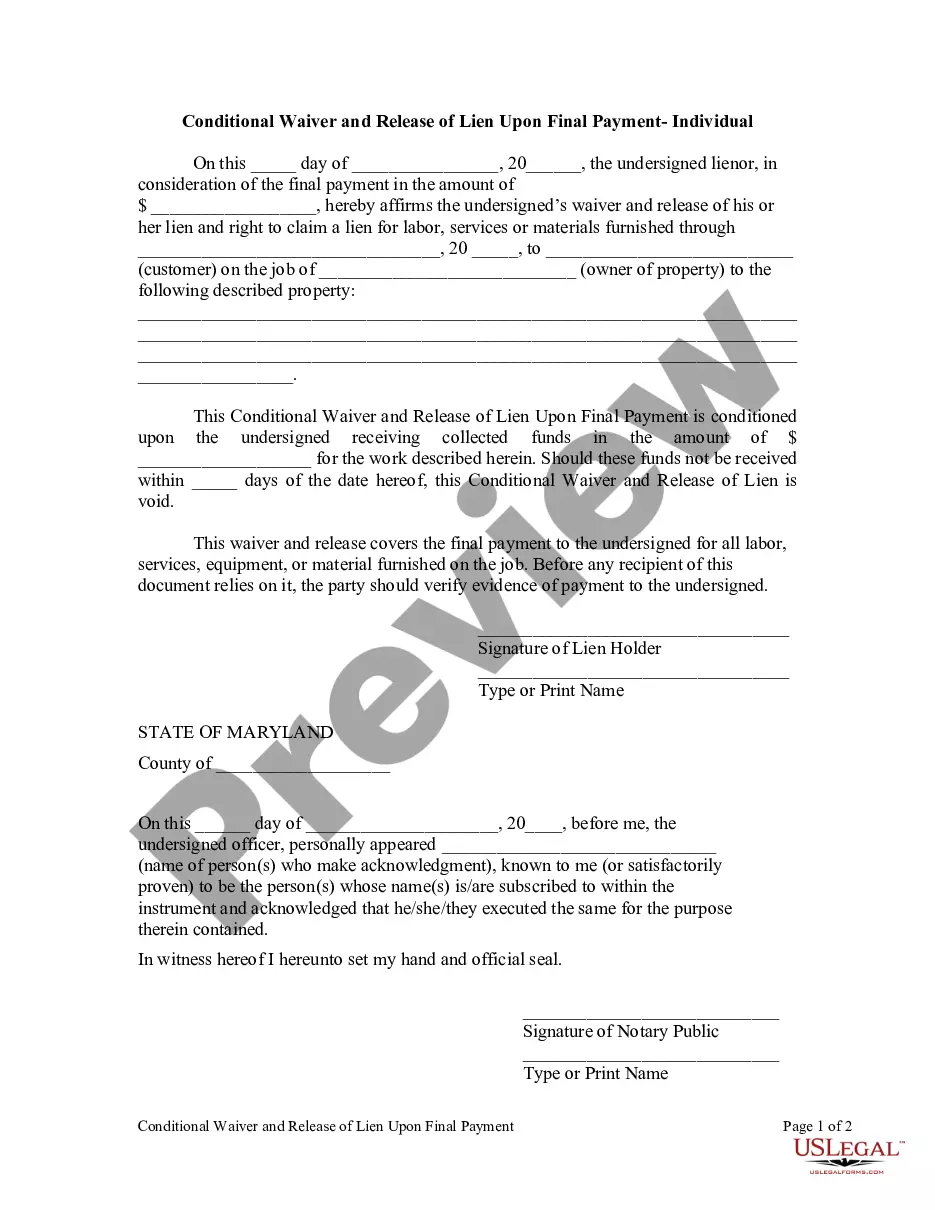

How to fill out Maryland Conditional Waiver And Release Upon Final Payment - Individual?

Creating legal documentation from the ground up can frequently feel a bit daunting.

Certain situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more cost-effective method of generating Maryland Tax Lien Foreclosure Process or any other paperwork without the hassle, US Legal Forms is always available to assist you.

Our online repository of more than 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs.

Review the document preview and descriptions to confirm that you have the correct document. Verify if the template you select meets the requirements of your state and county. Choose the most appropriate subscription plan to purchase the Maryland Tax Lien Foreclosure Process. Download the file, then complete, sign, and print it. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and make document execution an easy and efficient process!

- With just a few clicks, you can immediately obtain state- and county-specific forms meticulously prepared by our legal experts.

- Utilize our site whenever you require a dependable and trustworthy service to swiftly find and download the Maryland Tax Lien Foreclosure Process.

- If you’re already familiar with our website and have set up an account, simply Log In, choose the form, and download it or re-download it later from the My documents section.

- Don’t have an account? No problem. It takes minimal time to create one and browse the catalog.

- However, before rushing to download the Maryland Tax Lien Foreclosure Process, consider these recommendations.

Form popularity

FAQ

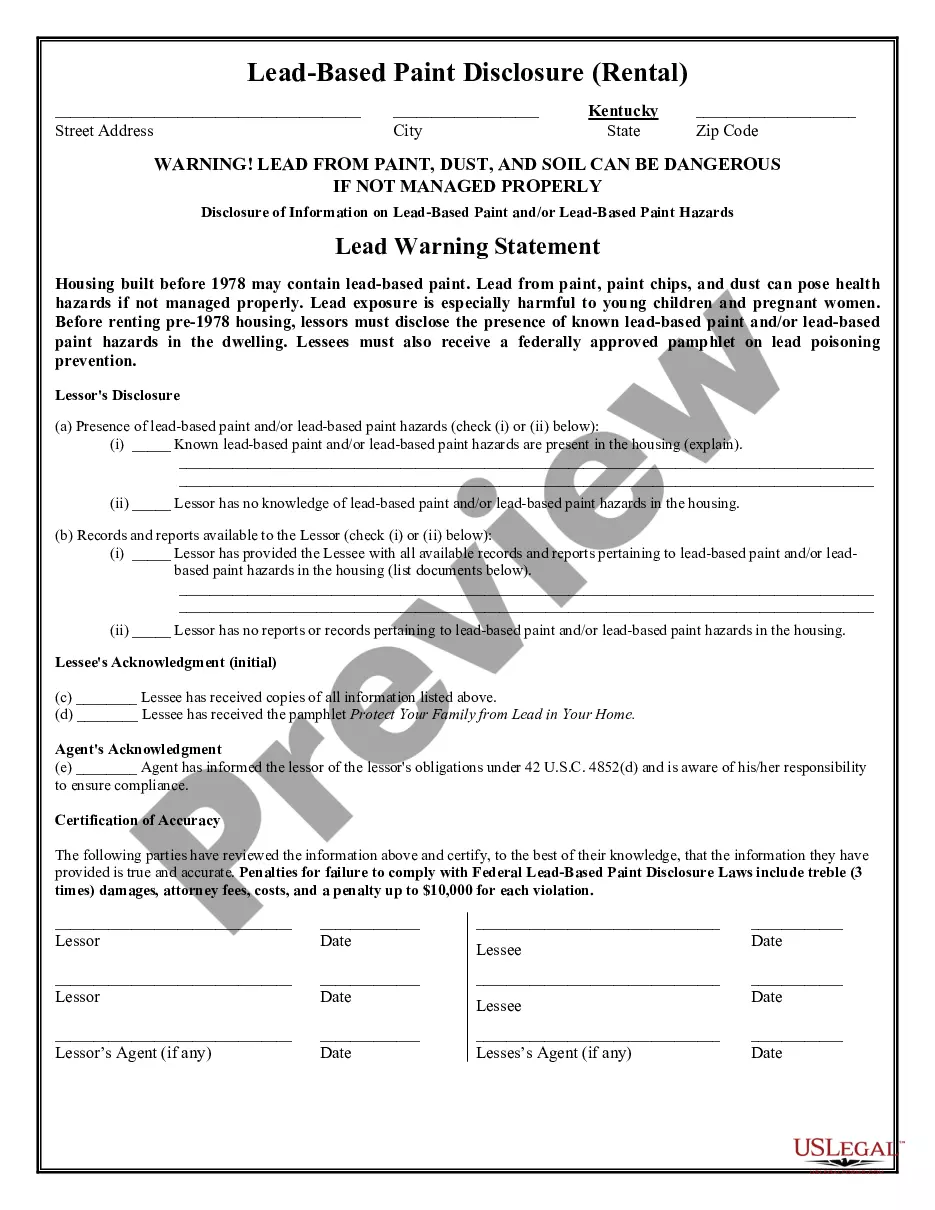

If your property taxes remain delinquent for a sufficiently long amount of time, your property will be sold off in a tax sale. (Md.

Unenforceable by reason of lapse of time; or 2. uncollectible; or (2) 20 years after the date of assessment. (b) (1) Except as otherwise provided in this subsection, a lien for unpaid inheritance tax: (i) arises on the date of distribution; and (ii) continues for 20 years.

ACTIONS TO FORECLOSE Six months after the tax sale (nine months for owner-occupied residences in Baltimore City), the purchaser may file a complaint in Circuit Court to foreclose all rights of the homeowner to redeem the property, provided that all notice requirements have been met.

To redeem the property after a tax sale, the homeowner must pay to the County or Baltimore City the total amount paid at the tax sale on his or her behalf, together with interest and penalties and any taxes that accrue after the tax sale date. This payment must be made with certified funds.

Any unpaid balances due past December 31 are considered delinquent and subject to accrued interest, penalties and tax sale. On March 1, a Final Tax Sale notice is mailed. This allows you 30 days to pay the property taxes, along with accrued interest and penalties.