Massachusetts Letter to Lienholder to Notify of Trust

Description

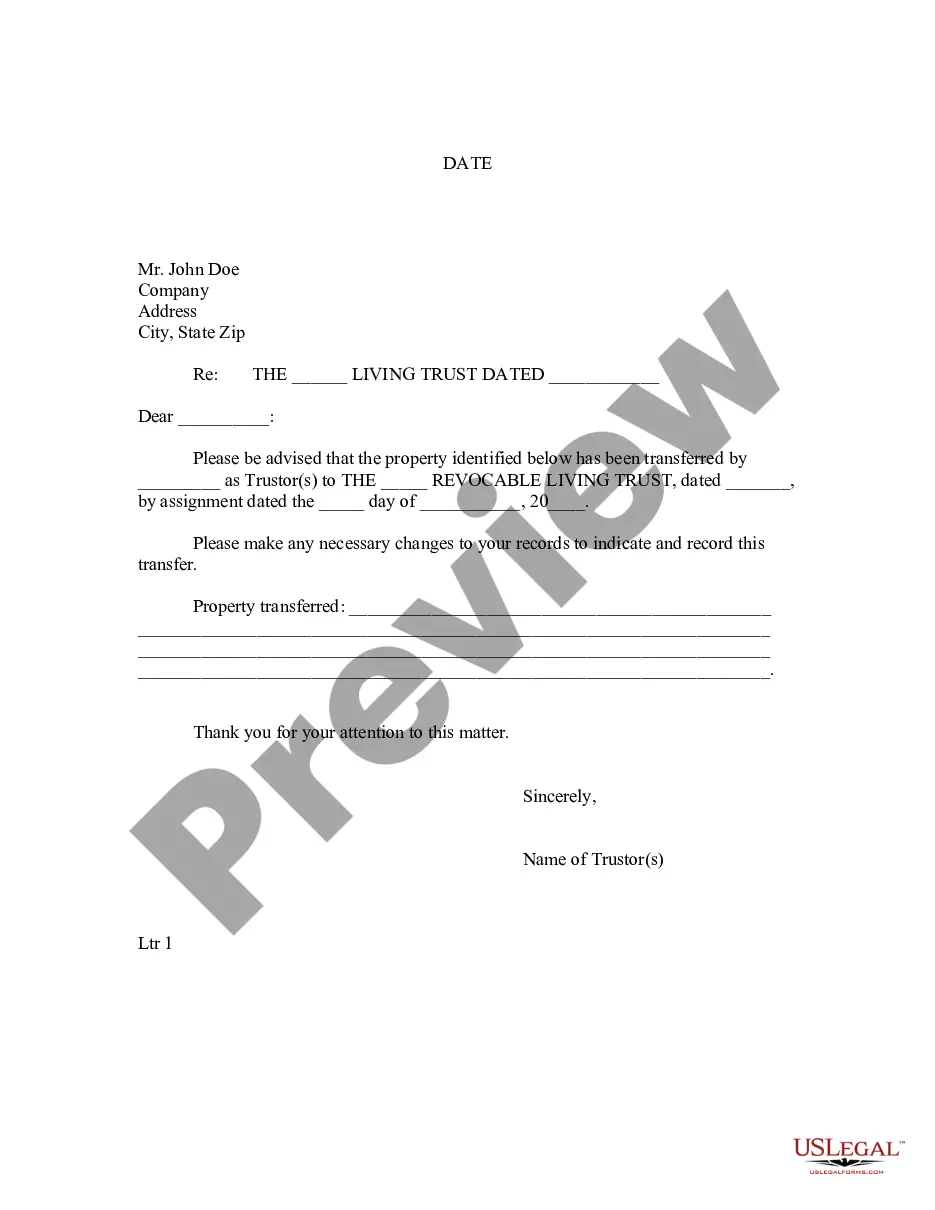

How to fill out Massachusetts Letter To Lienholder To Notify Of Trust?

Greetings to the finest legal documentation library, US Legal Forms. Here you will discover any template such as Massachusetts Letter to Lienholder to Notify of Trust and save them (as many as you desire or require). Prepare official documents in just a few hours, rather than days or even weeks, without the need to spend a fortune on a lawyer or attorney.

Obtain the state-specific template in a few clicks and feel assured knowing that it was created by our licensed legal experts.

If you’re already a registered user, just Log In to your account and then click Download next to the Massachusetts Letter to Lienholder to Notify of Trust you need. Because US Legal Forms is online-based, you’ll always have access to your saved templates, no matter the device you are using. Find them within the My documents section.

Print the document and fill it in with your or your business’s details. Once you’ve completed the Massachusetts Letter to Lienholder to Notify of Trust, hand it to your lawyer for validation. It’s an additional step but a crucial one to ensure you’re fully protected. Join US Legal Forms today and receive a plethora of reusable templates.

- If you don’t have an account yet, what are you waiting for? Follow our instructions below to begin.

- If this is a state-specific template, verify its suitability in your state.

- Review the description (if available) to determine if it’s the correct template.

- Explore additional details with the Preview option.

- If the document fulfills all of your requirements, click Buy Now.

- To create your account, select a pricing plan.

- Utilize a card or PayPal account to sign up.

- Download the template in the format you need (Word or PDF).

Form popularity

FAQ

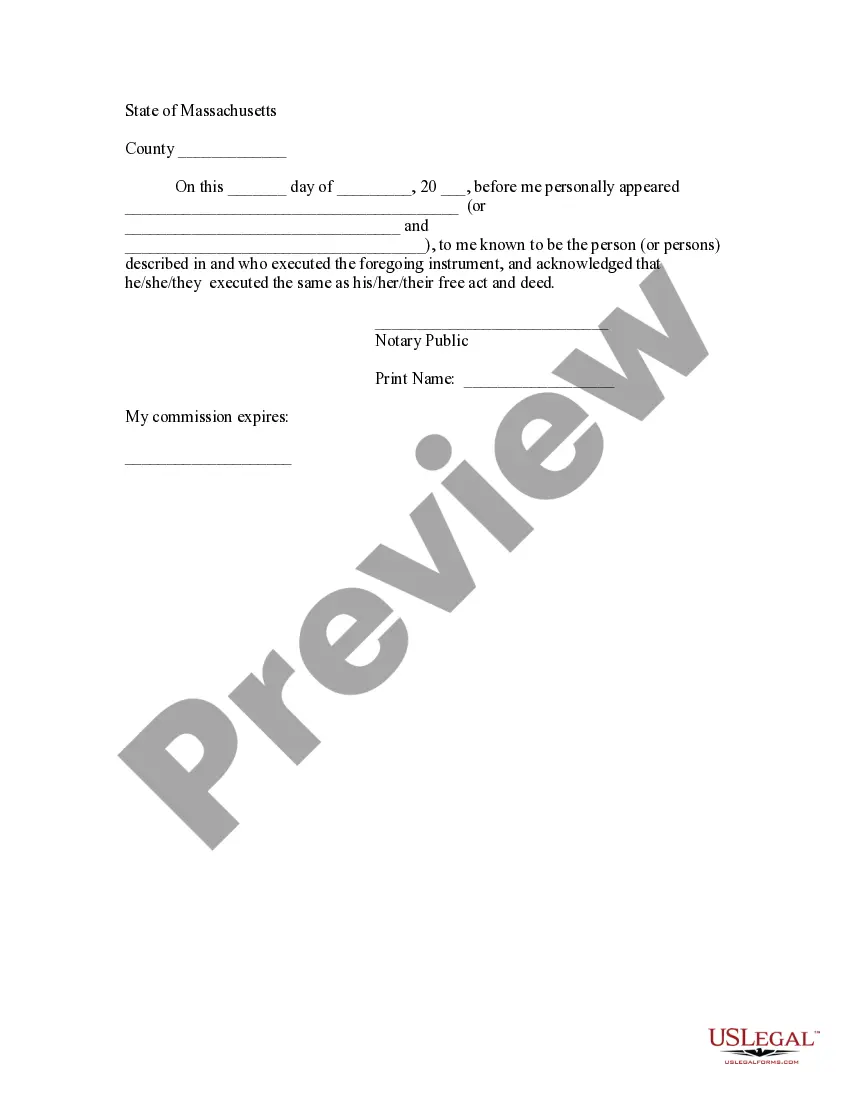

Consistent with current Massachusetts practice, a non-charitable irrevocable trust may be terminated or modified with consent of all the beneficiaries and with court approval, so long as the modification or termination is not inconsistent with a material purpose of the trust.

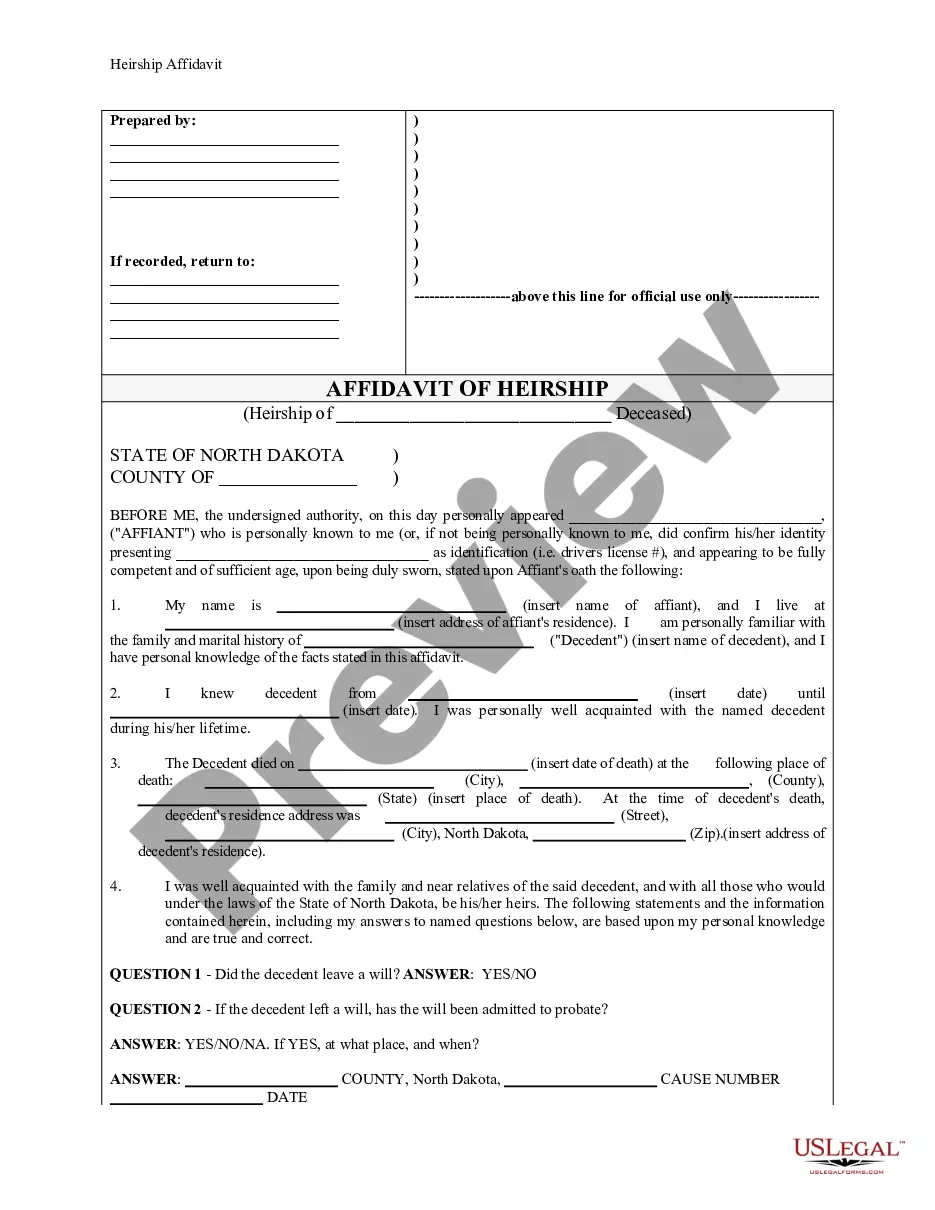

Since the Schedule of Beneficiaries to a trust is not recorded with the Declaration of Trust at the Registry of Deeds, the identity of the Beneficiaries is not a matter of public record.There are two types of Trusts in Massachusetts.

The car (vehicle) lien release form is a document that is used by a lending institution or entity after a borrower has paid the loan in full and the borrower would like to retrieve the title to their vehicle.

The release of lien may be a separate document or it could be the original vehicle title, with the lien signed off on the front. All titles and releases of lien are sent via regular, first-class mail.

Trusts in Massachusetts are governed by the Massachusetts Uniform Trust Code, codified at G.L.c. 203E.The trustee's certificate is recorded either immediately upon the trust's acquisition of real property, or when the trustee acts upon the title 1.

It's perfectly legal to sell a car with a lien, as long as you pay off the loan first. To sell a car with a lien, you have the option to sell it to a car dealer as a trade-in, or sell the car to a private buyer.

The car (vehicle) lien release form is a document that is used by a lending institution or entity after a borrower has paid the loan in full and the borrower would like to retrieve the title to their vehicle.

Depending on state laws, paper titles are generally mailed and electronic titles and/or liens are released to the motor vehicle agency approximately 10 business days after the payoff is received. Allow 15-30 days for receipt of your title based on mail time and/or motor vehicle agency process.

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.