Limited Company Meaning

Description

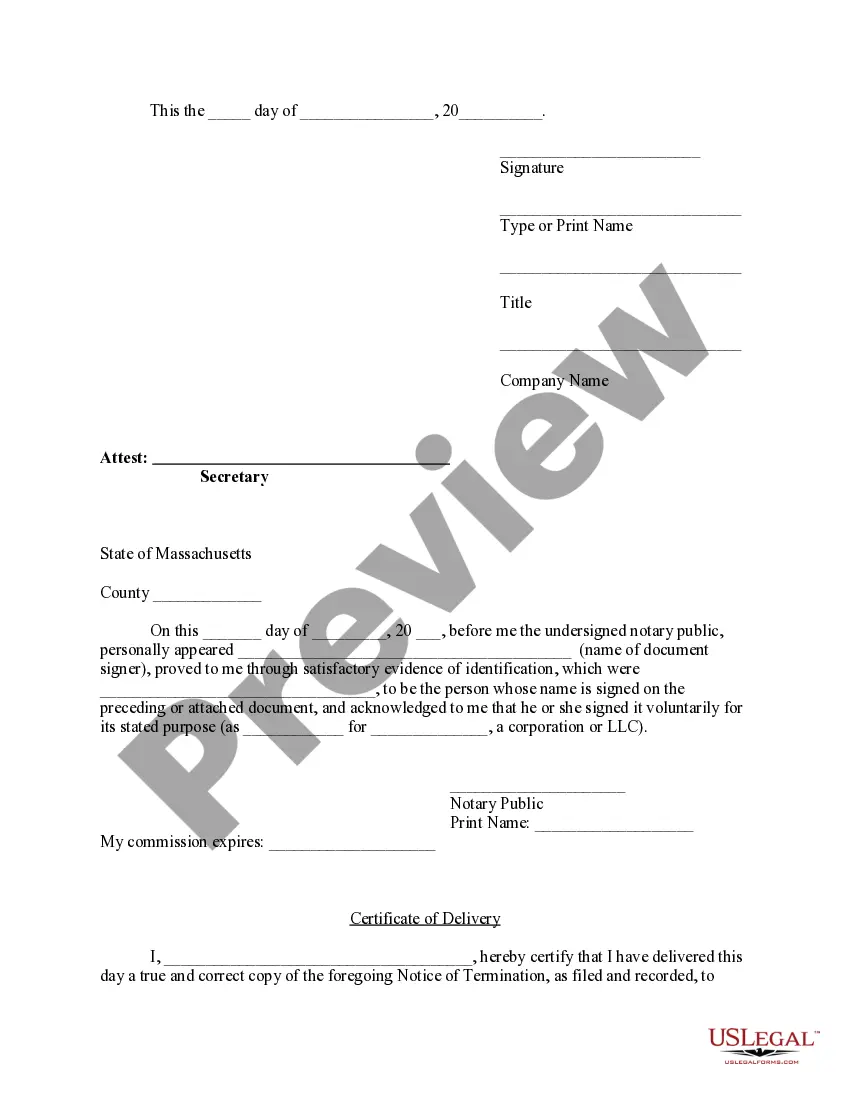

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- Log in to your US Legal Forms account if you're an existing user and verify your subscription status.

- Explore the available legal form templates in Preview mode, ensuring you select one that aligns perfectly with your jurisdictional requirements.

- If the necessary form isn’t available, utilize the Search function to find the correct template.

- Select the desired form and click on the Buy Now button to choose your preferred subscription plan.

- Complete your purchase by entering your payment details, either through credit card or PayPal.

- Once purchased, download the document to your device and find it later in the My Forms section of your profile.

US Legal Forms stands out with its vast array of over 85,000 editable legal documents that streamline the legal process. With premium expert assistance available, users can ensure their forms are accurate and compliant.

Take control of your legal document needs today—start your journey with US Legal Forms and experience the simplicity of obtaining the right legal forms.

Form popularity

FAQ

One notable disadvantage of a limited company is the increased regulatory scrutiny it faces compared to sole proprietorships. This may involve more complex legal compliance and higher operational costs. Understanding the limited company meaning includes recognizing these challenges, which can help you prepare and manage them effectively.

Having a limited company often comes with numerous advantages, such as limited liability and potential tax benefits. It allows business owners to separate their personal and corporate finances, providing additional security. By grasping the limited company meaning, you can make informed decisions that align with your business goals and personal circumstances.

A limited company must file several key documents, including annual accounts and confirmation statements, with the relevant authorities. This requirement ensures transparency and compliance with legal standards. Knowing the limited company meaning also entails understanding these filing responsibilities, which promote accountability and trust in the business.

When a company has the term 'limited' in its name, it indicates that liability is restricted for its shareholders. This means that if the company faces financial difficulties, the personal assets of the shareholders are typically protected. Understanding the limited company meaning helps in realizing the legal protections offered to owners, ensuring peace of mind while running a business.

You can identify if you are a limited company by checking whether your business is registered with the state as a corporation or limited liability company (LLC). You should have a unique company number, and your financial records must be distinct from personal finances. If you are unsure about your business structure, tools from platforms like US Legal Forms can assist you in clarifying your business status. Familiarizing yourself with the limited company meaning will provide further insight.

You become a limited company by registering your business with the necessary governmental bodies and complying with the established regulations. This process involves creating a memorandum and articles of association, which outline the company’s structure and operational guidelines. Additionally, you need to maintain proper financial records and adhere to tax obligations. Understanding the limited company meaning is key to navigating this registration process smoothly.

Choosing to operate as a limited company offers multiple benefits, such as reduced personal risk and enhanced business credibility. It can facilitate easier access to funding due to its formal structure. Many entrepreneurs select this option to ensure their personal assets are safeguarded against business debts. Grasping the limited company meaning can support your decision to pursue this advantageous business model.

The primary purpose of a limited company is to conduct business while protecting the owners from personal liability. This structure enables the company to raise capital more easily, as shares can be sold to investors. Additionally, a limited company can provide credibility and permanence to your business model. Knowing the limited company meaning helps you appreciate how it fosters growth and stability.

A limited company is a type of business structure that limits the personal liability of its owners, known as shareholders. To qualify, it must be registered with the appropriate authorities and conform to specific regulations in your state. Furthermore, it must have at least one director and shareholders, and its financial records should be separated from personal finances. Understanding the limited company meaning helps in recognizing its legal and fiscal framework.

The difference between LLC and limited primarily revolves around their legal structure and levels of formality. An LLC, or Limited Liability Company, combines the flexibility of a partnership with the liability protection of a corporation. In contrast, a limited company often refers to a traditional corporation, which may entail more regulatory requirements. Understanding the limited company meaning can help you navigate these options effectively.