Revocation Living Trust For Property

Description

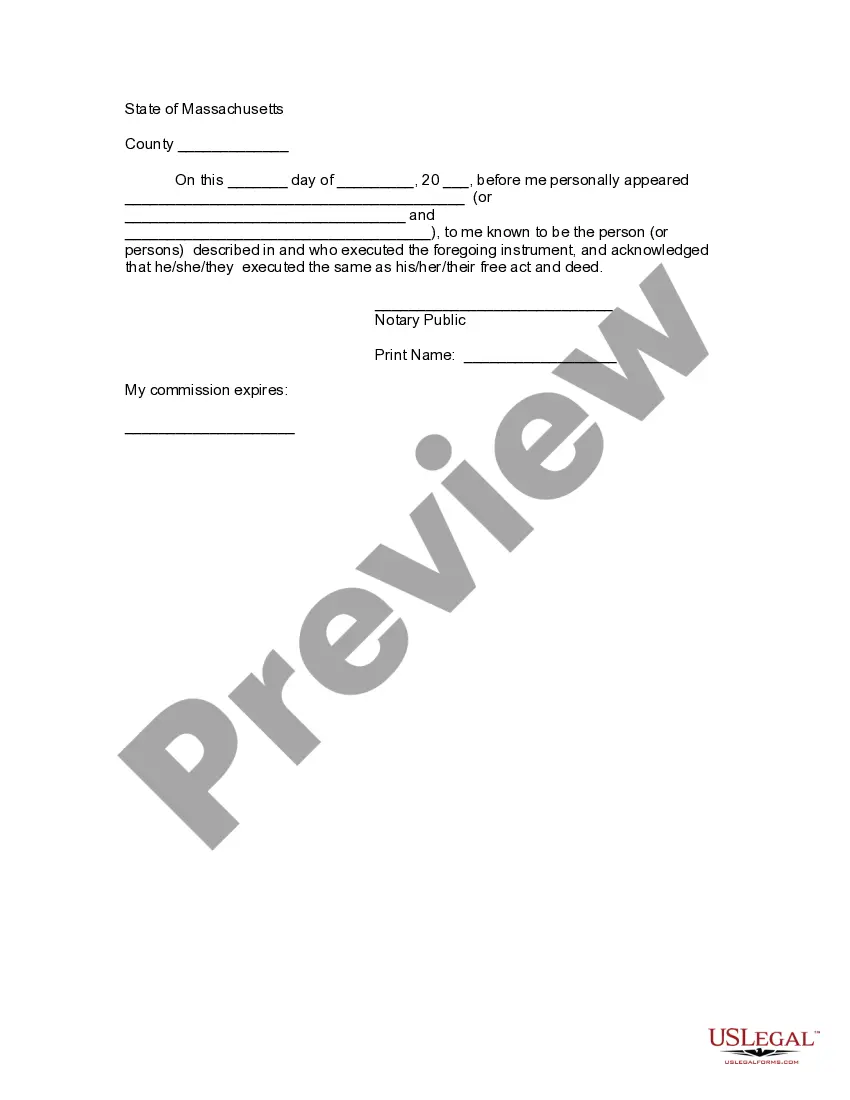

How to fill out Massachusetts Revocation Of Living Trust?

- If you're an existing user, log in to your account and select the form template you need. Confirm that your subscription is active; renew if necessary.

- Begin by checking the form's Preview mode and description to ensure it aligns with your specific needs and complies with local laws.

- If you need another template, utilize the Search feature to locate the correct form. Move forward if the form meets your criteria.

- Purchase the document by clicking the Buy Now button and choosing your desired subscription plan. Make sure to create an account for access.

- Complete the payment using either your credit card or PayPal account after selecting your subscription.

- Download the form directly to your device and access it anytime from the My Forms section.

In conclusion, utilizing US Legal Forms not only simplifies the process of obtaining a revocation living trust for property but also ensures that your documents are legally sound and precisely tailored to your needs.

Start your journey to effective property management today by accessing SS Legal Forms’ extensive library.

Form popularity

FAQ

A trust can be deemed void if it lacks legal capacity, purposes that are illegal, or fails to meet formal requirements. For a revocation living trust for property, any errors in document execution or unclear intentions can render the trust invalid. Additionally, if the trust is created under duress or coercion, it may also be void. Engaging with reliable platforms like uslegalforms can help prevent such issues.

The 5-year rule for trusts typically refers to a guideline affecting the distribution of assets and tax implications. Under certain conditions, if assets in a revocation living trust for property exceed 5 years, they may face different tax treatments. This rule is essential for ensuring that your estate planning aligns with your financial goals. It's wise to consult with a professional to navigate these rules.

A trust can be terminated in several ways, including through the completion of its purpose, by the request of the trustor, or via court order. In terms of revocation living trust for property, the trustor can simply revoke it at any time while they are alive. Additionally, if all beneficiaries agree, they may also terminate the trust. Understanding these options helps in managing your estate effectively.

Revoking a revocation living trust for property is generally straightforward. The process usually requires you to follow the procedures outlined in the trust document. This might include drafting a formal revocation document and notifying the relevant parties. With proper guidance, you can easily navigate this process successfully.

One disadvantage of placing your house in a revocation living trust for property is the potential for costs associated with creating and maintaining the trust. This may include legal fees and ongoing administrative costs. Moreover, transferring ownership can complicate tax benefits, such as the homeowner's exemption. Finally, you might lose some control over the property during your lifetime.

A trust can be invalid if it fails to meet legal requirements, such as not having a rightful creator, or lacking the proper documentation. In some cases, a revocation living trust for property may not align with state laws, making it void. Additionally, if the trust's purpose is illegal or against public policy, it can also be deemed invalid. Always consult with an expert to ensure your trust is valid.

Putting your house in a revocable trust can be a wise choice, as it can simplify the transfer of ownership upon your passing. It helps avoid probate, ensuring that your property is distributed according to your wishes without lengthy legal processes. However, you should consider potential tax implications and ensure that this action aligns with your overall estate plan. To explore how this could work for you, visit US Legal Forms for practical resources.

Some assets cannot or should not be included in a revocable trust, as they may require designated titling or special handling. For example, retirement accounts and life insurance policies should usually remain outside of the trust to prevent tax complications. Additionally, personal items that you may wish to pass outside probate can also be better handled through a will. Understanding these intricacies can help you optimize your revocation living trust for property.

A revocation of living trust allows you to dissolve or terminate an existing living trust, returning control of your property back to you. This process is straightforward and ensures that any assets within the trust are no longer governed by its terms. Essentially, it reinstates your authority over your property, making it an important option for individuals who wish to modify their estate plans. If you need assistance with this process, consider using US Legal Forms for expert guidance.

While revocable living trusts offer many benefits, there are also some disadvantages to consider. For example, assets in a revocable trust may not be protected from creditors, and setting up the trust can involve upfront costs. Understanding these aspects helps you make informed decisions about using a revocation living trust for property management on your terms.