Interdiction Force

Description

How to fill out Louisiana Petition In Suit For Interdiction?

Whether for corporate objectives or personal affairs, everyone must confront legal issues at some point in their lifespan.

Filling out legal documents necessitates meticulous care, starting with the selection of the correct template.

With an extensive US Legal Forms collection available, you don’t have to waste time searching for the correct template all over the internet. Take advantage of the library’s straightforward navigation to find the suitable form for any situation.

- Locate the template you require using the search bar or the catalog navigation.

- Review the form’s description to ensure it aligns with your circumstances, state, and locality.

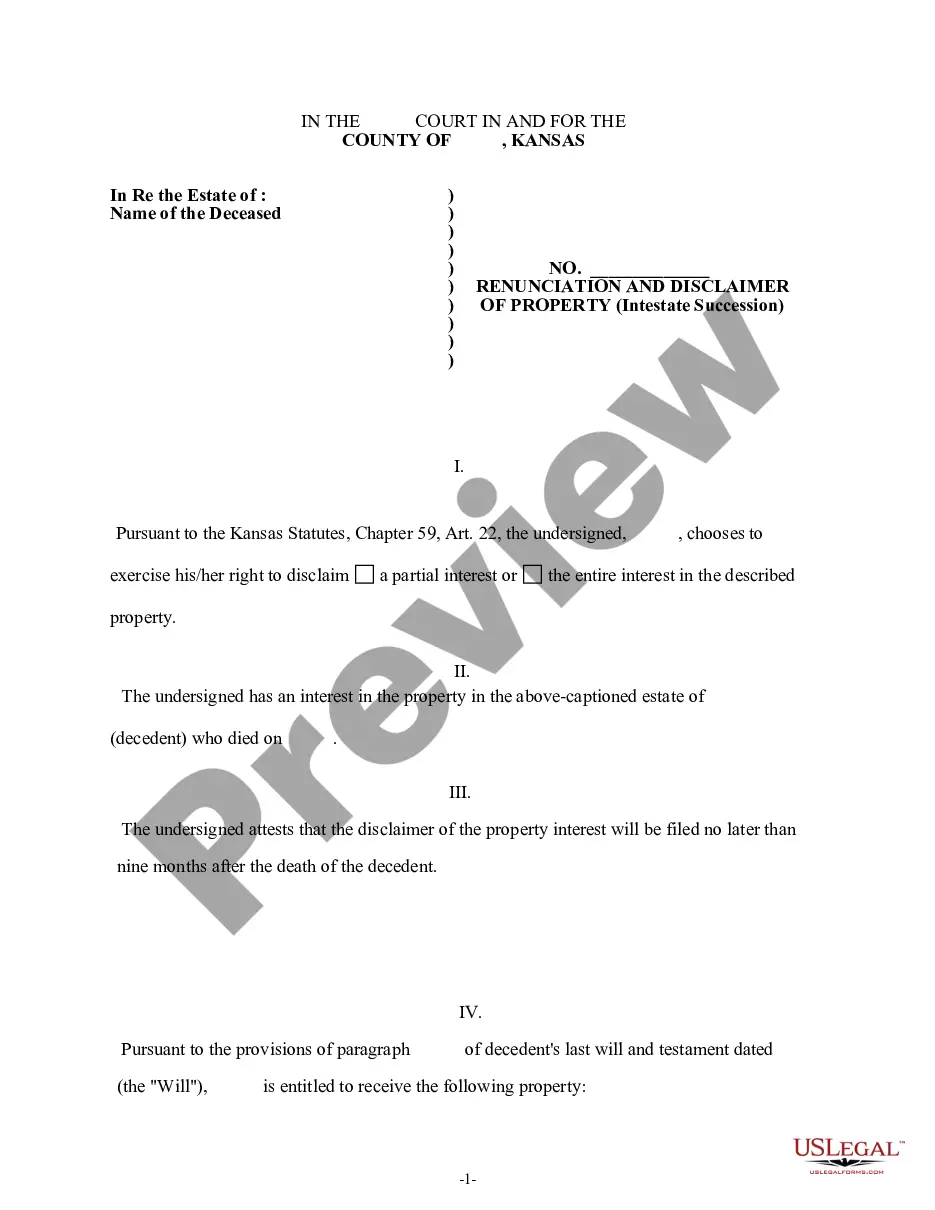

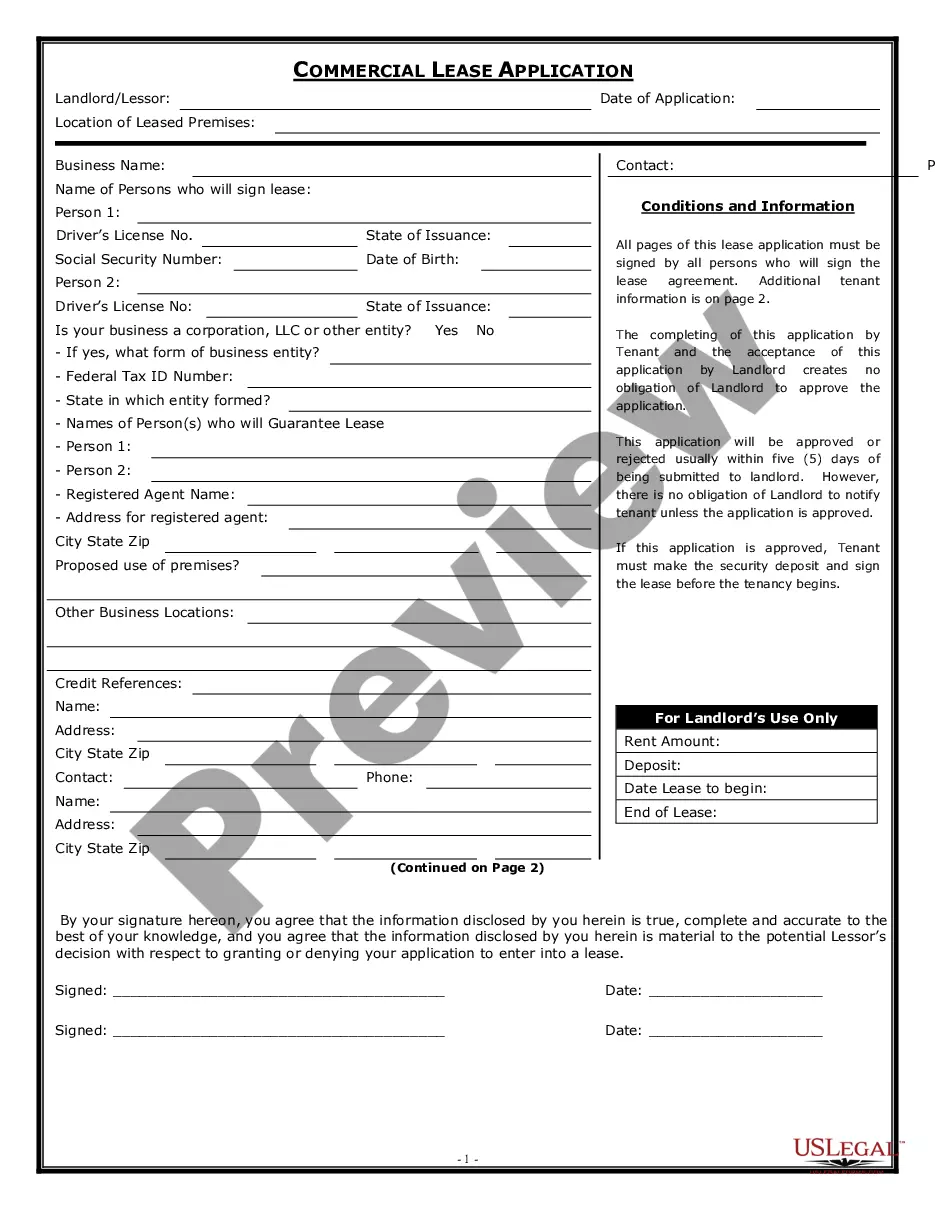

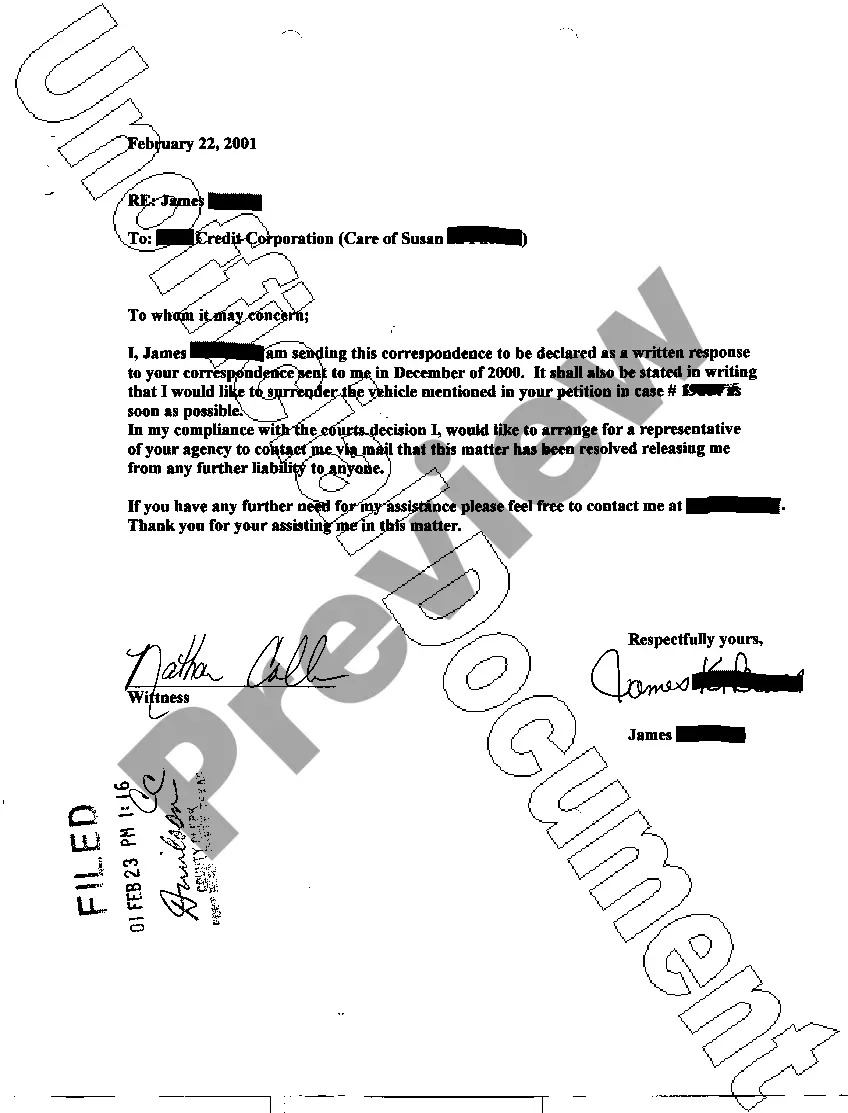

- Click on the form’s preview to examine it.

- If it is not the correct form, return to the search feature to find the Interdiction Force template you require.

- Obtain the template if it corresponds with your specifications.

- If you already possess a US Legal Forms account, simply click Log in to gain entry to previously saved templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: utilize a credit card or PayPal account.

- Pick the file format you desire and download the Interdiction Force.

- Once it is saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

All full-year Idaho residents qualify for a grocery credit refund. Qualifying dependents include those born or adopted by the end of 2022, as well as resident dependents who died in 2022.

The grocery tax credit offsets the sales tax you pay on groceries throughout the year. For most Idaho residents it averages $100 per person. You must be an Idaho resident to be eligible, and you might be able to claim a grocery credit for your dependents, too.

You indicated that you're required to file a tax return. Therefore, you should file Form 40 (if a full-year Idaho resident) or Form 43 (nonresidents, part-year residents, and military) for tax year 2022 to claim your grocery credit. See more information on our Individual Income Tax page.

If your account filing cycle is monthly, semimonthly, quarterly, or annually, you must pay the withheld Idaho income taxes electronically or with a Form 910, Idaho Withholding Payment Voucher.

If you need to change or amend an accepted Idaho State Income Tax Return for the current or previous Tax Year, you need to complete Form 40 (residents) or Form 43 (nonresidents and part-year residents). You can prepare a current tax year Idaho Tax Amendment on eFile.com, however you cannot submit it electronically.

If the business will have employees, the business must have a Federal Employer Identification Number (EIN). The EIN can be obtained by calling (800) 829-4933 or by visiting the IRS website at .

Visit tax.idaho.gov to check your refund status, get tax forms, make payments, and find tax help. You also can get help by calling (208) 334-7660 in the Boise area or toll free at (800) 972-7660.

Any Idahoan who was a full-year resident in 2020 and 2021 and who also filed an Idaho individual income tax return or a Form 24 for those years is eligible for the rebates.