Heirship Never Intestate For The Same Person

Description

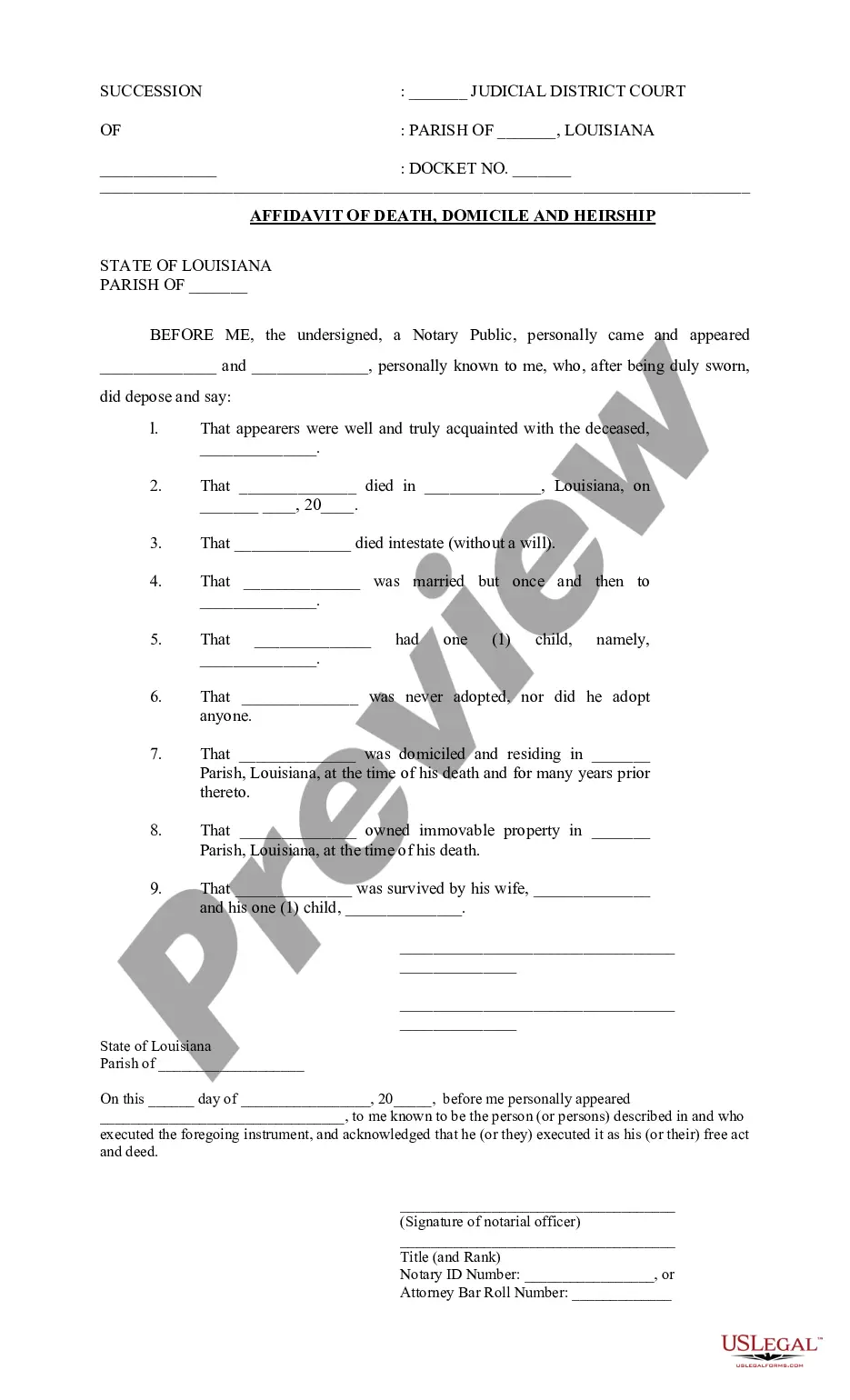

How to fill out Louisiana Affidavit Of Death, Domicile And Heirship Or Descent?

- If you are a returning user, simply log in to your account to access and download the necessary form templates. Ensure your subscription is active for uninterrupted service.

- In case you are new to our service, begin by reviewing the Preview mode and form descriptions to confirm you’ve selected a suitable document that complies with your local jurisdiction.

- Should you need additional documents, utilize the Search feature to find the appropriate forms that match your criteria.

- Once you've found the correct document, click the Buy Now button and select your desired subscription plan. You'll need to create an account for full access.

- Complete your purchase by providing your payment details, whether through credit card or PayPal, to activate your subscription.

- After payment, download the form to your device for easy access, while it will also be available in the My Forms section of your profile.

US Legal Forms not only provides an expansive repository of over 85,000 customizable legal forms but also empowers users with access to premium experts for guidance. This ensures that your forms are filled accurately and comply with legal standards.

Utilizing our platform enables you to execute essential legal documents effortlessly and with confidence. Start today to secure your legal standing for the future!

Form popularity

FAQ

Heirs typically have a limited period, often ranging from months to a few years, depending on state laws, to claim their inheritance. If an heir fails to make a claim within this timeframe, they may lose their right to inherit. For those grappling with issues of heirship never intestate for the same person, knowing these deadlines is crucial for securing what is rightfully theirs.

The order of next to kin establishes a clear hierarchy regarding who can inherit when close relatives are not available. This may include siblings, grandparents, and other relatives, all of whom are determined based on their proximity to the deceased. This understanding is pivotal for anyone navigating the complexities of heirship never intestate for the same person.

The next in line beneficiary typically consists of relatives who fall outside the immediate family, such as siblings, parents, or grandparents. Their eligibility depends on the absence or unavailability of closer relatives. Understanding who qualifies as a beneficiary under the notion of heirship never intestate for the same person can greatly simplify the inheritance process.

In inheritance matters, the first individuals entitled to an estate usually include the spouse and children of the deceased. These individuals generally have first claim over the assets accumulated during the deceased’s lifetime. This principle embodies the concept of heirship never intestate for the same person, ensuring that familial ties guide inheritance decisions.

The order of priority in succession refers to the hierarchy established by law for determining who inherits property after an individual passes away. Typically, this order starts with immediate family members, such as spouses and children, before moving to extended family. In cases of heirship never intestate for the same person, understanding this order helps clarify potential beneficiaries.

The consanguinity method calculates heirship based on blood relationships. It identifies how closely related individuals are to the deceased, allowing for a clear line of succession. Understanding this method is essential when considering how heirship never intestate for the same person operates within legal frameworks.

Yes, you can create your own affidavit of heirship in Texas, but it requires careful attention to detail. You need to make sure that your affidavit includes the correct information about the deceased's heirs and their relationships. With the right formats and guidelines, such as those found on US Legal Forms, you can prepare a compliant document that showcases heirship never intestate for the same person.

An affidavit of heirship can be prepared by an attorney, a legal expert, or a knowledgeable family member. However, it is crucial to ensure that the affidavit complies with the laws in your state. Utilizing a professional can help to guarantee that the document reflects your family's specific situation and effectively demonstrates heirship never intestate for the same person.

When a beneficiary dies, their share of the inheritance typically goes to their heirs or is divided among surviving beneficiaries. This reinforces the principle that heirship never intestate for the same person remains intact, as it directs the distribution according to established laws or estate documents. This scenario can create confusion, so consulting with legal experts is advisable. Platforms like uslegalforms assist in navigating these complexities, so the estate can be settled smoothly.

If an heir dies, their share of the inheritance is generally passed on to their beneficiaries or heirs, ensuring that heirship never intestate for the same person. This transfer can provide vital continuity and support to the family left behind. However, it often requires legal guidance to navigate the changes effectively. Using reliable platforms like uslegalforms can clarify the responsibilities and rights involved during this transition.