Life Estate Deed Explained

Description

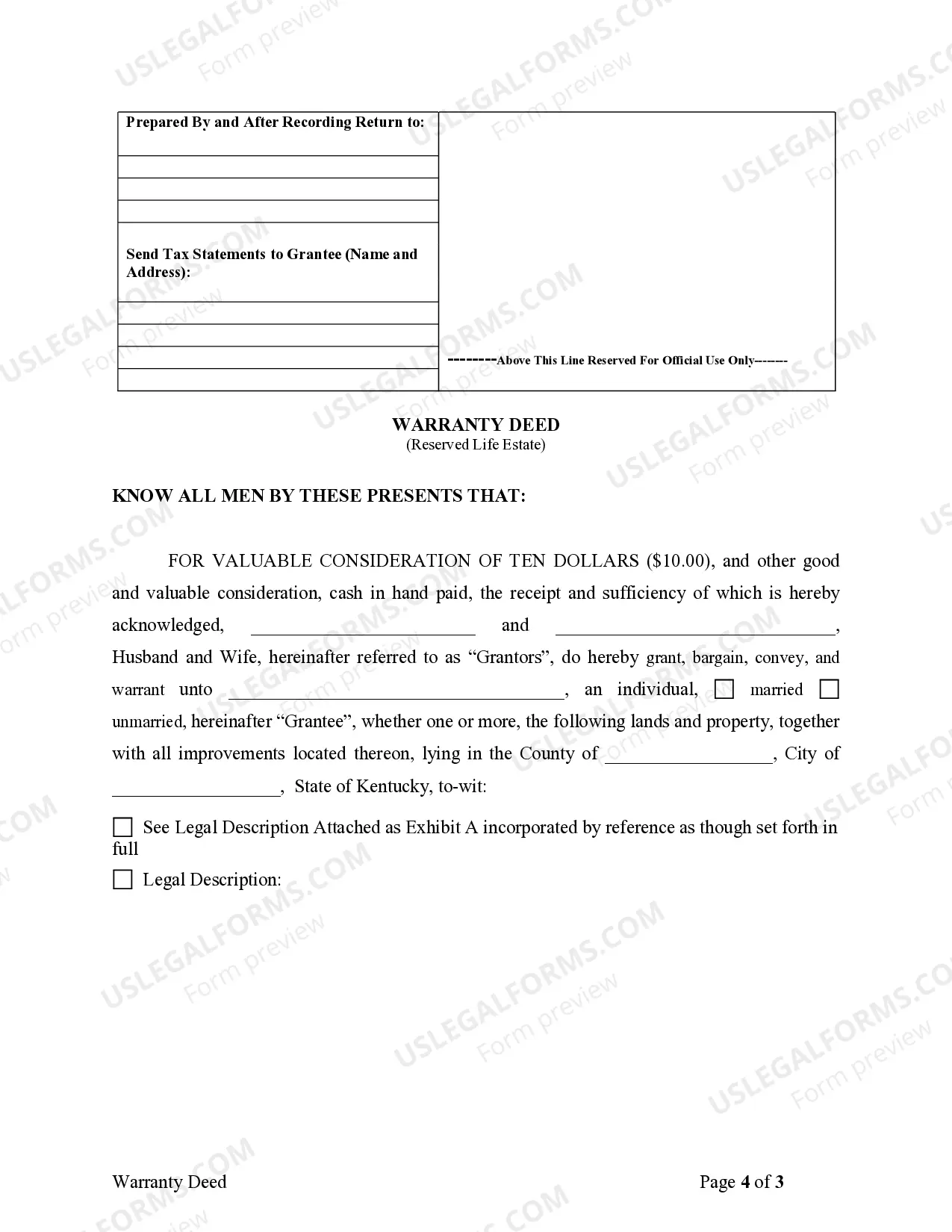

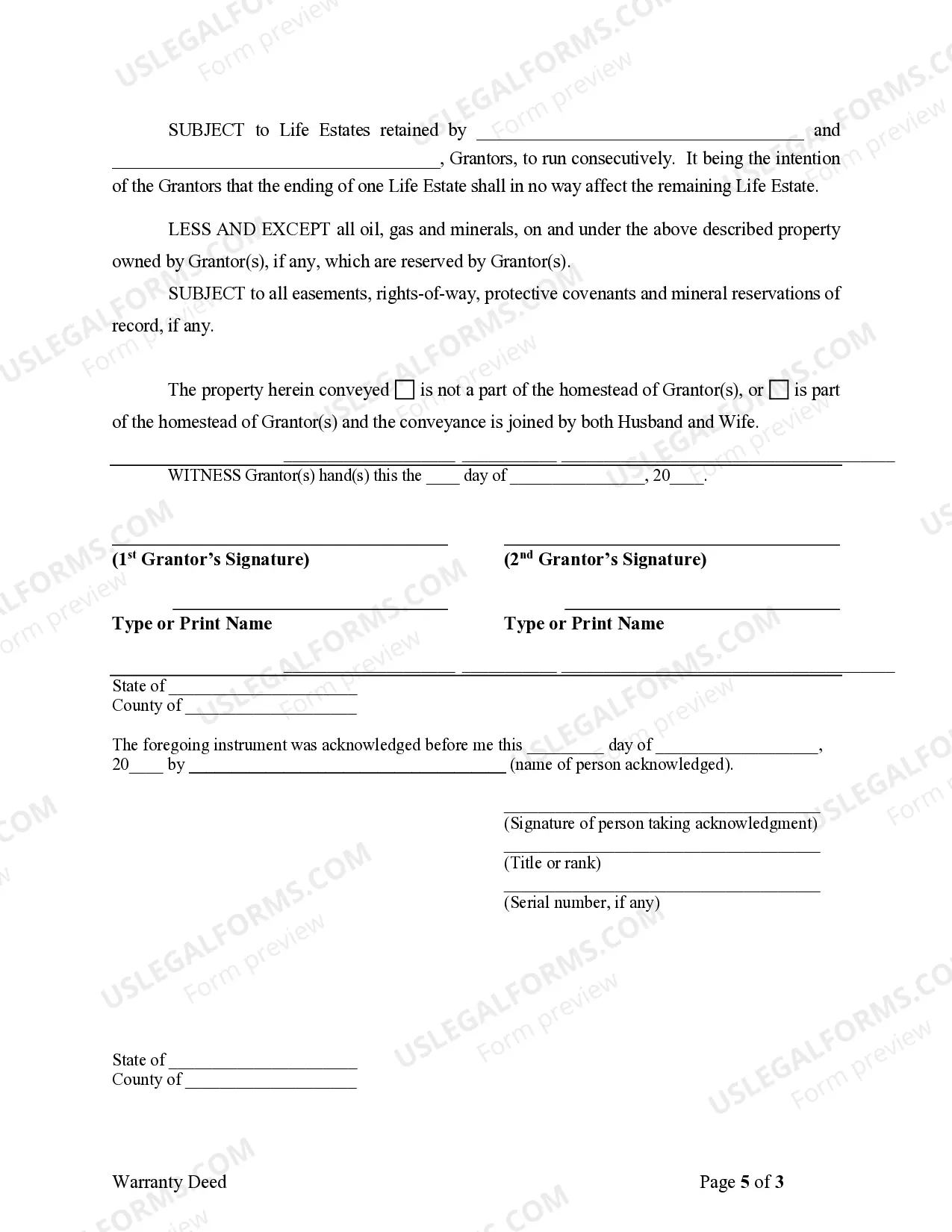

How to fill out Kentucky Warranty Deed To Child Reserving A Life Estate In The Parents?

It's clear that you cannot transform into a legal authority instantly, nor can you comprehend how to promptly assemble Life Estate Deed Explained without a specialized background.

Compiling legal documents is an extensive procedure necessitating specific training and expertise. Therefore, why not entrust the creation of the Life Estate Deed Explained to the professionals.

With US Legal Forms, one of the most extensive legal template libraries, you can discover everything from court documents to templates for internal business communication.

You can access your forms again from the My documents tab at any time. If you are a current client, you can simply Log In, and find and download the template from the same tab.

Regardless of the intent of your documents—whether financial and legal or personal—our website has you covered. Experience US Legal Forms now!

- Locate the document you need using the search bar at the top of the page.

- View it (if this option is available) and read the accompanying description to determine if Life Estate Deed Explained is what you're looking for.

- If you require any additional template, restart your search.

- Sign up for a free account and select a subscription plan to purchase the template.

- Click Buy now. Once the payment is completed, you can download the Life Estate Deed Explained, complete it, print it, and send it or mail it to the necessary parties or organizations.

Form popularity

FAQ

Breaking a life estate deed usually requires the consent of both the life tenant and the remainderman. In some cases, a court may allow a life estate to be terminated if it serves the best interest of all parties involved. This can often happen if the life tenant needs to move or if both parties agree on selling the property. For guidance on how to navigate these processes, US Legal Forms offers helpful tools and templates to simplify the necessary legal steps and make the concept of life estate deeds easy to understand.

When a life estate deed is established, the remainderman typically does not face immediate tax obligations. However, once the life tenant passes away and ownership transfers, the remainderman may be responsible for capital gains tax on the property's appreciation. A clear understanding of these tax implications is crucial, and our resource at US Legal Forms can help clarify these concepts further, ensuring you know how life estate deeds affect your financial situation.

The disadvantages of a life estate include restrictions on the life tenant's rights over the property, particularly regarding selling or leasing it without beneficiary approval. If relationships with the heirs deteriorate, it can lead to disputes. Moreover, the value of the property might be affected if the life tenant does not maintain it, complicating the overall ownership structure discussed in life estate deed explained.

Yes, selling a house with a life estate can be done, but it requires careful consideration. The life tenant must have the consent of the remainder beneficiaries to proceed with the sale, as they hold an interest in the property. Understanding these legalities is essential, and resources like uslegalforms can help clarify the process further.

People create life estates primarily to ensure that their property passes directly to their chosen beneficiaries without going through probate. This arrangement also allows them to maintain control over the property while alive, which can be a significant comfort. Additionally, it helps in estate planning by minimizing taxes and protecting assets from creditors.

While beneficial, a life estate deed also has drawbacks. The life tenant may face limitations on their ability to make decisions about the property, such as making significant modifications or selling without permission. Also, complications can arise if the relationship with the remainder beneficiaries becomes strained, and these issues are important to consider in the life estate deed explained.

The primary benefit of a life estate deed is that it allows the owner to effectively control their property while ensuring a seamless transition to heirs. It eliminates the need for probate, making the transfer of property easier and quicker. Furthermore, this deed can provide tax advantages and protect the property from creditors, adding another layer of security.

Yes, you can sell a home that has a life estate deed, but it involves specific conditions. The life tenant retains the right to live in the home but cannot sell the property without the consent of the remainder beneficiaries. It's crucial to understand these dynamics to make an informed decision, and the process can be clarified further by exploring the life estate deed explained.

A life estate deed can be an excellent estate planning tool for various reasons. It allows property owners to retain the right to live in their home while ensuring that it passes directly to their heirs, thus avoiding probate. However, it is crucial to consider your specific circumstances and goals before proceeding. Taking time to learn more about life estate deeds explained can help you make a well-informed decision.

Yes, there is generally a step-up in basis on inherited real estate, meaning the property value is adjusted to its fair market value at the date of the owner's death. This process reduces potential capital gains tax when heirs sell the property. Understanding this feature of inherited real estate is essential for effective estate planning. Life estate deed explained can provide insights into how this principle applies in different situations.