Agreement Mortgage Release For The Owner

Description

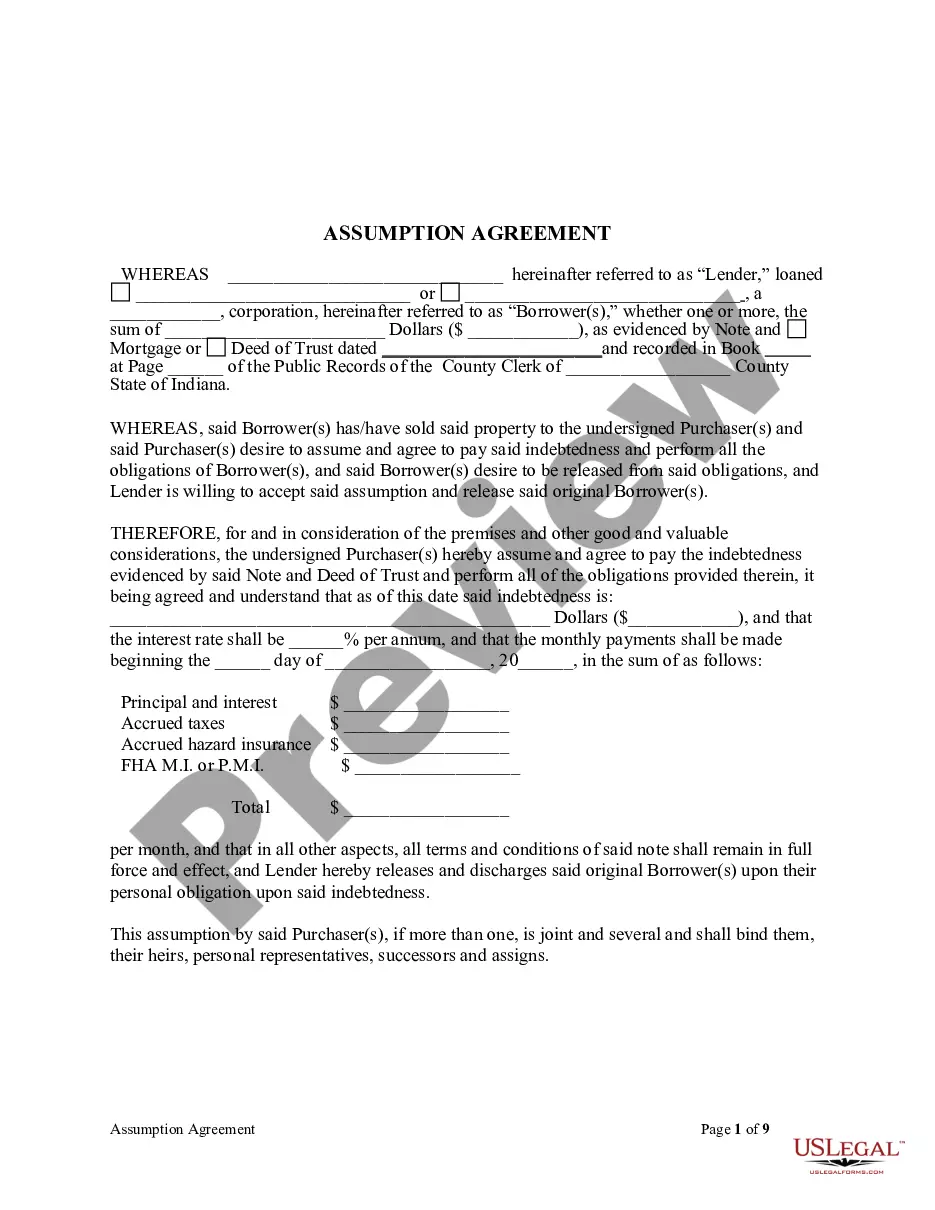

How to fill out Indiana Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

- If you're an existing user, log in to your account and download the required form template directly. Ensure your subscription is active; if not, renew as per your plan.

- For new users, start by exploring the Preview mode to browse through the form descriptions and confirm that you select the right template meeting your local jurisdiction needs.

- If you need a different template, use the Search tab above to find the appropriate form. Once you identify the correct document, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your desired subscription plan. You'll need to create an account to access all resources.

- Complete your purchase by entering your credit card information or using your PayPal account for payment.

- Download your form to your device. It will be accessible anytime in the My Forms section of your profile.

Utilizing US Legal Forms not only saves you time but also ensures that your legal documents are both accurate and compliant with current laws. Their extensive library contains over 85,000 forms that cater to a variety of legal needs.

Don’t let the complexities of legal documents overwhelm you. Start your journey with US Legal Forms today to empower yourself with the right tools for all your legal requirements!

Form popularity

FAQ

The time it takes to receive a mortgage lien release can vary but often ranges from a few weeks to a couple of months. After you complete the Agreement mortgage release process, the lender must prepare and file the necessary documents. Ensuring that all paperwork is accurate can speed up this process, and utilizing platforms like USLegalForms can simplify the steps involved significantly.

The release of a mortgage is generally considered a good outcome for the owner. It indicates that they have fulfilled their financial obligation, leading to the Agreement mortgage release. This process opens doors for new opportunities, such as refinancing or selling the property without the weight of debt lingering over them.

A mortgage release signifies that the debt tied to the property has been completely satisfied. For the owner, this represents a significant step in the Agreement mortgage release process, providing clear title and ownership. The release allows the property owner to sell, refinance, or otherwise manage their property without future claims from the lender.

You can find the title deed to your house in several places. First, check with the county recorder's office where your home is located; they maintain official records. Alternatively, if you have a title company or real estate attorney, they can assist you in retrieving it. Finding your title deed is essential for understanding your property rights and for any steps involving an Agreement mortgage release for the owner.

To obtain a copy of your mortgage contract, you should contact your mortgage lender. They can provide you with the original agreement or a duplicate if needed. In some cases, it may also be available through document-sharing services or legal document platforms like uslegalforms. Having the mortgage contract is crucial for understanding your obligations and rights for the agreement mortgage release for the owner.

Yes, mortgage agreements are considered public records and can usually be accessed through your local county recorder's office or online databases. Public access allows anyone to verify the details of the mortgage, including the parties involved and the property address. However, personal information may be limited to protect your privacy. Understanding this can aid you in the agreement mortgage release for the owner process.