Llc Vs Llp Canada

Description

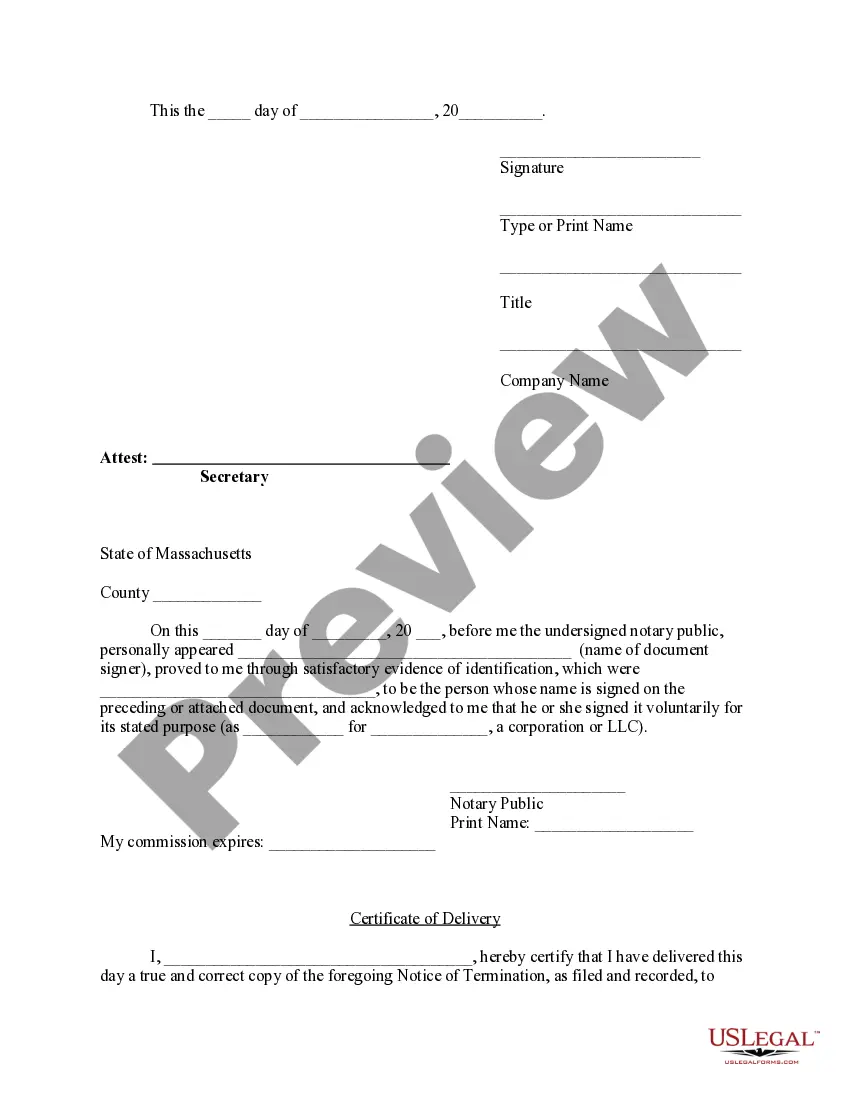

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- If you're a returning user, log into your account to access your previously purchased forms and download the necessary templates directly to your device. Ensure your subscription is active; if not, please renew it as per your plan.

- For first-time users, begin by exploring the Preview mode and form descriptions. Verify that you select the template that aligns with your specific needs and complies with your local requirements.

- If the form does not meet your criteria, utilize the Search feature at the top of the page to find an alternative template. Once you find a suitable option, proceed to the next step.

- Purchase the document by clicking the Buy Now button. Choose the subscription plan that fits your needs and register for an account to access the full library.

- Complete your payment by entering your credit card information or using your PayPal account to finalize the transaction.

- Download the form to your device, ensuring you can easily fill it out and retrieve it later from the My Forms section of your profile.

US Legal Forms stands out by empowering users, providing not just a robust collection of over 85,000 forms but also offering access to premium experts for guidance. This ensures that every legal document completed is not only accurate but also fully compliant.

Now that you have your documents, start your journey with confidence. Explore US Legal Forms for all your legal needs and experience the benefits of having expert assistance at your fingertips.

Form popularity

FAQ

LLCs, as understood in the U.S., are not officially recognized by Canadian law. Instead, Canadian legal frameworks provide alternatives like corporations or partnerships that can function similarly. Recognizing this difference is key when navigating the 'llc vs llp canada' landscape, as you seek the best entity for your business needs.

The primary difference between an LLC and an LLP in Canada lies in their structure and governance. While an LLC resembles a corporation offering broad protections, an LLP focuses on partnership models with mutual liability protection among partners. Understanding these distinctions illuminates the 'llc vs llp canada' debate, helping you choose the best legal form for your business.

Choosing an LLP over an LLC can benefit professionals looking for a flexible partnership with liability protection. An LLP can foster a collaborative environment, allowing partners to share management responsibilities and profits. When you examine 'llc vs llp canada', consider how the regulatory structure fits your personal and professional aspirations.

Whether an LLP is better than an LLC depends on your specific business needs and goals. LLPs provide liability protection like LLCs but often cater more to professional partnerships, such as law firms or accounting firms. Evaluating 'llc vs llp canada' requires assessing the advantages each structure offers based on your business model.

Yes, an LLP, or limited liability partnership, generally protects personal assets from business debts and liabilities. This means, as a partner, your personal property is typically not at risk if the business faces financial difficulties. In contrast to LLC structures, understanding this protection in the context of 'llc vs llp canada' is essential for making an informed choice.

The closest equivalent to an LLC in Canada is typically a limited partnership or a corporation, depending on the desired structure and liability protection. While these entities offer some features similar to LLCs, they operate under different regulations. When comparing 'llc vs llp canada', noting the variations in terms of partnerships versus corporations is vital.

In Canada, LLCs are not a formally recognized entity type like in the U.S. However, similar structures can be created under different terms, such as limited partnerships or general partnerships. This somewhat leads to confusion, as the concept of an LLC doesn't have a direct Canadian counterpart. Therefore, understanding 'llc vs llp canada' is crucial for choosing the right structure.

The downside of an LLP includes the potential for personal liability if a partner is found negligent or engages in misconduct. This partial liability can lead to risks that some business owners may prefer to avoid. Therefore, when comparing LLC vs LLP Canada, it is essential to carefully consider how these risks align with your business objectives.

One significant advantage of an LLP is the protection it offers partners from personal liability regarding the debts and obligations of the partnership. This benefit is particularly beneficial in high-risk industries. When considering the implications of LLC vs LLP Canada, an LLP allows for safer collaboration without compromising individual financial security.

An LLP may be seen as better than an LLC if you value personal involvement in management and decision-making without sacrificing liability protection. It promotes collaboration among partners while offering some liability shields. As you evaluate LLC vs LLP Canada, this format can enhance professional relations within your business network.