Ma Corporate Records For Sale

Description

How to fill out Massachusetts Corporate Records Maintenance Package For Existing Corporations?

Whether for commercial purposes or personal concerns, everyone must confront legal situations at some point in their existence.

Completing legal documentation requires meticulous attention, starting from selecting the appropriate form template.

With an extensive US Legal Forms catalog available, you no longer have to waste time searching for the right template across the internet. Take advantage of the library’s straightforward navigation to find the suitable form for any situation.

- For instance, if you choose an incorrect version of the Ma Corporate Records For Sale, it will be rejected upon submission.

- Thus, it is crucial to have a trustworthy source of legal documents like US Legal Forms.

- If you need to acquire a Ma Corporate Records For Sale template, adhere to these straightforward steps.

- Locate the template you require using the search feature or catalog navigation.

- Review the form’s description to ensure it is suitable for your situation, state, and locale.

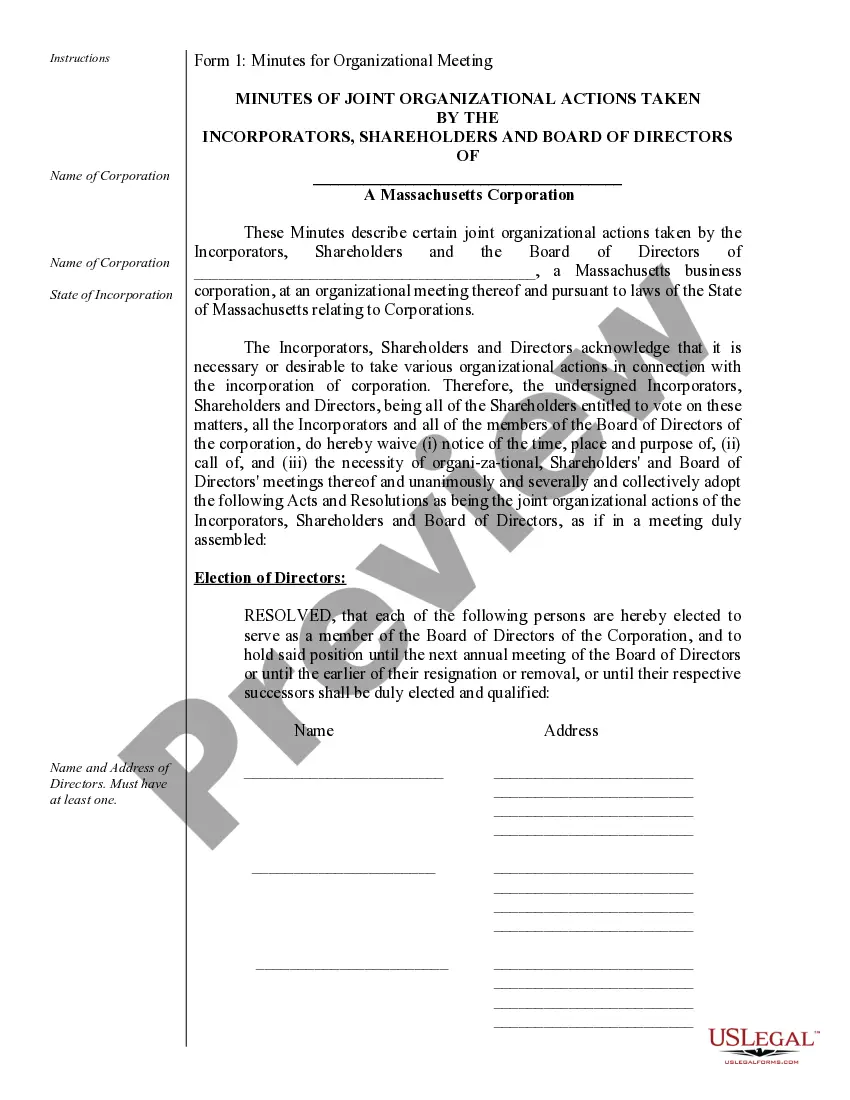

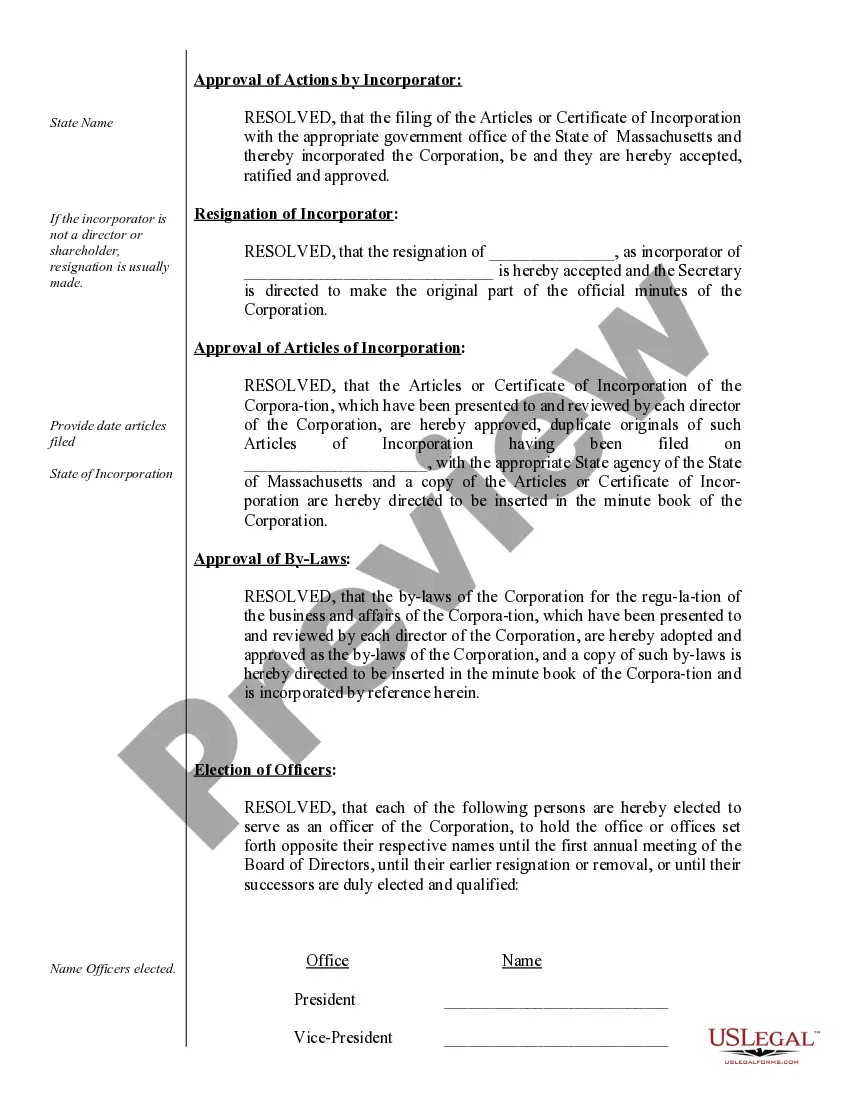

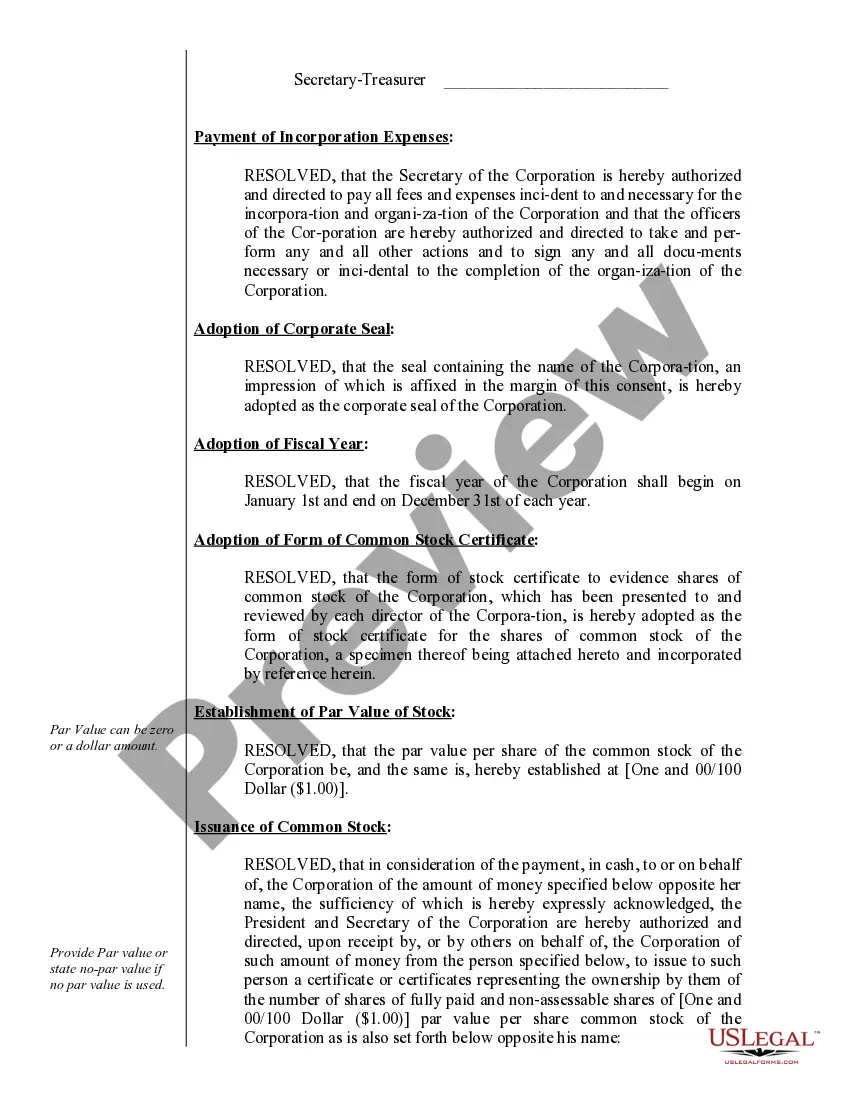

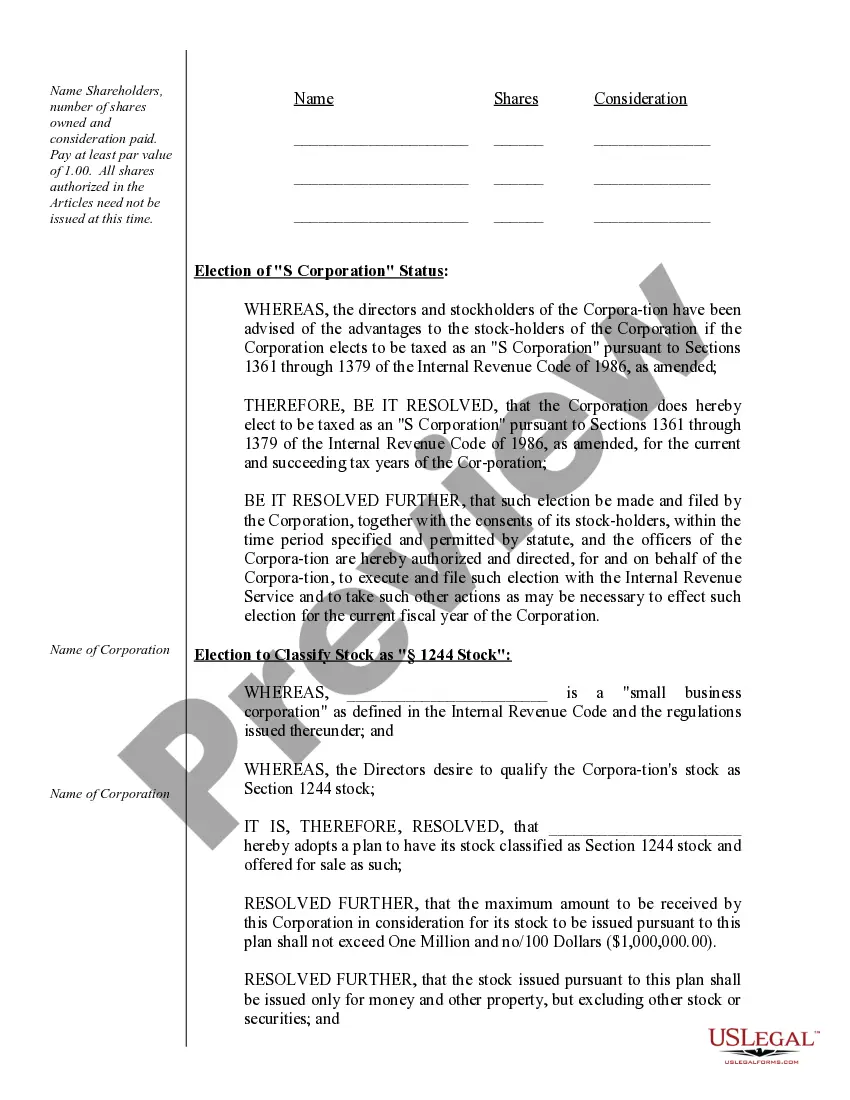

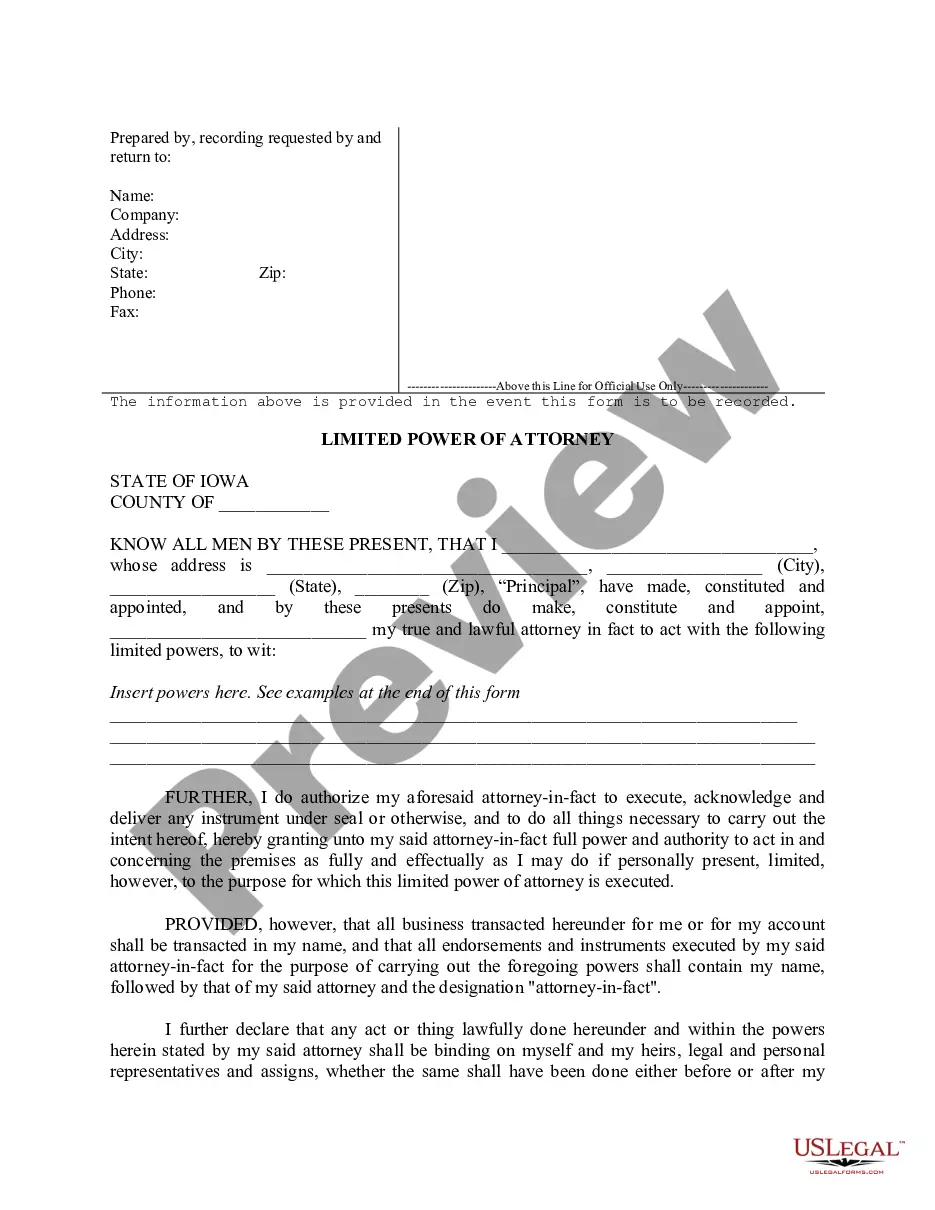

- Click on the form’s preview to examine it.

- If it is not the appropriate form, return to the search feature to locate the Ma Corporate Records For Sale sample you need.

- Obtain the file when it satisfies your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Choose the correct pricing option.

- Fill out the profile registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the document format you desire and download the Ma Corporate Records For Sale.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

Involuntary dissolution happens when a corporation is forced to close by the state, often due to failure to comply with state laws or regulations. This action can be initiated if the corporation does not file required documents, like annual reports. It's crucial to understand your obligations to avoid finding yourself in this situation. For those seeking detailed information, consider checking the MA corporate records for sale as they might provide additional insight.

You can get IRS forms and instructions quickly and easily by visiting the IRS.gov website 24 hours a day 7 days a week. They often appear online before they are available on paper. To view and download tax products, select ?Forms and Pubs.?

Get a federal tax return transcript You can get transcripts of the last 10 tax years. Transcripts are free. Online orders can be downloaded immediately. Phone and mail orders take 5-10 days.

You'll be able to access your most recent 3 tax returns (each of which include your Form 1040?the main tax form?and any supporting forms used that year) when sign into 1040.com and go to the My Account screen. If you filed through a tax preparer or CPA, they can provide a printed or electronic copy of your tax return.

Yes, you can print the tax forms you download for free from the IRS website.

Use Form 140X to correct an individual income tax return (Form 140, 140A, 140EZ, 140PY, or 140NR) filed within the past four years. The department will compute the interest and either include it in your refund or bill you for the amount due. NOTE: Do not use Form 140X to change an earlier filed Form 140PTC.

Here are the three ways to get transcripts: Online. People can use Get Transcript Online to view, print or download a copy of all transcript types. ... By phone. Taxpayers can call 800-908-9946 to request a transcript by phone. ... By mail.

State electronic filing details You must file a federal return with, or prior to filing, the AZ return. Arizona does not accept amended returns for any tax year.

Get the current filing year's forms, instructions, and publications for free from the IRS. Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)