Quitclaim Deed For Trust

Description

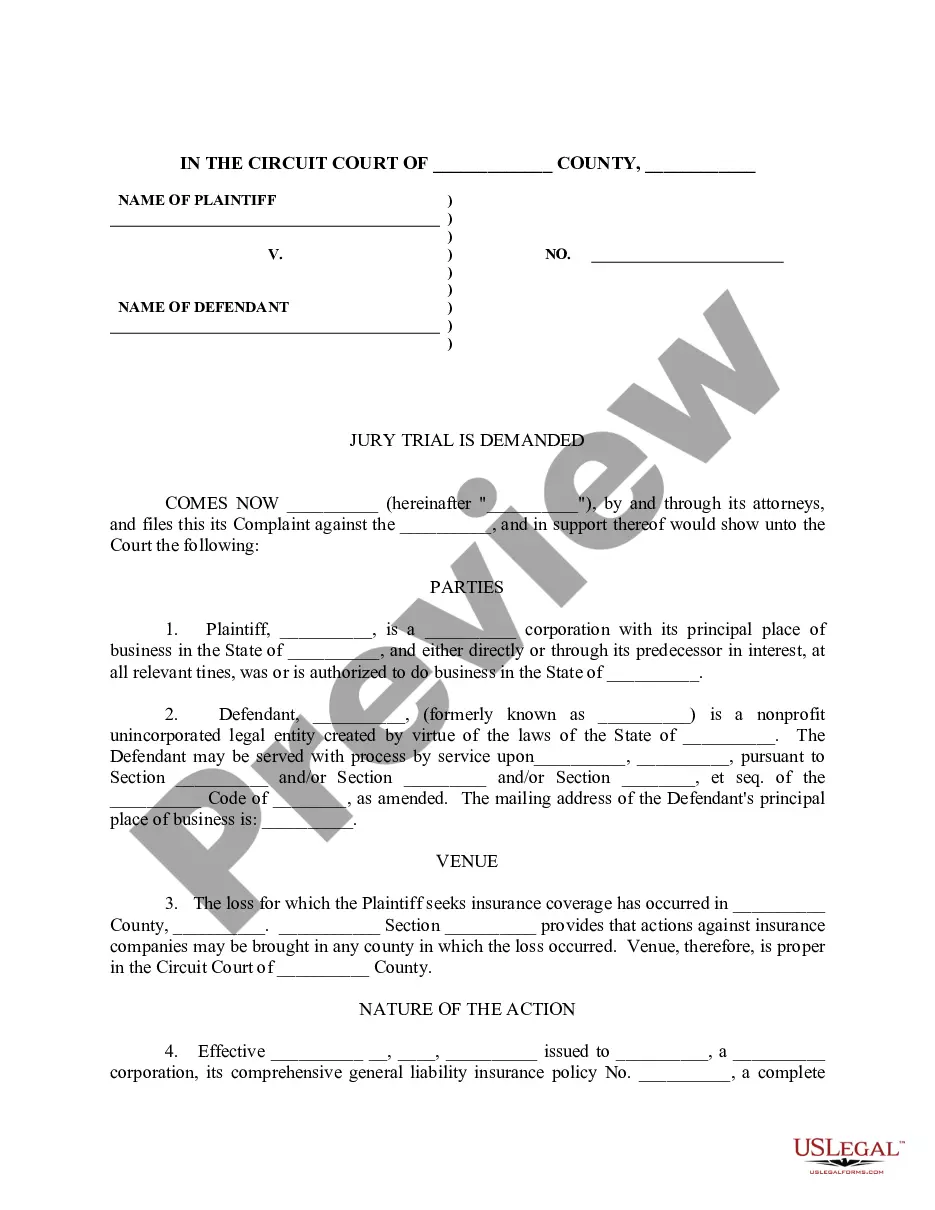

How to fill out Massachusetts Quitclaim Deed, W/O Quitclaim Covenants, From Three Individuals To A Trust?

- If you're a returning user, log in to your account and retrieve the required form template by clicking the Download button. Ensure your subscription remains valid to avoid any interruptions.

- For new users, begin by exploring the Preview mode and the form description to confirm that the selected quitclaim deed meets your specific needs and aligns with your local jurisdiction requirements.

- Should you need a different template, utilize the Search tab located above to locate the appropriate form. Once you find one that fits, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. A registration is necessary to gain access to the library's comprehensive resources.

- Complete your purchase by entering your credit card information or utilizing a PayPal account to finalize your subscription payment.

- Download the form to your device. You can also access it anytime from the My Forms section of your profile.

By using US Legal Forms, you not only gain quick access to a wide variety of legal documents but also benefit from their robust form collection—offering more choices than competitors at similar prices.

Empower yourself with the right tools for legal compliance. Start today and ensure your documents are precise and legally valid!

Form popularity

FAQ

Leaving a house to your child can be done effectively through a quitclaim deed for trust. This approach allows for simple transfer of ownership and can help mitigate potential estate taxes. Additionally, using this method can ensure that your child receives the property directly, avoiding complications often linked to wills. Consider working with a legal professional to guide you through the setup process.

When deciding whether to gift a house or place it in a trust, consider your long-term goals. A quitclaim deed for trust can provide a smoother transfer of property while maintaining control over it during your lifetime. This method can also help avoid probate, ensuring your wishes are fulfilled without unnecessary delays. Ultimately, it's wise to consult with a legal expert to choose the best option for your situation.

Many people view quitclaim deeds for trust with skepticism because they do not guarantee the property title's validity. Without a title search, there may be hidden liens or claims against the property. Furthermore, unlike warranty deeds, quitclaim deeds offer no protection against future disputes. It's crucial to understand these risks, and Uslegalforms can provide resources to help you navigate the process safely.

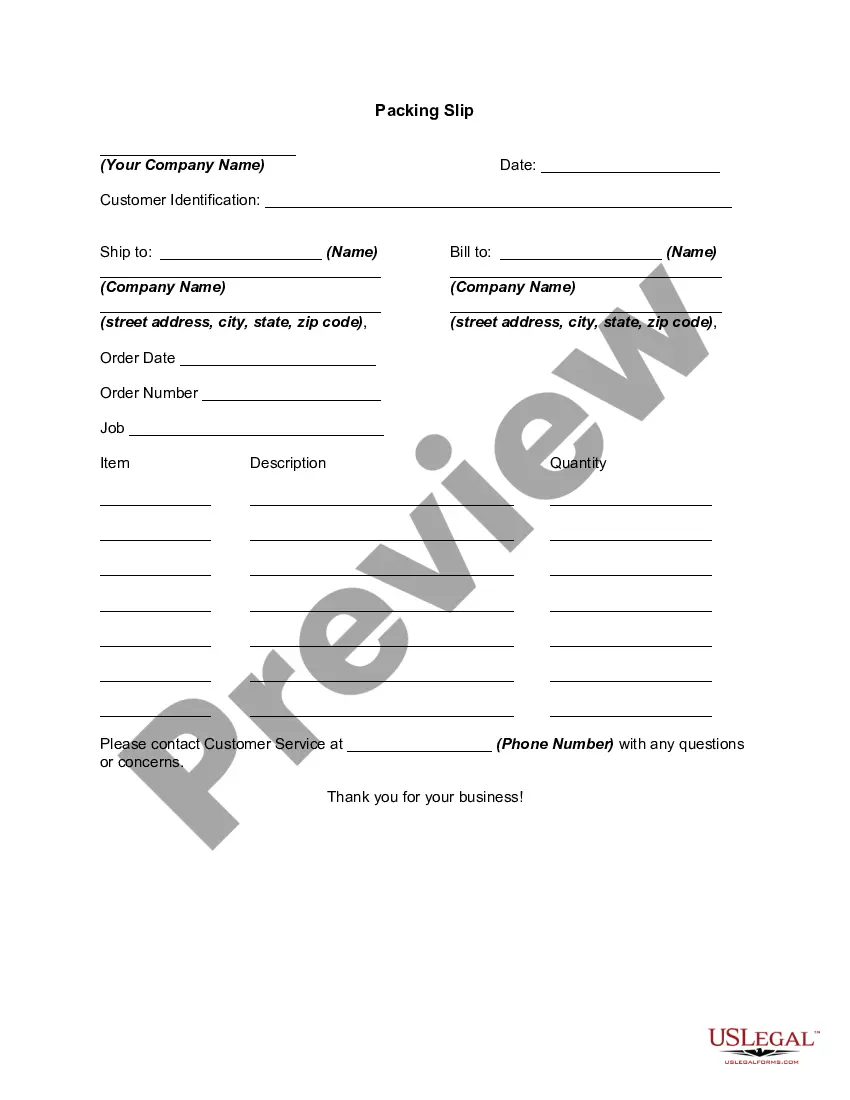

When completing a quitclaim deed form for trust, begin with the title 'Quitclaim Deed'. Fill in the grantor's name, the grantee's name, and the legal description of the property in question. Make sure to include any special clauses if necessary, and finally, notarize the document. Using Uslegalforms can offer you guidance and a properly structured form, ensuring all requirements are met.

To fill out a quitclaim deed for trust correctly, start by entering the names of the grantor and grantee. Clearly state the property description and include the county where the property is located. Ensure you sign and date the document as required, then have it notarized. Uslegalforms provides templates that simplify this process and help you avoid common pitfalls.

One major disadvantage of a quitclaim deed is that it does not guarantee a clear title, which might expose you to potential claims after the transfer. Additionally, it offers no protection for the grantee if the grantor has outstanding liens or legal issues. When dealing with a quitclaim deed for trust, it’s wise to consult professionals or utilize resources from UsLegalForms to fully understand the risks involved.

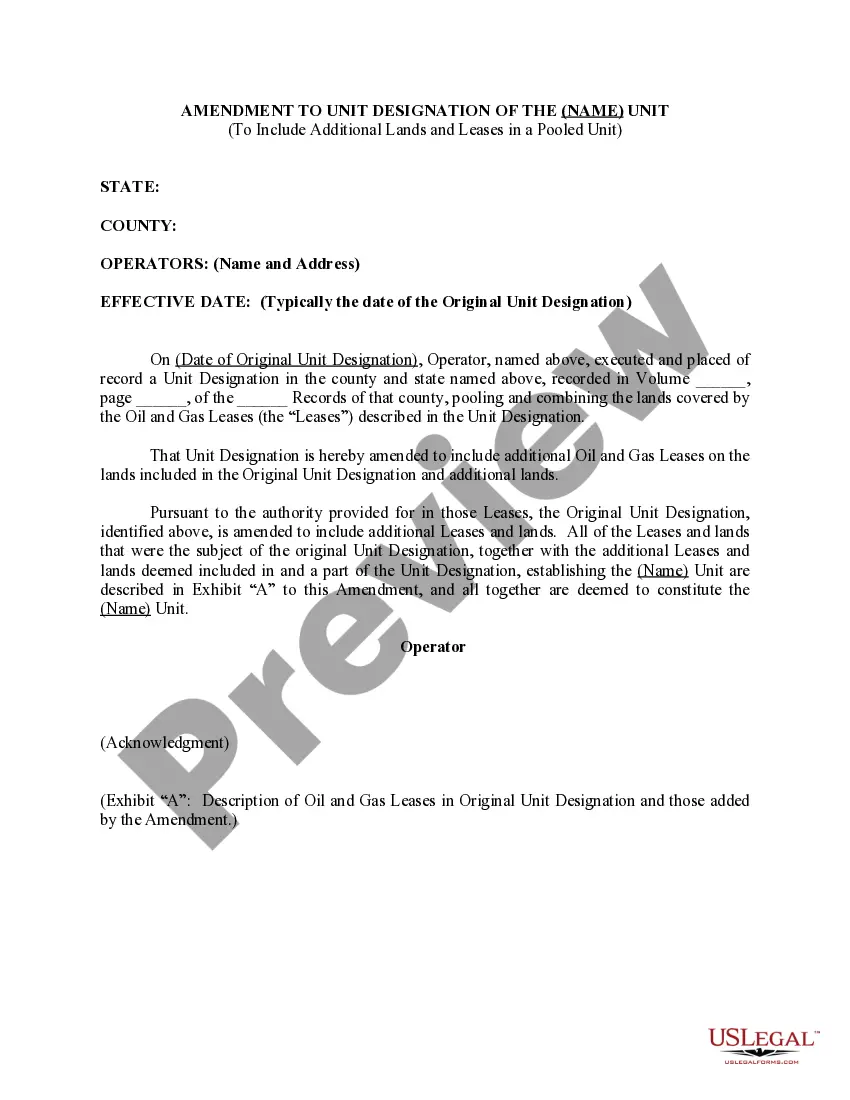

A quitclaim deed in a trust allows a trustee to transfer property rights to a trust without any warranties or guarantees. This means that the trustee conveys their interest in the property but does not ensure that the title is clear. Understanding how a quitclaim deed for trust works is essential for effective estate planning. You can use this deed to manage property assets within a trust more easily.

Determining whether a quitclaim deed for trust or a trust is better depends on your specific needs and goals. A quitclaim deed provides a quick transfer of ownership, while a trust offers long-term benefits like asset protection and estate planning. Consider your financial situation and intentions when deciding. Consulting with a legal expert or using platforms like US Legal Forms can help clarify your best options.

To quit claim deed to trust, start by preparing the necessary deed form, which identifies the grantor, grantee, and the property involved. Fill in the details accurately, and then sign the document in the presence of a notary public. Once completed, you should file the deed with your local county recorder to make the transaction official. Utilizing services like US Legal Forms can help simplify this process.

Putting your house in trust can limit your control over the property, as the trustee will manage it according to the trust’s terms. Additionally, transferring ownership might trigger tax implications, which could financially impact your situation. It's also possible that your creditors could claim interest in the trust. Therefore, understanding these disadvantages is vital before committing.