Conditional Lien Waiver With Notary

Description

Form popularity

FAQ

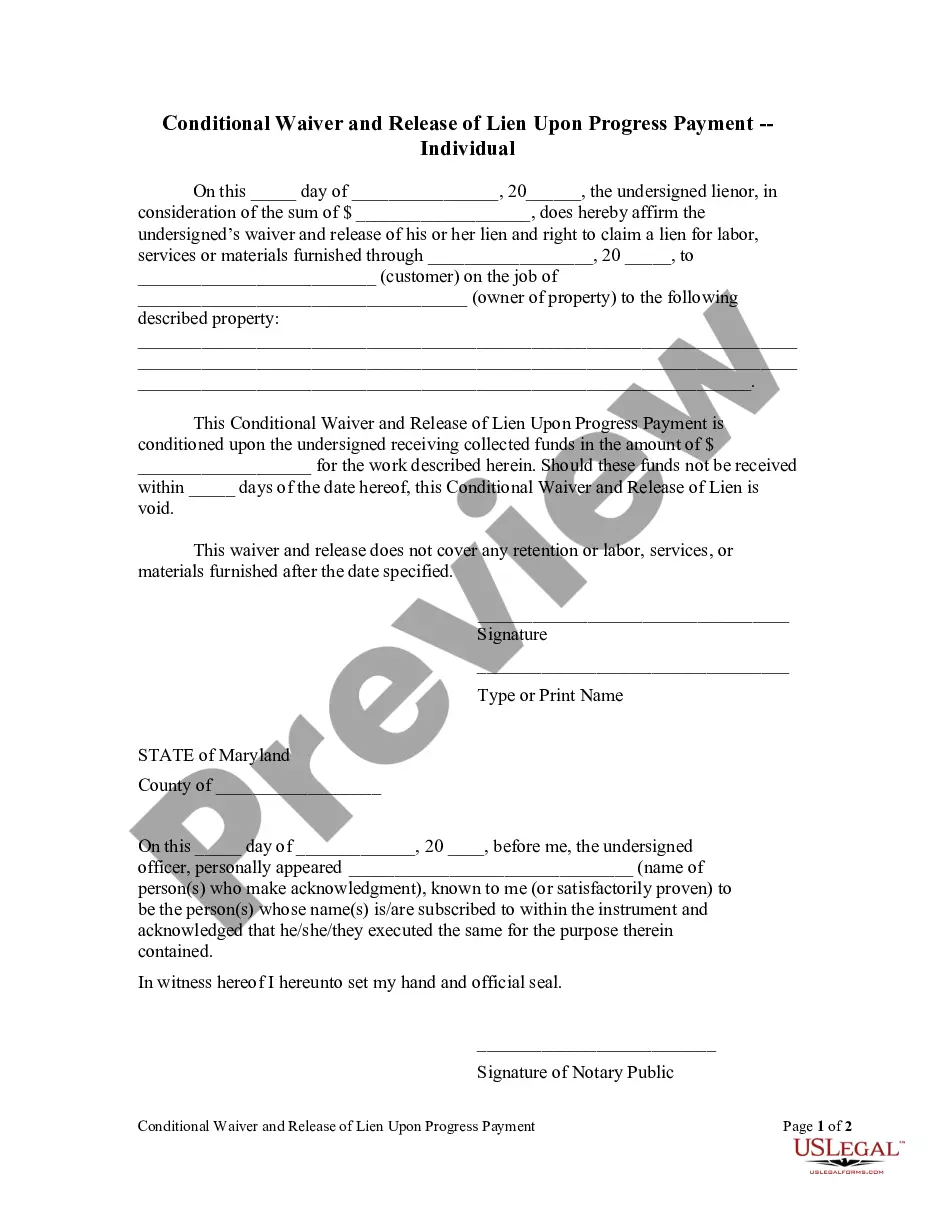

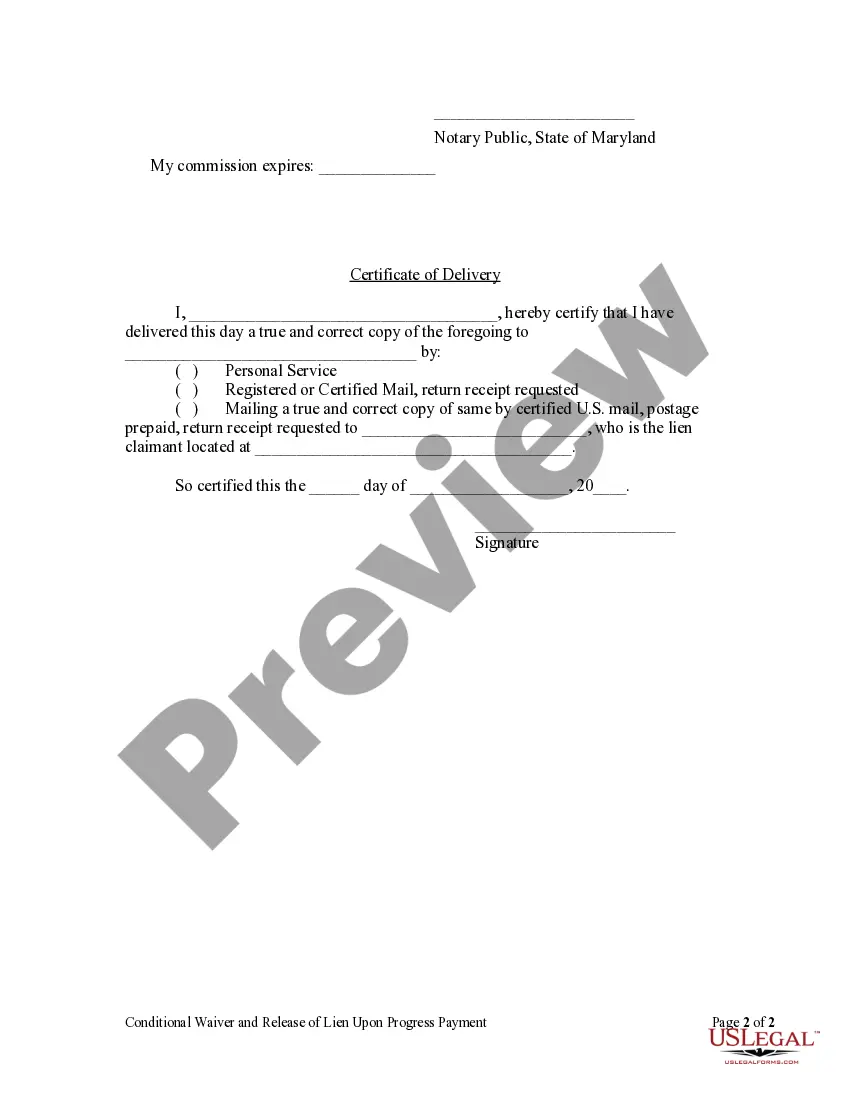

A conditional waiver of lien is a document that indicates a contractor agrees to waive their lien rights upon the fulfillment of specific conditions, usually the receipt of payment. This type of waiver safeguards the interests of all parties involved, providing clarity and assurance. Including a notary in the process enhances the legal standing of the waiver, verifying the identities of the parties involved. Platforms like US Legal Forms can help streamline the creation of these important documents.

A conditional waiver is a legal agreement that states a contractor will not file a lien against a property as long as certain conditions are met, typically the receipt of payment. This type of waiver helps protect both the property owner and the contractor by creating an expectation based on performance. Utilizing a conditional lien waiver with notary adds validity to this agreement. This ensures both parties feel secure in their financial transactions.

A waiver of lien is a legal document that relinquishes a contractor's claim to a lien against a property. This waiver signifies that the contractor, after receiving payment, agrees not to pursue a lien despite the possibility of non-payment in the future. Having a conditional lien waiver with notary can further safeguard your interests, as it provides a verified assurance of the transaction. This process promotes transparency in financial dealings.

In North Carolina, there are generally two types of lien waivers: unconditional and conditional. An unconditional waiver releases the right to lien immediately, while a conditional lien waiver with notary ensures that the waiver takes effect only upon receipt of payment. Understanding these differences is vital in navigating construction contracts successfully. A notary can add an extra layer of authenticity, assuring all parties involved.

A conditional release of lien in Florida is a document that relinquishes a contractor's or subcontractor's right to file a lien on a property, provided that payment has been received. This document plays a crucial role in the construction industry, ensuring smooth transactions between parties. By using a conditional lien waiver with notary, you establish a clear confirmation of payment. It helps property owners and contractors maintain trust and protect their investments.

In Texas, lien waivers do not always require notarization; however, a conditional lien waiver with notary can enhance its enforceability. A notarized waiver ensures that the document is executed properly and can reduce the risk of future disputes regarding payments. It is wise for contractors and property owners to familiarize themselves with Texas laws to understand when notarization is necessary. Utilizing resources from US Legal Forms can simplify the process, ensuring your documents comply with state regulations.

Whether lien waivers need to be notarized often depends on the state and the specific type of waiver being used. In many cases, a conditional lien waiver with notary offers an added layer of security, validating the identity of the signer and reinforcing the waiver's legitimacy. This is particularly beneficial in disputes, as a notarized document holds greater legal weight. If you have questions about notarization requirements, platforms like US Legal Forms can guide you through the process.

A final waiver of lien in New York is a document that confirms a contractor or supplier has received full payment for their work or materials provided. Once signed, it prevents the contractor from filing a lien against the property for that specific project. This waiver acts as a legal assurance for property owners, establishing that all debts related to the project have been settled. For those seeking clarity on conditional lien waivers with notary requirements, understanding this process can help ensure compliance and protect your interests.

A California mechanics lien does not typically require notarization, but having it notarized can enhance its validity. A conditional lien waiver with notary can also be beneficial if you want to avoid possible disputes in the future. Notarization adds a level of formality, which may be helpful in legal proceedings. Turn to US Legal Forms for resources on managing mechanics liens and waivers efficiently.

A lien waiver in California serves to release an owner's property from a claim during a construction project. By issuing a conditional lien waiver with notary, contractors and subcontractors confirm they have received payment and forfeit their right to file a lien for that amount. This protects property owners from unexpected claims. US Legal Forms offers templates and guidance to assist you in creating effective lien waivers for your projects.