Reserving Life Estate

Description

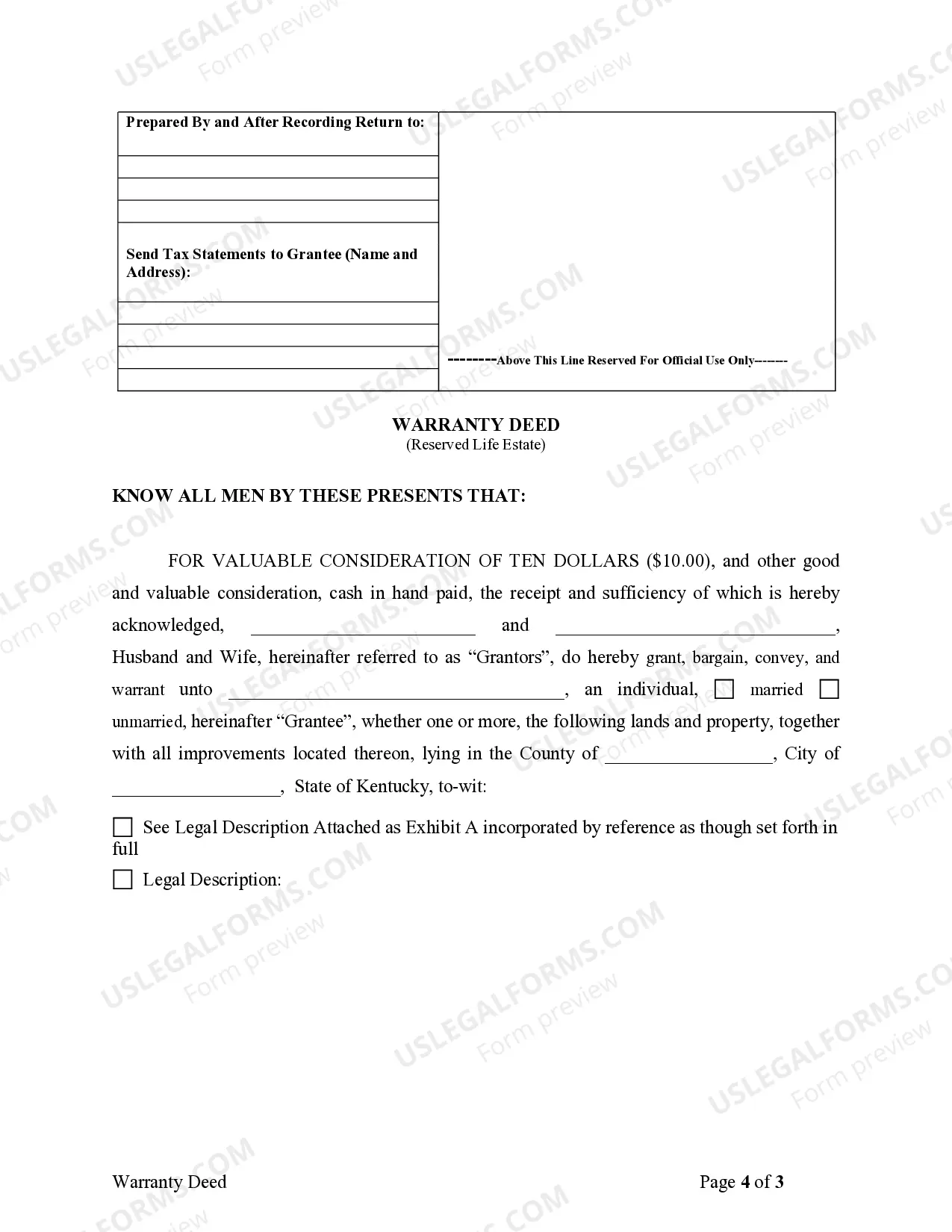

How to fill out Kentucky Warranty Deed To Child Reserving A Life Estate In The Parents?

- If you are a returning user, log in to access your account and select the needed life estate template. Ensure your subscription is active; if not, renew it first.

- For new users, start by reviewing the form descriptions and the preview mode to ensure you have selected the correct document that aligns with your state’s requirements.

- If you don’t find a suitable template, utilize the Search tab to locate alternatives that may better fit your needs.

- Once you identify a document, select the Buy Now option, and choose your preferred subscription plan. You’ll need to register for an account to gain access to the full resources.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Now, access and download your completed document to your device for future reference. It will also be available in the My Forms section of your profile.

In conclusion, using US Legal Forms simplifies the complicated process of reserving a life estate, making it accessible and efficient for users. With a vast library of over 85,000 templates and expert assistance available, you're well-equipped to complete your legal documents with ease.

Begin your hassle-free document management today by signing up with US Legal Forms!

Form popularity

FAQ

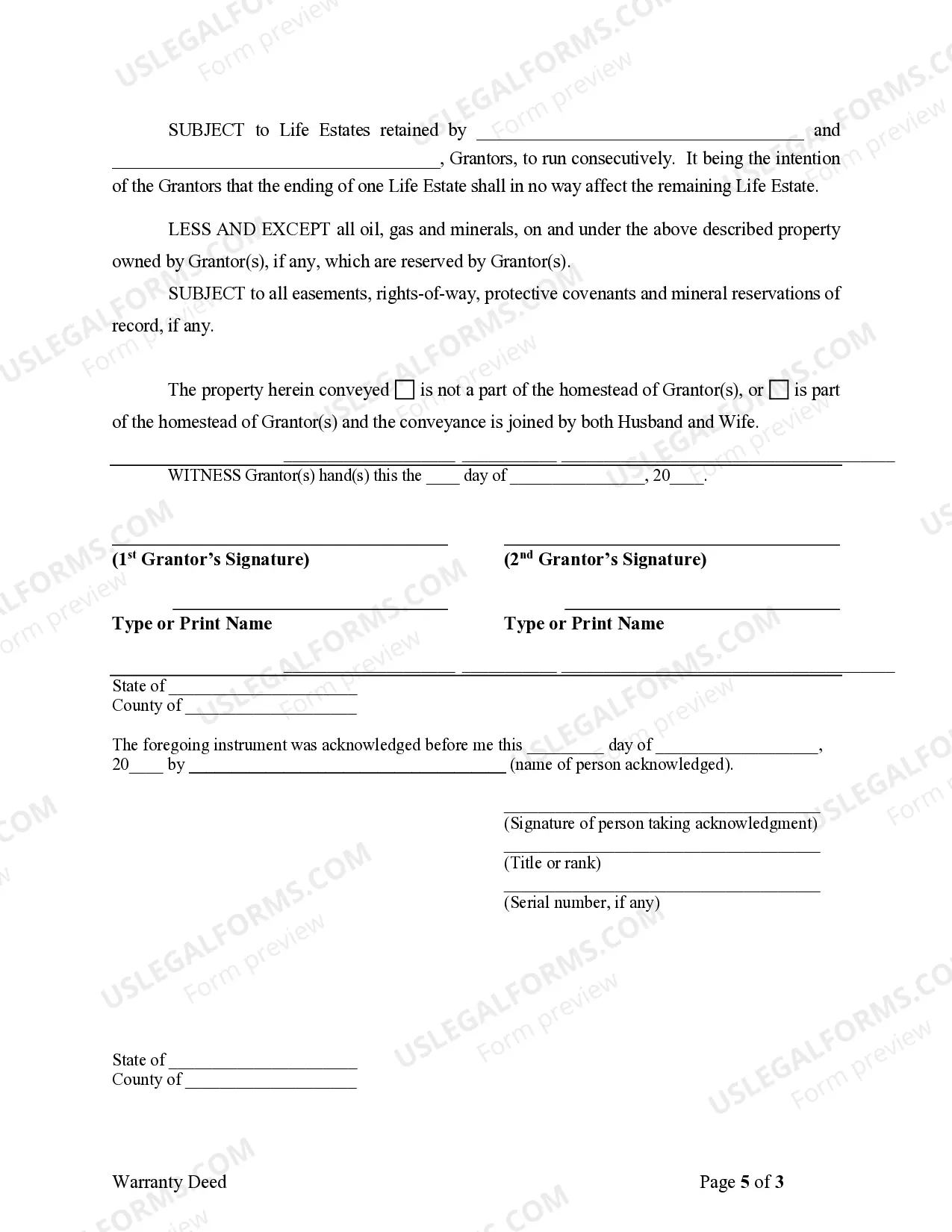

A reversionary life estate occurs when the property owner's rights revert back to them after the life tenant passes away. In this setup, the original owner retains the underlying ownership, but it vests in them again after the life estate ends. Understanding reversionary life estates is crucial for effective estate planning, as it helps clarify property distribution after the holder's lifetime. Using resources like US Legal Forms can assist you in creating the right documents.

A deed reserving life estate allows the property owner to transfer ownership while retaining the right to live in and use the property during their lifetime. This type of arrangement provides security and control for the grantor, ensuring they have a place to live while also providing for heirs. Utilizing a life estate deed can be a beneficial part of your estate planning strategy. It’s a good way to manage property succession efficiently.

When considering reserving life estate, it's important to recognize potential disadvantages. A life estate deed may limit your control over the property, as you cannot sell it without the consent of the remainderman. Additionally, this arrangement can complicate estate planning and trigger tax implications. Understanding these aspects can help you make an informed decision.

Despite their advantages, reserving a life estate may have drawbacks that are important to consider. One of the main issues is that a life tenant cannot easily sell or mortgage the property without the consent of the remainderman. Additionally, the life estate might not be suitable for everyone, especially if the property requires extensive maintenance or if the life tenant faces financial difficulties. Carefully evaluating your circumstances and options can lead to better-informed decisions in estate planning.

Yes, creditors can pursue a life estate holder for debts incurred during their lifetime. However, they may not be able to access the property after the life tenant has passed away, as the property by then is typically transferred to the remainderman. It's crucial to understand your financial obligations and how they might impact your life estate. Consulting with legal experts through resources like US Legal Forms can help clarify these complex issues.

A life estate reserved refers to a legal arrangement where the property owner retains ownership for their lifetime while designating the property to pass to another party after their death. This type of arrangement can simplify property transfer and assure that your wishes are met. Ultimately, reserving a life estate allows you to control your property during your life while planning for a seamless transition posthumously. It is a wise decision in estate planning.

To claim a life estate, you must first draft a legal document that clearly outlines the terms of the life estate arrangement. This document typically includes the rights of the life tenant and may need to be recorded with your local property records office. Engaging with legal professionals can ensure you fulfill all requirements and set up the life estate correctly. For a smoother process, consider using platforms like US Legal Forms that provide resources and templates.

Individuals may choose to reserve a life estate to retain control over a property during their lifetime while planning for future inheritance. This arrangement allows you to enjoy the benefits of ownership without transferring full ownership until after your passing. Additionally, it can prevent probate issues and ensure your loved ones receive the property efficiently. It’s a practical option for those considering their estate planning.

In a reserving life estate, the property is taxed based on its current ownership status. The life tenant, or the individual holding the life estate, is generally responsible for property taxes while living on the property. This responsibility continues even if the property is not generating income. Thus, it’s essential to be aware of tax obligations when reserving a life estate.

In Florida, a life estate allows the life tenant to live in and use the property until their passing, at which point ownership automatically transfers to the named remainderman. This arrangement provides the life tenant with rights similar to ownership without the ability to sell or lease the property. Understanding this process is crucial when considering the implications of reserving a life estate in Florida, especially for estate planning.