Maryland Wage Garnishment Form With Two Points

Description

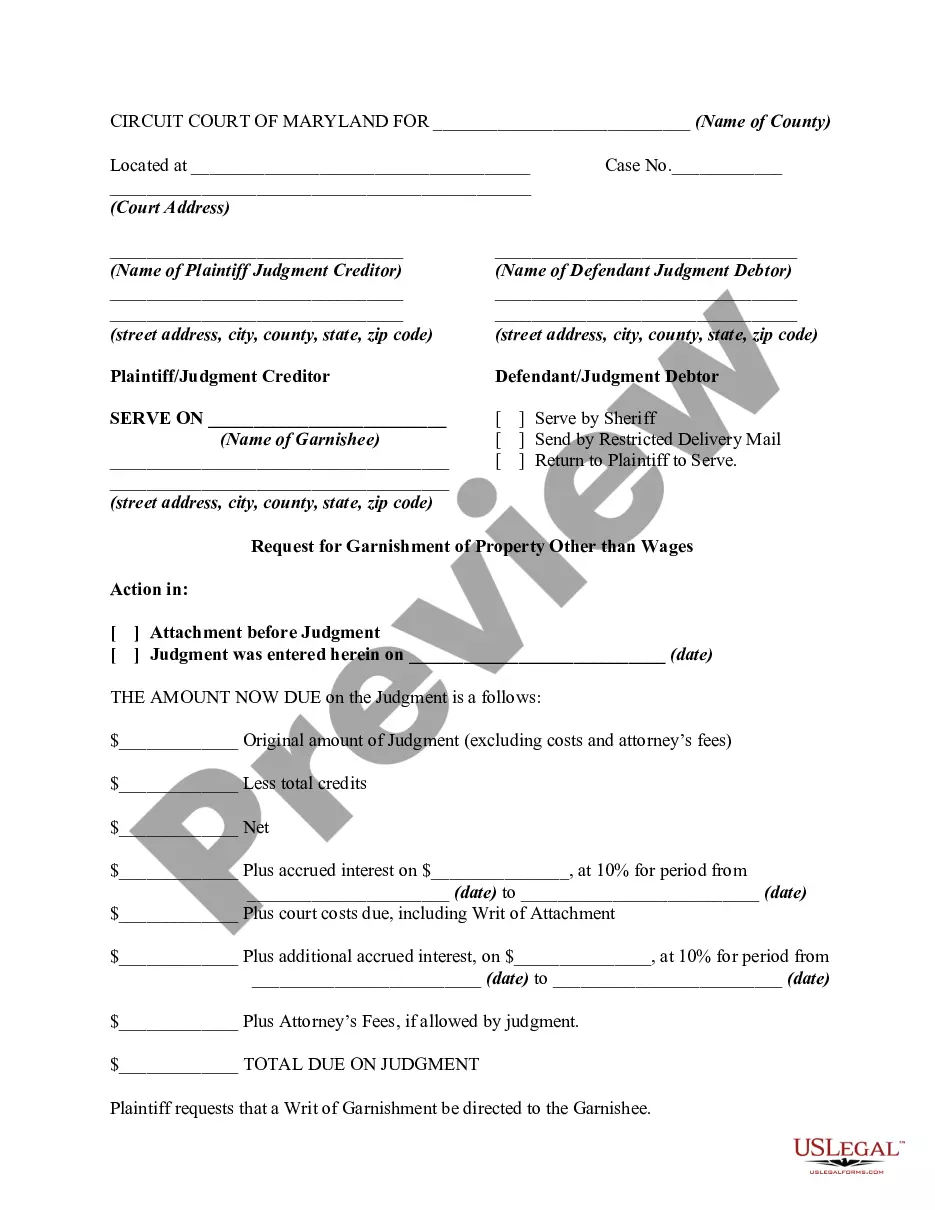

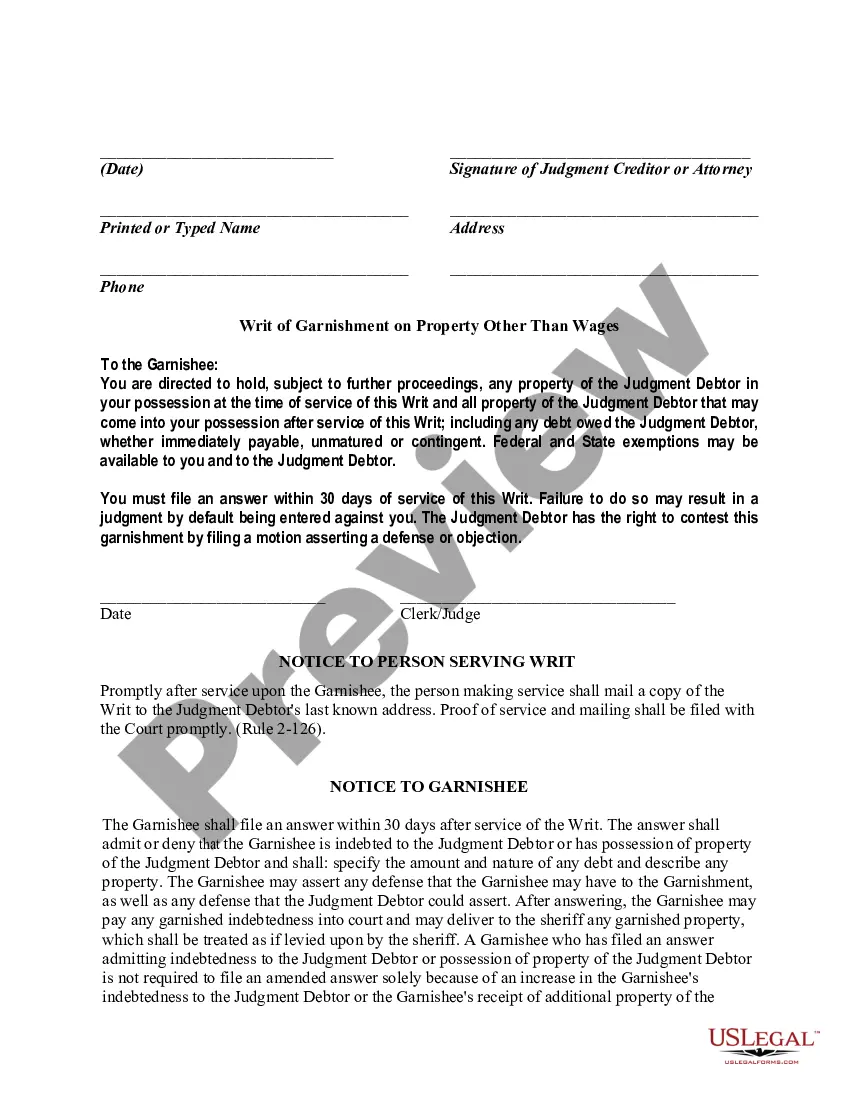

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

Drafting legal paperwork from scratch can often be daunting. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re looking for a an easier and more affordable way of preparing Maryland Wage Garnishment Form With Two Points or any other forms without jumping through hoops, US Legal Forms is always at your disposal.

Our online library of more than 85,000 up-to-date legal forms covers virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-specific forms carefully put together for you by our legal professionals.

Use our platform whenever you need a trusted and reliable services through which you can quickly find and download the Maryland Wage Garnishment Form With Two Points. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes little to no time to register it and explore the catalog. But before jumping directly to downloading Maryland Wage Garnishment Form With Two Points, follow these tips:

- Review the form preview and descriptions to make sure you are on the the document you are searching for.

- Check if form you select conforms with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Maryland Wage Garnishment Form With Two Points.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us now and transform document execution into something simple and streamlined!

Form popularity

FAQ

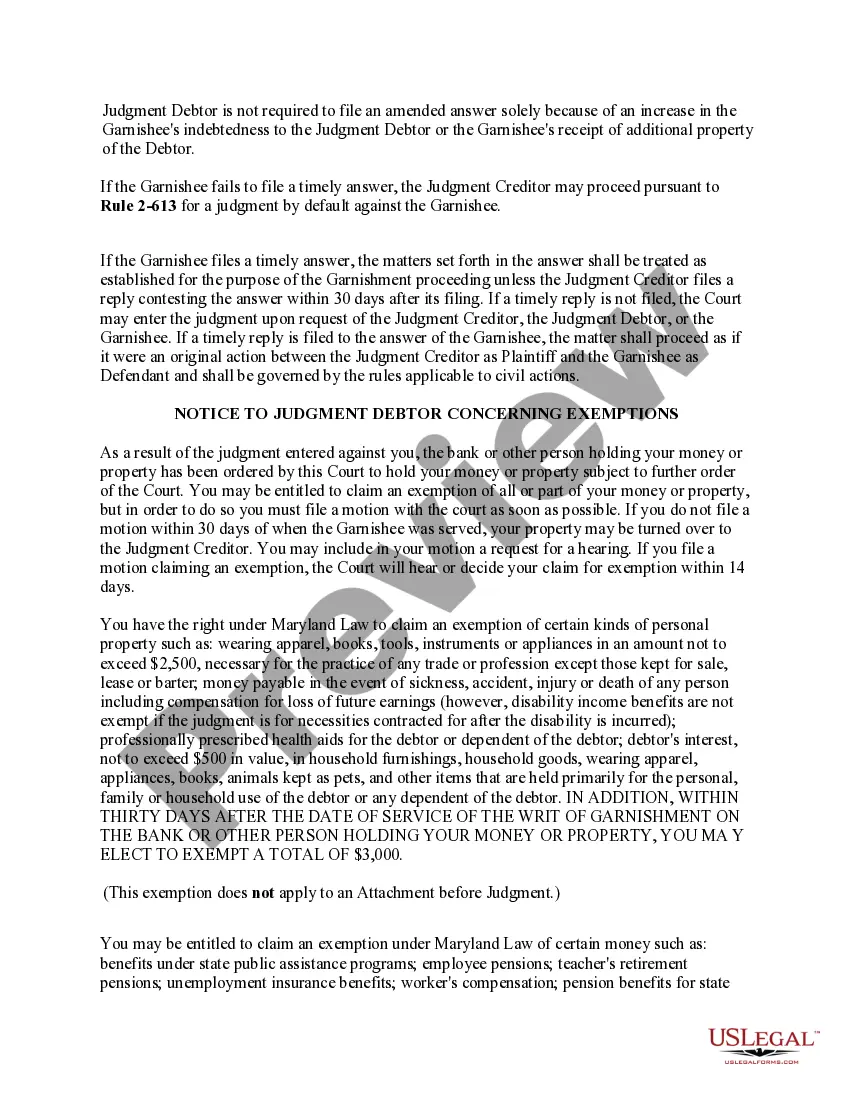

Maryland's laws vary depending on the county in which you live. In Montgomery County, pursuant to Commercial Law Article § 15-601.1, creditors can garnish the lesser of: 25% of your disposable earnings for that week, or. the amount by which your disposable earnings for the week exceed $145.

In any event, no more than 25% of your disposable wages for a week can be garnished. Understanding the amount that can be garnished may be confusing. The District Court publishes (DC-CV-065BR) a helpful brochure that contains an example of how the exemptions work: Debtor earns $7.25 per hour, (federal minimum wage).

You may request an exemption to the garnishment. You must make your request within 30 days of when the garnishment was served on the bank. Use the form Motion for Release of Property from Levy/Garnishment (DC-CV-036).

Federal law limits the amount of earnings that may be garnished to 25 percent of the debtor's disposable income. (Disposable earnings are the amount of earnings left after legally required deductions e.g., federal, state taxes, Social Security, unemployment insurance and medical insurance.)