Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate

Definition and meaning

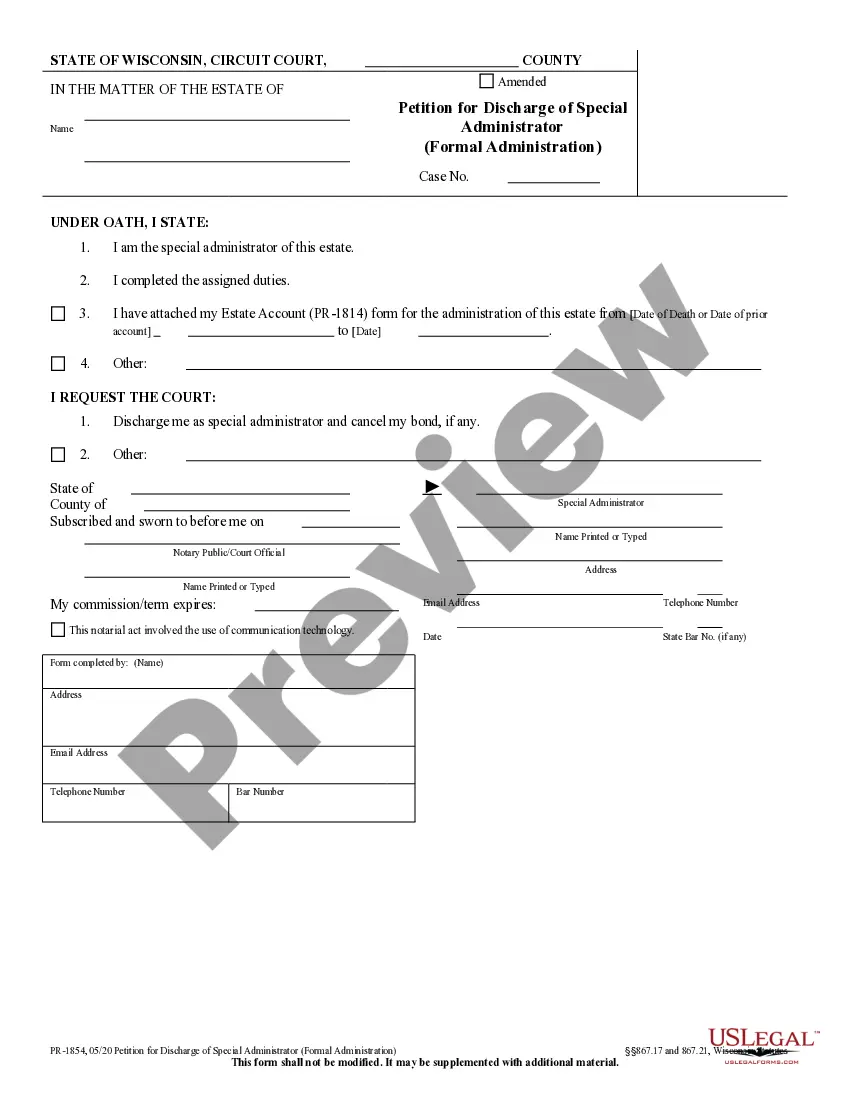

The Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate is a legal document that is filed in probate court by a creditor against the estate of a deceased individual. This petition serves to initiate the process of requesting the distribution of any remaining assets to creditors after the resolution of the estate's debts. It is essential for creditors to ensure their claims are satisfied within the legal framework established by the probate process.

Who should use this form

This form is intended for creditors who have claims against the estate of a decedent. Individuals or entities that have provided goods or services to the decedent prior to their death, and have had their claims allowed by the court, should consider using this petition to ensure they receive their rightful share of the remaining assets from the estate. Users should be prepared to provide proof of their claim and follow all procedural requirements as mandated by local laws.

Key components of the form

The Petition of Creditor includes several critical components:

- Identification of the Petitioner: The creditor's name who is filing the petition.

- Details of the Estate: Information about the decedent and the estate’s administrator or executor.

- Balance for Distribution: The amount of assets available for distribution among creditors.

- Request for Distribution: A clear request for the distribution of the remaining assets according to the law.

- Verification Statement: A statement affirming the truth and accuracy of the details provided.

Legal use and context

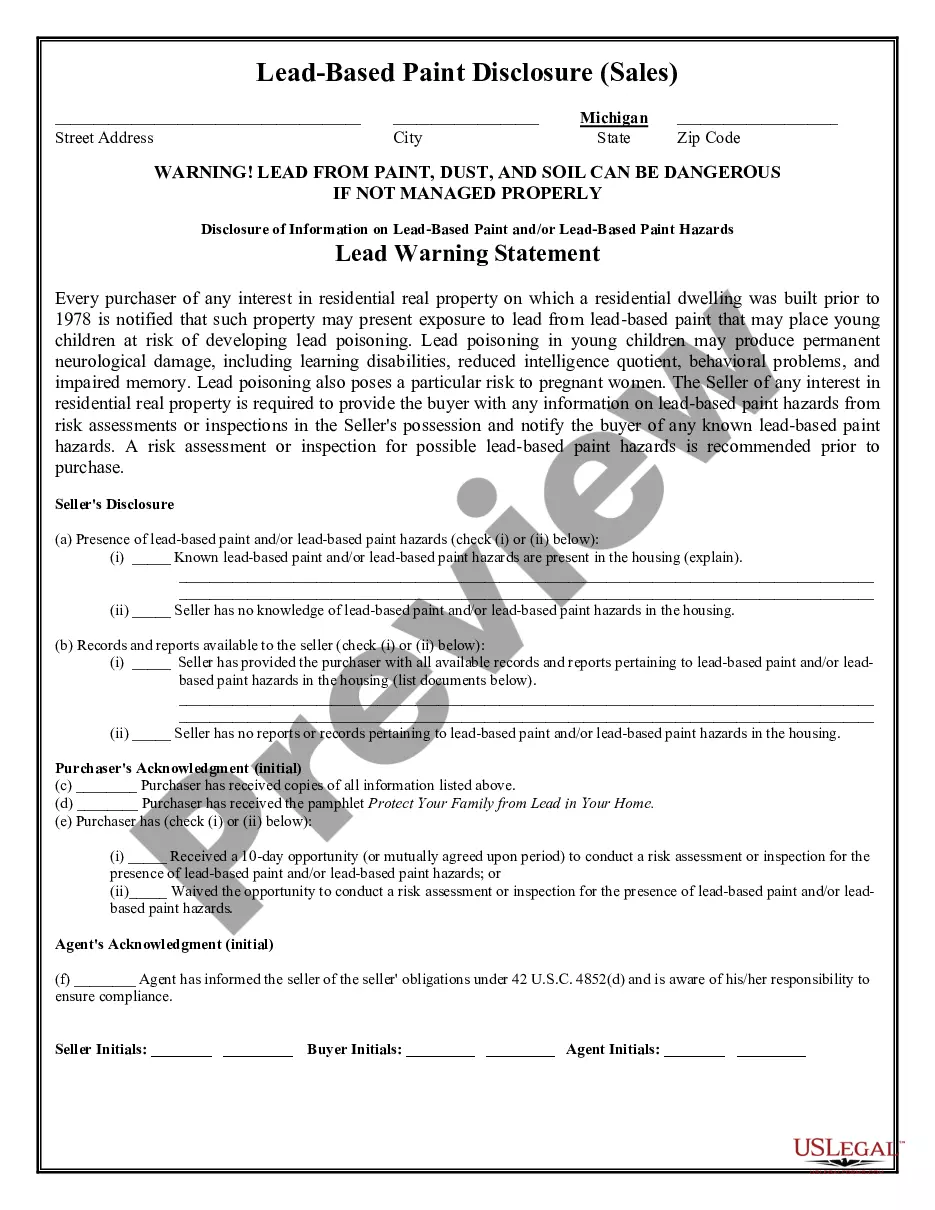

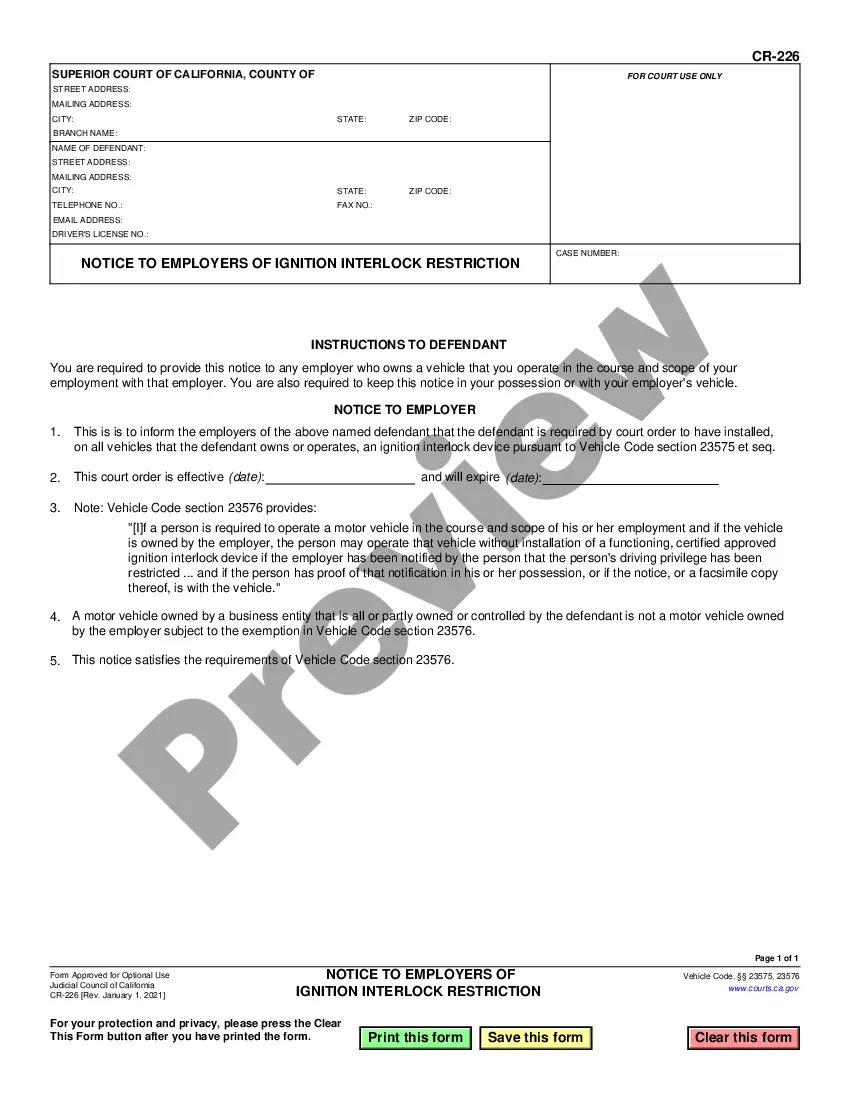

The petition is used within the context of probate law, where it plays a crucial role in ensuring that creditors are paid from the decedent's estate. It acts as a formal request for the distribution of any remaining assets after valid claims have been recognized and allowed by the court. This process is governed by state laws, and the use of this form may vary based on local regulations concerning estates and probate procedures.

Common mistakes to avoid when using this form

When completing the petition, it is important to avoid several common mistakes:

- Inaccurate Information: Ensure all information regarding the debtor and the estate is accurate to avoid delays.

- Missing Signatures: The petition must be signed by the petitioner and may require notarization.

- Failure to Notify Other Creditors: All known creditors may need to be notified regarding the petition.

- Ignoring State-Specific Requirements: Be aware of any additional documentation or procedural requirements specific to your state.

Form popularity

FAQ

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

Generally, in California creditors of a decedent's estate have up to one year (365 days) from the decedent's death to file a timely creditor claim.Also, in the case of small estates, i.e., a total gross value under $150,000, a creditor may consider opening a probate matter within 40 days of the decedent's death.

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

You can get a creditor's claim form at the Forms Window in Room 112 on the first floor of the Los Angeles Superior Court at 111 North Hill Street, or any other Superior Court location. The form is also available at the Judicial Council website: http://www.courtinfo.ca.gov/forms/. It is form number DE-172.

Find the Correct Probate Court. The probate court handles issues involving a deceased person's estate, along with potential disputes regarding outstanding debts, issues with heirs, etc. Confirm the Debt. Complete the Claim Form. File the Claim Form.

Introduction. Pay the debts of the estate first. Ask each beneficiary to acknowledge receipt of the gift. Transferring company shares. Transferring real property. Draw up the accounts of the estate. Other claims on the estate. Finishing up.

The statute of limitations for filing a claim against an estate is a strict one year from the date of the debtor's death (pursuant to California Code of Civil Procedure Section 366.2). This limitation period applies regardless of whether the judgment creditor knew the judgment debtor had died!

A creditor claim must be filed with the California Probate court. A copy of the creditor claim must be served on the personal representative within the later of 30 days of the filing of the claim or 4 months after letters are issued to a personal representative with general powers.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.