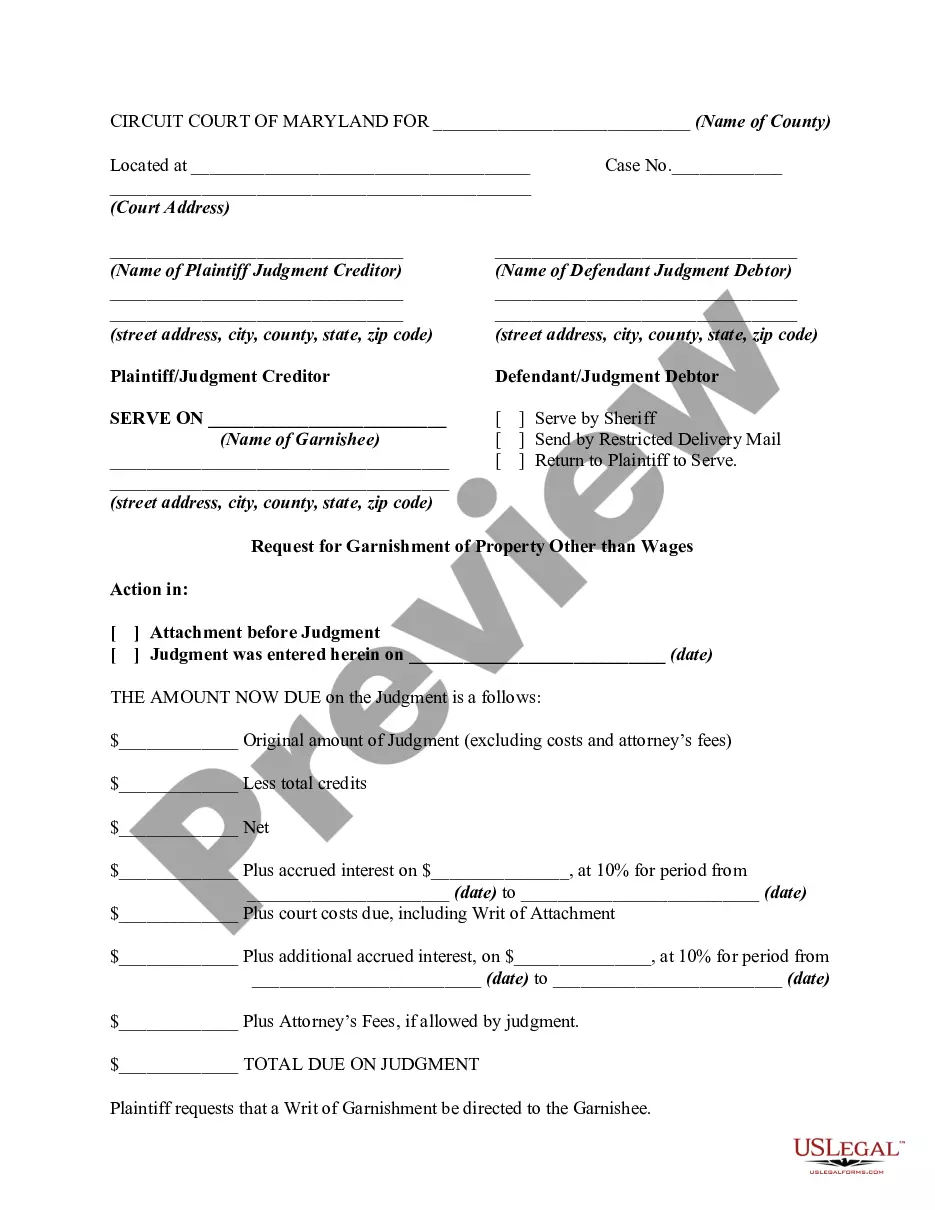

Request Garnishment With Bank

Description

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

- Log in to your US Legal Forms account if you're an existing user. Ensure that your subscription is active to access and download necessary form templates.

- If you're a new user, start by searching for your required form. Preview the document and verify that it meets your needs and adheres to your jurisdiction's requirements.

- If the first form doesn't fit, use the search feature to find additional templates specific to your needs.

- Purchase the selected document by clicking the 'Buy Now' button. Choose a subscription plan that suits you, and create an account to unlock the library's resources.

- Complete the purchase by providing your payment information through a credit card or PayPal.

- Download your completed form to your device. You can revisit it anytime from the 'My Forms' section in your account.

By following these steps, you can easily navigate the process of requesting garnishment with a bank. US Legal Forms not only simplifies this task but also ensures you have access to premium expert assistance for accurate document completion.

Don’t hesitate to take the first step! Start your journey with US Legal Forms today and access the legal resources you need.

Form popularity

FAQ

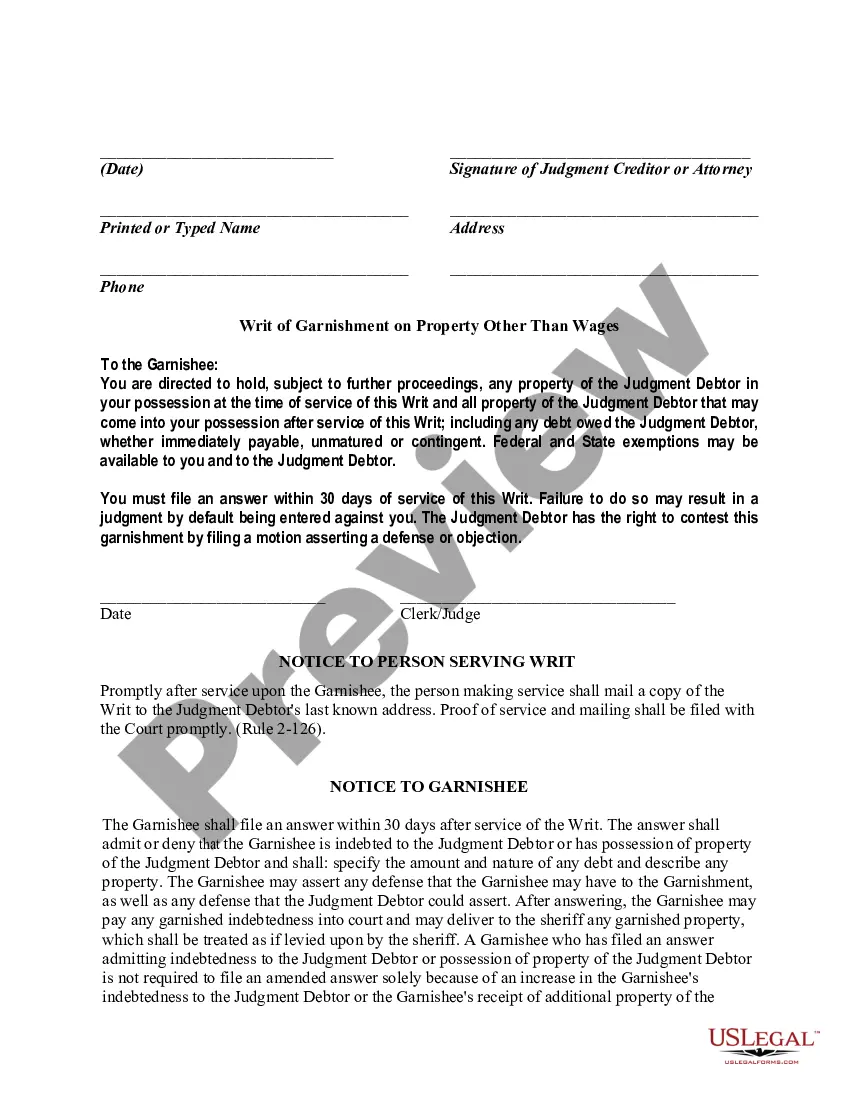

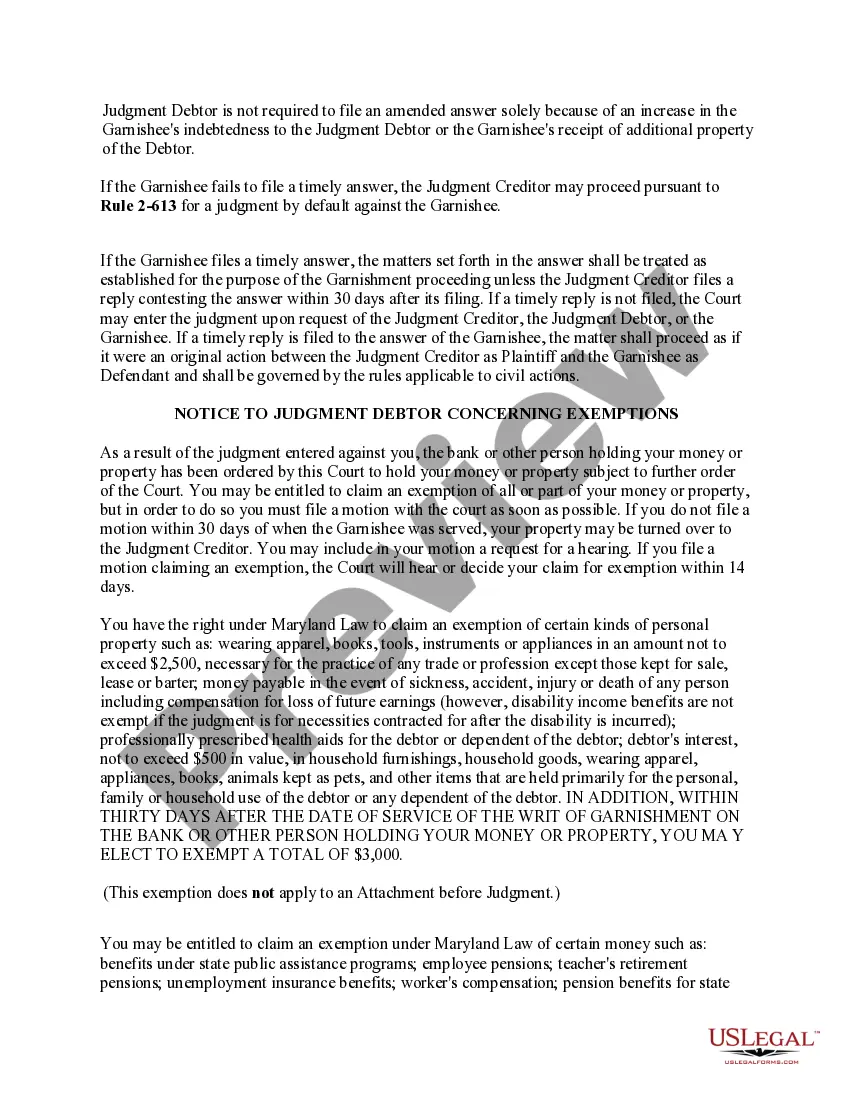

Filling out a challenge to garnishment form requires careful attention to detail. Start by gathering all necessary information about your case and the specific garnishment. Complete the form with accurate data and submit it to the court within the required timeframe. For those unsure about the process, US Legal Forms provides templates and guidance, helping you effectively challenge the garnishment.

You may find out if your bank account is being garnished through notifications from your bank or by monitoring your account activity. If a garnishment occurs, your bank should notify you about the freeze. Staying informed about your financial situation is essential for preventing surprises. To learn more about the process, visit US Legal Forms, which can guide you in understanding how to request garnishment with bank.

Your wages can be garnished without prior notice if a court order has been issued against you. Typically, creditors must provide you with a chance to address the debt before garnishment occurs. Understanding your rights regarding wage garnishment is crucial, and staying proactive can help. Use US Legal Forms to explore how to request garnishment with bank and learn more about your legal options.

To stop your bank account from being garnished, you can challenge the garnishment in court or negotiate with your creditors. Act quickly, as timely action can protect your funds. Seeking legal assistance can help you navigate this process more effectively. Consider US Legal Forms to learn how to request garnishment with bank and address your situation.

Yes, your bank account can be garnished without notice in some cases. Creditors may obtain a court order allowing them to freeze your funds, often leading to immediate access to your account. To protect yourself, it is important to stay informed about any debts you owe and consult a professional if you are at risk. If you need assistance, consider using US Legal Forms to understand your rights.

Several states offer laws that limit or prohibit bank account garnishments altogether. States like Texas and Florida have specific exemptions that make it harder for creditors to access your funds. When you request garnishment with a bank, knowing these regulations can help you understand your rights and protections. Always consult with a legal expert in your state to get tailored advice on your financial circumstances.

The timeline for a creditor to garnish your bank account can vary widely. Typically, after obtaining a court judgment, it can take a few weeks to several months before they initiate garnishment. Before any action takes place, they must follow legal proceedings to secure permission from the court. It’s crucial to stay informed throughout this process to anticipate potential changes to your financial situation.

To protect your bank account from garnishment, consider opening accounts that offer certain legal protections, such as retirement accounts or government benefits. Establishing a strategy to manage debts proactively can also reduce the chances of facing a bank garnishment. When you request garnishment with a bank, it’s vital to understand your options and potential implications. Seek financial advice to explore the best methods for safeguarding your assets.

Yes, certain types of accounts may offer protection from garnishment. For instance, accounts like retirement accounts and some government benefits can be exempt from garnishment when you formally request garnishment with a bank. However, the laws vary by state, so knowing your local regulations can make a significant difference. Consulting with a professional can guide you in identifying which accounts are safe.

Various entities can place a lien on your bank account, including creditors, tax authorities, and court judgments. When you request garnishment with a bank, it's essential to know who has the legal right to take action against your funds. Liens are typically the result of unpaid debts or legal judgments. Understanding this can help you take proactive steps to manage your finances.