Is A Limited Liability Partnership The Same As An Llc

Description

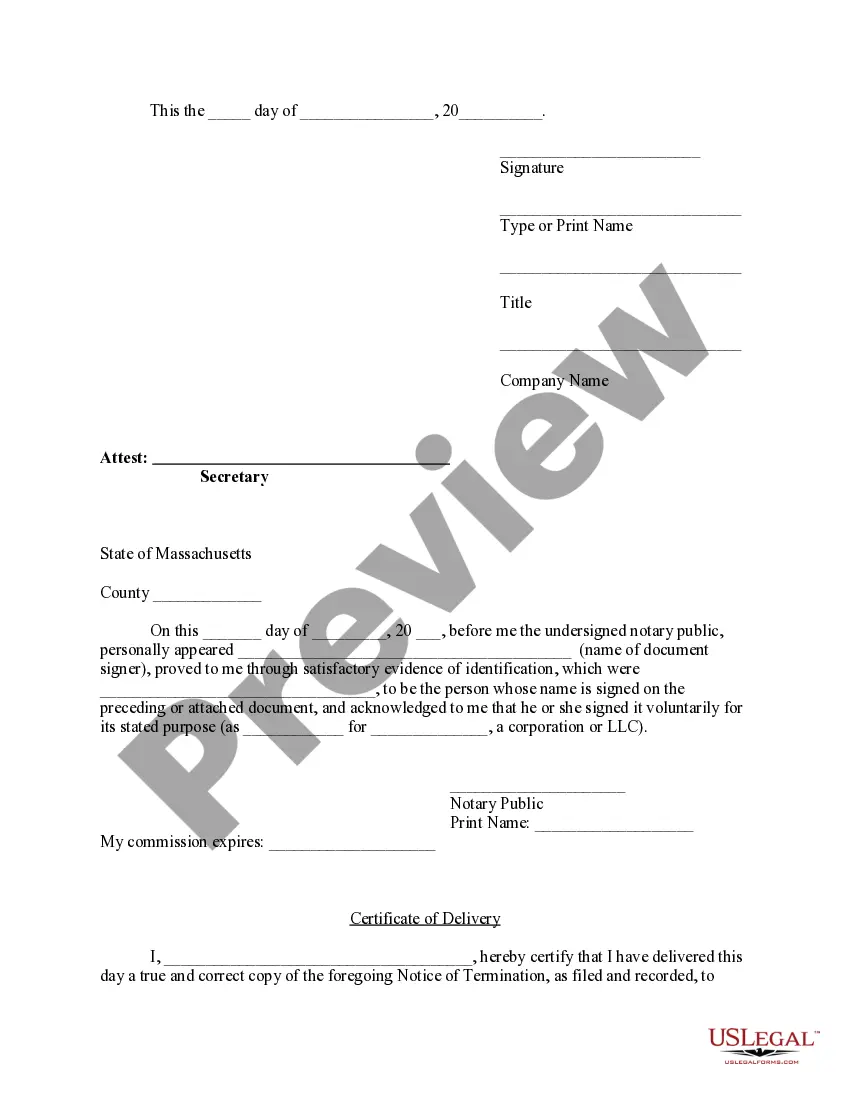

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- Log in to your account if you're a returning user and download the necessary form template by selecting the Download button. Ensure your subscription is active; renew if required.

- For first-time users, start by checking the Preview mode to confirm the form you choose meets your needs and complies with local regulations.

- If the initial form isn’t suitable, utilize the Search tab to find an appropriate template.

- To acquire the document, click on the Buy Now button and choose a subscription plan that works for you, noting that you need to create an account for access.

- Make your payment using a credit card or PayPal to complete the transaction.

- Download the completed form to your device. You can also find it later in the My Forms section of your profile.

US Legal Forms empowers users by offering a comprehensive collection of over 85,000 legal documents tailored for easy filling and editing. The platform is designed to ensure accuracy and compliance.

With unparalleled access to legal templates and expert assistance, getting the right form is straightforward. Start your journey today at US Legal Forms!

Form popularity

FAQ

The primary difference lies in liability and management structure. An LLC provides personal liability protection to its members, while a partnership LLC allows partners to be shielded from some personal liabilities while managing the business together. If you are uncertain about which structure suits your needs, US Legal Forms can guide you in making an informed choice regarding 'Is a limited liability partnership the same as an LLC?'

No, an LLC and a limited liability partnership are not the same. While both provide some level of protection for personal assets, they operate under different rules and structures. An LLC is typically owned by members, while a limited liability partnership is formed by two or more partners sharing management and profits. To clarify the distinctions, it's helpful to consult resources like US Legal Forms.

Choosing between an LLC and a partnership depends on your business needs. An LLC offers personal liability protection, while a general partnership does not. If you want to protect your personal assets, forming an LLC may be the better option for you. To navigate the decision-making process effectively, consider using US Legal Forms for all necessary documentation.

Yes, LLC members can also be limited partners in a limited liability partnership. However, understanding the distinctions between them is crucial. When considering whether a limited liability partnership (LLP) is the same as an LLC, it's important to note the different roles and responsibilities of members and partners. Using a platform like US Legal Forms can help clarify these concepts and assist you in forming the right partnership based on your business needs.

To identify your LLC type, review the formation documents you filed with your state and check your operating agreement. These documents will specify the number of members and the structure of your company. If you’re uncertain, utilizing resources like US Legal Forms can help you navigate through your options and confirm your LLC's classification.

To tell if an LLC is a single member, check your state’s business registration records and your operating agreement. A single-member LLC will list only one owner, whereas multiple owners indicate a partnership. You may also consider seeking professional guidance through platforms like US Legal Forms to confirm your LLC’s status.

You can identify if your LLC is single-member or partnership by reviewing your operating agreement and the number of members listed. A single-member LLC has only one owner, whereas a partnership LLC has two or more members. If you formed the LLC alone, it’s single-member. If you joined with business partners, it is categorized as a partnership.

An LLC, or Limited Liability Company, provides personal liability protection to its owners, while an LC, or Limited Company, may offer less comprehensive protection depending on the jurisdiction. The primary distinction lies in their formation, structure, and how they handle taxes. Understanding these differences is crucial if you're considering starting a business, so it’s advisable to consult legal resources or platforms like US Legal Forms.

To determine if your LLC is a sole proprietorship or partnership, first, consider the ownership structure. A sole proprietorship has one owner, while a partnership has multiple owners. Review your formation documents and operating agreement for clarity. If you have business partners, your LLC is likely a partnership and not a sole proprietorship.

Common problems with LLPs include potential conflicts between partners, particularly when there are no clear guidelines in the partnership agreement. Additionally, certain states impose strict regulations on LLPs that could affect your operations. When exploring if a limited liability partnership is the same as an LLC, it’s important to recognize these challenges to avoid future complications.