Deed Property Spouse Without

Description

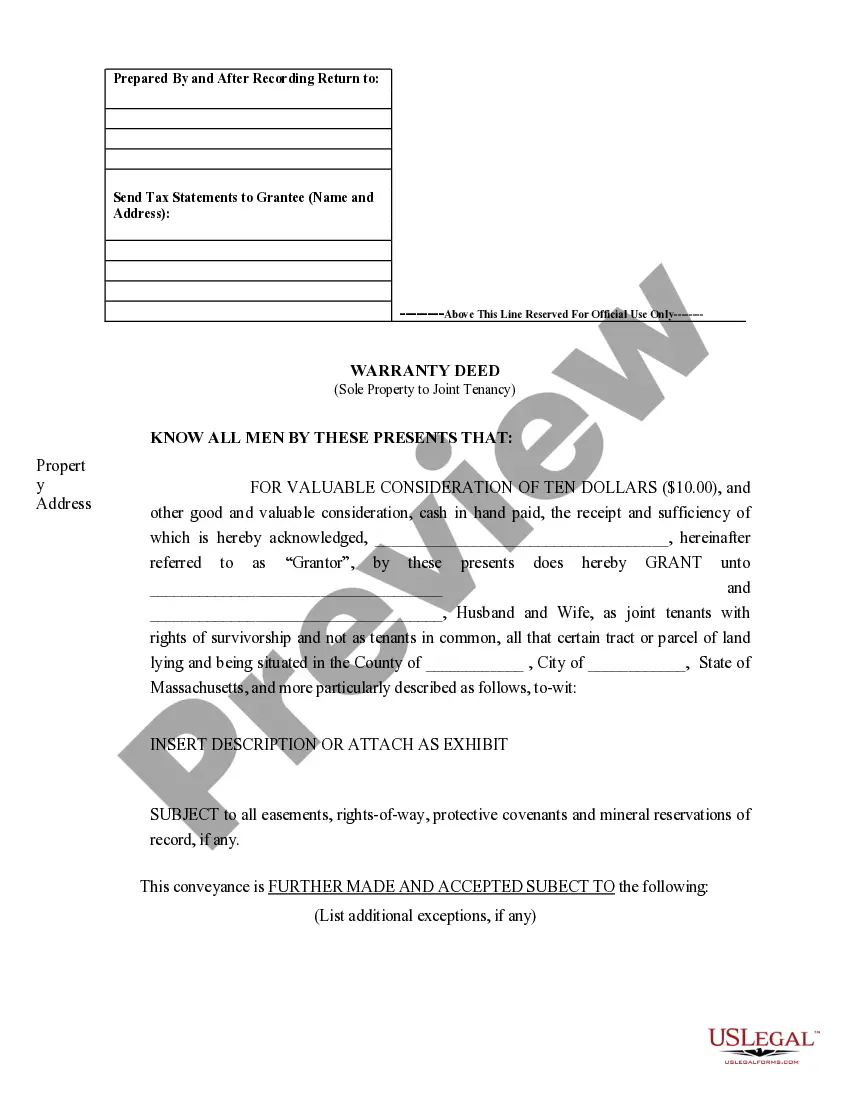

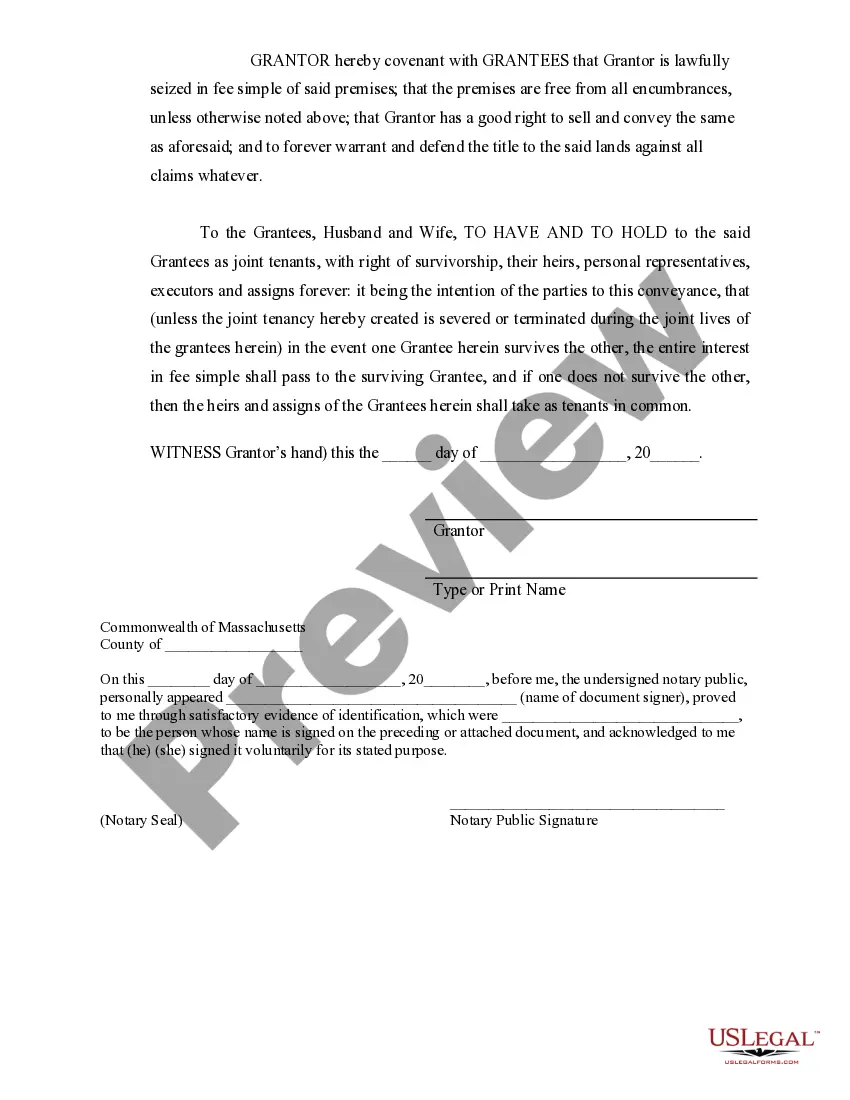

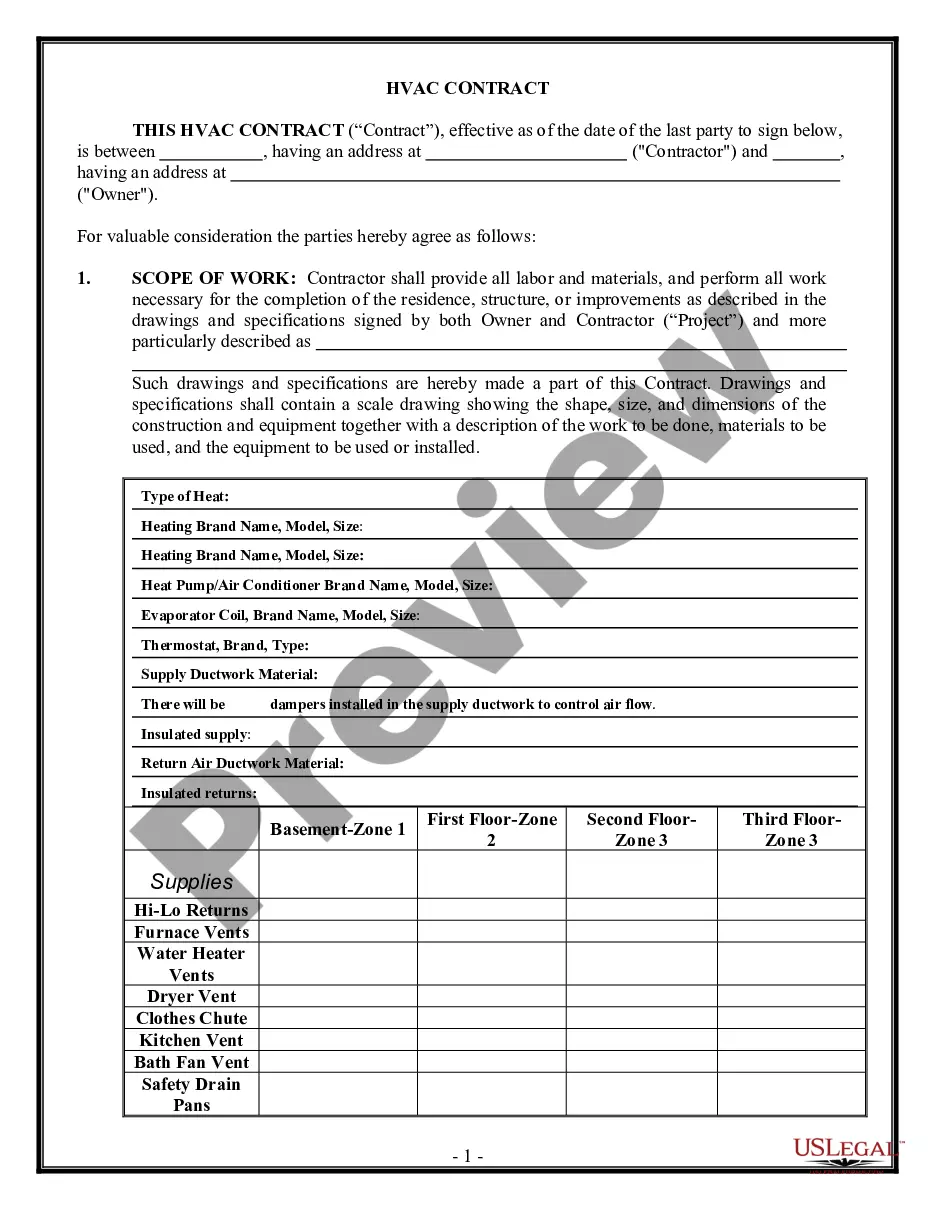

How to fill out Massachusetts Warranty Deed To Separate Property Of One Spouse To Both Spouses As Joint Tenants?

There's no further justification for investing time searching for legal documents to satisfy your local state regulations.

US Legal Forms has gathered all of them in a single location and streamlined their access.

Our platform offers over 85,000 templates for any business and personal legal scenarios categorized by state and area of application. All forms are properly written and validated for authenticity, ensuring you can trust that you're receiving an up-to-date Deed Property Spouse Without.

Click Buy Now next to the template title when you find the correct one. Select your preferred subscription plan and create an account or Log In. Complete the payment for your subscription with a card or through PayPal to proceed. Choose the file format for your Deed Property Spouse Without and download it to your device. Print your form to fill it out manually or upload the sample if you prefer to use an online editor. Preparing legal documents under federal and state laws is quick and easy with our platform. Try US Legal Forms now to keep your documentation organized!

- If you are acquainted with our platform and already possess an account, ensure that your subscription is current before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents whenever necessary by accessing the My documents tab in your profile.

- If you are unfamiliar with our platform, the procedure will require a few additional steps to complete.

- Here's how new users can find the Deed Property Spouse Without in our library.

- Carefully read the page content to confirm it contains the sample you need.

- To do so, use the form description and preview options if available.

- Utilize the Search field above to locate another sample if the current one does not suit you.

Form popularity

FAQ

When you add someone to a deed in California, it can trigger tax implications, such as a reassessment of property taxes. Transferring ownership, even partially, may lead to tax liabilities based on the value of the property. To navigate these complexities effectively, consider using a trusted platform like USLegalForms to gain insights on handling the deed property spouse without unexpected tax consequences.

In California, adding your wife to the deed of your house involves preparing a new deed that lists both of your names. After completing the deed, you must sign it and have it notarized before recording it with your local county recorder’s office. This action helps solidify both spouses' rights to the property, especially if you are concerned about a deed property spouse without joint ownership.

To add a spouse to a deed in Louisiana, you typically fill out a new deed that includes both names and indicates that you are married. After preparing the document, you will need to sign it in front of a notary and file it with the parish clerk of court. This process can help clarify ownership rights and avoid misunderstandings related to a deed property spouse without proper documentation.

In California, signing a quit claim deed does not automatically strip a spouse of their rights to property. However, it can affect claims in future property disputes. If you are faced with this situation, it’s crucial to assess the specifics and consider consulting with a legal professional to understand how a quit claim deed impacts your interests, especially in light of the deed property spouse without ownership.

Having both spouses on the house title in California is typically a wise choice. It ensures that both parties have legal rights to the property and can reduce future disputes about ownership. When considering a deed property spouse without their name, think about the potential implications for property division during a divorce.

In California, even if your name is not on the deed, marital laws generally grant you rights to the property acquired during the marriage. This means that if you and your spouse bought the property together, you may have a claim to it. Additionally, if you face any legal issues regarding the property, you might benefit from consulting with a professional to understand your rights better, especially when dealing with a deed property spouse without your name on it.

Yes, one spouse can own the house without the other having formal ownership. However, this can lead to complexities regarding rights, mortgages, and property claims. It's advisable to understand the implications of such ownership and seek legal assistance if necessary.

If your wife is not listed on the deed or mortgage, she may still have legal rights to the property, depending on your living situation and local laws. The absence from the deed does not automatically revoke her claim, especially if the house was acquired during the marriage. Consider discussing your situation with a legal expert to explore options.

Yes, you can buy a house without your spouse in Canada, but there are considerations to keep in mind. This action can affect financial discussions, future property rights, and may even complicate matters during a divorce. It's wise to consult a legal professional for personalized advice.

Having both spouses on the house title can safeguard interests and clarify ownership. This approach helps streamline legal processes in the event of separation or death. It is often advisable for both partners to be involved in property ownership discussions to ensure transparency.