Bank Form For Opening Account

Description

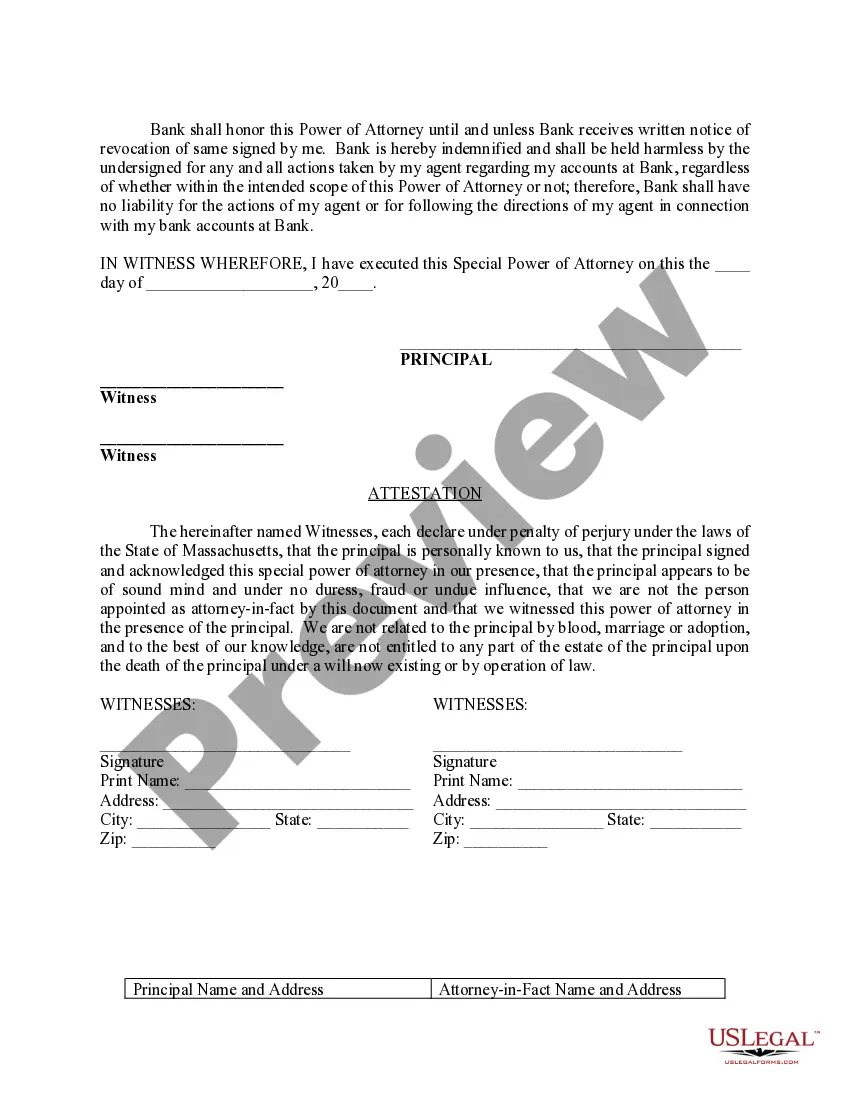

How to fill out Massachusetts Special Durable Power Of Attorney For Bank Account Matters?

- If you are a returning user, log into your account and check your subscription status. Ensure it is valid before proceeding to download your needed template.

- Review the Preview mode and form description to verify that you have selected the bank form that aligns with your specific needs and adheres to local jurisdiction requirements.

- If the chosen form does not meet your criteria, utilize the Search tab to explore other templates that may better suit your needs.

- After selecting the correct document, click the Buy Now button and pick a suitable subscription plan. You'll need to register for an account to gain access to the complete library of forms.

- Complete your purchase by providing your payment details through credit card or PayPal methods.

- Finally, download your form and save it on your device. You can access it anytime via the My Forms section of your account.

By utilizing US Legal Forms, you can quickly and effortlessly obtain legal documents tailored to your situation. With a vast collection of over 85,000 fillable and editable forms, you can be confident you are making the right choice.

Don't wait—start your journey to financial freedom by accessing the bank form for opening an account today!

Form popularity

FAQ

You can typically obtain a bank verification form directly from your bank’s website or by visiting a branch. Banks often provide downloadable forms that you can fill out and submit online or in person. If you encounter any difficulty, contacting customer service can provide you with immediate assistance. Ensure your form aligns with the bank form for opening an account to avoid delays.

To request bank account verification, reach out to your bank via their customer service line or through their website. Most banks have a specific process in place for such requests, often requiring you to complete an online form or submit a written request. Don't hesitate to ask for details to ensure you have everything needed. This process can be vital if you require a bank form for opening an account.

The time it takes to receive a bank verification letter can vary based on the bank’s policies. Generally, you can expect to wait a few business days once your request is submitted. However, some banks may expedite the process for urgent needs. Make sure to follow up if you do not receive the verification letter within the expected timeframe, especially if you need a bank form for opening an account.

For bank verification, you usually need to provide your identification, such as a driver's license or passport, along with your account details. Some banks may also ask for proof of address or additional documentation. It's important to check with your bank for their specific requirements. This will help you streamline the process and ensure you have the right bank form for opening an account.

To obtain a bank verification document, you typically need to contact your bank directly. Visit their website or call customer service to find the specific process they use. Often, you can request this document through an online form or by visiting a branch. If you need a bank form for opening an account, your bank can provide guidance on that as well.

Filling out a form for opening a bank account requires clear and accurate information. Start by entering your personal or business details, such as your name, address, and Social Security number. Be prepared to provide identification and any necessary documents, like your LLC resolution. Using a bank form for opening a account can assist you in ensuring all required fields are completed, making the process straightforward.

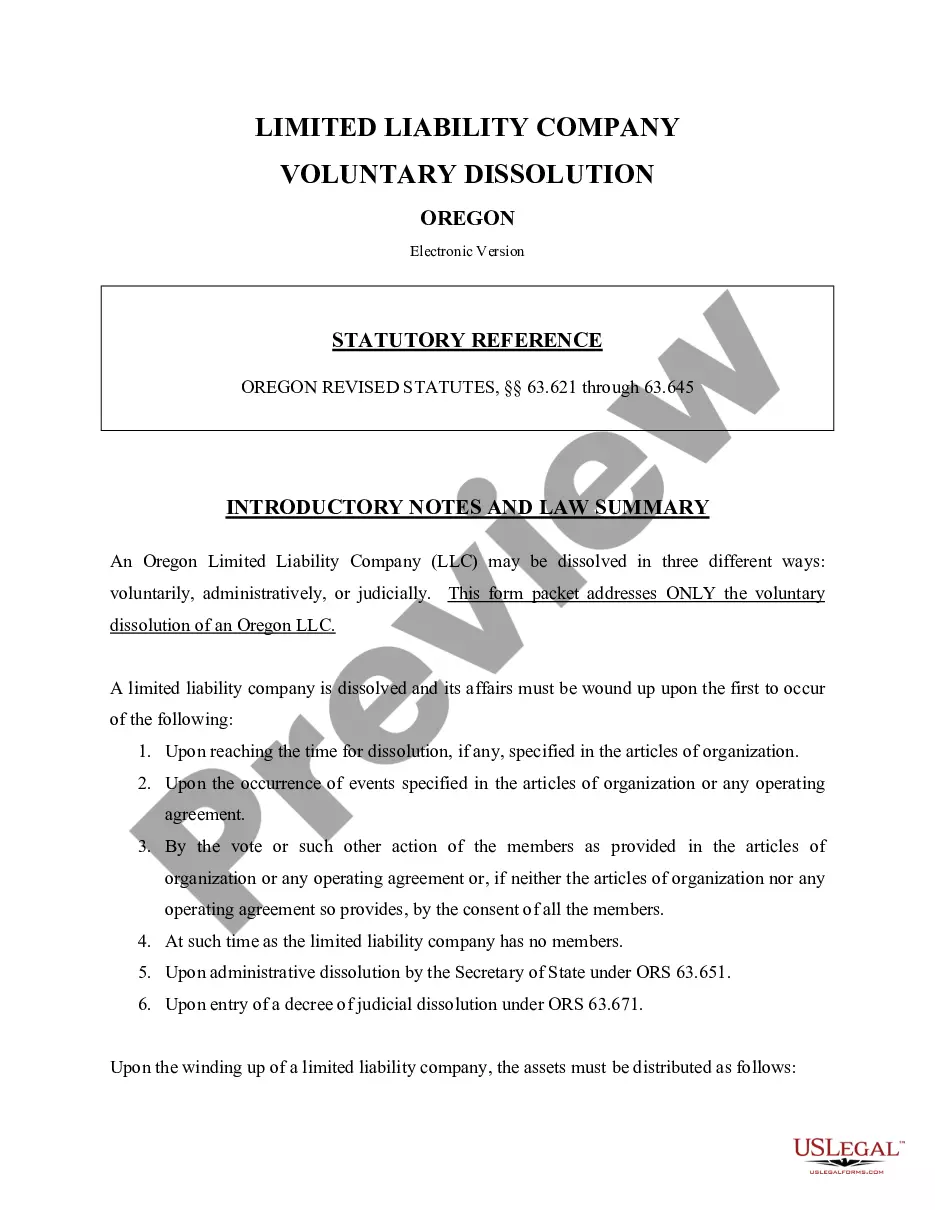

To write a resolution for opening a bank account, draft a document that states your LLC’s name and the purpose of the resolution. Include the specifics of who is authorized to act on behalf of the LLC regarding the bank account. It’s crucial to see that the resolution is signed by members or managers of the LLC to maintain credibility. A bank form for opening account can help guide you in capturing all essential details accurately.

An example of a resolution to open an account starts with a statement like, 'Resolved, that LLC Name approves the opening of a bank account with Bank Name, and designates Name of Person as authorized signatory.' This concise statement articulates the decision made by the LLC members. You can refer to a bank form for opening account to find a suitable template to ensure all required components are included.

To fill out an LLC resolution for opening a bank account, start by entering the LLC's official name and date. Clearly outline the specific resolution which authorizes the opening of the account, including who is designated to act on behalf of the LLC. Make sure to sign and date the document according to your state’s regulations. Using a bank form for opening account simplifies this by highlighting essential elements to include.

An LLC can open a bank account by providing the necessary documentation to the bank. These documents typically include the LLC's formation paperwork, operating agreement, and a resolution authorizing the opening of the account. It’s important to complete the bank form for opening account to ensure all required information is included, making the process smooth and efficient.