Trust Account For Lawyer

Description

How to fill out Kentucky Financial Account Transfer To Living Trust?

- If you're an existing user, log in to your account and navigate to the Download section to retrieve the required form. Ensure that your subscription is active for seamless access.

- For new users, visit the US Legal Forms website and explore the Preview mode to find the form that suits your requirements. Confirm that it matches your local regulations.

- If you need to search for additional forms, utilize the Search tab prominently displayed on the site for efficient results.

- To purchase the selected document, hit the Buy Now button and select your preferred subscription plan. You will need to create an account to unlock the full library.

- Complete your transaction by entering your payment details, either by credit card or PayPal.

- Finally, download your form to your device and keep it accessible for easy reference in the My Forms section of your profile.

In conclusion, US Legal Forms provides a valuable resource for managing a trust account with its user-friendly platform and extensive range of legal documents. Their service not only allows for swift document acquisition but also ensures each form is compliant with legal standards.

Start using US Legal Forms today to enhance your legal practice and streamline your document management!

Form popularity

FAQ

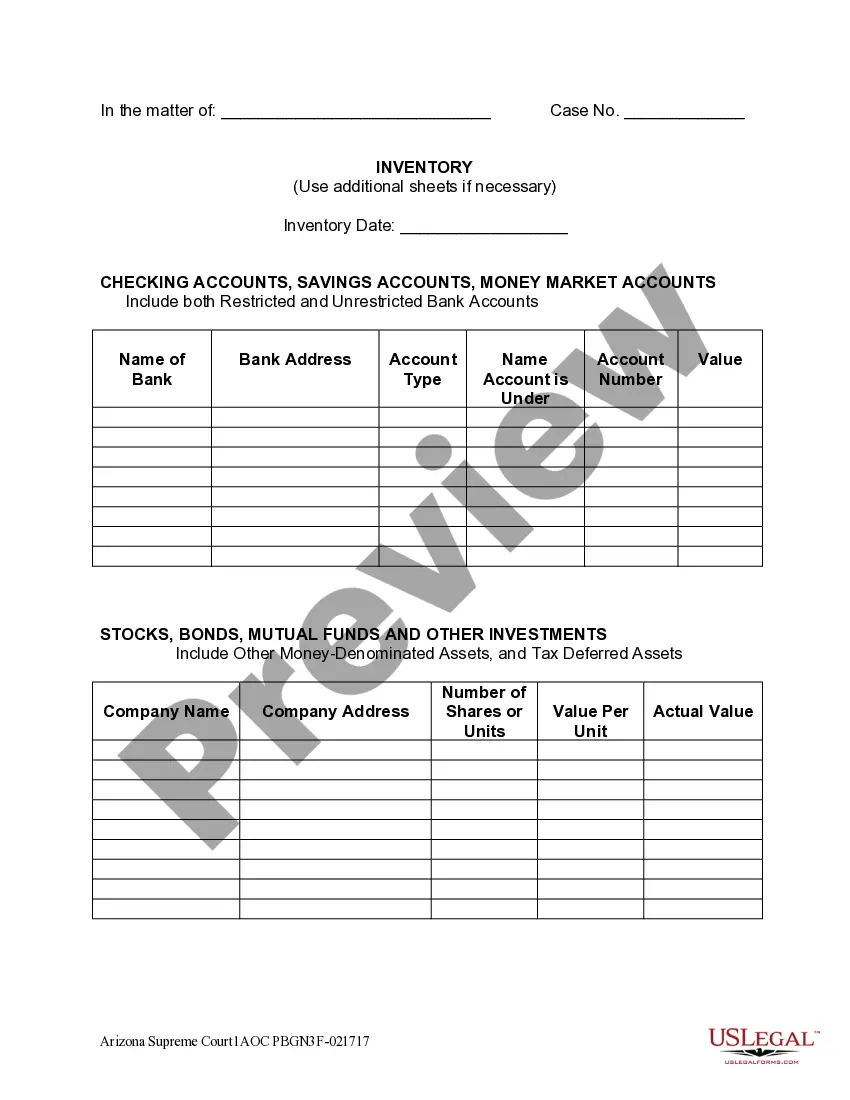

Filling out a trust fund form requires you to provide specific details about the account and the funds involved. You will need to include the client's information, such as their name and address, along with the purpose of the trust account. It's essential to ensure the accuracy of these details, as a properly filled out form reflects professionalism and dedication to client trust. USLegalForms offers templates and guidance to simplify this process and keep your trust account for lawyer compliant.

Yes, a trust generally requires a separate bank account to properly manage and protect the funds held in trust. Having a distinct account keeps the trust funds separate from other personal or business accounts, which is essential for legal compliance and financial transparency. This separation not only safeguards clients' interests but also provides a clear framework for trust accounting.

A trust payment to a lawyer refers to funds that a client deposits into a trust account for lawyer services, meant to cover future legal costs. This payment ensures that the lawyer uses the funds solely for the client's benefit, whether for legal fees or other expenses related to the case. Understanding how these payments work helps clients stay informed about their financial commitments to their legal representation.

Accounting for a trust involves keeping meticulous records of all transactions in the trust account for lawyer services. Start by documenting all deposits made into the account and expenses associated with each client's case. Regular reconciliation with bank statements is crucial to ensure accuracy and prevent discrepancies, making it easier to provide clients with transparent financial reports.

While it's not strictly necessary to have a separate trust account for each client, many law firms choose this route for better organization and tracking. By maintaining distinct accounts, lawyers can provide more accurate billing and facilitate easier access to client funds. Nonetheless, firms must follow state regulations regarding trust accounts, so consulting local laws is essential.

Trust accounting for law firms involves tracking and managing funds held in trust accounts for clients. This process requires detailed record-keeping of all deposits and withdrawals to maintain compliance with legal regulations. Utilizing effective trust accounting software can simplify this task, ensuring that every transaction is documented, which promotes transparency and builds trust with clients.

Yes, a client can have multiple trust accounts for lawyer services, especially if they engage with different attorneys or law firms for various legal matters. Each account can be designated for particular cases or purposes, streamlining the management of client funds. This structure can enhance organization and help prevent confusion over the allocation of funds.

A trust account for a lawyer is a special bank account where attorneys hold client funds for specific purposes, such as retainers or settlements. This account is strictly regulated to ensure that lawyers do not mix their personal funds with client funds. By using a trust account, lawyers maintain transparency and uphold the ethical standards of the legal profession.

To set up a trust fund for your property, you should first determine the type of trust that suits your needs. Work with an attorney to draft a trust agreement and identify the assets to be included. Following this, you will need to fund the trust either through direct transfer or by retitling assets. Understanding how trust accounts for lawyers operate can simplify this process.

While putting your house in trust has benefits, there are also disadvantages to consider. Transferring your property may lead to tax implications or loss of control over your home. Additionally, a trust may require ongoing administration costs. Therefore, it is important to consult with a legal professional familiar with trust accounts for lawyers to weigh the pros and cons specific to your situation.