Kansas Name Change For Withholding

Description

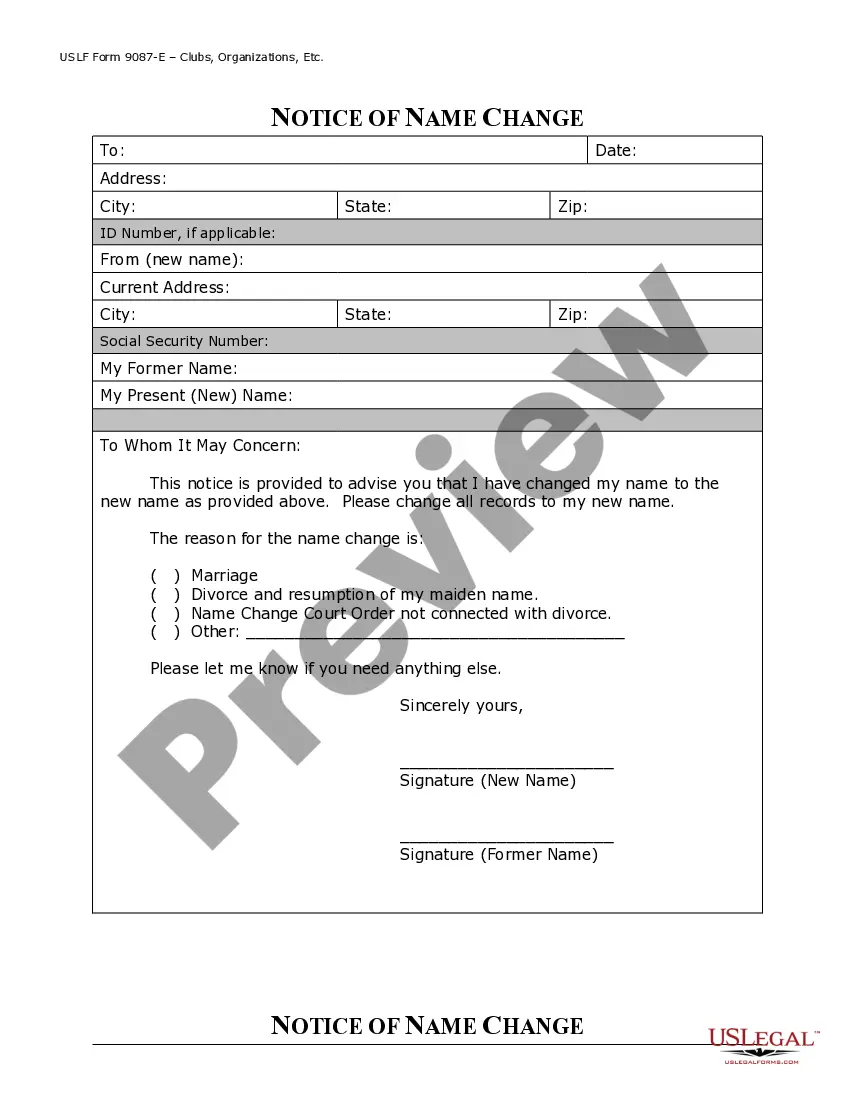

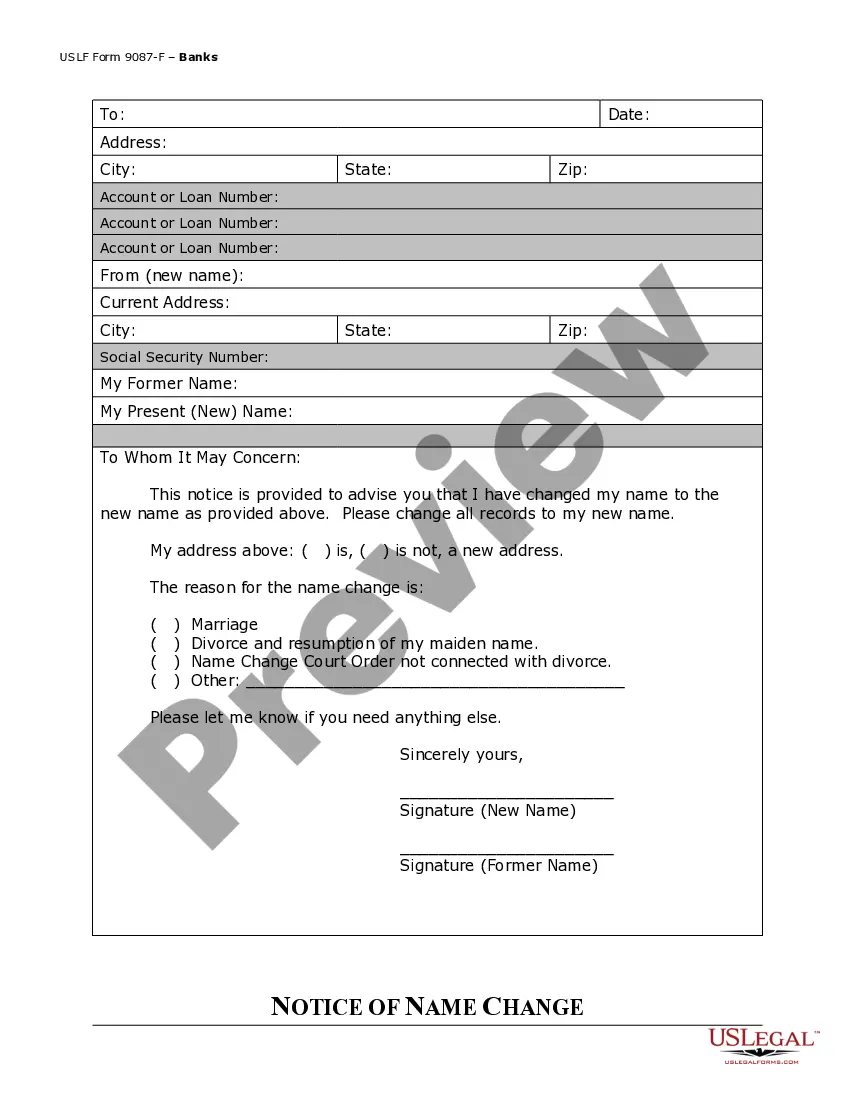

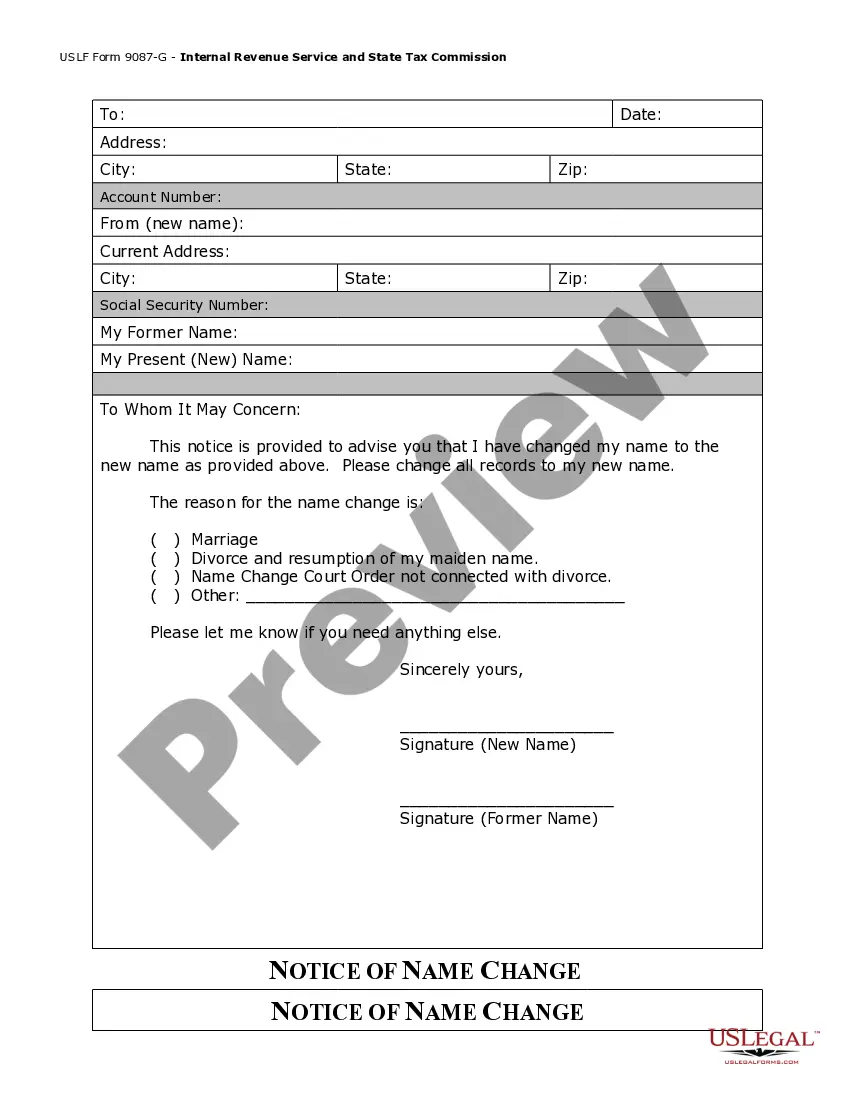

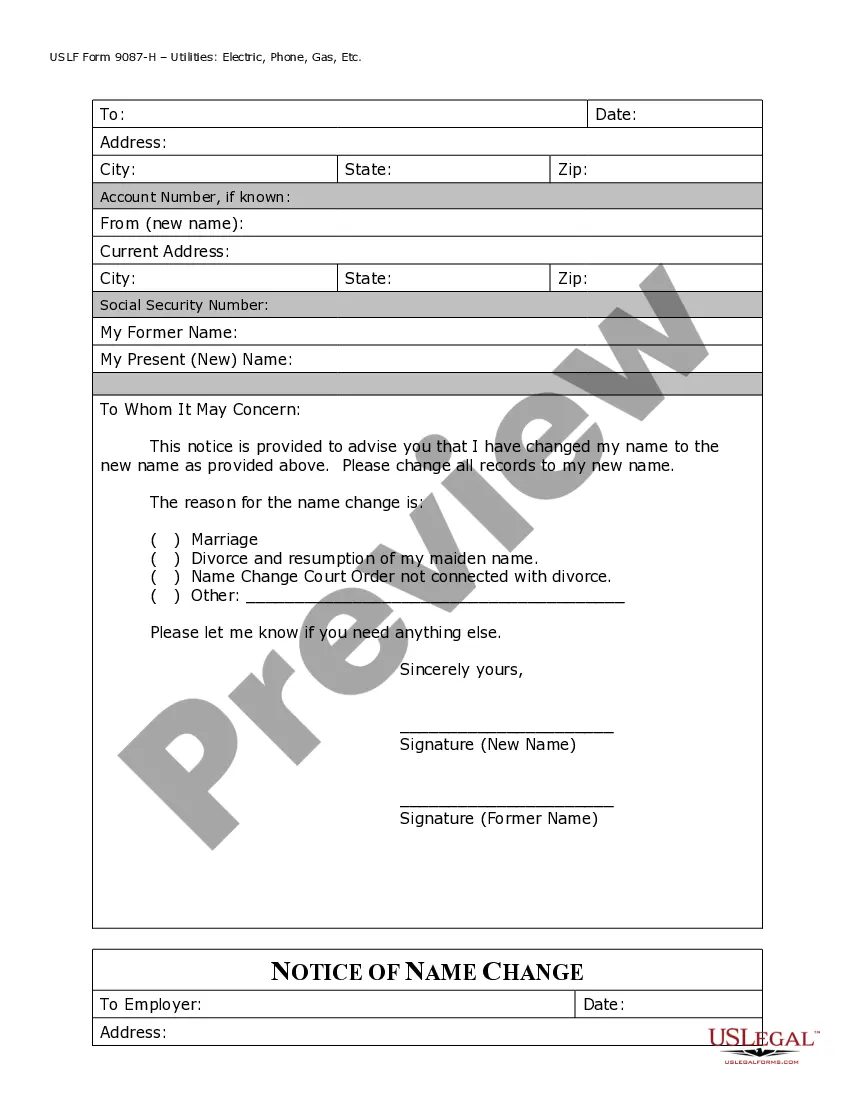

How to fill out Kansas Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

Legal managing might be overwhelming, even for experienced specialists. When you are looking for a Kansas Name Change For Withholding and do not get the time to spend trying to find the appropriate and up-to-date version, the processes might be stressful. A strong web form library could be a gamechanger for everyone who wants to deal with these situations efficiently. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and organization forms. US Legal Forms covers any demands you may have, from personal to organization documents, all in one location.

- Make use of advanced tools to finish and handle your Kansas Name Change For Withholding

- Access a resource base of articles, tutorials and handbooks and materials relevant to your situation and needs

Help save effort and time trying to find the documents you will need, and use US Legal Forms’ advanced search and Preview tool to find Kansas Name Change For Withholding and download it. If you have a monthly subscription, log in in your US Legal Forms account, look for the form, and download it. Take a look at My Forms tab to view the documents you previously saved and to handle your folders as you see fit.

Should it be the first time with US Legal Forms, create a free account and have unlimited use of all advantages of the platform. Here are the steps to take after downloading the form you need:

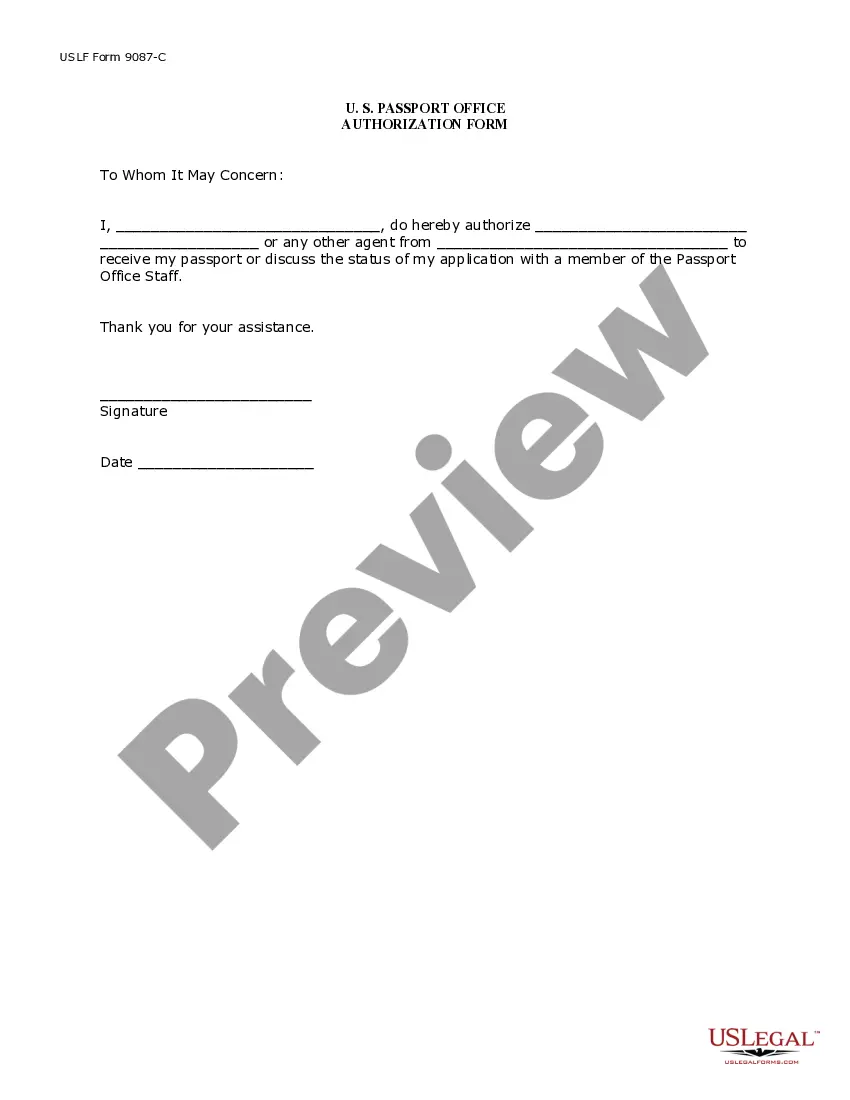

- Verify this is the correct form by previewing it and reading its description.

- Ensure that the sample is approved in your state or county.

- Select Buy Now when you are all set.

- Select a monthly subscription plan.

- Pick the file format you need, and Download, complete, eSign, print out and send your document.

Enjoy the US Legal Forms web library, supported with 25 years of expertise and reliability. Enhance your day-to-day document administration into a easy and user-friendly process right now.

Form popularity

FAQ

To qualify for exempt status you must verify with the Department of Revenue that: 1) last year you had the right to a refund of all State taxes withheld because you had no tax liability; or, 2) this year you will receive a full refund of all State income tax withheld because you will have no tax liability.

Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions. You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

Option 1: Sign in to your eFile.com account, modify your Return and download/print the KS Form K-40 under My Account. Mark the check box "Amended Return" sign the form and mail it to one of the addresses listed below.

Companies who pay employees in Kansas must register with the KS Department of Revenue for a Withholding Account Number and the KS Department of Labor for an Employer Serial Number. Apply online at the DOR's Customer Service Center to receive a Withholding Account Number within 48 hours of completing the application.

Kansas law requires withholding on wages. If your cafeteria, 401K, profit sharing, or other employee plan is considered to be wages by the federal government and federal income tax withholding is required, Kansas withholding is also required.