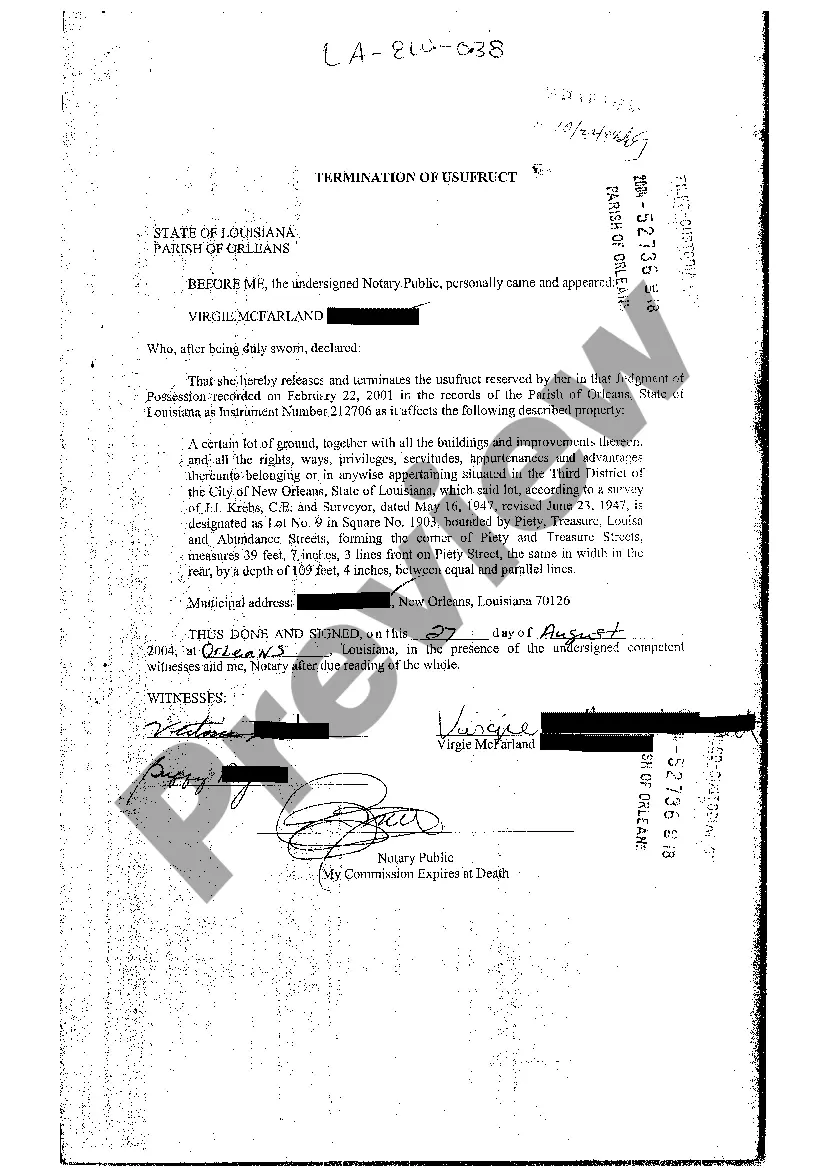

Termination Of Usufruct Formula

Description

How to fill out Louisiana Termination Of Usufruct Over Real Estate?

It's clear that you can't become a legal specialist instantly, nor can you easily create a Termination Of Usufruct Formula without a focused education. Drafting legal documents is a lengthy process that demands specific knowledge and abilities. So why not entrust the creation of the Termination Of Usufruct Formula to the experts.

With US Legal Forms, one of the most extensive collections of legal documents, you can find everything from judicial paperwork to templates for internal business communications. We recognize the importance of maintaining compliance with federal and local regulations. Therefore, on our site, all forms are tailored to location and current.

Let’s get started with our service and obtain the form you need within moments.

You can revisit your forms from the My documents section at any time. If you are a current client, you can easily Log In, and locate and download the template from the same section.

No matter the reason for your forms—be it financial, legal, or personal—our platform has you supported. Give US Legal Forms a try now!

- Find the document you’re looking for by utilizing the search feature at the top of the page.

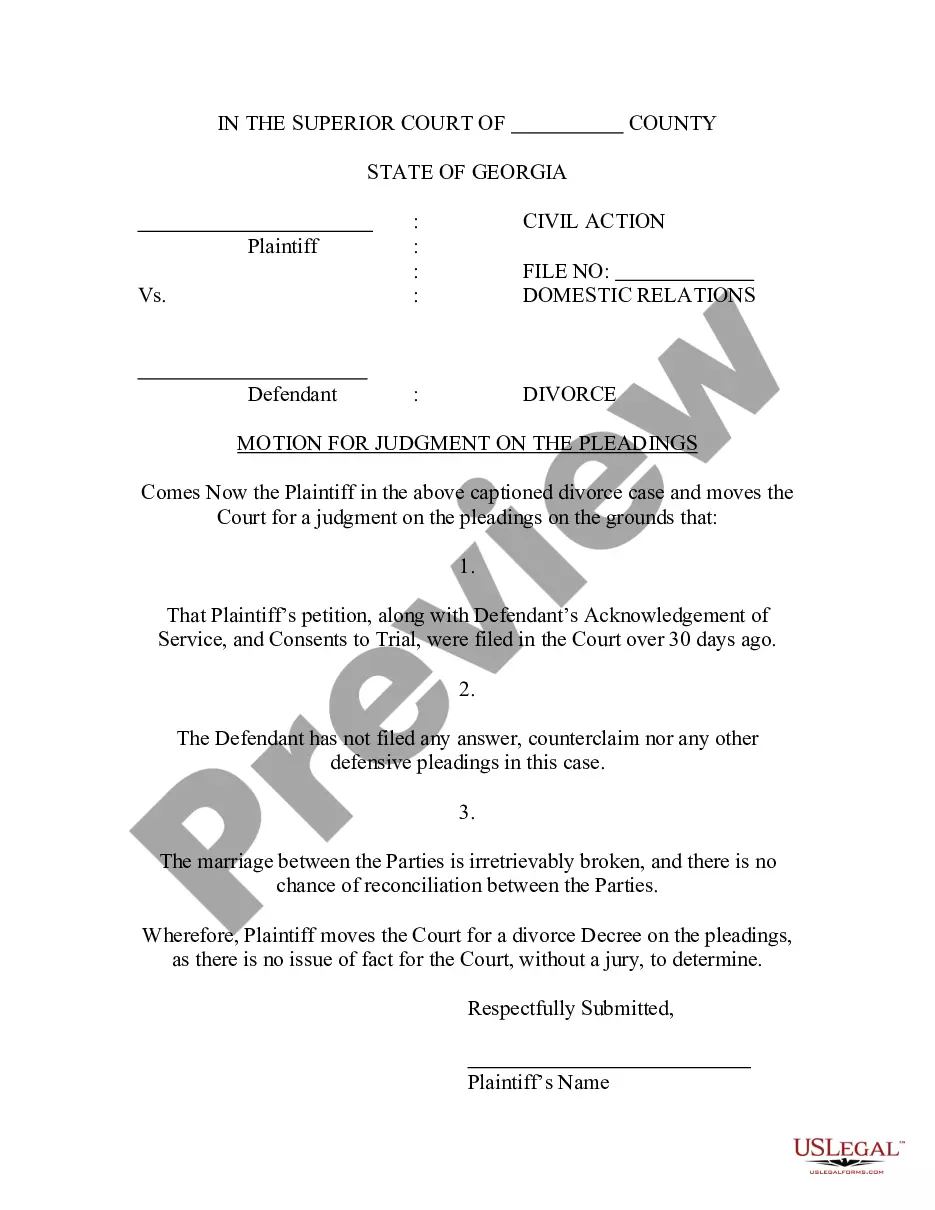

- Preview it (if this option is available) and read the accompanying description to determine if Termination Of Usufruct Formula is what you need.

- Restart your search if you require a different template.

- Sign up for a complimentary account and choose a subscription plan to acquire the form.

- Select Buy now. Once the payment is completed, you can receive the Termination Of Usufruct Formula, complete it, print it, and deliver or mail it to the relevant parties or organizations.

Form popularity

FAQ

When property subject to usufruct is sold or exchanged, whether in an action for partition or by agreement between the usufructuary and the naked owner or by a usufructuary who has the power to dispose of nonconsumable property, the usufruct terminates as to the nonconsumable property sold or exchanged, but as provided ...

There are seven ways to terminate a usufruct: Contractual conditions. Death of usufructuary (most common) Loss of property (one of the most complicated methods) Abuse by usufructuary. Prescription of non-use. Confusion. Renunciation.

The duration can be either definite or indefinite. However, if nothing is contractually provided, the following rules apply: Maximum 99 years unless the usufructuary - in the case of a natural person - lives longer; The usufruct does not continue after the death of a person enjoying the right of usufruct.

The usufruct shall be for life unless expressly designated for a shorter period, and shall not require security except as expressly declared by the decedent or as permitted when the legitime is affected.

Usufruct right for real estate The conditional usufruct is chosen when the ownership of a property changes and the previous owner simultaneously receives the usufruct on a conditional basis. Once the transfer of the property is complete, the conditional usufruct becomes a fixed right of use.