Ma Trust With 401k

Description

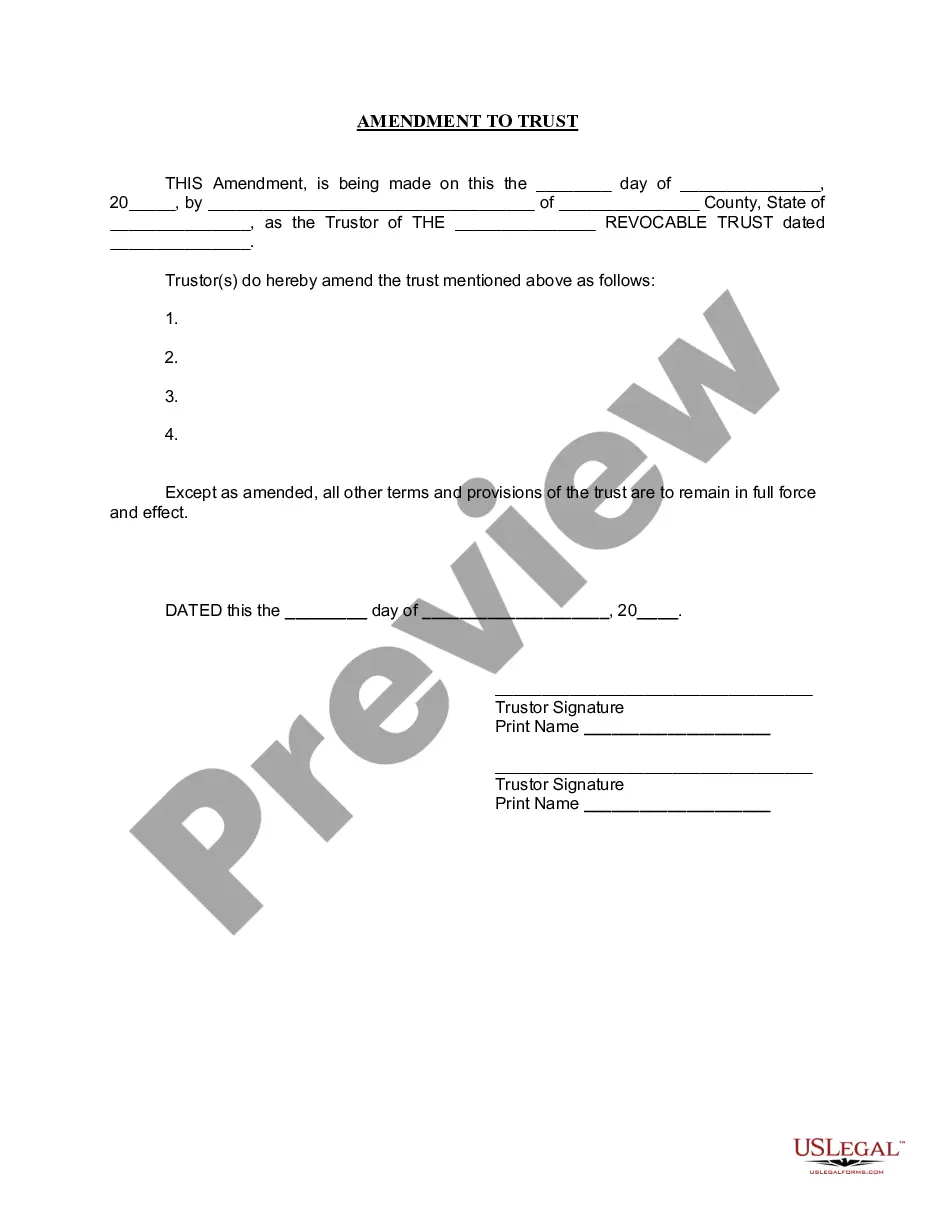

How to fill out Massachusetts Amendment To Living Trust?

The Ma Trust With 401k displayed on this page is a reusable legal template crafted by experienced attorneys in compliance with federal and state laws.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners more than 85,000 certified, state-specific documents for any professional and personal situation. It’s the quickest, simplest, and most reliable method to acquire the forms you need, as the service ensures the utmost level of data security and anti-malware safeguards.

Choose the format you desire for your Ma Trust With 401k (PDF, DOCX, RTF) and download the sample onto your device.

- Search for the document you require and examine it.

- Browse through the sample you looked up and preview it or review the form details to confirm it meets your requirements. If not, utilize the search bar to locate the appropriate one. Click Buy Now after finding the template you need.

- Subscribe and sign in.

- Choose the pricing plan that fits your needs and create an account. Use PayPal or a credit card for a quick payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

Filling out your 401k beneficiary form requires careful attention to detail. Start by writing your full name and beneficiary information clearly. If naming a Ma trust with 401k as the beneficiary, ensure to provide the trust's name and relevant identification details, which will help avoid future confusion.

One disadvantage of naming a trust as a beneficiary of your 401k is the potential tax ramifications. Distributions to the trust may be subject to higher tax rates compared to direct distributions to individual beneficiaries. Understanding these implications is vital, so consulting with a financial advisor is a wise step.

You may choose to name your trust as the beneficiary of your 401k. This decision can provide clarity regarding how funds will be distributed. Additionally, it may help in avoiding probate and aligning with your overall estate planning strategy.

Listing your trust as the beneficiary of your 401k can simplify your estate planning process. It allows for controlled distributions and helps you define how the assets are managed after your passing. Consider consulting with an estate planner to identify the best approach for your individual situation.

Making a trust the beneficiary of a 401k can be advantageous. It ensures that the distribution aligns with your estate plans, especially for minors or those who may need guidance managing their inheritance. However, weighing potential tax implications is essential, as funds might be taxed differently.

Yes, a 401k can be placed in the name of a trust, allowing you to manage the account according to your wishes. By designating a Ma trust with 401k as the owner, you ensure that the funds are handled according to your long-term plans. This strategy can help your beneficiaries manage the tax implications effectively.

The 5 year rule for trusts refers to a requirement that some irrevocable trusts must adhere to regarding the taxable distributions of income. Specifically, it requires that any funds placed in such a trust must be accounted for over a five-year period for tax purposes. If you're considering a Ma trust with 401k, understanding this rule is crucial as it can impact your estate planning strategy. Connecting with a qualified professional can clarify how this rule applies to your unique situation.

One of the biggest mistakes parents make when setting up a trust fund is failing to properly fund it, especially with assets like a Ma trust with 401k. Without fully funding the trust, it cannot achieve its intended goals, which often include asset protection and tax efficiency. Additionally, parents sometimes overlook updating their beneficiaries or the trust's terms after major life events. Regular reviews and adjustments can help maintain the trust's effectiveness.

Yes, you can transfer your 401k to your trust, but you must first set up a Ma trust with 401k. This allows you to direct your retirement funds in a way that aligns with your estate planning goals. Keep in mind that the transfer process may require specific documentation and adherence to IRS guidelines. Working with a legal expert can help ensure a smooth transition.

To put your 401k into a trust, you need to first establish a Ma trust with 401k specifically designed for retirement accounts. Contact your 401k plan administrator to learn about their specific procedures and requirements for making this transfer. It's essential to ensure that the trust is properly structured to comply with tax regulations and can effectively manage the 401k assets. This process may involve paperwork to change the beneficiary designation to the trust.