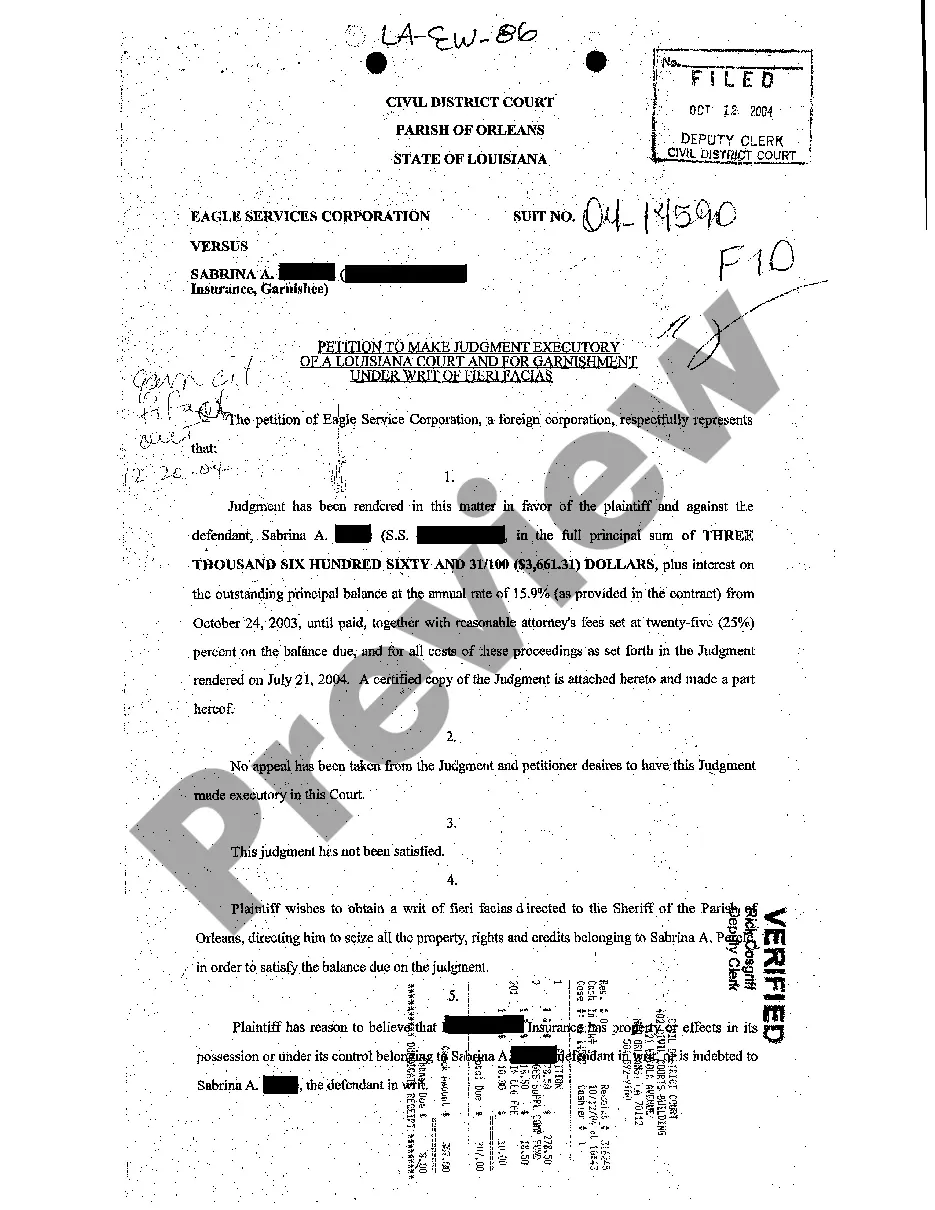

Executory Judgement For Credit Card Debt

Description

How to fill out Executory Judgement For Credit Card Debt?

Navigating through the red tape of official documents and forms can be challenging, particularly for those who do not engage in such tasks professionally.

Even locating the appropriate form to obtain an Executory Judgement For Credit Card Debt may consume considerable time, since it must be accurate and valid down to the last detail.

However, you will significantly reduce the time spent finding a suitable template from a reliable source.

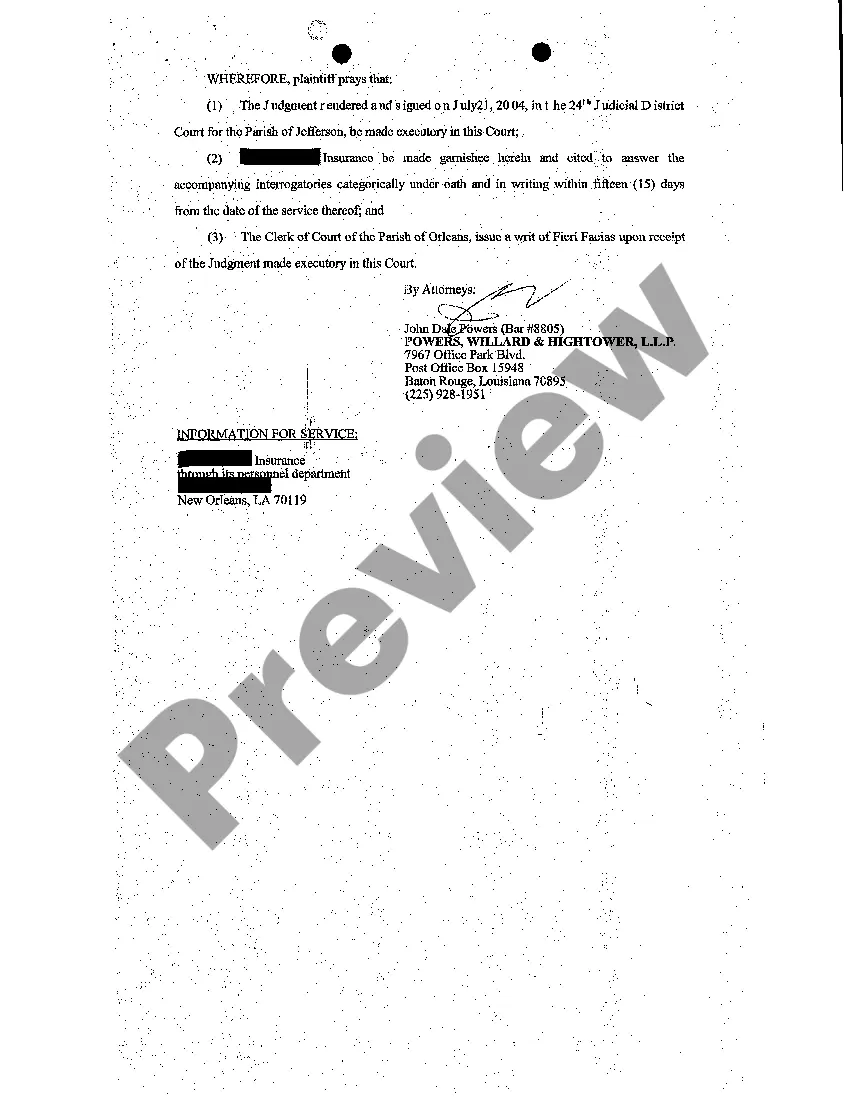

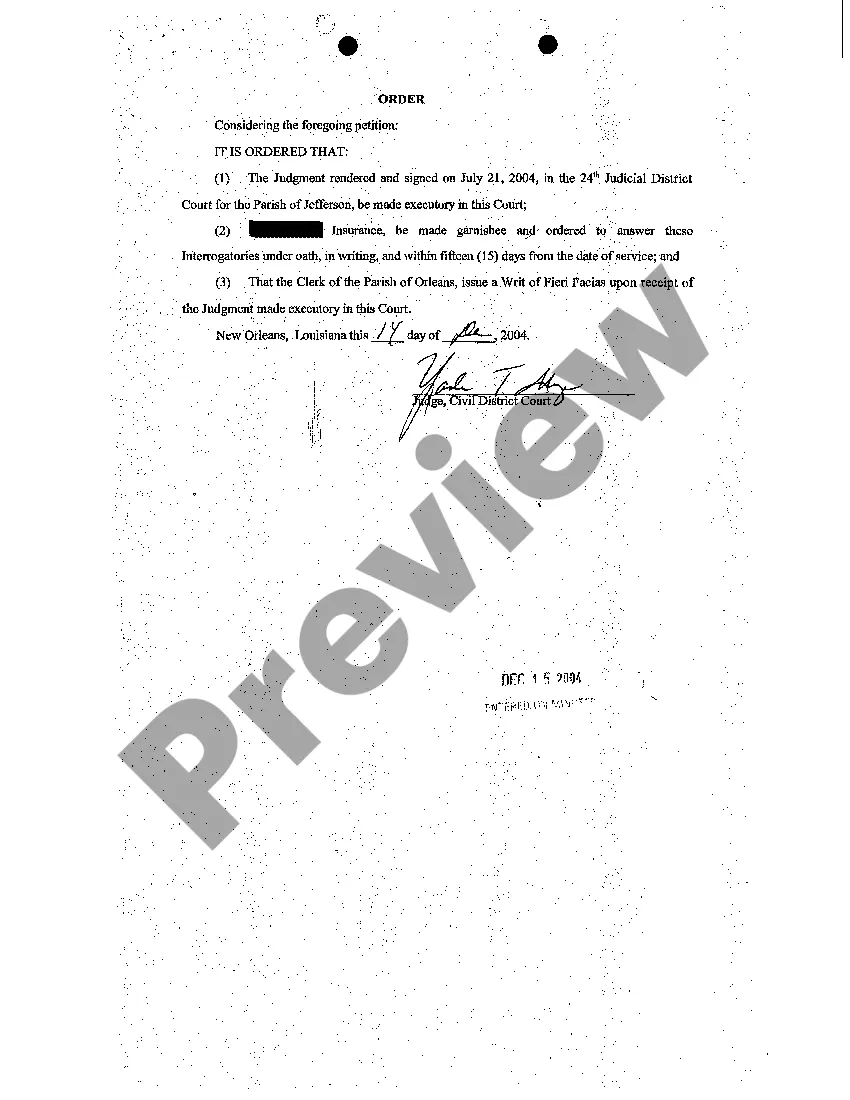

Obtain the proper form in a few simple steps: Enter the document name in the search box, locate the appropriate Executory Judgement For Credit Card Debt among the options provided, review the sample description or view its preview, if the template fulfills your needs, click Buy Now, select your subscription plan, use your email to set a secure password to create an account on US Legal Forms, choose a payment option via credit card or PayPal, and download the template document in your desired format. US Legal Forms can alleviate the time and effort spent verifying whether the form you encounter online meets your specifications. Establish an account and gain unlimited access to all the templates you need.

- US Legal Forms is a service that streamlines the procedure for searching the correct forms online.

- It serves as a one-stop destination for obtaining the latest document samples, verifying their purpose, and downloading these files for completion.

- This collection encompasses over 85K forms applicable across various professional fields.

- When seeking an Executory Judgement For Credit Card Debt, you can trust its relevance as all forms have been authenticated.

- Having an account with US Legal Forms guarantees that all essential samples are accessible.

- You can store them in your history or add them to the My documents section.

- Your saved forms can be retrieved from any device by clicking Log In at the library site.

- If you haven't created an account yet, you can still search for the required template.

Form popularity

FAQ

To halt a judgement for credit card debt, you must act quickly. You can file an appeal if you believe the judgement is unjust or request a settlement with the creditor. Consider utilizing legal resources such as USLegalForms to find helpful documents tailored to this process. Taking these steps can help you reclaim financial control and avoid further penalties.

When a credit card company obtains a judgement against you, it can lead to wage garnishment or bank account levies. This situation happens if you do not respond or settle the original debt. An executory judgement for credit card debt means the creditor can pursue collection methods legally. It's important to understand your options and potentially seek legal advice to navigate this issue.

Receiving a credit card court summons is serious, but you have options. First, read all documents carefully and understand your rights. You can either respond to the summons in court or negotiate with the creditor. Resources like USLegalForms offer templates that can assist you in drafting your response to an executory judgement for credit card debt.

When you face a credit card judgement, it’s crucial to act promptly. You may file an answer with the court to contest the judgement or negotiate a settlement with the creditor. Additionally, consider contacting a legal expert who can guide you through the process of dealing with an executory judgement for credit card debt. Effective action can help mitigate the financial consequences.

After seven years of not paying credit cards, the debt may drop off your credit report, but this does not erase the obligation. Creditors can still attempt to collect the debt, and if they do, they may seek an executory judgement for credit card debt if they decide to pursue legal action. This can lead to garnishments or other collection tactics, so it is essential to remain proactive. Consulting with professionals can provide you with options tailored to your circumstances.

In general, a debt may be considered 'time-barred' after a period of three to six years, depending on the state laws governing the debt. This means creditors may not be able to sue you for repayment after this time, but the debt itself does not disappear automatically. An executory judgement can change this situation, as it keeps the debt valid until fully satisfied. Staying informed about your rights is crucial to navigating this aspect of debt.

Yes, unpaid credit card debt can be converted into a judgement against you. Creditors can file a lawsuit for the unpaid balance, and if they prevail, they may obtain an executory judgement for credit card debt. This judgement may lead to wage garnishments or bank levies if not addressed. Knowing the implications of a judgement can empower you to take action before legal proceedings occur.

To clear your credit card debt legally, consider options such as negotiating settlements with creditors or enrolling in a debt management program. It is essential to keep in mind your rights under the Fair Debt Collection Practices Act when dealing with creditors. Using platforms like US Legal Forms can guide you through the necessary legal processes to navigate executory judgment for credit card debt effectively.

Credit card companies typically settle for a percentage of your outstanding balance, often ranging from 40% to 60%. However, this can vary based on your payment history, the age of the debt, and your financial situation. It is crucial to approach conversations with creditors armed with knowledge about executory judgment for credit card debt to secure the best possible settlement.

A solid strategy to eliminate credit card debt involves assessing your total debt and creating a repayment plan that suits your financial situation. Consider using the snowball or avalanche method to systematically tackle your debts. Additionally, understanding the implications of executory judgment for credit card debt can help you make informed decisions about settlements and payment plans.