Attorney Quit Claim Deed With Right Of Survivorship

Description

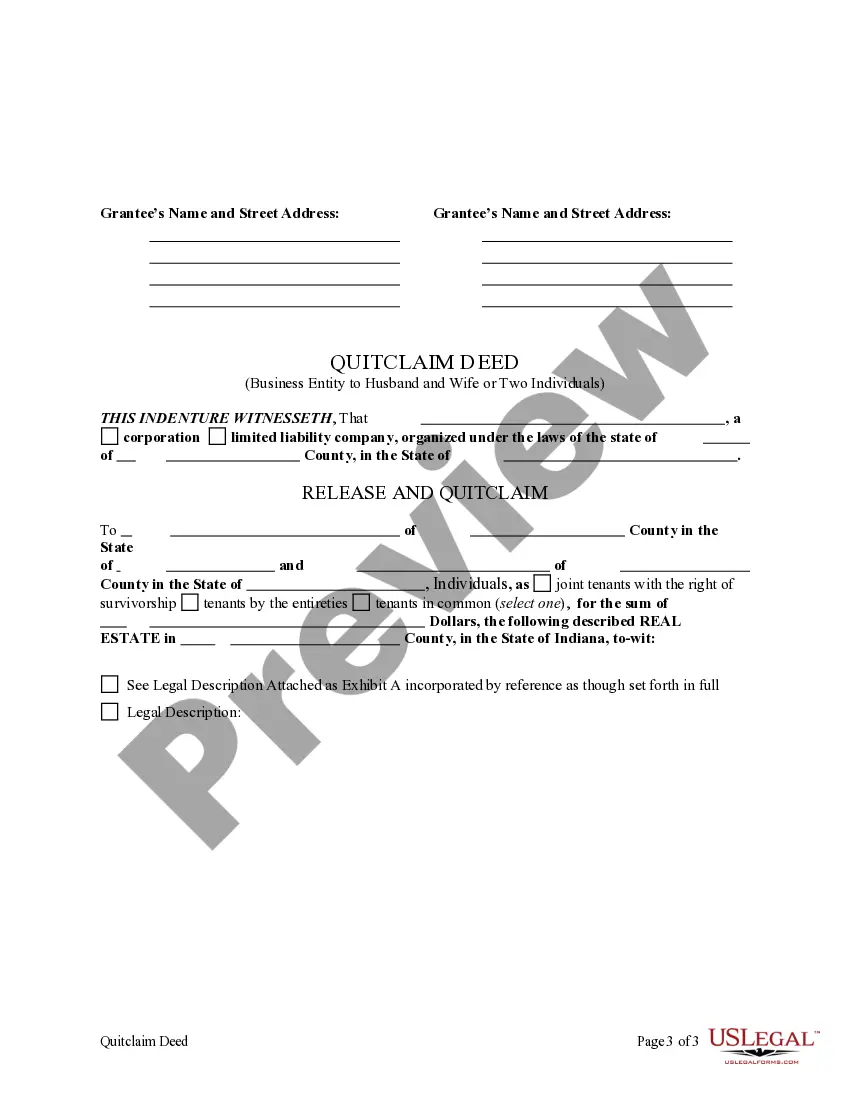

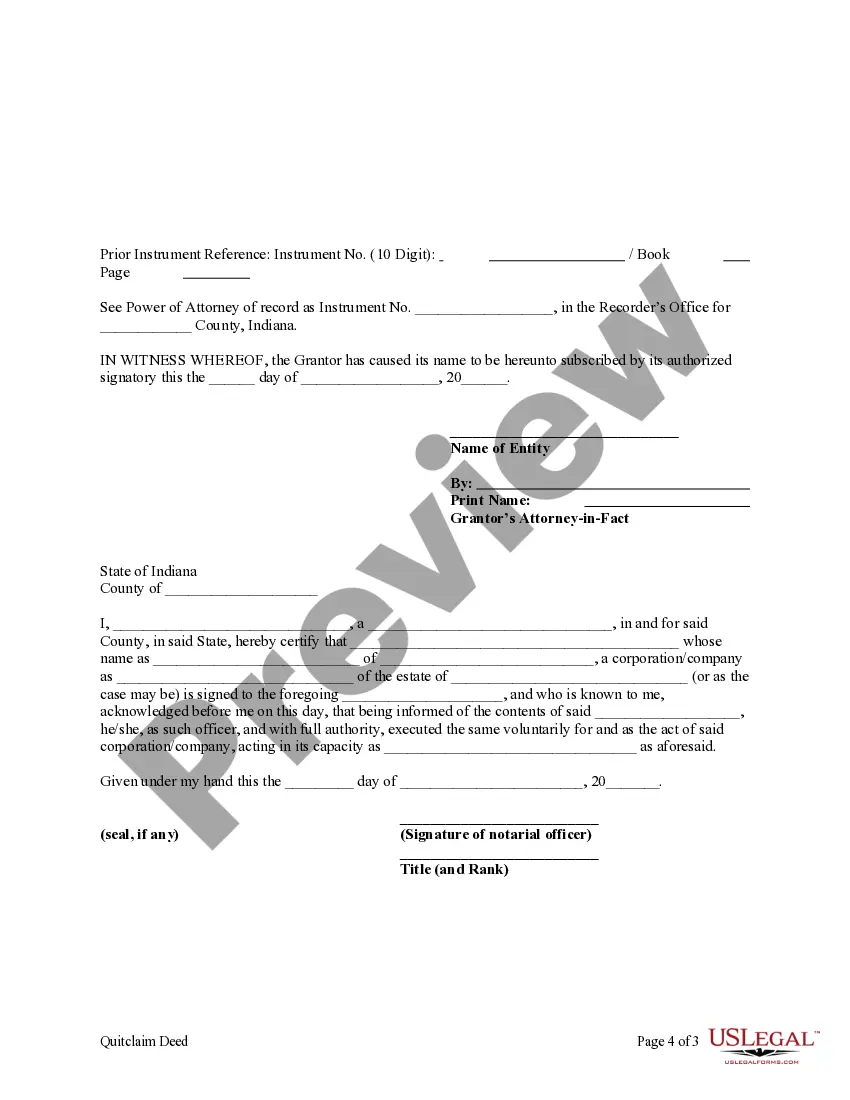

How to fill out Indiana Quitclaim Deed From Business Entity, Through Attorney-in-fact, To Two Individuals Or Husband And Wife?

Individuals frequently link legal documents with complexity that only an expert can manage.

In a way, this is accurate since creating an Attorney Quit Claim Deed With Right Of Survivorship necessitates considerable understanding of subject matter, encompassing state and county laws.

Nevertheless, with US Legal Forms, everything has become simpler: pre-made legal templates for every life and business scenario specific to state regulations are compiled in a single online catalog and are now available for everyone.

Register for an account or sign in to move on to the payment page. Pay for your subscription using PayPal or by a credit card. Choose the format for your file and click Download. Print your document or upload it to an online editor for faster completion. All templates in our catalog are reusable: once purchased, they remain saved in your profile. You can access them whenever needed through the My documents tab. Discover all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents organized by state and area of application, allowing you to search for an Attorney Quit Claim Deed With Right Of Survivorship or any specific template in just a few minutes.

- Users who have already registered with a valid subscription must Log In to their account and click Download to acquire the form.

- New users of the service will first need to create an account and subscribe before they can save any legal documents.

- Here’s a step-by-step guide on how to obtain the Attorney Quit Claim Deed With Right Of Survivorship.

- Scrutinize the page content carefully to ensure it aligns with your requirements.

- Review the form description or explore it through the Preview option.

- If the previous sample does not meet your needs, search for another via the Search field in the header.

- When you find the correct Attorney Quit Claim Deed With Right Of Survivorship, click Buy Now.

- Select a pricing plan that meets your needs and budget.

Form popularity

FAQ

A typical survivorship clause may state that upon the death of one joint owner, their interest in the property automatically transfers to the surviving owner. For instance, in a deed, the clause could read, 'Upon the death of one party, the remaining party shall become the sole owner of the property.' This clause is essential for clarifying ownership and can be effectively created with the help of an attorney utilizing a quit claim deed with right of survivorship.

Survivorship refers to the legal right of a surviving co-owner to fully control an asset after the death of another owner. This concept is often applied to joint ownership situations, such as property or bank accounts. By executing an attorney quit claim deed with right of survivorship, you can establish clear terms on how assets will be managed and passed on, making estate planning more straightforward.

Assets that commonly pass by survivorship include real estate, bank accounts, and investment accounts held in joint tenancy. When one owner dies, their interest in these assets automatically transfers to the surviving owner. Utilizing an attorney quit claim deed with right of survivorship helps ensure that these assets are preserved for the surviving owner without undergoing probate.

In Canada, the right of survivorship does typically override a will when it comes to jointly owned property. This means that if you own a property with another individual and one party dies, that property will automatically transfer to the surviving owner, regardless of what the will states. This highlights why it is advisable to consult with an attorney regarding a quit claim deed with right of survivorship, especially for estate planning purposes.

A common example of the right of survivorship occurs when two people, such as spouses or business partners, own a property together. If one owner passes away, the other automatically gains full ownership of the entire property, regardless of any will. This type of ownership arrangement is frequently set up using an attorney quit claim deed with right of survivorship to ensure seamless transfer without probate complications.

One significant disadvantage of the right of survivorship is that it can complicate the distribution of assets after an owner passes away. Since the surviving owner automatically receives the deceased owner's share, this may lead to disputes among heirs or beneficiaries outlined in a will. It's crucial to understand that a quit claim deed with right of survivorship can override other estate planning documents, which may not align with your intended distribution.

When considering protection, the warranty deed offers the highest level of security for a property buyer. It protects against potential claims, ensuring no one can challenge ownership. Conversely, an attorney quit claim deed with right of survivorship is designed for joint owners, providing a different type of protection — the seamless transfer of ownership without going through probate. It’s essential to understand your specific needs to choose the right deed.

The safest kind of deed is one that provides the most security and assurance against future claims. A warranty deed stands out here, as it guarantees that the grantor has the legal right to sell the property. Alternatively, an attorney quit claim deed with right of survivorship also provides safety in specific cases, especially amongst family members or partners, ensuring that property automatically transfers to the surviving owner upon death.

The strongest deed is usually the warranty deed, as it offers the most protections and guarantees. It ensures that the buyer receives full ownership without any hidden issues. On the other hand, an attorney quit claim deed with right of survivorship serves a different purpose, prioritizing the ease of transferring ownership without warranties. This means while it might not be the 'strongest' in traditional terms, it still offers critical benefits for those in joint ownership situations.

The best type of deed often depends on the circumstances. For individuals looking to transfer property securely and ensure their heirs are protected, a warranty deed is ideal. However, if you are considering joint ownership and wish to provide rights of survivorship, an attorney quit claim deed with right of survivorship can be an excellent choice. This type allows partners to transfer property to each other seamlessly, often without complications.