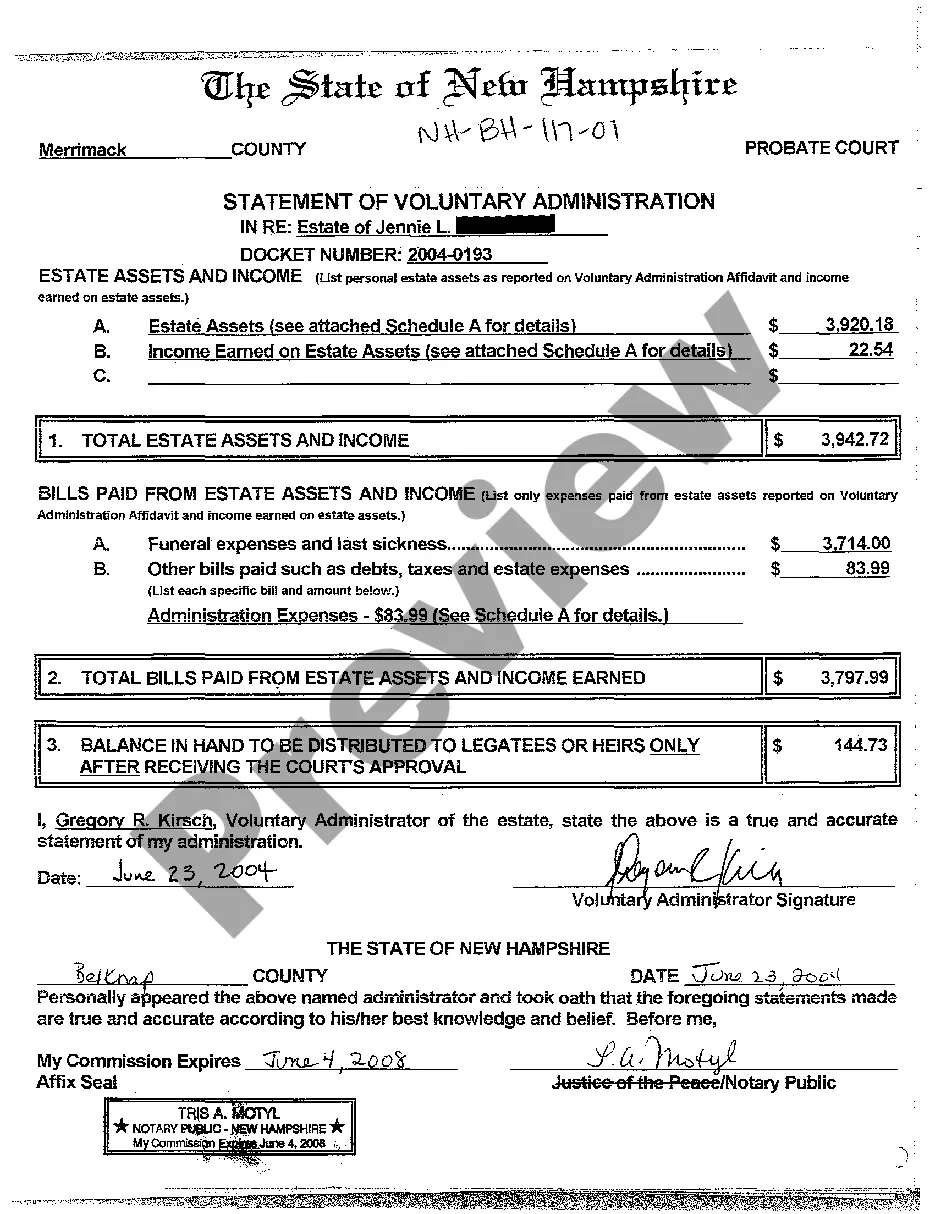

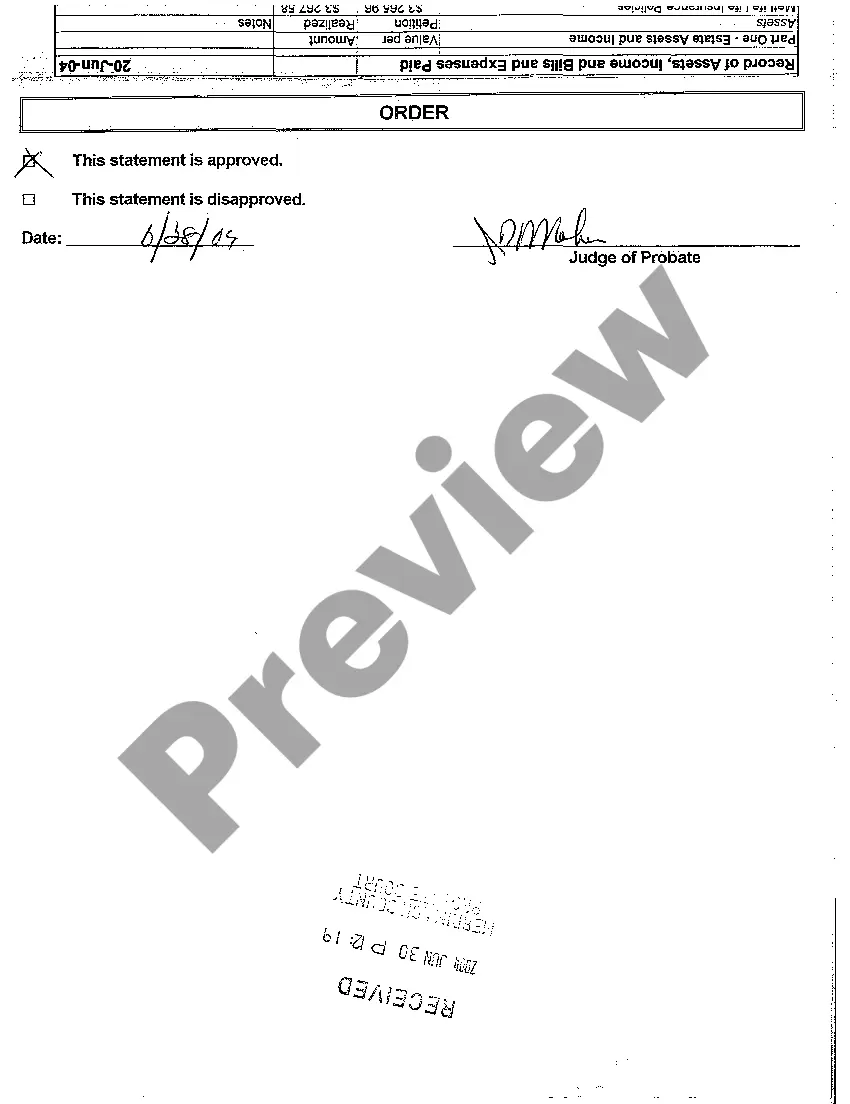

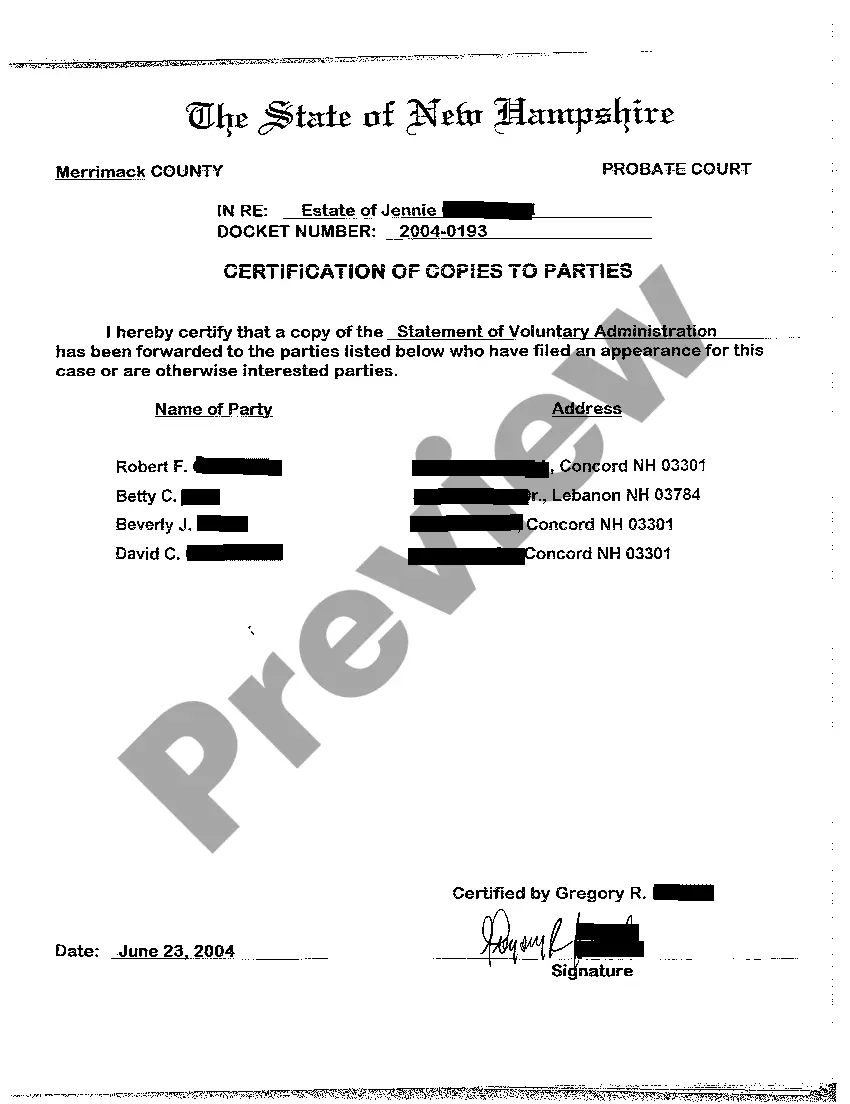

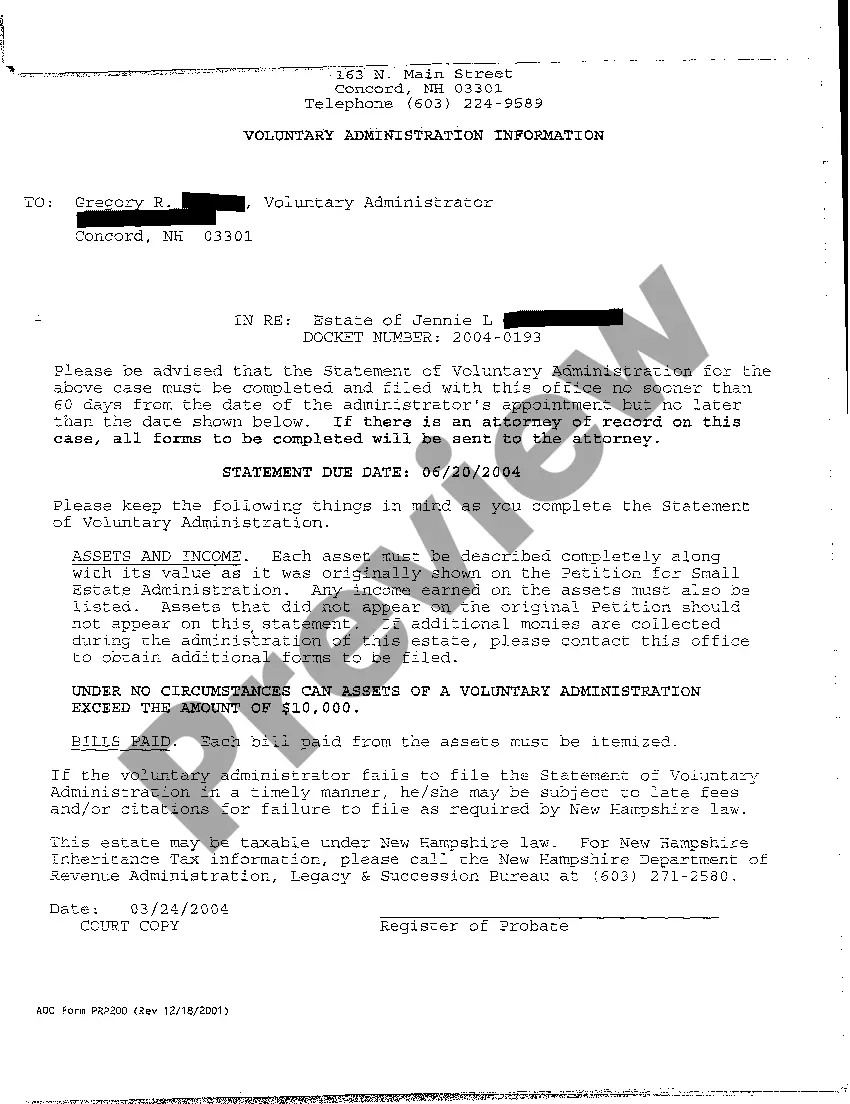

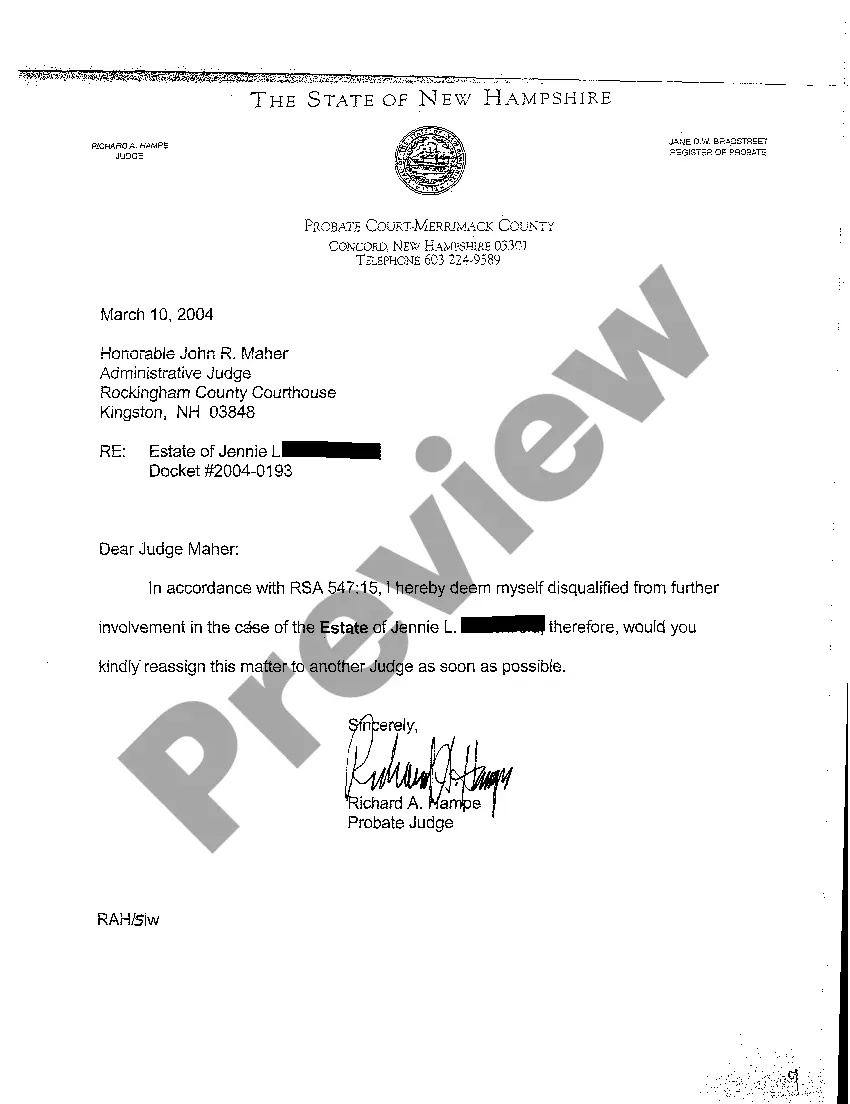

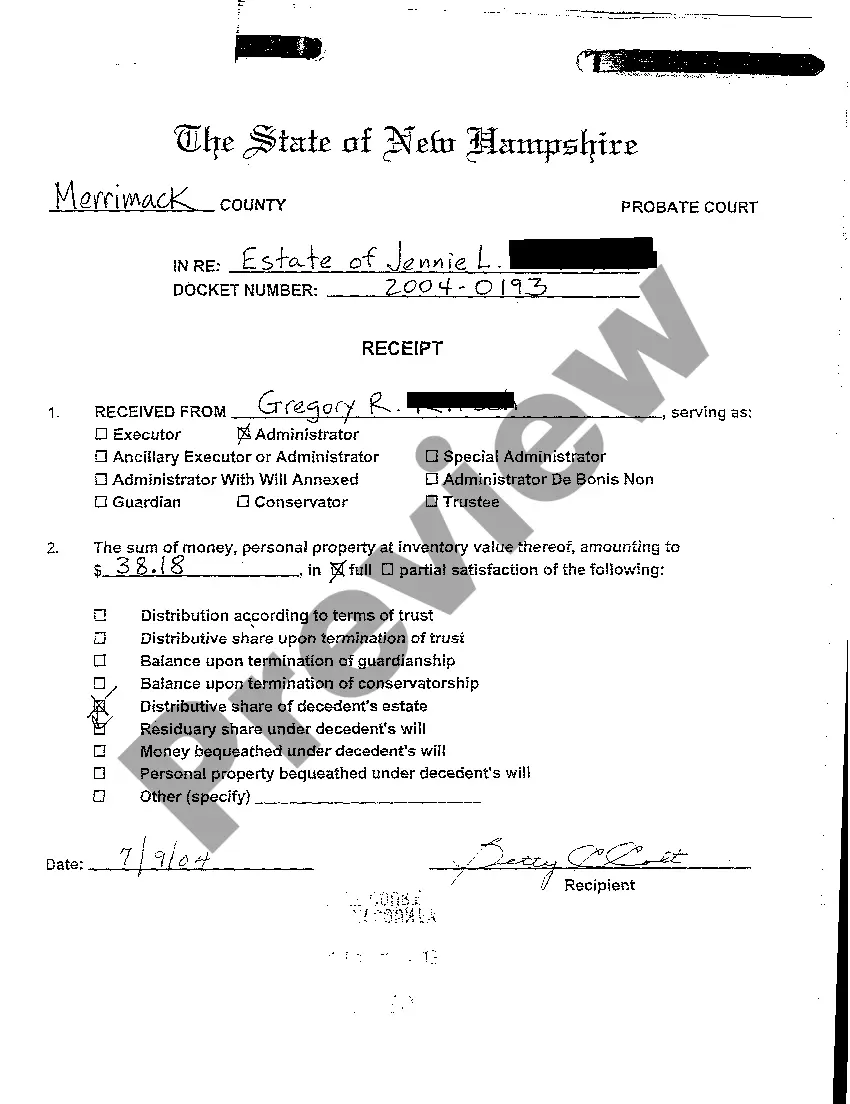

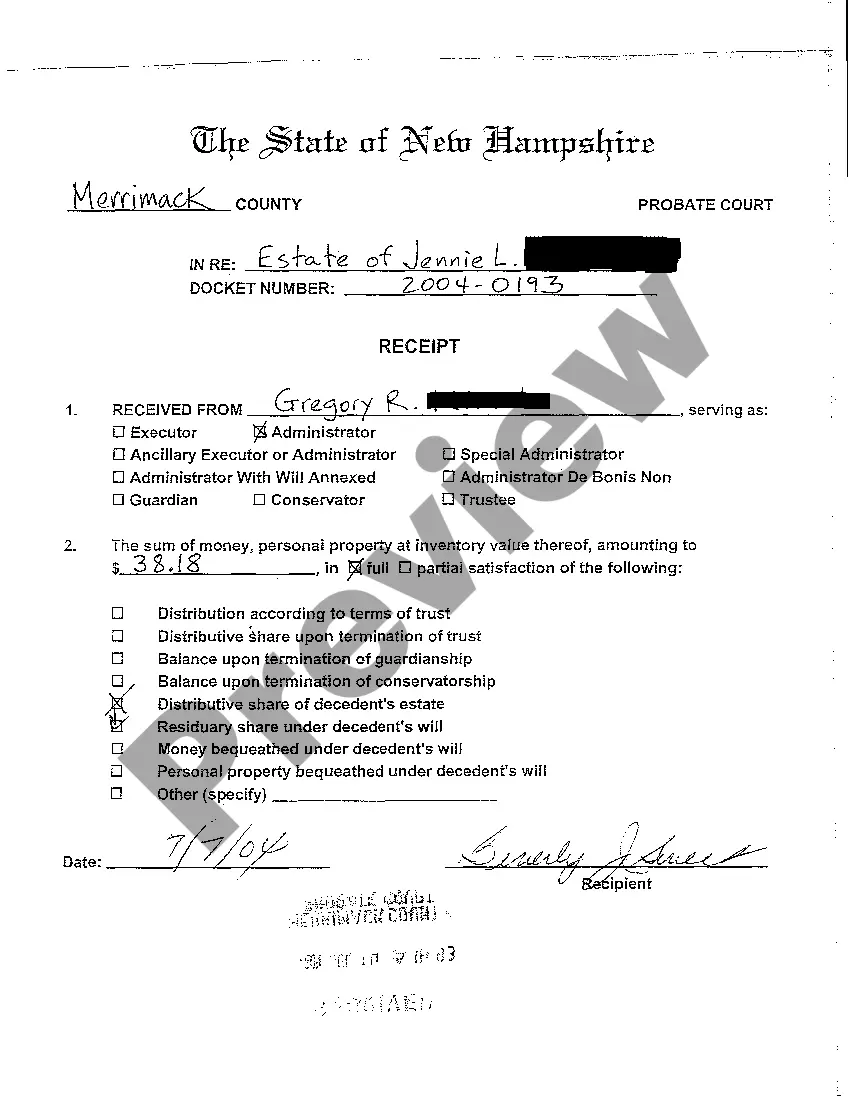

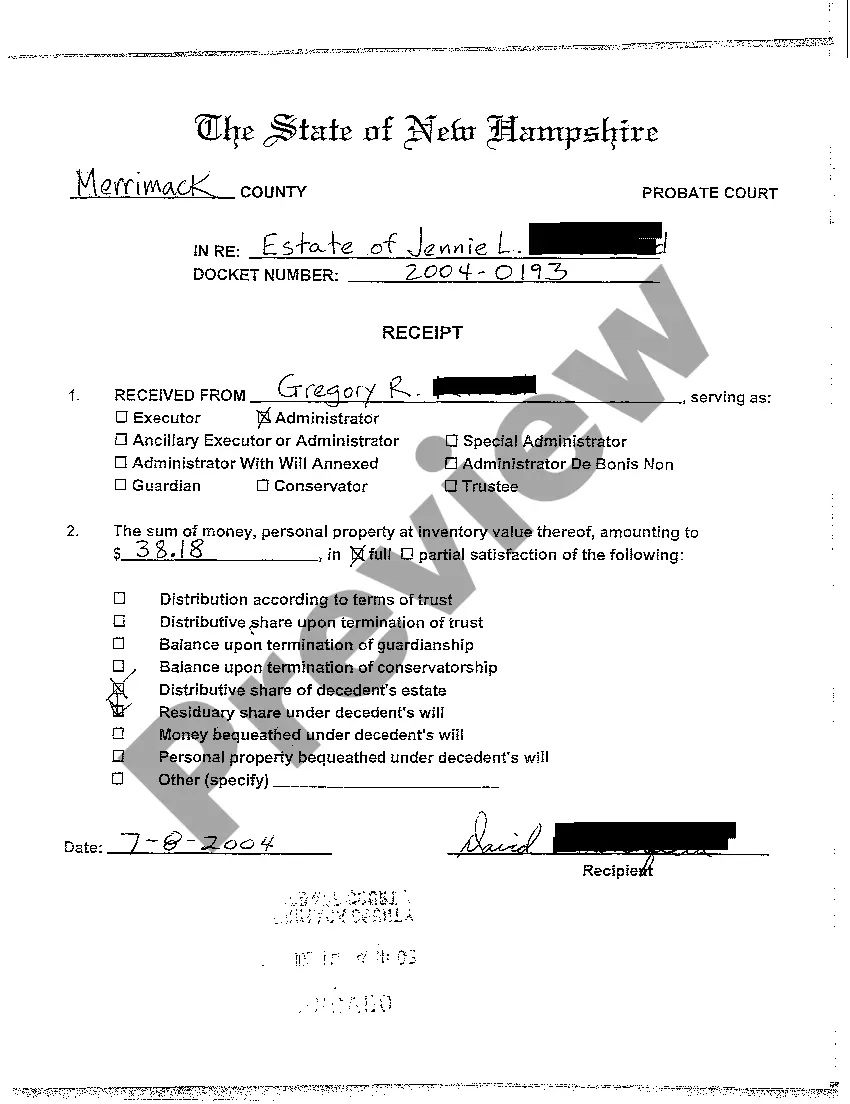

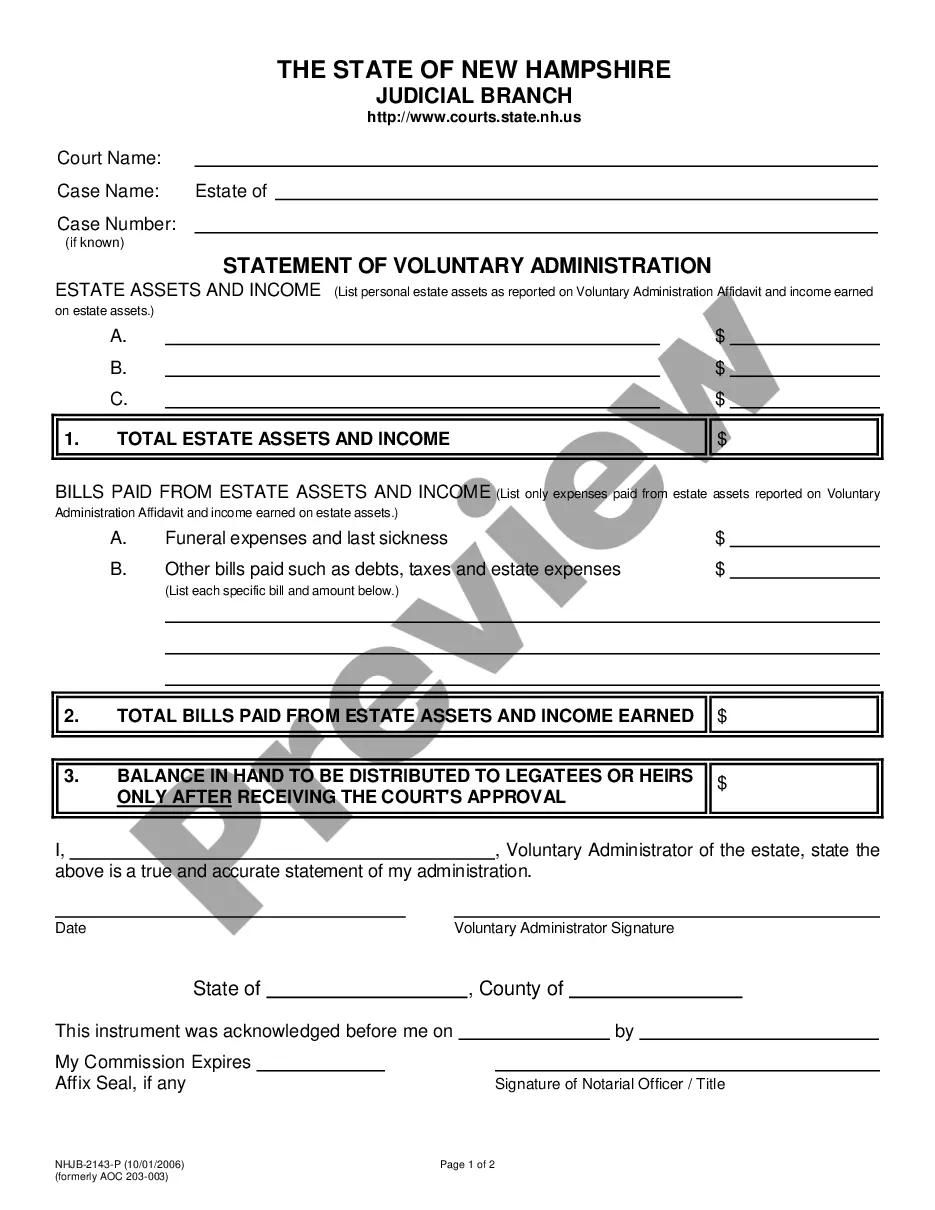

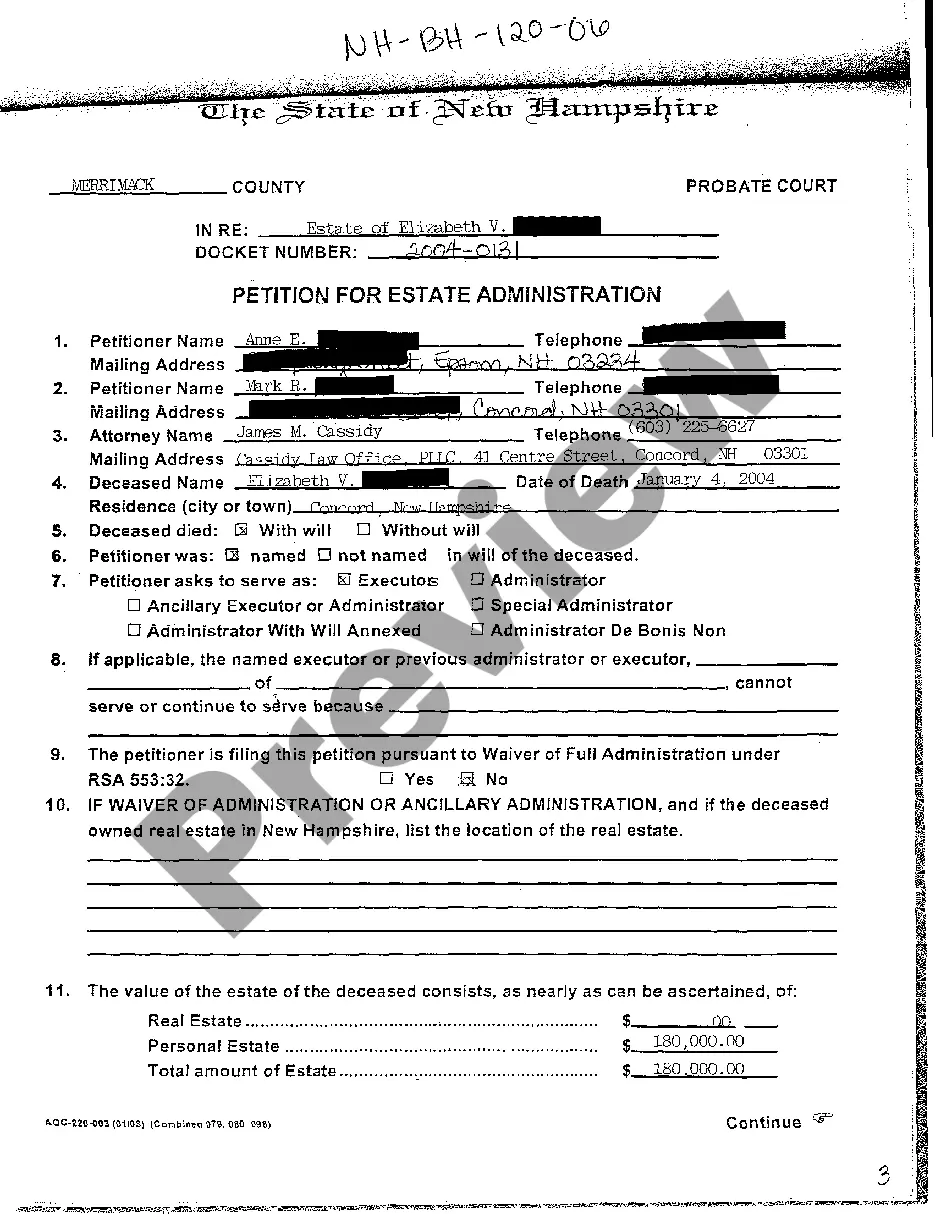

New Hampshire Statement of Voluntary Administration regarding Probate of Will

Description

How to fill out New Hampshire Statement Of Voluntary Administration Regarding Probate Of Will?

Avoid pricey attorneys and find the New Hampshire Statement of Voluntary Administration regarding Probate of Will you need at a reasonable price on the US Legal Forms website. Use our simple categories functionality to search for and obtain legal and tax documents. Go through their descriptions and preview them before downloading. Additionally, US Legal Forms enables users with step-by-step instructions on how to download and complete every template.

US Legal Forms subscribers basically have to log in and obtain the specific form they need to their My Forms tab. Those, who haven’t obtained a subscription yet must stick to the tips listed below:

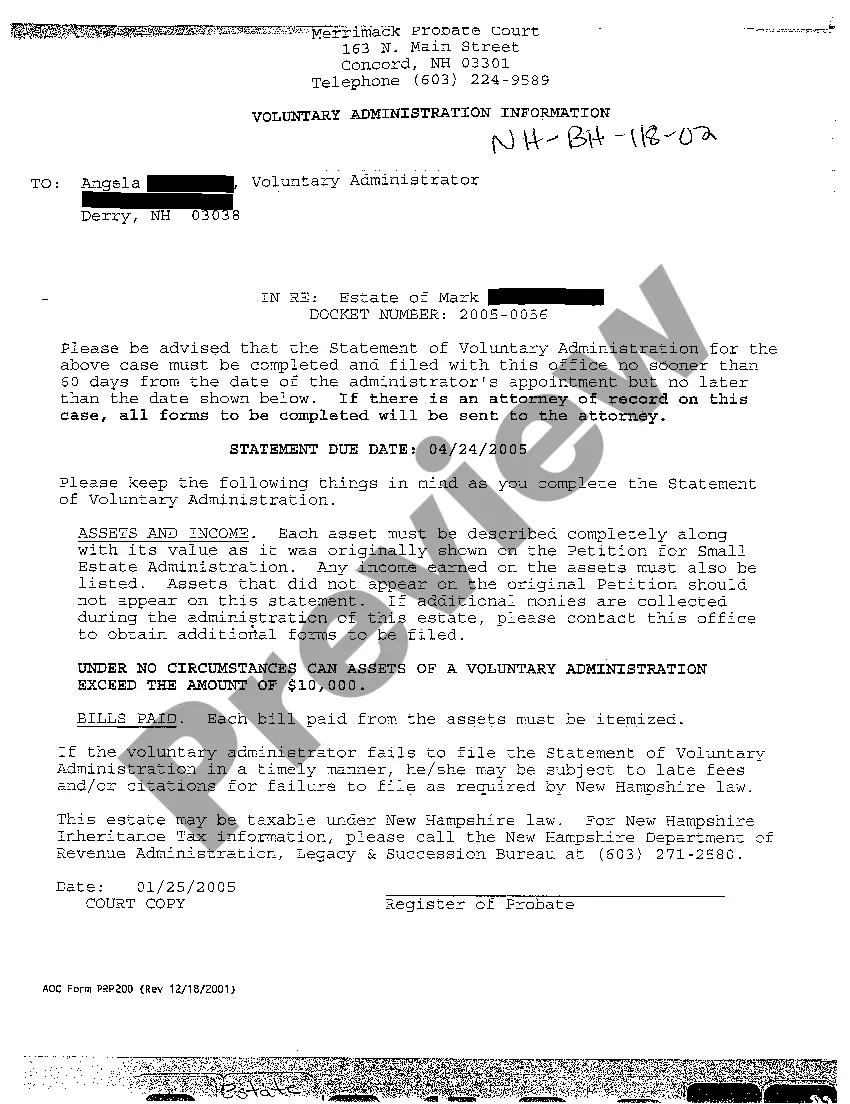

- Ensure the New Hampshire Statement of Voluntary Administration regarding Probate of Will is eligible for use where you live.

- If available, read the description and make use of the Preview option well before downloading the sample.

- If you are confident the template suits you, click Buy Now.

- If the form is incorrect, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Choose to download the form in PDF or DOCX.

- Click Download and find your template in the My Forms tab. Feel free to save the form to your device or print it out.

Right after downloading, you may fill out the New Hampshire Statement of Voluntary Administration regarding Probate of Will by hand or with the help of an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Forcing the probate will be easy. This is done by filing a petition to probate the estate as a creditor, which you do have a right to do. The family, will probably object but if a family member is awarded Letters, then you will be able to file a creditor...

As an Executor, what you cannot do is go against the terms of the Will, Breach Fiduciary duty, fail to act, self-deal, embezzle, intentionally or unintentionally through neglect harm the estate, and cannot do threats to beneficiaries and heirs.

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.

In most circumstances, the executor named in the will assumes the role of handling probate. If there's no will, the state probate court will decide the rules of inheritance. Keep in mind that the probate process and timeline will vary depending on the state but, in general, probate law requires these steps.

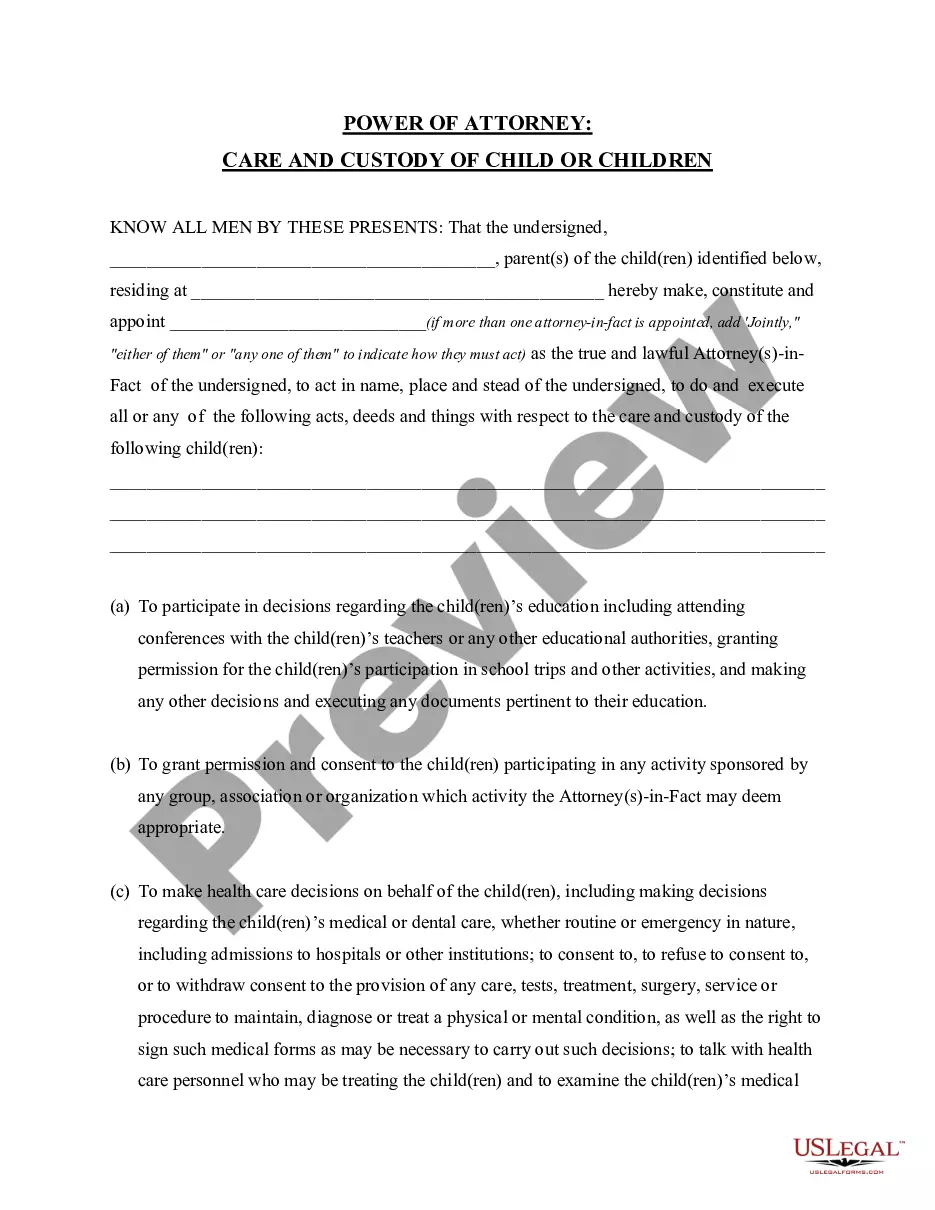

An executor is someone who is named in the will as responsible for dealing with the estate. An executor may have to apply for a special legal authority before they can deal with the estate. This is called probate.An administrator has to apply for letters of administration before they can deal with an estate.

Only parties with legal standing can force an executor to finalize an estate. Individuals with a legal interest in an estate have standing. Examples of interested parties would be beneficiaries and heirs, or conservators or guardians named in a will.

In New Hampshire, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

The will and a petition for probate must be filed with the court in the county where the decedent lived or had property if they lived out of state. An executor or administrator is appointed and approved by the court. The executor must take inventory of all the assets and may need to have some appraised.

If an estate doesn't go through probate and it is a necessary process to transfer ownership of assets, the heirs could sue the executor for failing to do their job. The heirs may not receive what they are entitled to. They may be legally allowed to file a lawsuit to get what they are owed.