Lease Landlord Tenant Contract With Tenant Improvements

Description

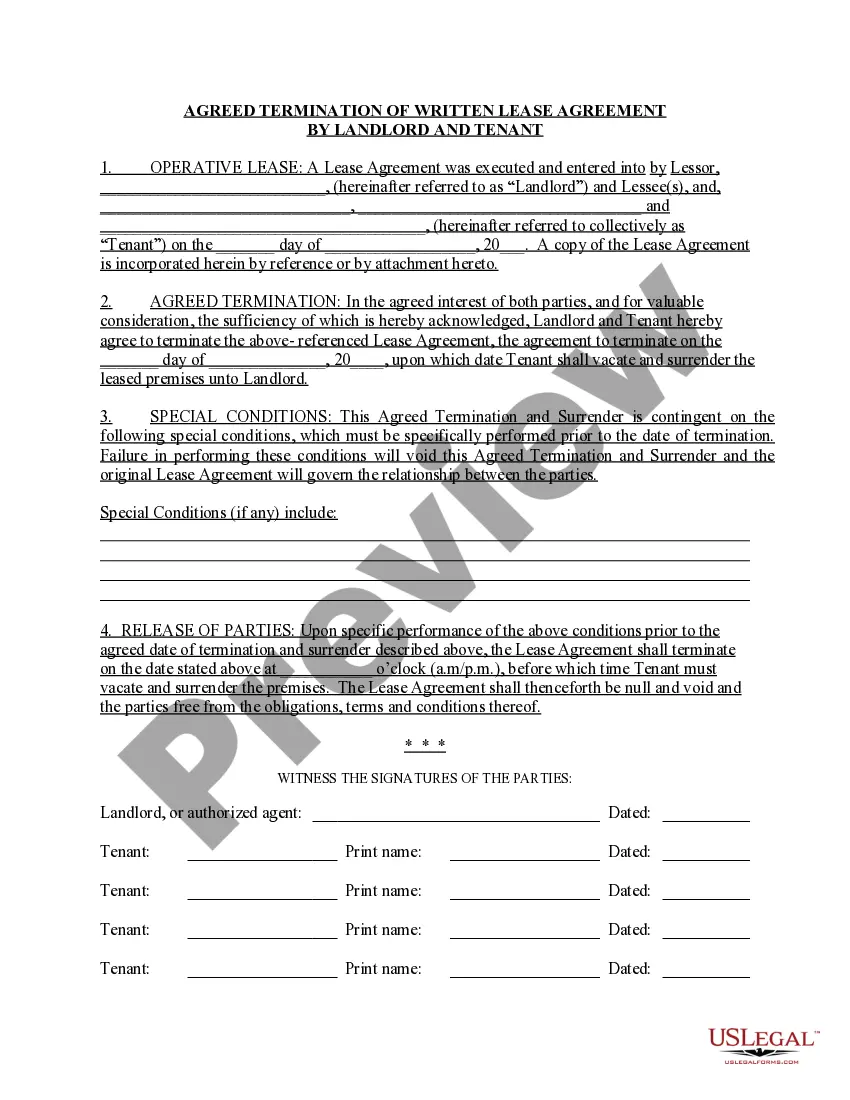

How to fill out Louisiana Agreed Written Termination Of Lease By Landlord And Tenant?

Carefully authored official documents are among the crucial assurances for preventing issues and disputes, but obtaining them without legal counsel may require time.

Whether you urgently seek a current Lease Landlord Tenant Contract With Tenant Improvements or other templates for employment, familial, or business events, US Legal Forms is consistently available to assist.

The procedure is even simpler for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button beside the selected file. Additionally, you can access the Lease Landlord Tenant Contract With Tenant Improvements anytime later, as all documents acquired on the platform remain accessible within the My documents section of your profile. Conserve time and money in crafting official documents. Experience US Legal Forms immediately!

- Verify that the form aligns with your circumstances and locality by reviewing the description and preview.

- Search for an alternative example (if necessary) through the Search bar in the header of the page.

- Press Buy Now once you locate the appropriate template.

- Select the pricing option, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Select either PDF or DOCX format for your Lease Landlord Tenant Contract With Tenant Improvements.

- Press Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

How Do you Calculate the TI Allowance? The tenant improvement allowance is typically given based on the rental square feet (RSF) of the commercial space. To calculate the Tenant improvement allowance simply multiply the RSF by the TI allowance you have negotiated.

The IRS does not allow deductions for leasehold improvements. But because improvements are considered part of the building, they are subject to depreciation. Under GAAP, leasehold improvement depreciation should follow a 15-year schedule, which must be re-evaluated each year based on its useful economic life.

The cost of leasehold improvements over the capitalization threshold of $50k should be capitalized. Examples of costs that would be included as parts of a leasehold improvement include: Interior partitions made up of drywall, glass and metal. Miscellaneous millwork, carpentry, lumber, metals, steel, and paint.

Your belongings are covered away from home for up-to 60 days at a time. Tenants' improvements. Improvements you make to your rented property, such as putting in a new kitchen or bathroom, are covered up-to £25,000. Rent or alternative accommodation for your family and pets.

Under IRC Sec. 263(a), Capital Expenditures, if a lessee makes a leasehold improvement that isn't a substitute for rent, the lessee is generally required to capitalize the cost of the improvement.