Limited Liability Company With The Ability To Establish Series

Description

How to fill out Louisiana Limited Liability Company LLC Formation Package?

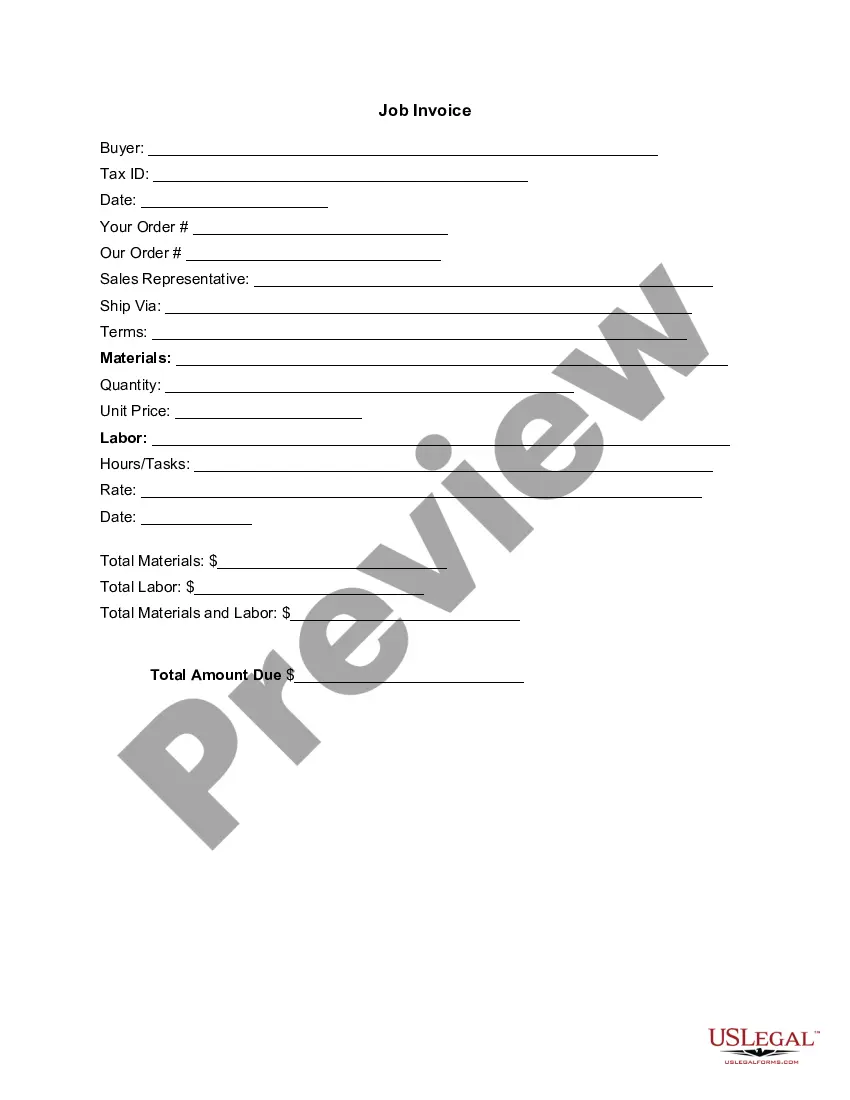

- Begin by logging into your US Legal Forms account. Check that your subscription is active; renew it if necessary.

- Access the Preview mode to review the form descriptions available. Confirm you select a template tailored to your requirements.

- If you encounter any issues or discrepancies, utilize the Search feature to find alternative templates that suit your needs.

- Select the desired document by clicking the Buy Now button. Choose a subscription plan that fits your needs and set up an account.

- Complete your transaction by entering your payment information, using either a credit card or PayPal.

- Once your purchase is confirmed, download the document onto your device for easy access. You can also find this form in the My Forms section of your profile.

By following these steps, you will have the legal forms you need to establish your LLC with the ability to create series, backed by the extensive resources of US Legal Forms.

Experience the ease and efficiency of creating legal documents with US Legal Forms today. Start now and empower your business journey!

Form popularity

FAQ

To obtain an EIN for your limited liability company with the ability to establish series, you need to complete the IRS Form SS-4. This form collects essential information about your Series LLC, including its legal structure and the nature of its business activities. After filling out the form, you can submit it online, by mail, or by fax to the IRS. Remember, having an EIN is vital for tax purposes and helps protect your limited liability company with the ability to establish series as a separate entity.

A series LLC is typically taxed as a single entity unless each series elects to be treated differently for tax purposes. Income and losses can flow through to the owners based on their individual tax responsibilities. To better understand your specific tax obligations and options, consult resources like US Legal Forms to streamline the process.

Yes, each series within a series LLC should ideally have its own bank account to maintain clear financial boundaries. This separation helps protect each series from liabilities associated with others, which is a key advantage of a limited liability company with the ability to establish series. Managing finances separately also facilitates easier accounting and tax preparations.

A series LLC can be worth the investment if you own multiple assets or businesses, as it offers enhanced liability protection and administrative efficiencies. It helps you segregate risks associated with different series while maintaining a centralized management structure. Weigh your specific needs and consider using a resource like US Legal Forms to help assess if a series LLC suits you.

A limited liability company with the ability to establish series is a unique business structure allowing for the creation of multiple protected divisions under one LLC. Each series operates independently, with its own assets and liabilities, while benefiting from the overarching protection of the LLC. This structure offers an efficient way to manage various business operations without setting up separate companies.

A series LLC can be a great option for many businesses, especially if you plan to own multiple assets or businesses. It allows you to protect each series from liabilities associated with one another, providing more security. Additionally, with a limited liability company with the ability to establish series, you can streamline your operations and reduce administrative costs.

Filing taxes for a Series LLC requires attention to detail, as each series may have its own tax obligations. Generally, all series can file together on the same return, but you'll need to report income, expenses, and any deductions separately. A limited liability company with the ability to establish series can offer certain tax advantages, so consulting an accountant familiar with this structure is advisable.

Absolutely, an LLC can establish a series, making it a Series LLC. This setup allows for the creation of distinct series or divisions within the LLC, each with its own assets and liabilities. If you're interested in this structure, consider platforms like US Legal Forms, which provide resources to navigate the formation process easily.

Yes, converting your LLC to a Series LLC is possible and can be beneficial. This involves filing specific documents with your state while ensuring compliance with regulations. A limited liability company with the ability to establish series allows you to create separate divisions under one umbrella, providing asset protection and simplified management.

Yes, you can change the classification of your LLC to suit your business needs. This might include transitioning from a single-member to a multi-member LLC or electing to be taxed as an S Corporation. Remember, if you choose a limited liability company with the ability to establish series, the classification can help you manage liability more effectively.