Special-d

Description

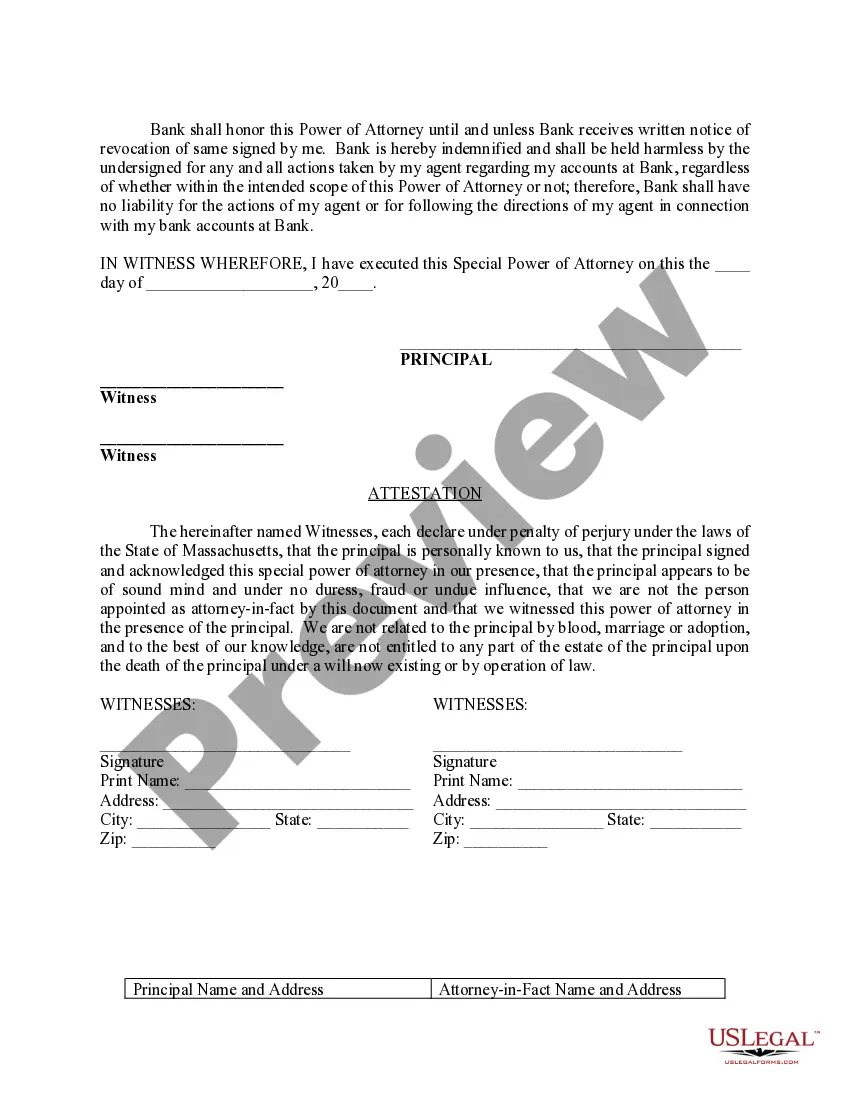

How to fill out Massachusetts Special Durable Power Of Attorney For Bank Account Matters?

- If you are a returning user, log in to your account and choose the required form template to download by clicking the Download button. Ensure your subscription is active; renew if necessary.

- For first-time users, start by examining the preview mode and description of your desired form to confirm its relevance to your needs and compliance with local regulations.

- Utilize the Search tab above to find alternative templates if the first option does not meet your needs.

- Once you identify the correct form, click on the Buy Now button to select your preferred subscription plan. You will need to create an account for full access to resources.

- Proceed to make your payment by entering your credit card information or using a PayPal account.

- After purchase, download your form and store it on your device. You can access it later in the My Forms section of your profile.

Utilizing US Legal Forms allows you to tap into an extensive collection of over 85,000 accurately fillable forms. Their platform provides access to premium experts who can assist you in preparing legally sound documents.

Don't hesitate—take advantage of the special-d benefits of US Legal Forms today and streamline your legal needs!

Form popularity

FAQ

The highest salary for a Special Education Teacher can vary significantly based on location, experience, and education level. In urban areas with higher living costs, salaries tend to be above average. Some experienced Special Education Teachers can earn six-figure salaries, particularly when they take on additional responsibilities or specializations. This financial potential makes a career in Special-d an appealing option for many.

A child qualifies for an Individualized Education Program (IEP) if they meet specific criteria defined by the Individuals with Disabilities Education Act (IDEA). This usually involves demonstrating a specific learning disability, autism, or another qualifying condition that affects their educational performance. It's essential to gather documentation and evaluations to support your child’s eligibility within the Special-d context. Local school districts often have guidelines to help navigate the process.

The 80/20 rule in special education suggests that 80% of results come from 20% of efforts. This means that focusing on key strategies can maximize success for students with special needs. By identifying the most impactful interventions and resources, educators can improve outcomes for students in the Special-d framework efficiently. This principle encourages prioritizing effective teaching methods and targeted supports.

With a doctorate in special education, you can pursue various rewarding career paths. Many individuals choose to teach at the university level, conducting research in the Special-d sector and training future educators. Alternatively, you could work as a consultant, providing expertise to school districts and organizations seeking to improve their special education programs.

The job that pays the most in special education is generally a special education director or administrator. In these positions, professionals manage special education services, develop policies, and supervise staff. This high level of responsibility comes with a corresponding salary, making it a lucrative career option in the Special-d domain. Gaining experience in teaching or program development can lead you to these high-paying roles.

The highest paying job in special education typically goes to school administrators or special education directors. These roles involve overseeing special education programs and ensuring compliance with federal and state regulations. They often require advanced degrees and significant experience. Pursuing such positions within the Special-d realm can yield rewarding financial and professional opportunities.

To get a special education advocate, start by researching local advocacy groups that focus on special education. These groups often provide resources and can connect you with a trained advocate. You may also consider reaching out to educational professionals who have experience with special needs to get referrals. Having a special education advocate can significantly enhance your understanding of your child’s rights within the Special-d framework.

To report accrued market discount, you will typically adjust the basis of the bond you are reporting. It's essential to include this information in your overall capital gains calculations, especially when completing forms like Schedule D. Understanding how to factor this into your Special-d reporting can help optimize your tax strategy.

Individuals who sold stocks, bonds, or other capital assets typically need to fill out form 8949. This form is essential for reporting each transaction accurately, especially if you have capital gains or losses to disclose. Utilizing the Special-d framework can simplify this process for you.

Yes, you must report every stock trade on your tax return if it resulted in a gain or loss. The IRS requires you to maintain transparency regarding your investment activities. By using the Special-d approach, you can document these trades accurately and fulfill your reporting obligations.