Loan Modification Agreement Form With Collateral

Description

How to fill out Massachusetts Loan Modification Agreement (Fixed Interest Rate)?

Traversing through the red tape of official documents and formats can be challenging, particularly if one does not engage in that professionally.

Even locating the appropriate format for a Loan Modification Agreement Form With Collateral will be tedious, as it must be legitimate and precise to the last detail.

However, you will need to invest considerably less time obtaining an appropriate template from a source you can rely on.

Acquire the appropriate form in a few straightforward steps: Enter the name of the document in the search field. Locate the correct Loan Modification Agreement Form With Collateral from the results list. Review the description of the sample or open its preview. Once the template suits your requirements, click Buy Now. Proceed to select your subscription plan. Use your email and set a security password to create an account at US Legal Forms. Choose a credit card or PayPal payment option. Download the template file onto your device in the format of your preference. US Legal Forms will save you time and effort investigating if the form you found online is appropriate for your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a service that streamlines the procedure of hunting for the correct forms online.

- US Legal Forms is a singular place you require to acquire the latest samples of documentation, understand their application, and download these samples to complete them.

- This is a collection boasting over 85K forms that pertain to diverse sectors.

- While searching for a Loan Modification Agreement Form With Collateral, you will not need to question its validity since all the forms are authenticated.

- Having an account at US Legal Forms will ensure that you have all the essential samples at your fingertips.

- You can store them in your history or include them in the My documents collection.

- You can access your saved forms from any device by clicking Log In at the library site.

- If you still lack an account, you can always search for the template you require.

Form popularity

FAQ

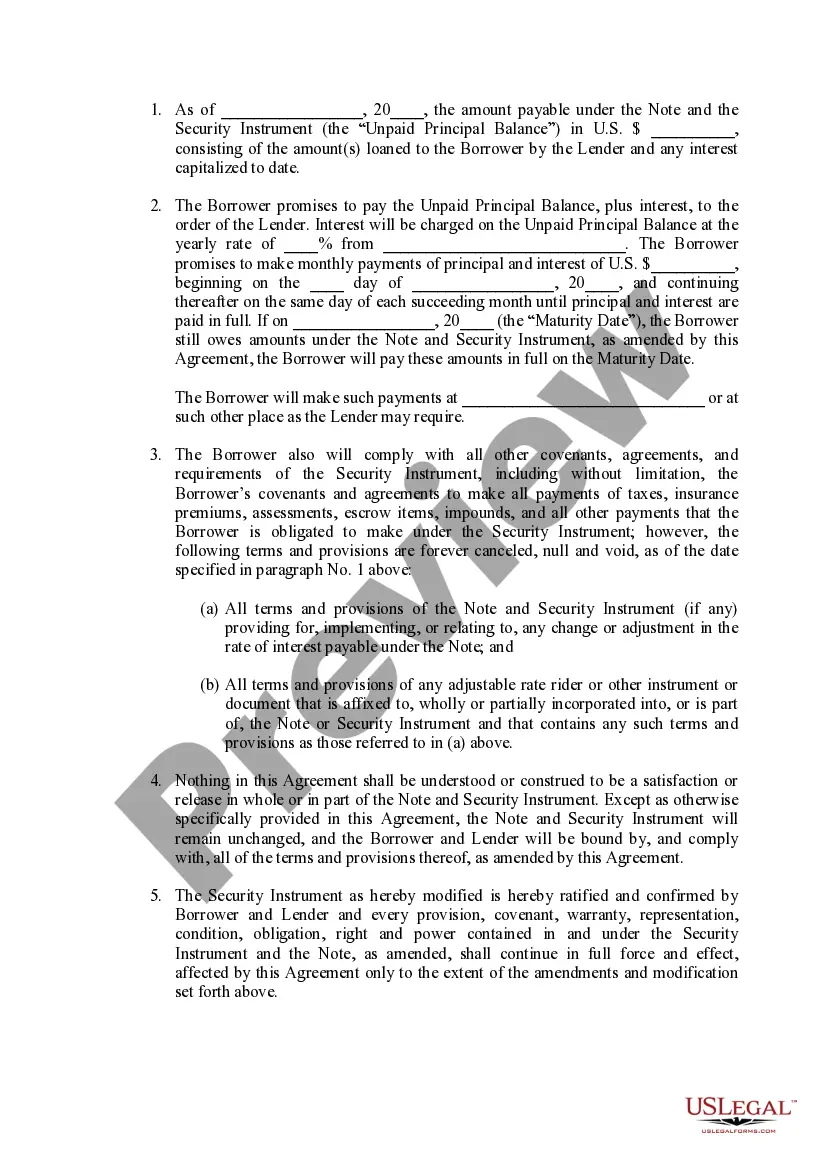

The following are the most common instances in which a loan modification will require recordation: Adding new collateral to secure the loan or releasing part or all of the collateral currently securing the loan. Increasing the maximum available funds under the loan. Adding a revolving feature to an existing loan.

When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include carsonly if they are paid off in fullbank savings deposits, and investment accounts.

Examples of collateral documents are a security agreement, guarantee and collateral agreement, pledge agreement, deposit account control agreement, securities account control agreement, mortgage, and UCC-1s.

Companies that operate by contractually agreeing to provide services or products for a specific project or event can use the contract as collateral to secure necessary funding.

If a loan agreement includes collateral, it means that the borrower has agreed to pledge certain assets as security for the loan. In the event the borrower defaults and does not uphold his or her agreement to repay the loan amount plus interest, the lender gets to keep the pledged collateral.