Living Trust Kentucky Without A Will

Description

Form popularity

FAQ

Choosing a trust over a will offers several advantages, especially a living trust in Kentucky without a will. Trusts provide privacy since they don’t go through probate, thus keeping your affairs confidential. Additionally, trusts allow for more control over when and how your assets are distributed, which can be particularly advantageous for minor children or beneficiaries who may not be financially responsible. Using a living trust can also streamline the estate administration process.

If there is no will in Kentucky, the state's intestacy laws dictate who inherits your assets. Generally, your closest relatives, such as your spouse, children, or parents, will receive your property according to predetermined rules. Establishing a living trust in Kentucky without a will can help you avoid this uncertainty and provide clear instructions about who should receive your assets.

To register a trust in Kentucky, you typically need to create a trust document that outlines the trust's terms and the assets it will hold. While registration is not mandatory, you may want to file the trust document with your county clerk for public record. Additionally, you can use platforms like US Legal Forms to simplify the process and ensure your living trust in Kentucky without a will is properly established.

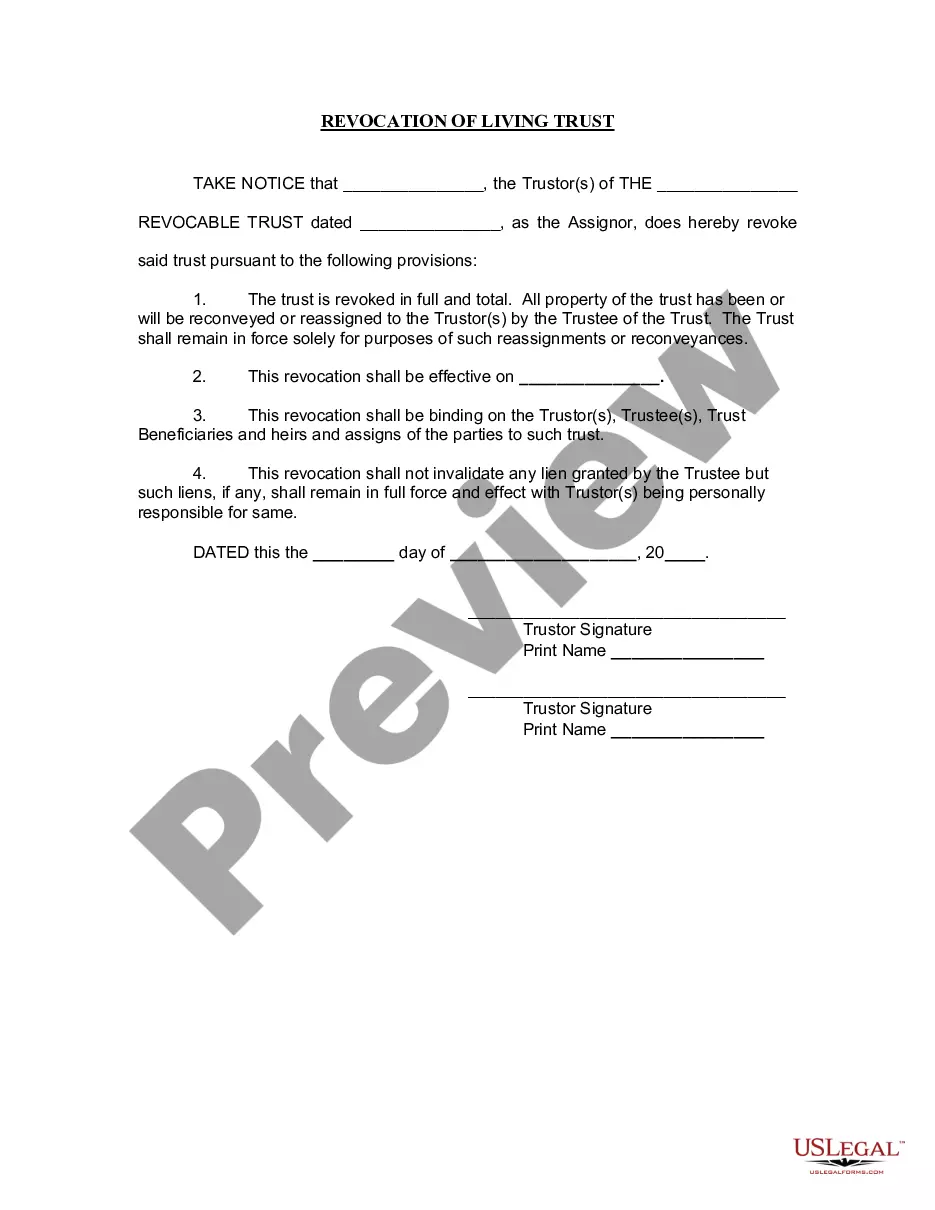

The three common types of trusts are revocable trusts, irrevocable trusts, and testamentary trusts. A revocable trust allows you to modify or cancel the trust during your lifetime, while an irrevocable trust cannot be changed once created. Testamentary trusts take effect after your death and are often specified in a will. Each type of trust can be beneficial when considering a living trust in Kentucky without a will.

Yes, you can establish a living trust in Kentucky without creating a will. A living trust allows you to manage your assets during your lifetime and dictate how they should be distributed after your death. By using a living trust in Kentucky without a will, you can avoid probate, ensuring a smoother transfer of your assets. This approach provides flexibility and control over your estate.

Choosing between a will and a living trust in Kentucky without a will depends on your specific situation. If you seek simplicity and a direct method for asset distribution after death, a will may suffice. However, for those wishing to avoid probate and ensure a private, efficient transfer of assets, a living trust is often the superior option. Consult the uslegalforms platform to explore tailored solutions that fit your preferences and needs.

Using a living trust in Kentucky without a will can be beneficial when you want to avoid probate. A trust allows for a smoother transfer of assets upon death, as it can continue managing your estate without court intervention. Additionally, a trust offers privacy, as it does not become a public record like a will does. If you anticipate complex family situations or wish to control asset distribution over time, a living trust may be the better choice.

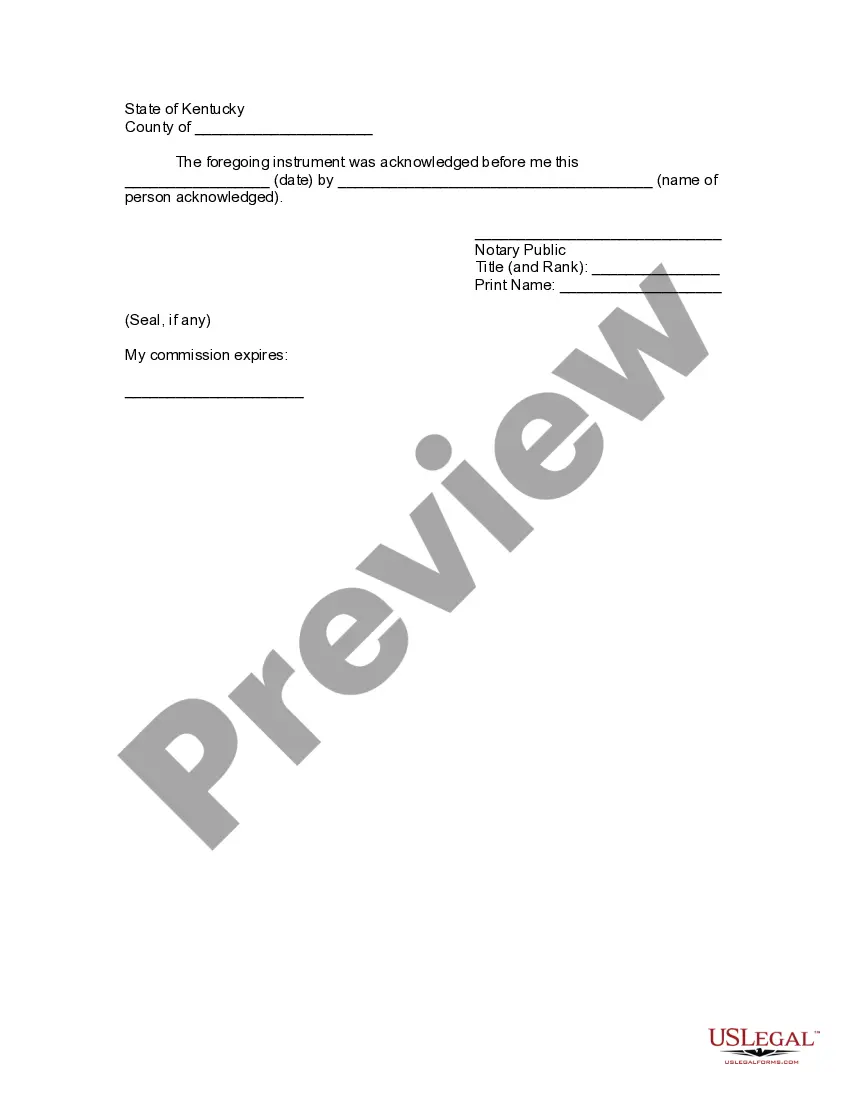

In Kentucky, a trust does not necessarily have to be notarized to be valid, but having it notarized can add an extra layer of authenticity and help in clarifying any disputes that may arise in the future. It's advisable to consult with legal resources or utilize platforms like US Legal Forms to ensure your living trust is properly executed. Notarizing the document can also help if you need to assert its validity later on, especially when the trust is created without a will.

A living trust in Kentucky operates by allowing you to transfer your assets into the trust while you are still alive. You maintain control over these assets, and upon your death, they are distributed to your beneficiaries according to your instructions without going through probate. This streamlined process provides privacy and efficiency, making it easier for your loved ones during a challenging time. You can find comprehensive guidelines on managing a living trust through platforms like US Legal Forms.

Yes, a trust can be created without a will. A living trust functions independently and can specify how assets are managed and distributed during your lifetime and upon your death. This approach allows for seamless transitions of asset management, especially in Kentucky, making it a valuable estate planning tool. Using resources like US Legal Forms, you can create a living trust in Kentucky without a will that effectively serves your needs.