Notice Failure Form Withdrawal

Description

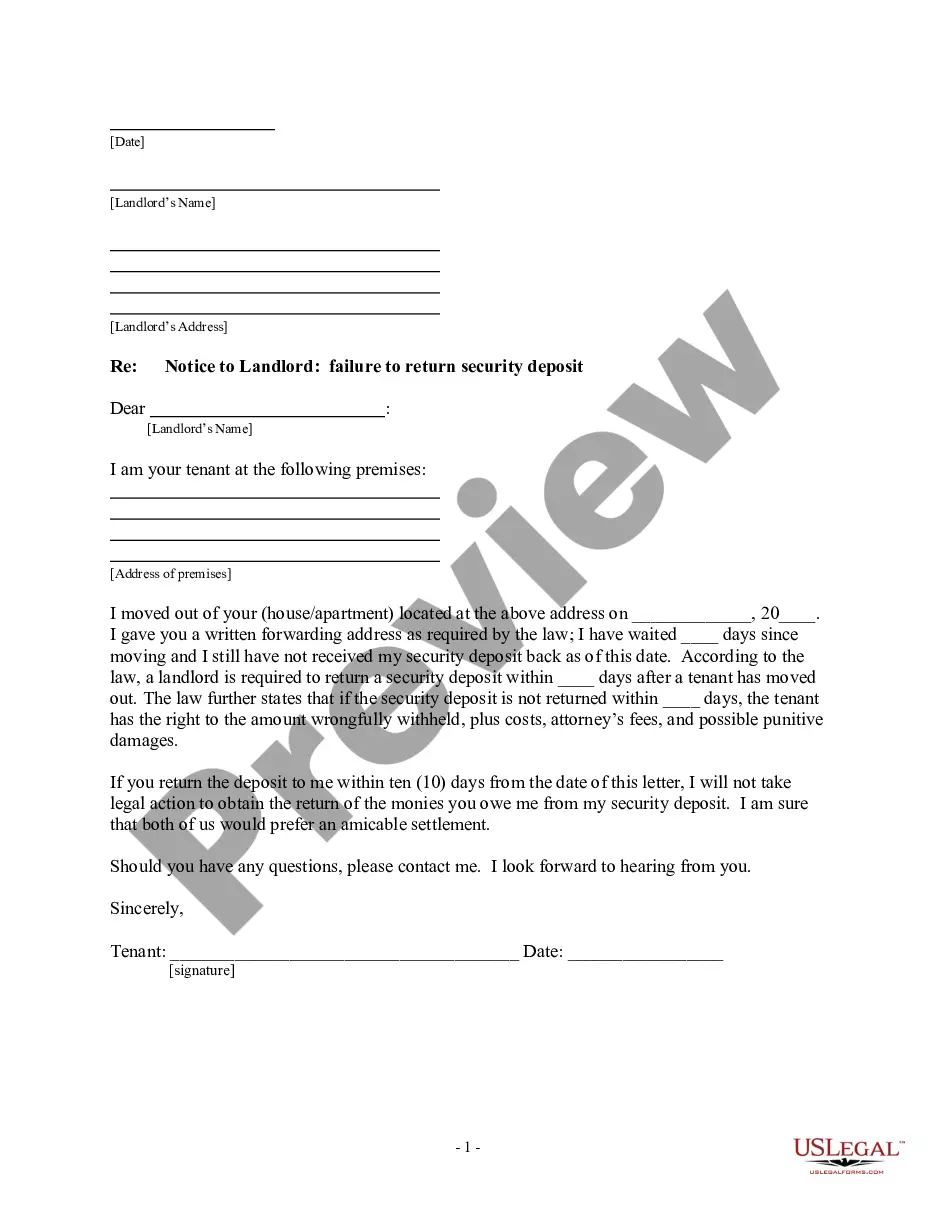

How to fill out Kansas Letter From Tenant To Landlord Containing Notice Of Failure To Return Security Deposit And Demand For Return?

Individuals frequently link legal documentation with something intricate that solely an expert can manage.

In a specific sense, this is accurate, as composing the Notice Failure Form Withdrawal demands significant proficiency in subject matters, including state and municipal regulations.

Nonetheless, with US Legal Forms, everything has transformed into a more straightforward process: pre-prepared legal templates for any personal and business circumstance specific to state statutes are compiled in a single online repository and are now accessible to everyone.

Print your document or upload it to an online editor for quicker completion. All templates in our library are reusable: after purchase, they remain stored in your profile for easy access at any time via the My documents section. Explore all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current documents categorized by state and area of application, making the search for the Notice Failure Form Withdrawal or any other specific template quick and easy.

- Users already registered with an active subscription must Log In to their account and click Download to obtain the form.

- New users will first have to establish an account and subscribe before they can download any legal papers.

- Here is a detailed guide on how to obtain the Notice Failure Form Withdrawal.

- Review the page content carefully to confirm it fits your needs.

- Read the form description or view it using the Preview option.

- If the previous sample doesn’t fit, search for another one using the Search bar above.

- Once you find the appropriate Notice Failure Form Withdrawal, click Buy Now.

- Choose a subscription plan that suits your needs and financial plan.

- Sign up for an account or Log In to navigate to the payment page.

- Complete your payment via PayPal or your credit card.

- Select your file format and click Download.

Form popularity

FAQ

The tax form used for hardship withdrawals depends on the specific account type and circumstances involved. For retirement accounts, you may need to fill out a specific IRS form related to distributions. It's essential to document your situation clearly if you're managing a Notice failure form withdrawal alongside your withdrawal request. Platforms like uslegalforms can help ensure you're using the correct forms and provide guidance tailored to your needs.

Form 668 Z is a document the IRS issues to establish a lien against the taxpayer's assets. This form indicates that the IRS has a legal claim to your property due to unpaid taxes. If you face issues related to a Notice failure form withdrawal, understanding the implications of form 668 Z becomes crucial. Seeking professional assistance can help you manage and potentially resolve these tax lien issues.

Yes, you can negotiate IRS liens in certain circumstances, often leading to their release or withdrawal. It’s important to discuss your financial situation with a tax professional to determine the best approach. One option might include submitting a Notice failure form withdrawal if you're eligible for it. Engaging with uslegalforms can provide you with the necessary tools to navigate this negotiation process effectively.

Form 12277 is used to request the withdrawal of a filed Notice of Federal Tax Lien. By submitting this form, individuals can help clear their financial records and potentially improve their credit standing. It's important to ensure that all eligibility requirements are met before filing this form, especially when dealing with a Notice failure form withdrawal. Using a platform like uslegalforms can simplify the process and ensure you complete it correctly.

The IRS often considers various factors when settling, including the taxpayer’s income, assets, and overall situation. Generally, tax settlements can vary widely, depending on individual circumstances. Understanding the nuances can help you navigate through a Notice failure form withdrawal effectively. Consulting a tax professional might provide you with a more tailored estimate based on your specific situation.

A withdrawal of a filed notice of federal tax lien removes the lien from public records, essentially stating that the tax liability has been resolved. This action restores your ability to manage and utilize your property without the burden of tax claims holding you back. To facilitate this process, consider leveraging the services of uslegalforms, which can guide you through the necessary steps for a successful Notice failure form withdrawal.

Withdrawing a federal tax lien means that the IRS agrees to remove its claim against your property, usually after you have settled your tax debt. This process is critical for restoring your credit and freedom regarding property ownership. To effectively execute this, it's advisable to utilize tools that can streamline your application for a Notice failure form withdrawal, such as those provided by uslegalforms.

A notice of federal tax lien is a legal document that the IRS files to inform creditors that it has a claim against your property due to unpaid taxes. This notice serves as public evidence of the government's right to seize your assets to satisfy the tax debt. If you face such a situation, understanding how to process a Notice failure form withdrawal can help you regain control over your financial matters.

A lien withdrawal involves formally removing a lien from the public record, which may occur for several reasons, including invalid claims or changes in the debt arrangement. This process can help restore your credit rating and property ownership rights, making it essential to understand how to navigate it correctly. If you need assistance, uslegalforms offers resources tailored to help you with a lien withdrawal.

A lien release signifies that a creditor has relinquished their claim on a property, often after the debt has been settled. In contrast, a lien withdrawal, particularly a Notice failure form withdrawal, removes the lien from the official records, indicating that the claim was potentially invalid or incorrectly filed. Understanding this difference helps you choose the correct process when dealing with liens.