Will Spouse With Social Security

Description

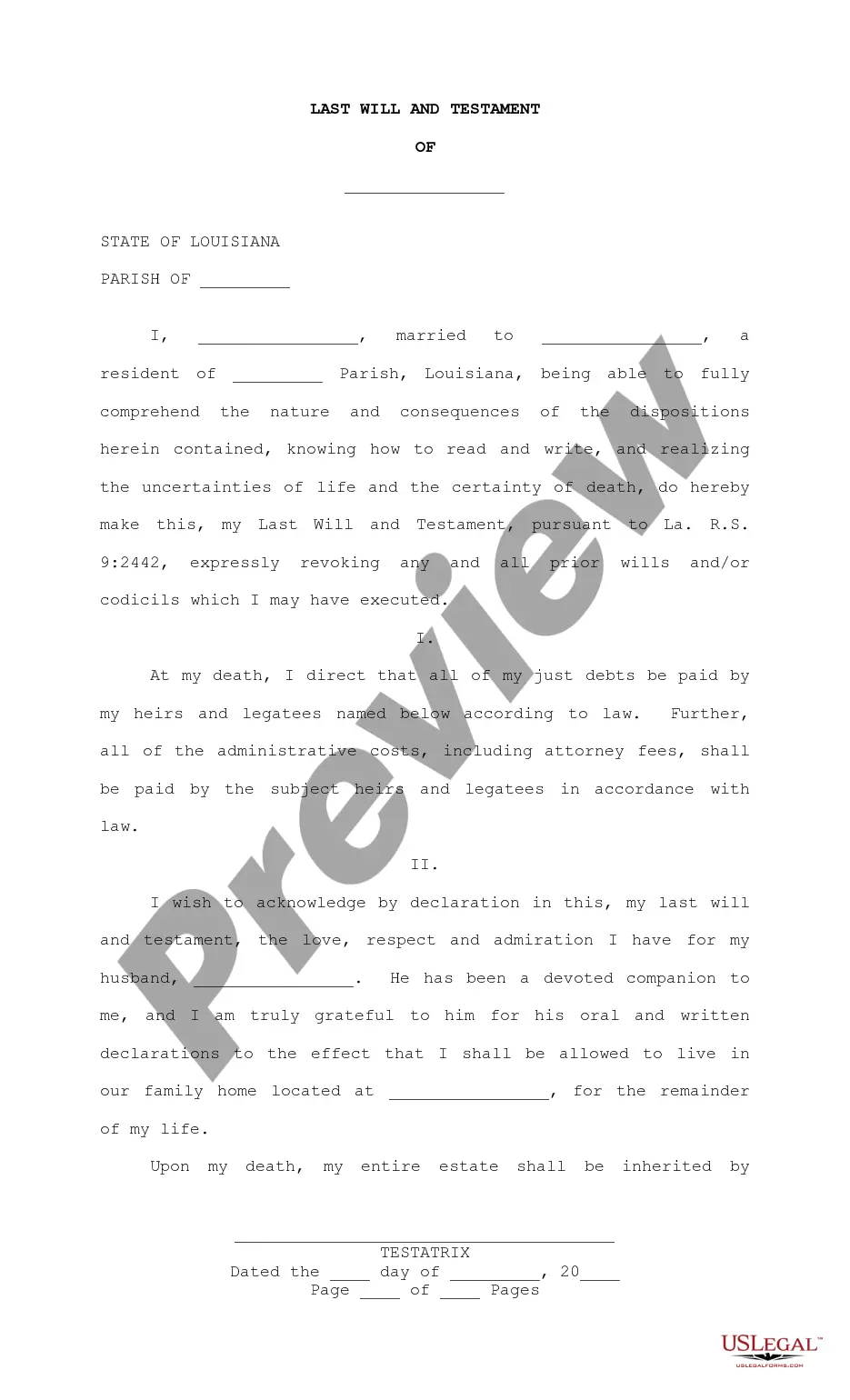

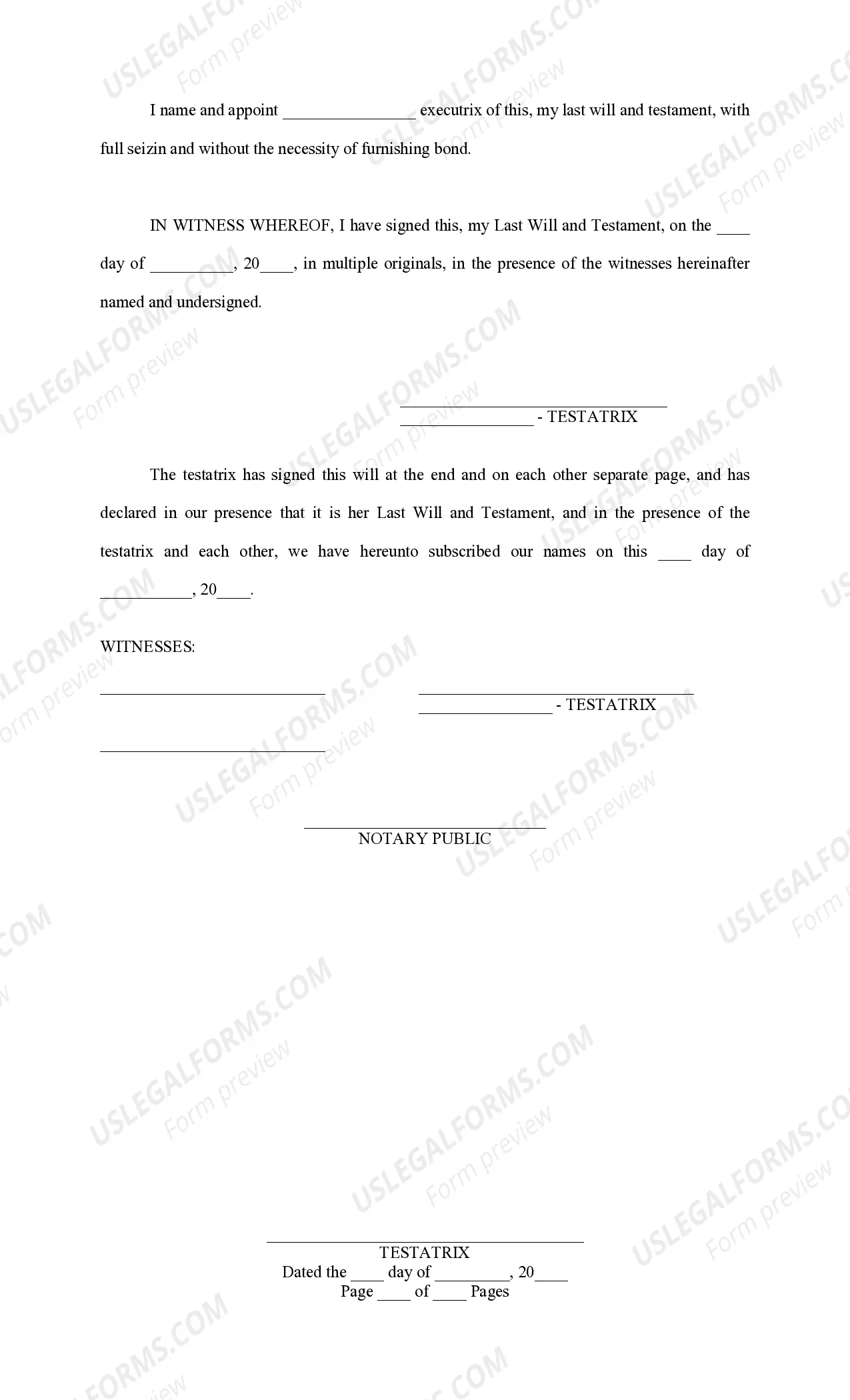

How to fill out Louisiana Last Will And Testament, Spouse, No Children?

Creating legal documents from the ground up can occasionally be daunting. Certain situations may require extensive research and significant financial investment.

If you're in search of a simpler and more affordable method to prepare Will Spouse With Social Security or any other forms without the hassle, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-compliant forms meticulously prepared for you by our legal professionals.

Utilize our platform whenever you need a dependable and trustworthy service where you can quickly locate and download the Will Spouse With Social Security. If you’re a returning user and have previously created an account with us, simply Log In to your account, find the form, and download it or re-download it at any time in the My documents section.

Ensure the form you choose complies with the laws and regulations of your state and county. Select the appropriate subscription option to purchase the Will Spouse With Social Security. Download the file, then complete, certify, and print it out. US Legal Forms boasts a solid reputation and over 25 years of expertise. Join us today and make form completion effortless and efficient!

- Don’t possess an account? No worries.

- Setting it up and navigating the library takes minimal time.

- Before you rush to download Will Spouse With Social Security, consider these suggestions.

- Review the document preview and descriptions to confirm you have located the correct document.

Form popularity

FAQ

The spousal benefit can be as much as half of the worker's "primary insurance amount," depending on the spouse's age at retirement. If the spouse begins receiving benefits before "normal (or full) retirement age," the spouse will receive a reduced benefit.

Your SSN, and the deceased worker's SSN. Your birth certificate. Your marriage certificate if you're a widow or widower. Your divorce papers if you're applying as a divorced widow or widower.

If you're getting Social Security retirement benefits, some members of your family may also qualify to receive benefits on your record. If they qualify, your ex-spouse, spouse, or child may receive a monthly payment of up to one-half of your retirement benefit amount.

Surviving spouse, full retirement age or older ? 100% of the deceased worker's benefit amount. Surviving spouse, age 60 ? through full retirement age ? 71½ to 99% of the deceased worker's basic amount. Surviving spouse with a disability aged 50 through 59 ? 71½%.

The spousal benefit can be as much as half of the worker's "primary insurance amount," depending on the spouse's age at retirement. If the spouse begins receiving benefits before "normal (or full) retirement age," the spouse will receive a reduced benefit.