Does A Usufruct Have To Be Registered

Description

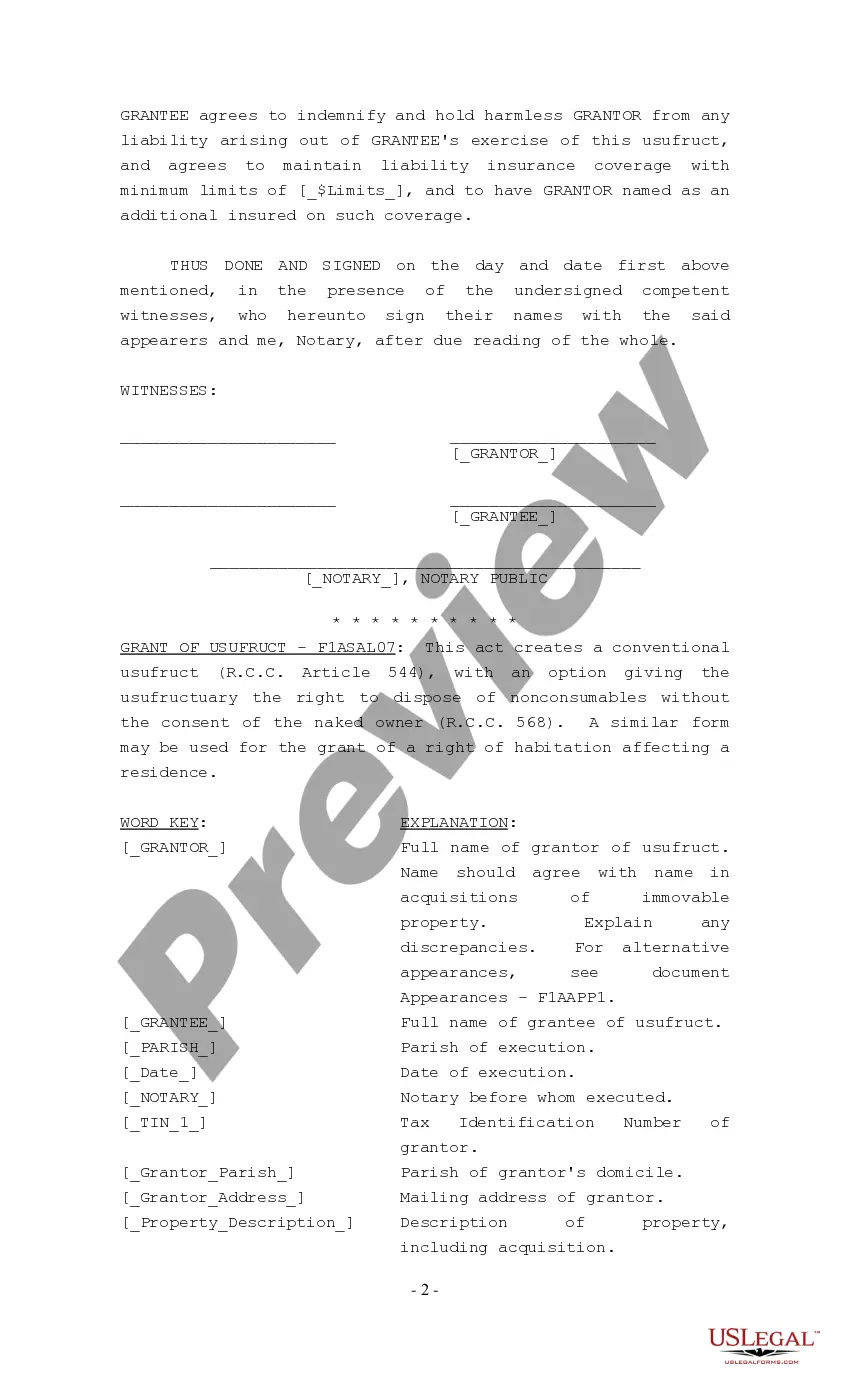

How to fill out Louisiana Grant Of Usufruct?

- Log in to your existing account on US Legal Forms to download the necessary form by clicking the 'Download' button. Verify that your subscription is active; if not, renew it based on your payment plan.

- For first-time users, start by checking the Preview mode and form description. Confirm that you've selected the correct document that meets your requirements.

- If the selected form doesn’t fit your needs, use the Search tab to find a more suitable template.

- Purchase the document by clicking the 'Buy Now' button and choosing your desired subscription plan, which will require account registration for library access.

- Complete your purchase by entering your credit card information or using PayPal for transaction convenience.

- Download the form and save it to your device. You can also access it later through the 'My Forms' section of your profile.

In conclusion, US Legal Forms offers an extensive library of over 85,000 legal documents, making it easy for users to find the right forms. With premium expert assistance available, you can ensure that your documents are accurately completed and legally sound.

Begin your legal paperwork journey today with US Legal Forms!

Form popularity

FAQ

Yes, a usufruct can be revoked under certain conditions, typically outlined in the agreement or by law. Factors such as the misuse of property or violation of terms can lead to revocation. If you're facing issues or have questions like, does a usufruct have to be registered? Consulting a reliable platform like US Legal Forms can help clarify your rights and guide you through the necessary steps.

The maximum period for usufruct varies based on local laws and agreements. Generally, a usufruct can last for a specified number of years, often up to 30 years, or until the usufructuary's death. If you are considering creating a usufruct, you may be wondering does a usufruct have to be registered? Registering can help in establishing the duration and conditions clearly.

The owner of the usufruct is called the usufructuary, who temporarily enjoys the rights to use the property and receive its benefits. The underlying property owner, known as the bare owner, retains ownership while the usufruct is active. It's vital to understand the distinction because many people ask, does a usufruct have to be registered? Proper registration can help define these roles clearly.

Usufruct refers to a legal right allowing an individual to use and benefit from another person's property. In the United States, this concept usually pertains to real estate, where the usufructuary can enjoy the property's benefits while maintaining its preservation. You might wonder, does a usufruct have to be registered? Registration can help secure the rights associated with the usufruct, providing clarity and reducing disputes.

A usufruct right allows someone to use and enjoy property that belongs to someone else. For instance, if you have a usufruct on a piece of land, you can build a house, harvest crops, or generate income from the property. However, it is important to consider, does a usufruct have to be registered? In most cases, registering the usufruct can provide legal protection and clarity for both parties involved, ensuring that rights are recognized and upheld.

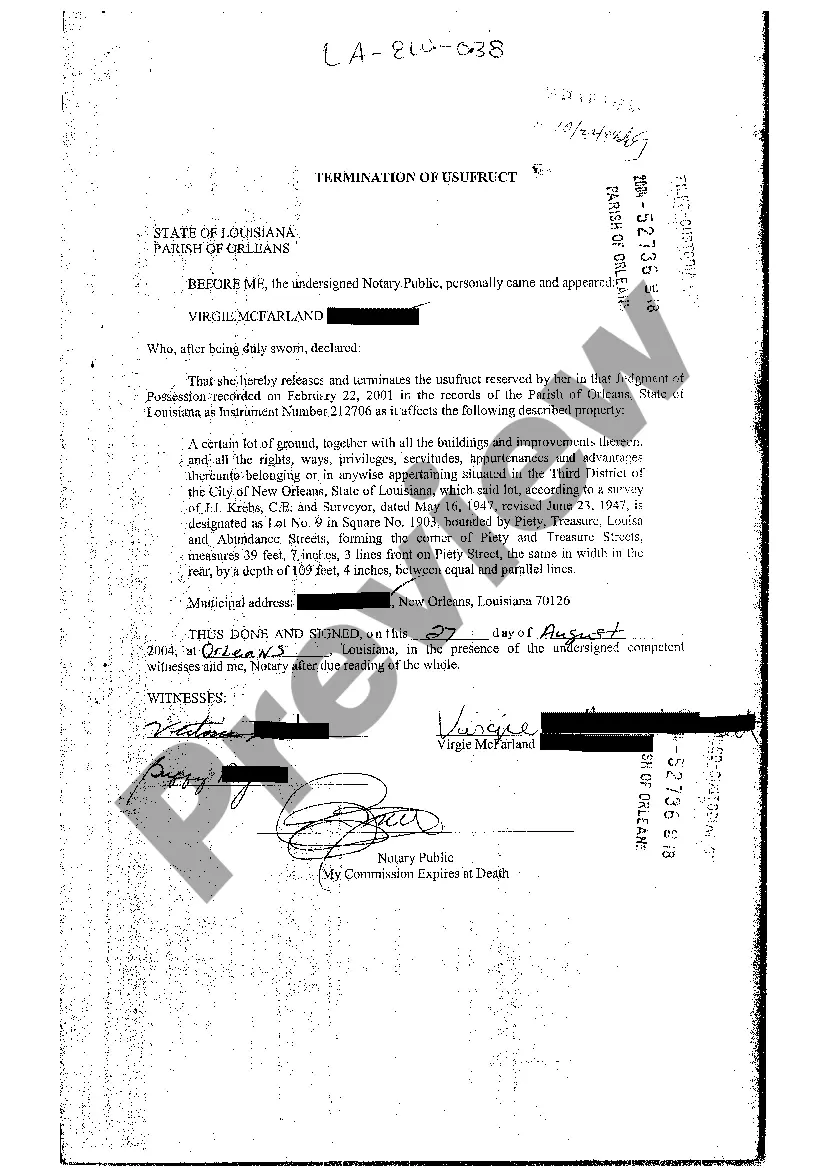

A usufruct can be terminated through various means, such as the expiration of the agreed term, the death of the usufructuary, or mutual agreement between the parties. It is wise to consider whether does a usufruct have to be registered, as registered agreements can simplify the termination process. For a smooth conclusion, clarify terms and document the resolution properly to avoid disputes.

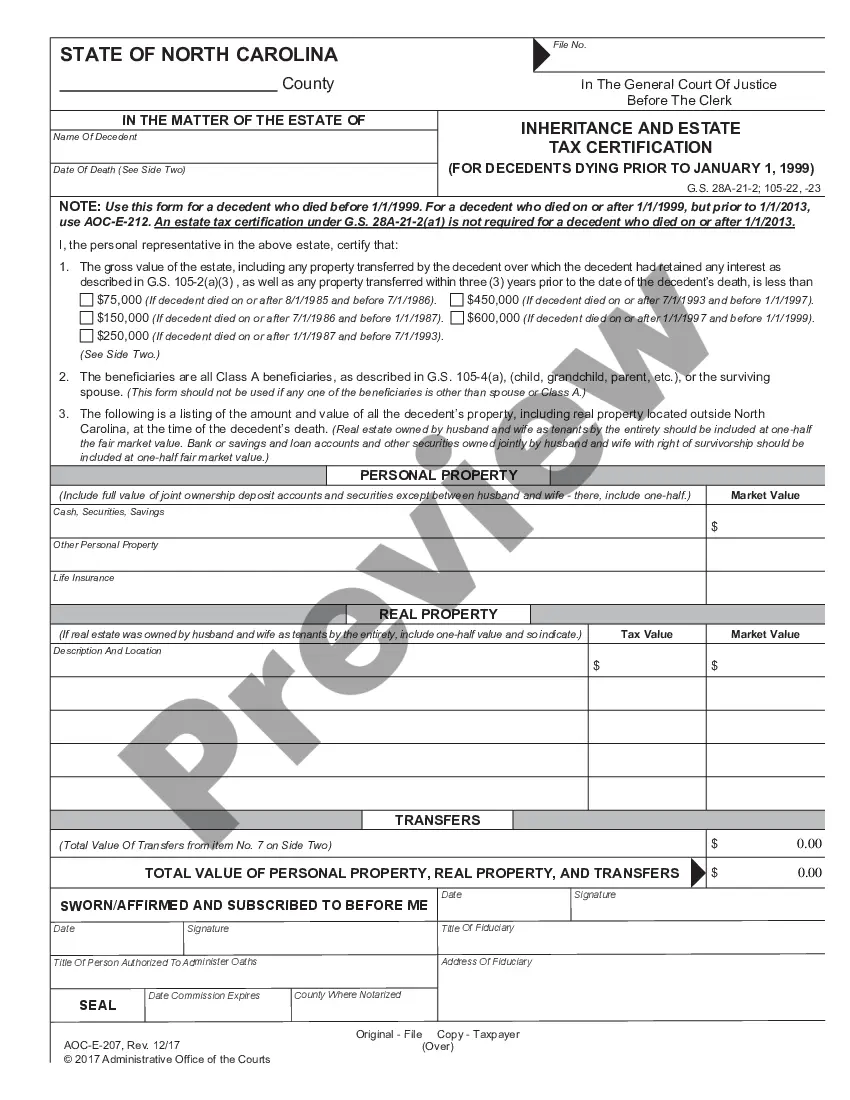

Typically, the usufructuary is responsible for paying taxes on the property they’re using, such as income tax derived from its revenue. One may wonder if does a usufruct have to be registered; registration can clarify such responsibilities in legal terms. It can provide peace of mind about who pays what and underlines the rights and duties of both parties.

In a usufruct arrangement, the usufructuary usually pays tangible personal property taxes. This duty often aligns with the rights to use the property during the usufruct period. You might be curious, does a usufruct have to be registered? While not required, understanding ownership and tax responsibilities benefits from having a registered agreement.

When a usufructuary passes away, the usufruct typically ends, and the rights to the property return to the bare owner. This outcome is important, especially if you are pondering, does a usufruct have to be registered? Registration can clarify ownership transitions posthumously. It helps in easing the management of estate affairs and understanding subsequent ownership.

Understanding the tax implications of a usufruct agreement is crucial for both parties involved. Generally, the usufructuary is responsible for property-related taxes during their tenure. Additionally, one might ask, does a usufruct have to be registered? While registration isn’t mandatory, it may simplify understanding tax responsibilities and benefit calculations.