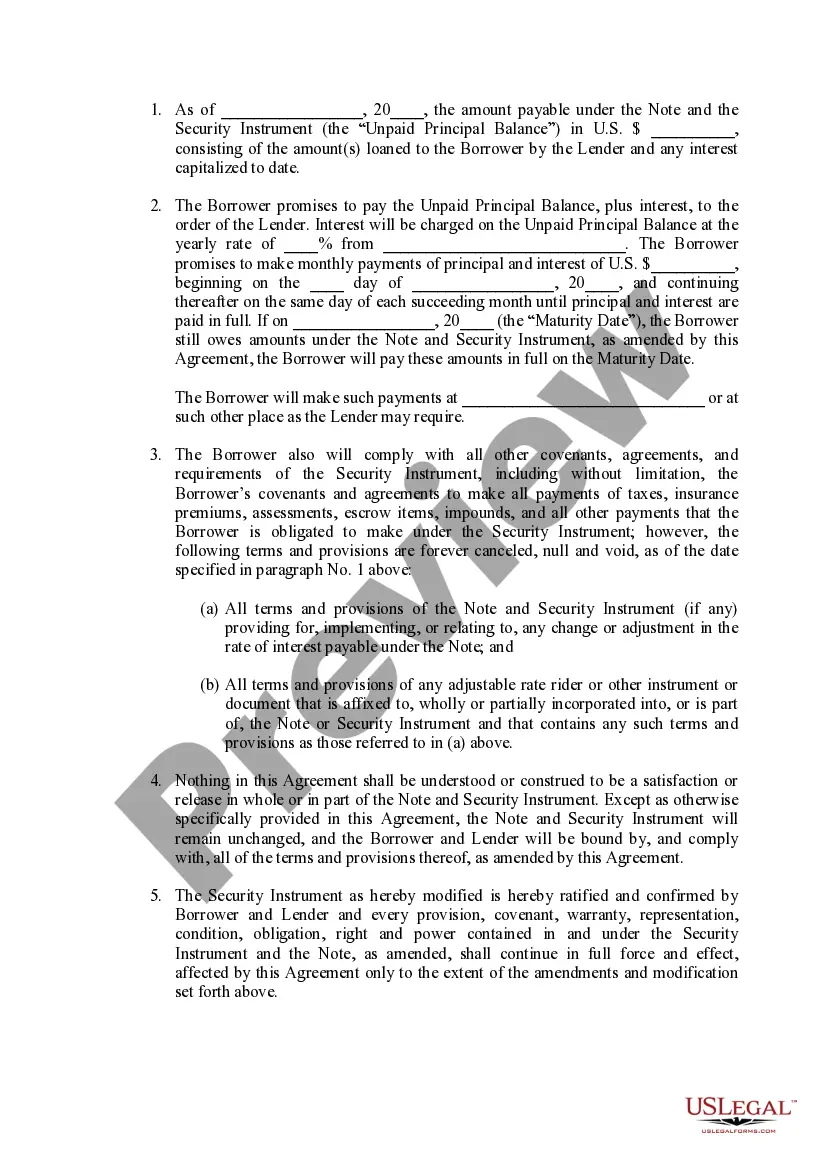

Loan Modification Agreement Form With Interest

Description

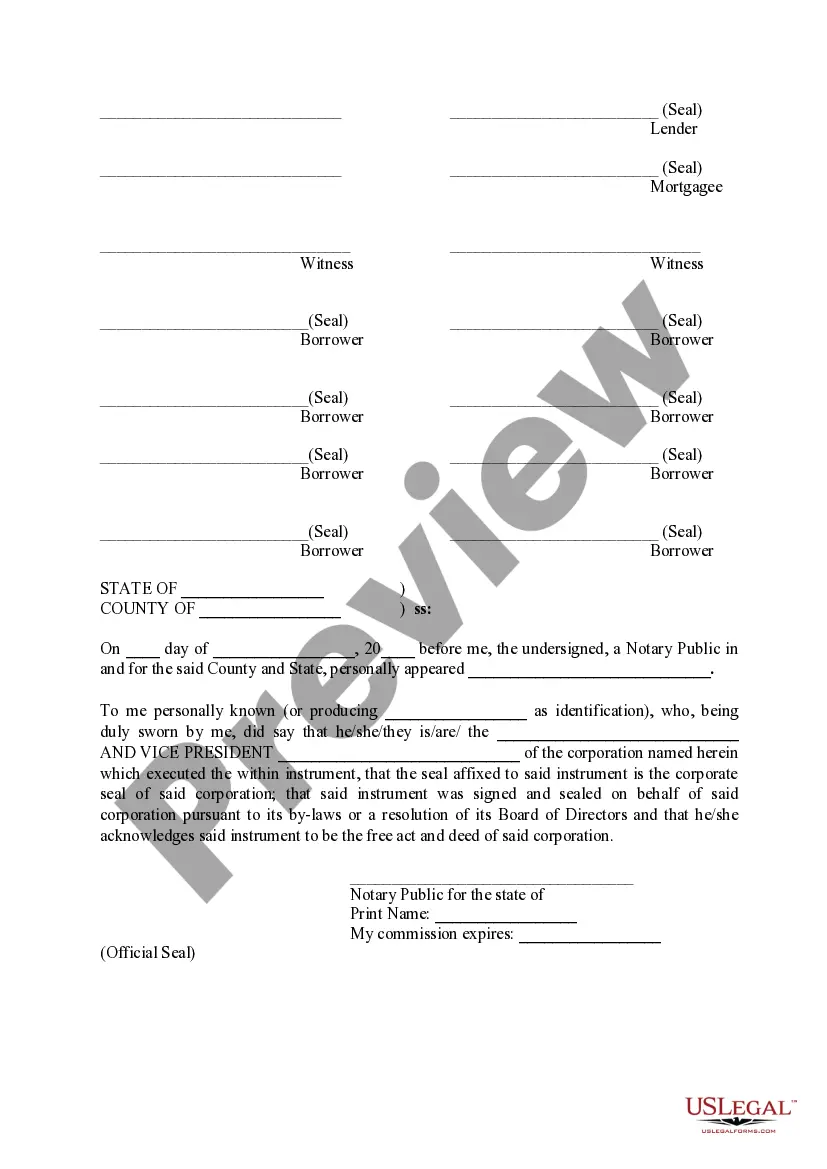

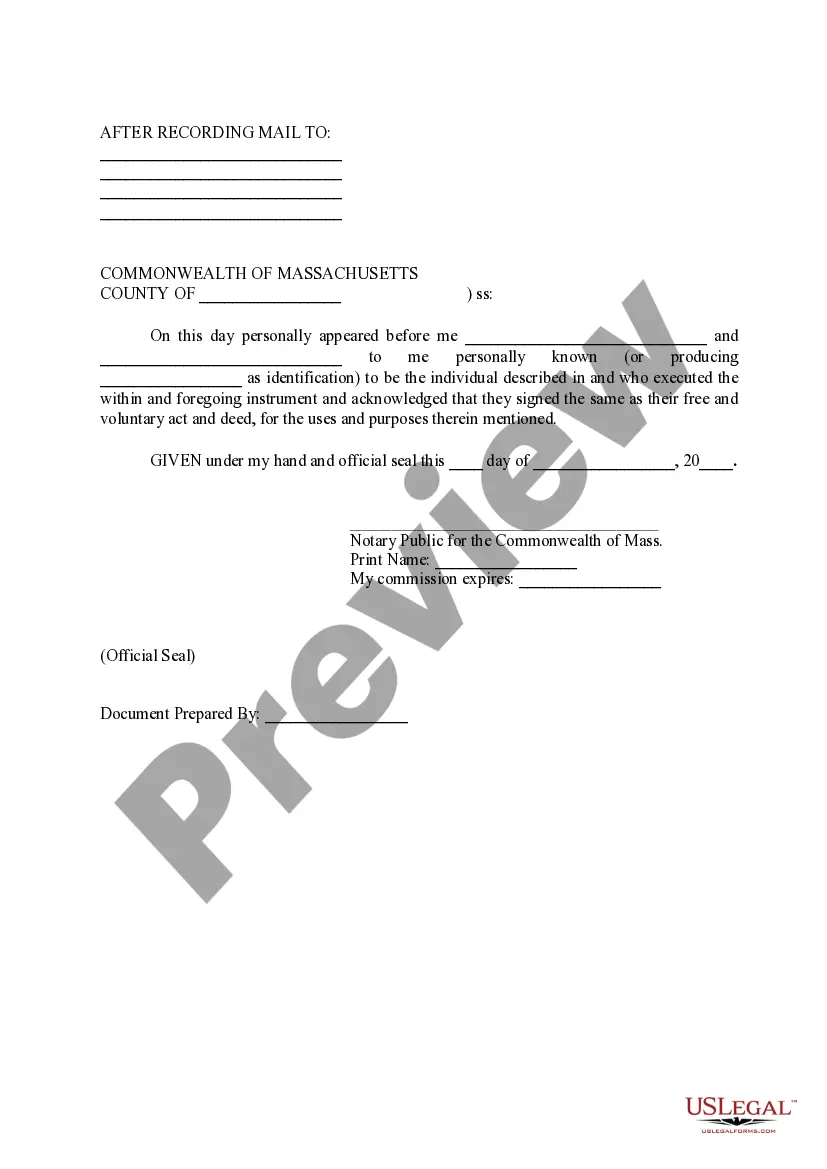

How to fill out Massachusetts Loan Modification Agreement (Fixed Interest Rate)?

Bureaucracy requires exactness and correctness.

Unless you engage with completing documentation such as Loan Modification Agreement Form With Interest regularly, it could result in certain misinterpretations.

Choosing the appropriate template from the beginning will ensure that your document submission proceeds smoothly and avert any hassles of re-submitting a document or undertaking the same task entirely from the beginning.

If you are not a subscribed user, finding the necessary template would involve a few additional actions: Locate the template using the search box.

- You can always find the right template for your documentation in US Legal Forms.

- US Legal Forms is the largest online repository of forms that holds over 85 thousand templates for various areas.

- You can find the most recent and suitable edition of the Loan Modification Agreement Form With Interest by simply searching for it on the platform.

- Identify, store, and download templates in your account or verify with the description to confirm you possess the correct one at your disposal.

- With an account at US Legal Forms, you can effortlessly obtain, keep in a single location, and navigate through the templates you save to access them in just a few clicks.

- When on the website, click the Log In button to authenticate.

- Then, navigate to the My documents page, where a compilation of your documents is stored.

- Explore the description of the forms and download those you need at any time.

Form popularity

FAQ

Loan modifications are a long-term mortgage relief option for borrowers experiencing financial hardship, such as loss of income due to illness. A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable.

A modification involves one or more of the following: Changing the mortgage loan type (e.g., changing an Adjustable Rate Mortgage to a Fixed-Rate Mortgage) Extending the term of the mortgage (e.g., from a 30-year term to a 40-year term) Reducing the interest rate.

What Is A Loan Modification? A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

COVID-19: How to Write a Mortgage Loan Modification Request...Keep your letter to a single page.Include income and asset documentation such as pay stubs, bank statements, and other relevant paperwork.Stick to the facts.Let the lender know the specific concession you are requesting.

A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.