Limited Lliability

Description

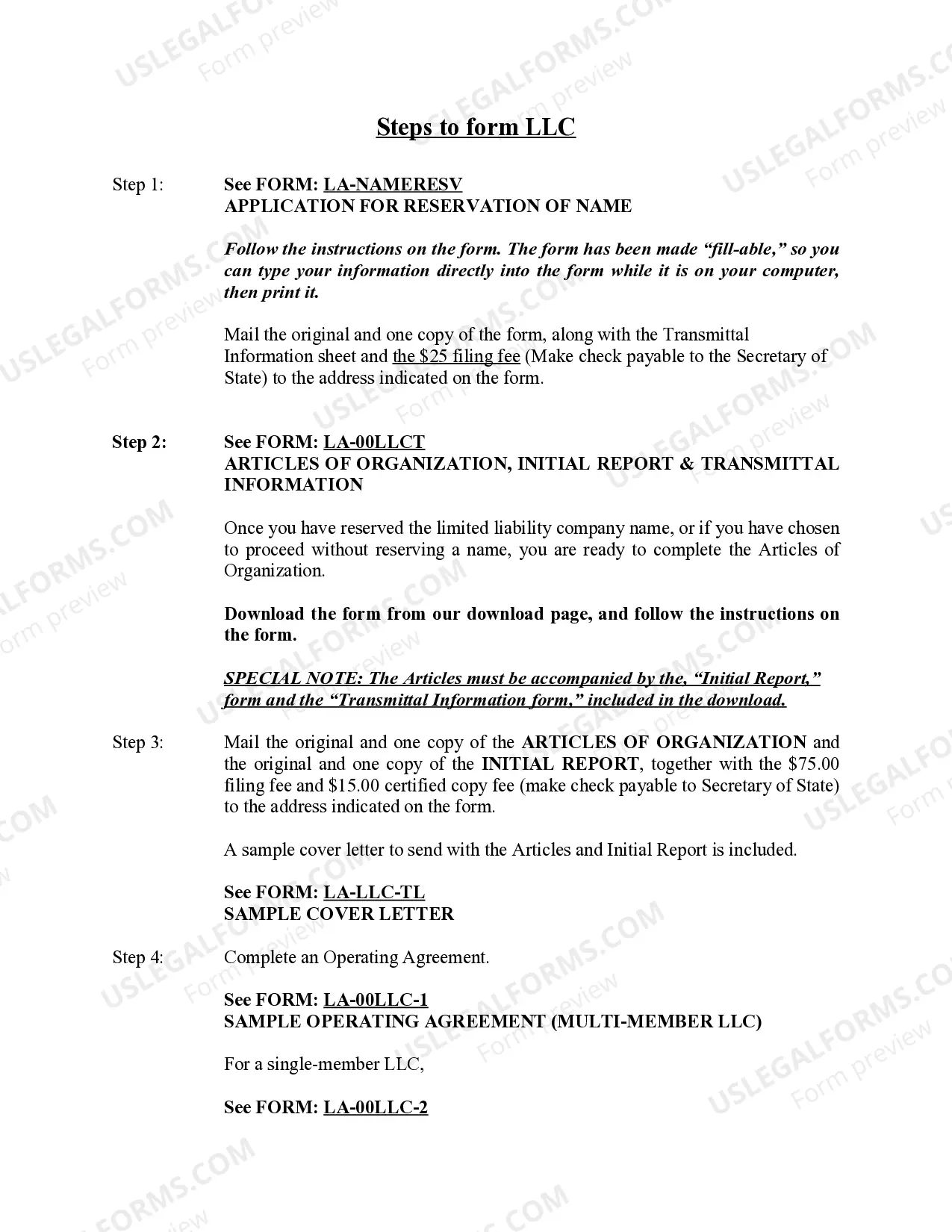

How to fill out Louisiana Limited Liability Company LLC Formation Package?

- If you’re an existing user, log into your account and check if you can download the desired form template. Ensure your subscription is active; otherwise, update your plan as needed.

- For first-time users, start by exploring the Preview mode and form descriptions to find the document that fits your requirements and complies with your local laws.

- If the document isn’t right, utilize the Search feature to find another template that better suits your needs.

- To proceed, click on the Buy Now button, select your desired subscription plan, and create an account for access to the platform's resources.

- Complete your purchase by entering your payment details, utilizing a credit card or PayPal for convenience.

- Finally, download your form and save it on your device. You can access it at any time from the My Forms section of your profile.

By leveraging US Legal Forms, you gain access to an extensive library of over 85,000 templates, ensuring you have the tools needed for quick and legally sound document preparation.

Take the first step in securing your limited liability protections today. Start exploring US Legal Forms to find the right legal templates for your needs!

Form popularity

FAQ

There is no specific income threshold that dictates when to form an LLC, but substantial income or contracts can warrant this step. If you earn a consistent income, it’s wise to establish an LLC to ensure your limited liability protection. This approach not only secures your personal assets but also enhances your credibility with clients.

While an LLC provides limited liability, there are downsides to consider, such as ongoing administrative costs and compliance regulations. You may face annual fees and paperwork that could take time away from focusing on your business. However, the benefits of protecting personal assets often outweigh these concerns.

You should consider forming an LLC when your business begins to generate revenue or if you plan to sign contracts. An LLC offers limited liability protection that safeguards your personal assets from business debts. This protection is crucial as your activities grow, ensuring that your personal wealth remains secure.

Yes, you can start an LLC even if you do not have a fully operational business. Many entrepreneurs set up an LLC to secure their limited liability protection while exploring business ideas. It’s essential to register your LLC officially to take advantage of the benefits and protections offered.

Determining a reasonable salary for your LLC involves considering the work you contribute and the profits generated. Generally, it should reflect your active involvement in the business and stay within industry standards. Balancing this salary with the protections of limited liability is key for compliance and financial health.

A limited liability company (LLC) is defined as a business entity that blends the liability protections of a corporation with the tax efficiencies of a partnership. This means that members enjoy limited liability while benefiting from fewer administrative requirements. Understanding this definition helps entrepreneurs make informed decisions about their business structure.

An LLC is best for small to medium-sized businesses that want to combine flexibility with limited liability protection. It suits entrepreneurs looking to protect their personal assets while enjoying the tax benefits of pass-through taxation. This structure is appealing for those who seek a simple management framework and personal asset security.

Limited liability means that an owner's financial responsibility for business debts is limited to their investment in the company. This structure safeguards personal wealth from business-related risks and liabilities. For many entrepreneurs, this offers peace of mind and encourages business growth without the fear of losing personal assets.

Limited liability refers to the protection of business owners' personal assets from company debts, while unlimited liability means that owners are personally responsible for all business obligations. In a limited liability company, members are shielded from personal loss beyond their investment in the business. Understanding the difference is essential for anyone considering starting a business.

A limited liability company, or LLC, is a hybrid business entity that offers both organizational flexibility and personal asset protection. In an LLC, members enjoy limited liability, which shields their personal assets if the company faces lawsuits or financial troubles. This structure enables owners to operate with more security while enjoying favorable tax treatment.