Divorce Lawyers Document For Low Income

Description

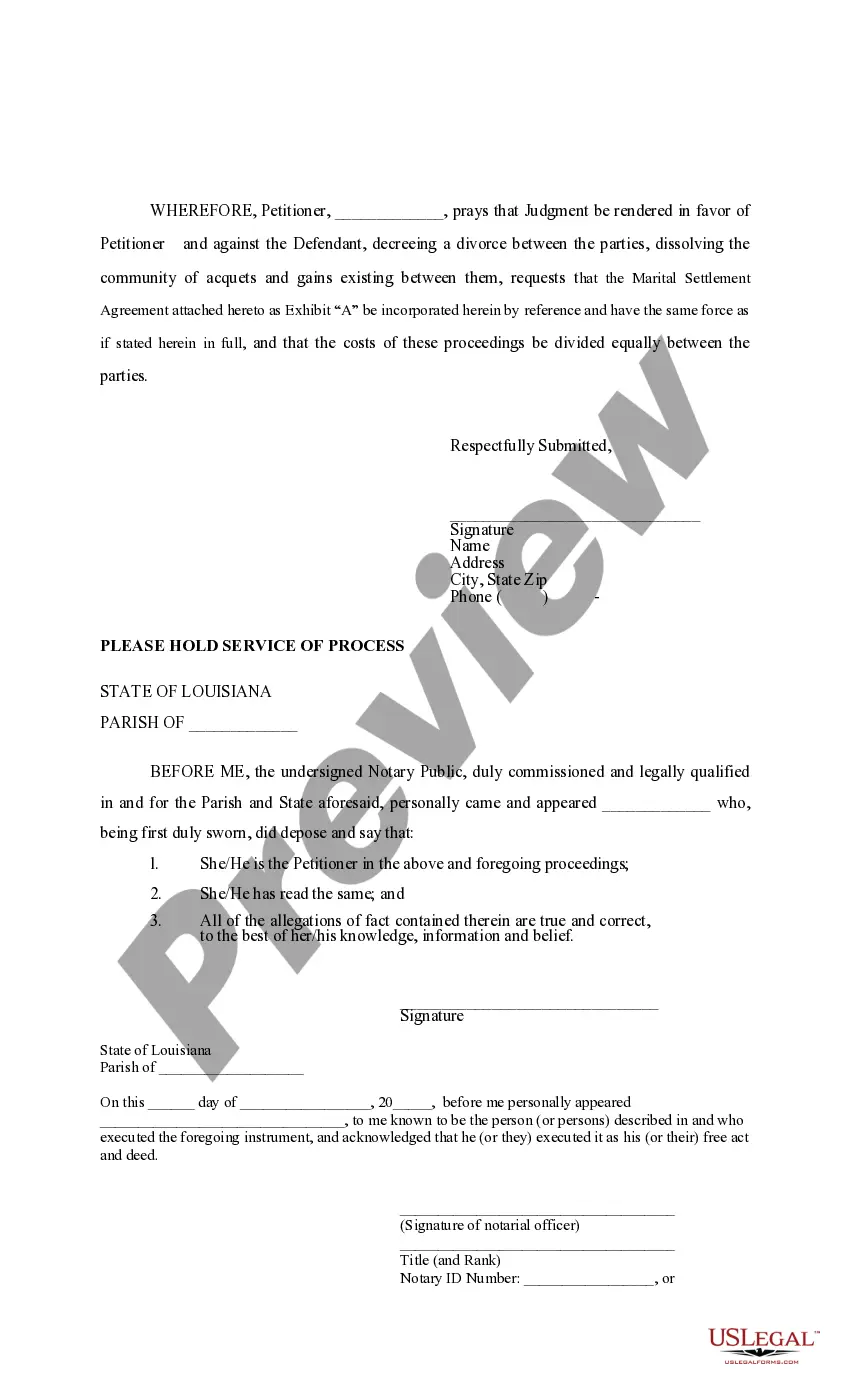

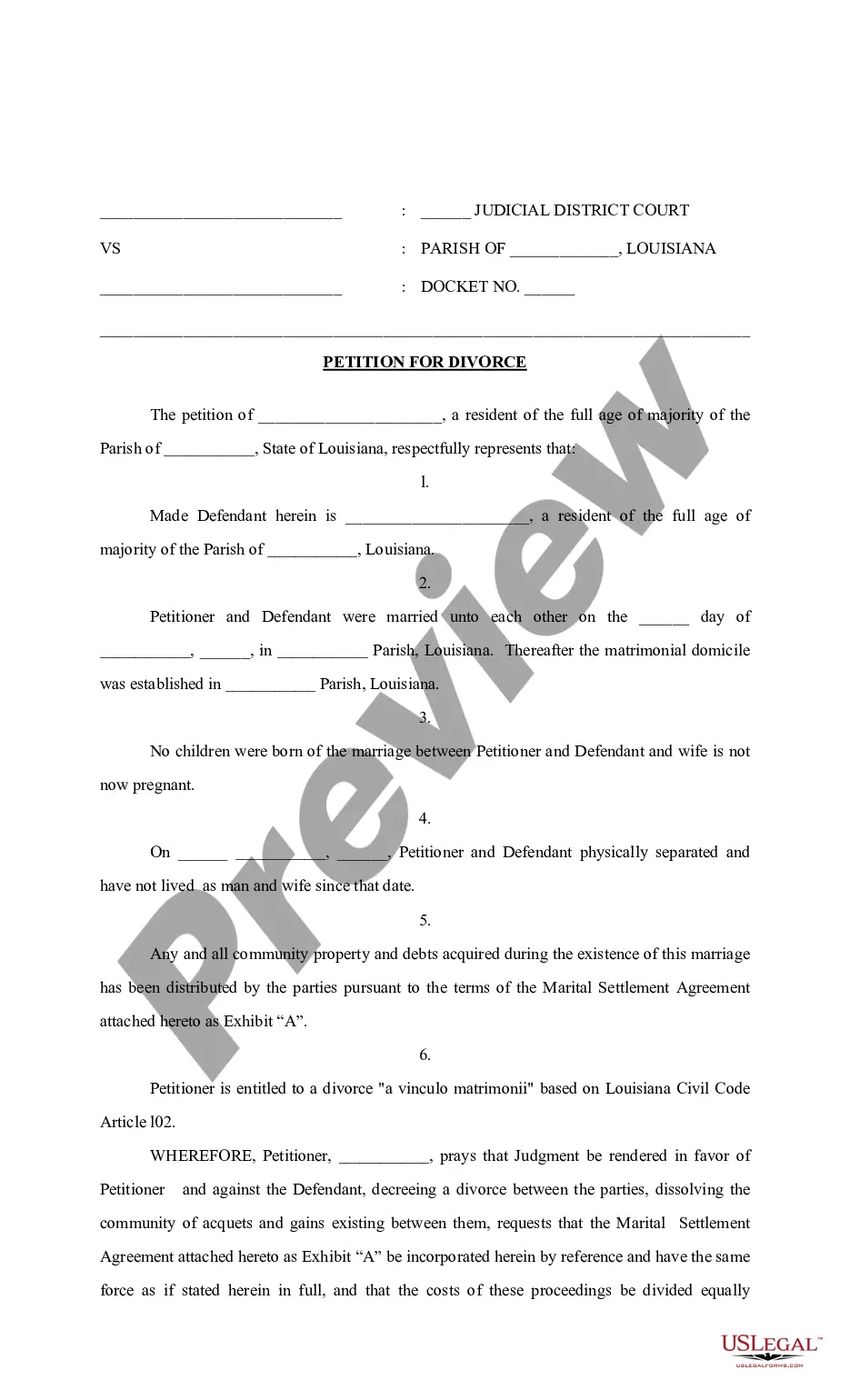

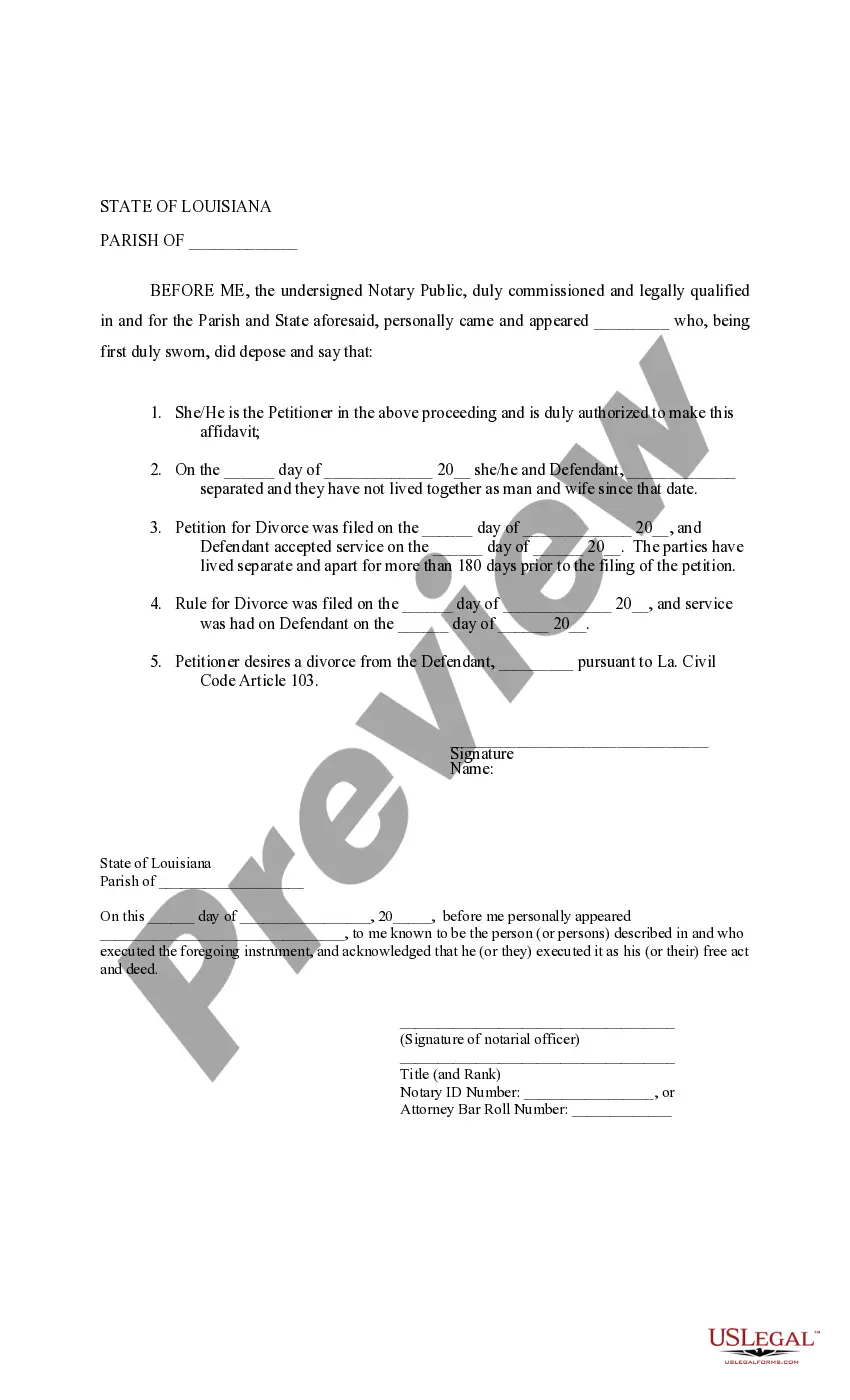

How to fill out Louisiana Petition For Divorce - La. CC Art. 103 - No Children?

Acquiring legal document samples that adhere to federal and state laws is essential, and the web provides numerous selections to consider.

However, what is the benefit of spending time searching for the appropriate Divorce Lawyers Document For Low Income example online if the US Legal Forms digital library already has such templates gathered in one location.

US Legal Forms stands as the premier online legal library with over 85,000 fillable templates crafted by attorneys for every professional and personal situation. They are straightforward to navigate with all documents categorized by state and intended use.

All templates available through US Legal Forms are reusable. To re-download and fill out forms previously acquired, visit the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal documentation service!

- Our specialists keep abreast of legislative changes, ensuring that your form is current and compliant when acquiring a Divorce Lawyers Document For Low Income from our site.

- Obtaining a Divorce Lawyers Document For Low Income is swift and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In to download the document sample you need in the appropriate format.

- If you are a newcomer to our site, adhere to the steps outlined below.

- Review the template using the Preview feature or through the text description to confirm it meets your requirements.

Form popularity

FAQ

Secured promissory notes By assuring that the property attached to the note is of sufficient value to cover the amount of the loan, the payee thus has a guarantee of being repaid. The property that secures a note is called collateral, which can be either real estate or personal property.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

Circumstances for release of a promissory note The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

Promissory notes are legally binding contracts that can hold up in court if the terms of borrowing and repayment are signed and follow applicable laws.

Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.

Even legitimate promissory notes involve risks: competition, bad management or severe market conditions can impact the issuer's ability to carry out its promise to pay interest and principal to note buyers.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.