Massachusetts Deed In Lieu Of Foreclosure Form

Description

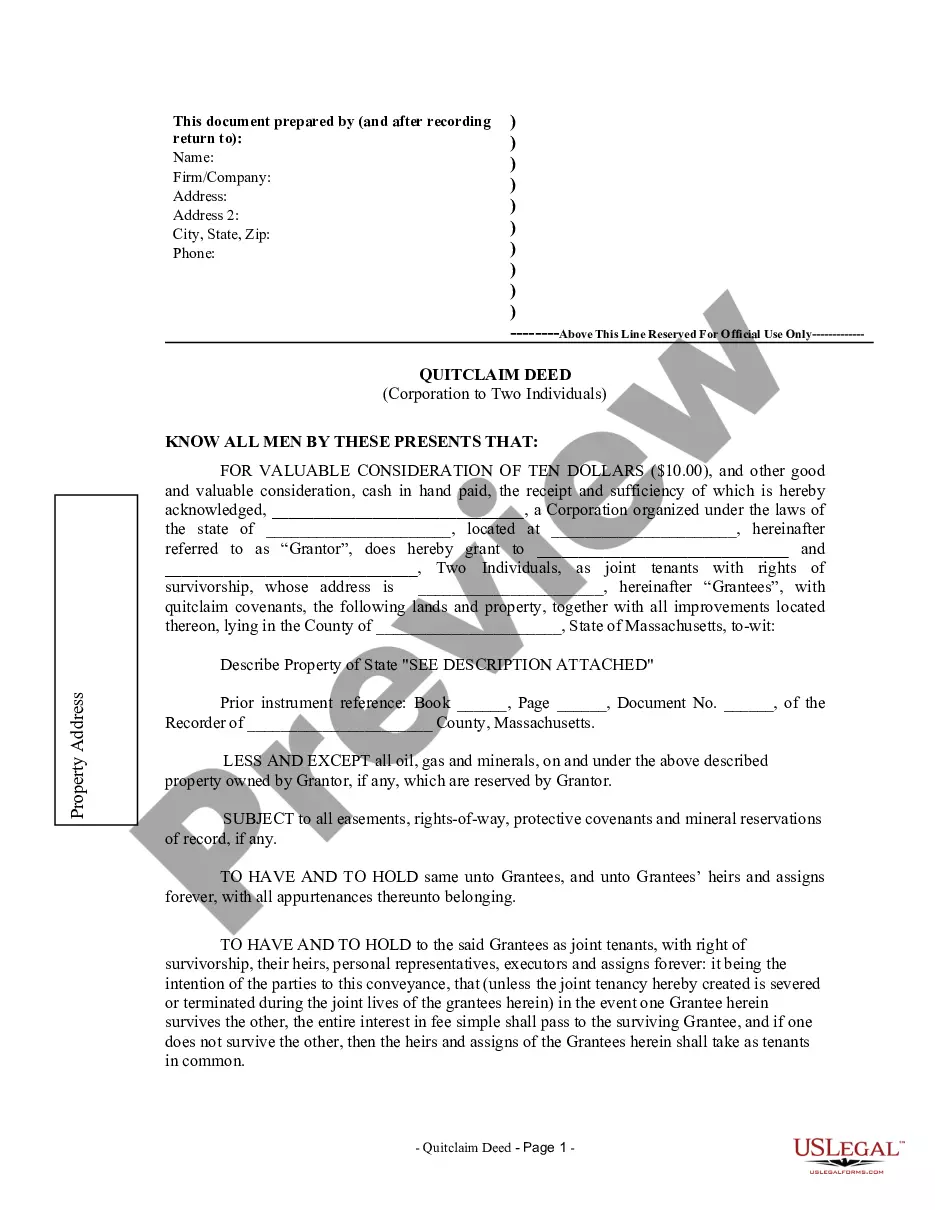

How to fill out Massachusetts Quitclaim Deed From Corporation To Two Individuals?

There's no longer any reason to squander time searching for legal paperwork to comply with your local state laws.

US Legal Forms has gathered all of them in a single location and made them easier to access.

Our platform provides over 85,000 templates for various business and personal legal situations organized by state and application area.

Utilize the search bar above to find another template if the previous one did not satisfy your needs.

- All documents are professionally composed and validated for authenticity, ensuring you can confidently obtain an up-to-date Massachusetts Deed In Lieu Of Foreclosure Form.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, choose the document, and click Download.

- You can revisit all downloaded documents whenever needed by accessing the My documents tab in your profile.

- If this is your first time using our service, the procedure will require a few additional steps to finish.

- Here’s how new users can find the Massachusetts Deed In Lieu Of Foreclosure Form in our library.

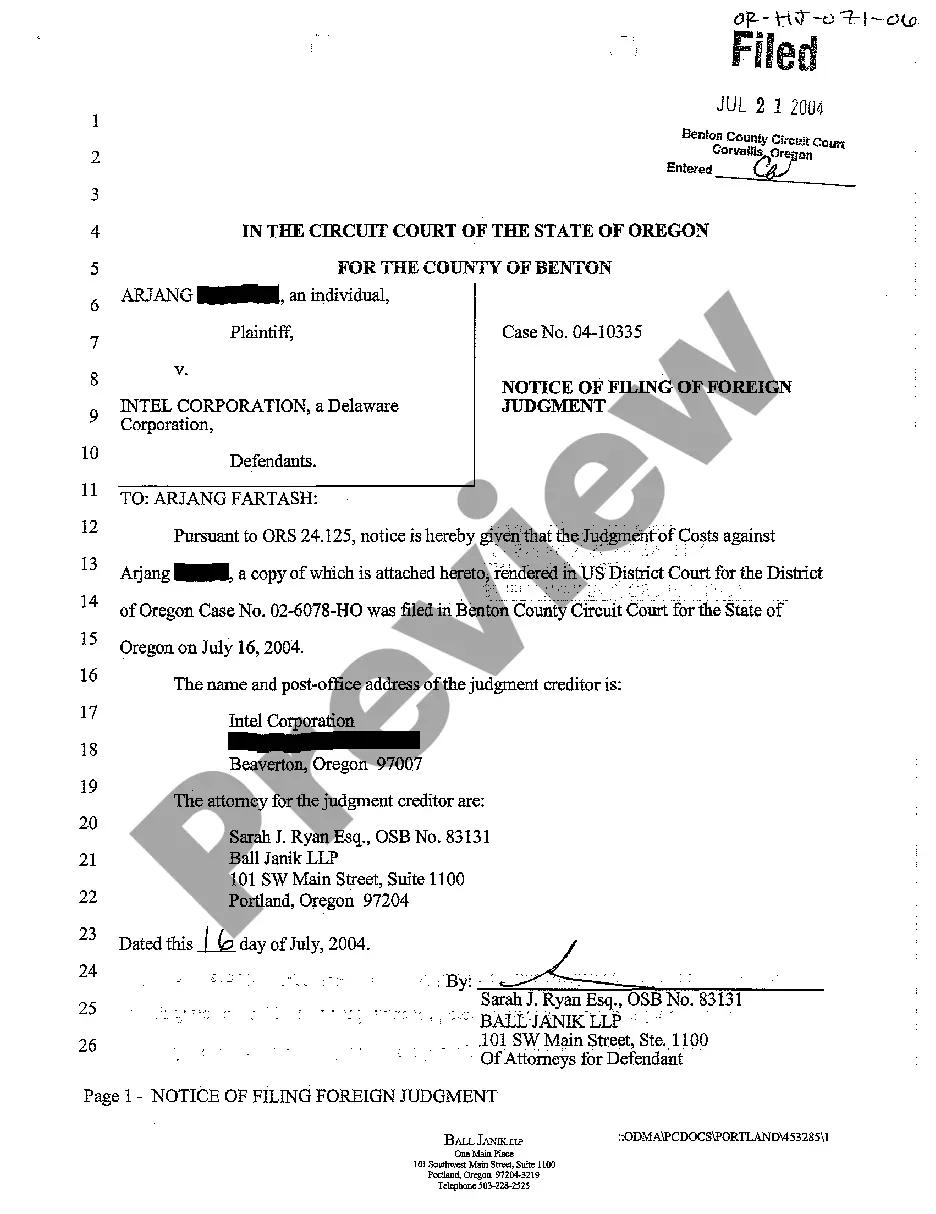

- Review the page content closely to ensure it contains the sample you need.

- To assist with this, use the form description and preview options if available.

Form popularity

FAQ

You can find a blank deed in lieu of foreclosure form through various online legal resources. Websites like US Legal Forms offer a user-friendly platform where you can download this form conveniently. Ensure the form is tailored for Massachusetts to meet state-specific regulations. Having the correct Massachusetts deed in lieu of foreclosure form is crucial for a smooth transaction.

To obtain a copy of a deed in Massachusetts, you should start by visiting your local registry of deeds. Each county has its own registry office where they maintain property records, including deeds. You can also access these records online in many cases. If you need a Massachusetts deed in lieu of foreclosure form specifically, platforms like US Legal Forms provide easy access to the necessary documents.

A foreclosure deed in Massachusetts is a legal document that transfers ownership of a property from the borrower to the lender after the foreclosure process has been completed. This deed signifies the lender's ownership and allows them to sell the property to recover owed funds. Understanding this process is vital, especially if you are exploring options like the Massachusetts deed in lieu of foreclosure form, which may provide a more amicable solution.

In Massachusetts, the foreclosure process typically takes about six months to a year, depending on legal circumstances and the lender's actions. The timeline may vary, especially if homeowners choose to contest the foreclosure. Keeping this timeline in mind can help homeowners make informed decisions, such as considering a Massachusetts deed in lieu of foreclosure form as a potential alternative.

One significant disadvantage for lenders that accept a Massachusetts deed in lieu of foreclosure form is the potential for losing recovery options. They may not recover the full amount owed if the home value has significantly depreciated. Additionally, lenders might face legal challenges if borrowers claim the transaction was not fully voluntary. Thus, careful consideration is essential before proceeding.

The most significant disadvantage for a lender in accepting a deed in lieu of foreclosure is the uncertainty regarding the property's condition and market value. Lenders may face losses if they have to quickly sell the property in a declining market. Thus, using a Massachusetts deed in lieu of foreclosure form can help clarify expectations and streamline the acceptance process for both parties.

A primary disadvantage of a deed in lieu of foreclosure includes potential long-term impacts on your credit. Moreover, some lenders may impose rigid guidelines, complicating the acceptance of the deed. Understanding these implications is vital, hence the importance of a comprehensive tool like the Massachusetts deed in lieu of foreclosure form to ease the transaction.

A deed in lieu of foreclosure in Massachusetts is an arrangement where a borrower voluntarily hands over their property to the lender to avoid foreclosure. This process allows the borrower to resolve their mortgage default without the lengthy and costly foreclosure procedure. Utilizing a Massachusetts deed in lieu of foreclosure form can facilitate this transaction and help you close this chapter of financial distress.

One disadvantage of a deed in lieu of foreclosure is that it may negatively impact your credit score, similar to traditional foreclosure. Additionally, it does not relieve you from potential tax liabilities, and some lenders may still pursue deficiencies after accepting the deed. It's important to weigh these factors when considering a Massachusetts deed in lieu of foreclosure form as a solution.

In Massachusetts, a lender must provide a notice to the borrower at least 90 days before initiating foreclosure proceedings. This notice must inform the borrower of their default and include information on potential loss mitigation options. Understanding this notice is crucial, as it gives homeowners a chance to explore alternatives, such as using a Massachusetts deed in lieu of foreclosure form.